Guanajuato Silver – Production And Exploration Update AT The El Cubo Mine And Pinguico Project

James Anderson, President and CEO of Guanajuato Silver (TSX.V:GSVR – OTCQX:GSVRF), joins us to provide an operations and exploration update at the El Cubo Mine and Pinguico Project. We start off reviewing the ramp up of gold and silver production at El Cubo, and how after getting things commissioned with above-ground stockpiles of ore, that now the underground areas at El Cubo, and eventually Pinguico will be higher grade and starting to bring the costs down.

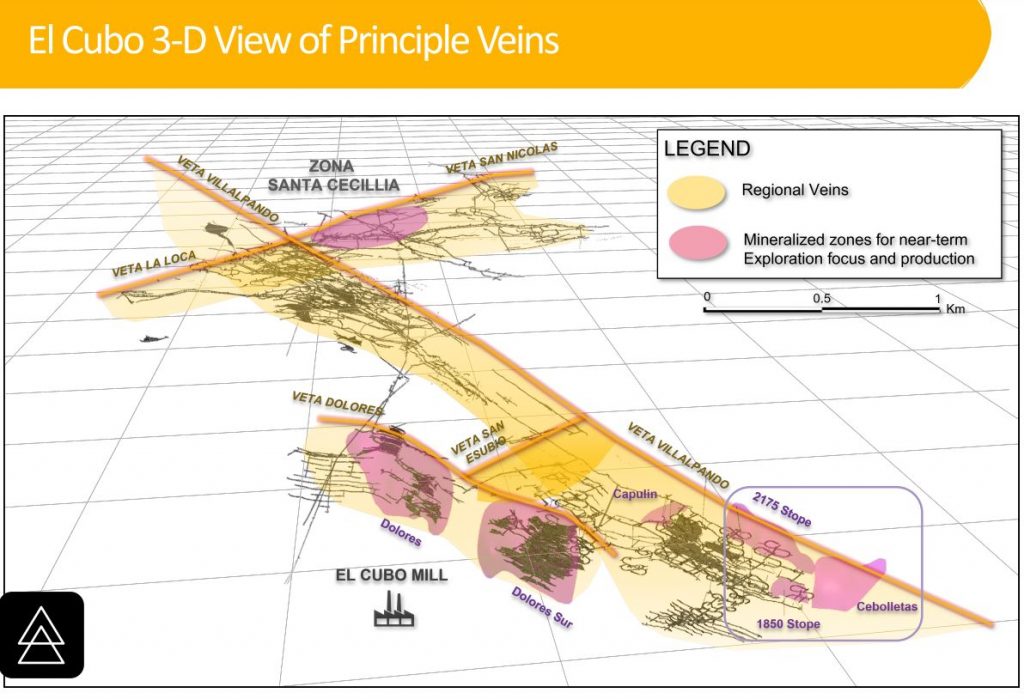

Next we shifted over the recent drill results reported, with headline Hole VP022-002: returning 1,956 grams per tonne (gpt) Ag and 12.90 gpt Au for 2,988 gpt AgEq over 0.55m (0.35m est. true width) from the Villalpando vein, at the Capulin area, at El Cubo. Holes SC22-001 and SC22-002: 42 gpt Ag and 7.56 gpt Au for 647 gpt AgEq over 0.35m (0.3m est. true width) in hole SC22-001 and 276 gpt Ag and 4.49 gpt Au for 636 gpt AgEq over 0.30m. There are a number of exploration target at El Cubo along the Villalpando Vein, Asuncion, Santa Cecilia, San Nicolas, Arroyo, Tuberos and Poniente veins, and James describes them as vein swarms all over the Property.

We wrap up with the exploration the company also has slated at it’s Pinguico Property at the Veta Madre Vein and James explains just how prolific this vein and mineral trend has been for over a hundred years, and why their exploration team has a thesis that this vein may interested their other key veins in a deformation zone that could have brought many mineral rich fluids into this prospective area to test.

Please email us any follow up questions for James over at Guanajuato Silver. Our email addresses are Fleck@kereport.com and Shad@kereport.com.

Click here to visit the GSilver website and read over the recent news.

.

Short-covering In Gold Silver; Bulls Have More Heavy Lifting Ahead

Jim Wyckoff – Monday May 16, 2022

“Gold and silver prices are higher, with silver sharply up, in midday U.S. trading Monday. Gold hit a nearly four-month low overnight. Short covering by the shorter-term futures traders was featured on this first day of the trading week. A weaker U.S. dollar index, higher crude oil prices and lower bond yields on this day also worked in favor of the metals markets bulls. However, the bulls need to put together some solid price-gain days to begin to repair recent chart damage. June gold futures were last up $4.70 at $1,813.10. July Comex silver futures were last up $0.479 at $21.48 an ounce.”

Silver’s last several COT reports have improved dramatically and much more so than those of golds which is much better than the reverse. Consistent with that development is the fact that SILJ is working on its “best” low vs GDX since the covid crash.

That would be great to start seeing some solid outperformance of the Silver Juniors over the Gold Seniors and would be good for the whole sector indeed.

Many of the silver juniors have just been taken out behind the woodshed and beaten with the ugly stick for quite some time now, so accumulating them down at these levels still has downside risk if Silver falls out of bed down to $19 (or $18.75 as Jordan and Dave Erfle are watching for), but at this point there is far more risk that the silver stocks could suddenly take off to the upside leaving most investors out of position. I’ve added to about a dozen of my silver positions over the last 2 weeks, to take advantage of the selling pressure.

Gold price back above $1,800 as Treasury yield retreats

Mining.com – May 16, 2022

“Gold prices bounced back emphatically on Monday as a retreat in US Treasury yields offset headwinds from a relatively firm dollar, driving more investors towards the safe haven metal. Spot gold rose 2.0% to $1,813.34 per ounce by 12:20 p.m. ET, after hitting a three-and-a-half-month low previously.”

“Gold’s rebound was attributable to a dip in Treasury yields and a small pullback in the dollar,” RJO Futures senior market strategist Bob Haberkorn told Reuters, adding that “the overall trend for the dollar was still high as the Fed is being aggressive with its rate hikes.”

https://www.mining.com/gold-price-back-above-1800-as-treasury-yield-retreats/

I picked up some ELO, CXB, LAB, GASX, and AUN, today. Aurcana Silver Corp. is selling for eight cents. LOL! DT

Thanks for sharing some of what you are trading these days DT. Out of the list you shared there, I added to some of my Calibre and NG Energy as well last week, and considered Eloro (but still want to see it correct down even more first).

As for Aurcana, I was noticing their price point at the close today, down another 11% to $0.08 and it is amazing how much value has been lost in that stock, due to all their ramp up into production challenges. I finally had to sell my Aurcana position last Oct & Nov for tax loss purposes, and because it looked like they were not going to get things off the mat any time soon. I had done really well over the last few years in with a half dozen swing-trades and position-trades in AUN, and I was interested to see how things went as they got Revenue Virginius into production (being the highest grade undeveloped silver deposit on the planet). There is still so much exploration upside left around their mine in Colorado, and really also at Shafter in Texas. Regardless, they ran into a series of challenges and have not diluted down share holders with repeated financings to the point where most threw their hands up in the air and just walked away quite jaded.

It may be a good contrarian bet at this point though, as it is priced for failure, and while it still could fail, it also could gradually dig it’s way out of the hole it’s been in, or it could be a takeover candidate by a larger producer that smells blood in the water. That is often when we see a predatory bid come into the equation.

I am rooting for their team to get a turn-around executed over the next 12-18 months, and we had Kevin on the show a few times in earlier 2021 as the development timeline was getting closer to production, and learned a lot about all the different veins they have to yet explore. The challenge is that they need to prove to the marketplace that they can efficiently run that mine at a profit, and then show they can expand the resources to a larger deposit size. Again, wishing that team all the best, but it remains a “show me” story. Having said that, it could have a very nice bounce on a percentage move at this low valuation if they can garner any market love.

On a related note on Aurcana, here is a reflection from Bill Powers over a Miningstockedu.

It will be difficult for AUN to shake this perception and disappointed investors after the journey it has been on. We may reach back out to Aurcana though at one point and just get an update on how things are proceeding.

____________________________________________________________________________________________________________

(AUN) (AUNFF) Aurcana Silver: From 10-bagger to Huge Disappointment…Bill Powers shares analysis & lessons learned

Mining Stock Education – May 12, 2022

Hi Ex, thanks for your reply, I just couldn’t resist buying Aurcana today when it popped up on my screen. I have bought it in the past and also have done well. But at this point it is anybody’s guess…………….. DT!

Hi DT. Sure, you never know what can happen to mining stocks down at these levels. They can go the way of TMAC or Klondex or Richmont and get taken over for a nice 30-40% premium for investors that try and go bottom fishing, or they can get raided and destroyed like Harte, Primero, Red Eagle, or Sage Gold.

I hadn’t finished listening to the whole Bill Powers interview when I posted that earlier, and just did, and by the way it sounds with Kevin selling his shares and the amount of capital needed to get the mine properly up and running, it will not be the current team that digs this out of the whole, in his opinion. It is likely going to require a new team with enough capital or a takeover by a larger mining company to get it across the finish line into commercial production, or there will be a default and the debtors will get the project and have to resell it another group.

That was one of the more brave and candid interviews I’ve heard anyone do in a long time that Bill Powers released a few days ago on Aurcana, and there are so many lessons in it for investors, regardless of whether or not they are following the AUN story. I’d recommend anyone that is serious about investing in the junior mining sector review that interview, especially the middle to end of it, as the journey he went through is applicable to so many other mining stock speculations.

Hi Ex, I listened to the Bill Powers interview shortly after you posted it. It was a learning experience that never seems to end when investing. I’ve never heard of him but he is candid and blunt which gives the video credibility. Most of us armchair investors never get to go on site visits or talk to a mining crew but we can live this experience through others. It all takes a lot of time and commitment but so does anything in life. Thanks for sharing! Cheers! DT

DT – Absolutely agreed that it is learning experience every single day in the junior mining sector, and the larger investing universe overall. All we can do is keep expanding our scope of knowledge and experience to ideally make more well-informed decisions. As the old saying goes… “If you are green then you grow, and if you are ripe then you rot.”

Yes, I’ve been following Bill P. over at Mining Stock Education for the last few years and he brings on a number of guest that are also friends of our show as well (like Dave Erfle, Brian Leni, Brien Lundin, Jordan Roy Byrne, Rick Rule, John Feneck, etc…) and believe he is one of the good guys in the sector. Also, he does a really good job in interviewing companies and drawing out of them different points I don’t hear in other interviews, so I try and check in there about once a week to see what interviews are posted. I’ve been reposting those interviews here on the KE Report for a few years as well. Good stuff.

Ever Upward!

Michael Boutros (Gold 27:48): https://www.youtube.com/watch?v=hr8KK5-dIjQ

Summary of previous 2 day purchases and letter writer who sponsored the idea:

Max Resources Coffin

Braveheart Resources Moriarity

Chargepoint Holdings Prins

Phenom Resources McCoach

CMC Metals Krauth

Southern Silver Krauth

American Pacific Chen Lin

FWIW

Hi Lakedweller2. Thanks for sharing some of the companies that you are trading and that caught your eye after watching the MIF presentations and other newsletter writer pieces.

As a heads up, we are working on getting an update on American Pacific on the show sometime in June.

Some of points from my notes on American Pacific indicate a share structure of 117.7mil/133.4 Diluted, Michael Gentile an investor, 3 different projects (1. Montana/copper/gold/good drill results. 2. Nevada/large grade samples. 3. Also Nevada: Goosberry/silver/gold) Suposedly #1 gold performer on Canada exchange last year. But…possibly a 60% drawback like Emerita. Didn’t write down price when they achieved #1 but currently around .60 US. I like that they have 3 possible shots at a project and all in US. Also shot at silver/copper options along with gold.

MIF: Not a lot of strong feelings from letter writers as to where the miners are going. A lot of comment about “we have never been here before” and some direct comments about Market Intervention which alters predictive ability. Also several references to a “reset” in many forms which will include an international digital currency. Also a lot of talk about the future of silver and other electronic metals being in short supply in the future and should be part of the new technical revolution of energy changes…but some hesitancy about putting any dates on anything. All used the word “close”, but couldn’t define close.

My concern is and has been that bullion banks like JP Morgan will be altering reality in the past, current and future and will continue to try to distort markets through the paper markets or other criminal interventions and Governments will continue to facilitate them by lack of regulation. We are in new times….

My impression was that most are mining oriented but they mentioned “diversification” but concentrated in diversification of metals. Krauth is a silver guy with a new book and concentrated on silver. Chen Lin also concentrated in his presentation on silver which was interesting from the perspective that he also claims to roll with markets and doesn’t have a preference for metals, but a preference for the “trending sector’. He also mentioned an ongoing interest in biomedical which he maybe toned down for MIF. Anyway …if anyone is looking for a possible investment, they may want to go to the MIF site and see the Agenda for the meeting and checkout the stocks presenting. More explorers than anything that I always fall for, but a few that are farther along. If nothing else, print the agenda and follow how they do “when When happens”.

Thanks for sharing those thoughts Lakedweller2, and great synopsis of the MIF and the general temperament and themes of the presentations. I’ve not had a chance to review any of the keynotes or company presentations yet personally, but will aim to digest those later in the week. Ever Upward!

Just Remembered another point: Chen Lin: what was refreshing is that his English has improved and with it comes more personality. Might be my listening getting better. But, during the final panel discussion, he mentioned that he still had contacts in China he maintains association with and one of the things that Chen considered to be an important issue for the Metals markets in general was the Covid lockdowns. This was confirmed by his Chinese counterparts and all are expecting possibly a “bottom trigger” in the metals to be reopening China and a resumption buying of gold by the Chinese government and base metals in general as their economy gets back to work. He mentioned a date in May or June as the reopening date set by the government but I did not take any notes during the panel.

(SLVR) and (SLVTF) Silver Tiger Intersects 2,338.5 g/t AgEq Over 1.0 Meter Within a Broader Interval of 9.1 Meters Grading 809.7 g/t AgEq in a Step Out Hole in the Black Shale at the Benjamin Vein

17 May 2022

https://ceo.ca/@accesswire/silver-tiger-intersects-23385-gt-ageq-over-10-meter

Good timing on SLVTF as I took profits in Summa and Blackrock as they got in the Long Term tax area. I rolled some of them into rebuying Silver Tiger, but recently sold back to a core position. I need to add back all of them, but right now ST.

Metals Up for Rebound

Bob Moriarty – May 16, 2022

“I follow the Daily Sentiment Indicator closely as my regular readers are well aware. The DSI for the Stock Indexes and most foreign currencies hit near record lows in the last three weeks but have turned higher as the DSI for the Dollar Index has been dropping making the market for resources more favorable. Monday the 16th of May is a full moon and would be a great time for a rebound in shares including resource stocks that have been hammered over the past month. If there is a rebound, get cashed up.”

“I’m on record as saying I believe we are in the greatest financial collapse in history. I use as a comparison the DOW Jones dropping 89% between September of 1929 to July of 1932. But even during that period there were big rallies that managed to convince the ordinary investors, indeed even the “experts” that the worst was over.”

http://www.321gold.com/editorials/moriarty/moriarty051622.html