Sell low, buy high: the sheep investors are back

Investors are back with a vengeance

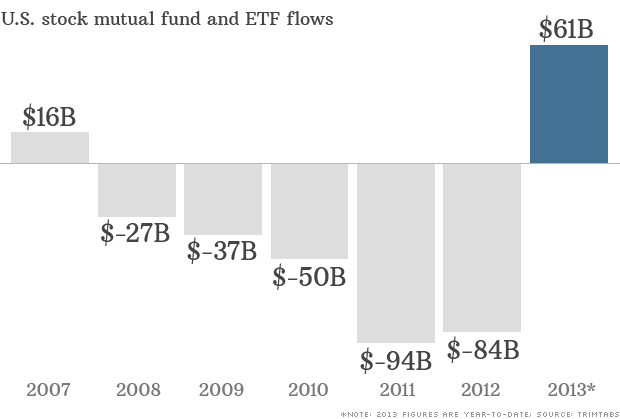

Investors have plowed more than $60 billion into mutual funds and ETFs that hold U.S. stocks, according to research firm TrimTabs. That’s already more than any full calendar year since 2004.

Investors have been rushing off the sidelines this year and show no signs of letting up.

So far, they’ve pumped more than $60 billion into mutual funds and ETFs that hold U.S. stocks, according to research firm TrimTabs.

Oh, he will be back with some salt!

Who knows, Marc, maybe he will be right for a time?

Big Al

Ugh! Jeffery Christian on BNN. Says $1480 to $1430 is the low in second quarter sometime. RSI is leaving a bit more room to the downside for gold. Will be ready for buying call options soon. Go away and buy in May.

Dan

That is kind of what both Rick and Doc said, Calgary Dan!

Big Al

There was a lot of congestion on the chart from $1380 to $1430 in late 2010 (a quadruple top) and early 2011 before the big move up to $1900. In early 2011 it took a fair time to get the price above $1430 after a small correction to just over $1300 at the beginning of the year. There should be a lot of support there, methinks. However, if it breaks below $1430, we could be in big trouble.

Its not even May yet!!!

Ok who’s manipulating silver and gold today. They dont get prosecuted so why would they stop?

Yep, Professor, why should they? (Assuming that they exist!)

Big Al

Of course they exist. You cant tell me this was healthy trading.

It was Ben & Draghi that organised this with the Banksters in their pockets. They want lots of money and who still has it. The people that have worked all their life for it. I am very angry and down over $100,000 on Friday. If I sell though I have lost it all. Will it recover….. who knows. Is it gonna be allowed to. They can keep doing this forever………. it stinks big time. I am sorry but the soon the dollar crashes the better.

It came down to 1530 to 1550 so many times that it had to break through and being it is near the end of the strong season for gold it had to go a lot lower over the next few months. Had it been around the 1700+ area it would have not been so bad during the summer but falling from such a low level of around 1550 it has to go a quite a long way down by June/July.

The gold price has spent so much time only just above the support at $1500-1540 that it had to break eventually. Any savvy buyers at those levels previously would just step aside and wait to buy at a lower price – and apparently they have.

The charts don’t lie. I posted them over and over. That is all.

IMO, it’s good that we took out the low in gold today. It was obvious that there weren’t any buyers to take it over 1800. Today, the weak longs capitulated. Hopefully, this will attract in new buying and force the weak longs to buy at a higher price in the future. The real question now is: When (and at what price) will see the major low in gold?

The next month or so will be really interesting, Jimmy!

Big Al

$1430 maybe, if not then $1307 which would give $20 silver, probably.

IMHO only. I have flipped through a bunch of charts and have not seen any yet that seem oversold enough for a spring -back rally yet. RSIs are low but don’t seem at washout levels. A secondary low with a higher RSI may be the sign I am looking for.

Dan

The gold commentators who constantly say buy hurt the gold market by convincing those who cannot handle volatility that it is a one way street higher. GATA has out lived thir usefulness so has Sinclair.

Ecclesiastes says there is a time for everything…a time to buy a time to sell…the manipulation talk is talk of sore losers blaming others for their losses.

Gold has cycles just like the seasons and the cycle is down right now. The bottom is near $1350-1400.

Cyclesman, or is it Bankster ben of the BIS, ECB……

Cyclesman,

It really would not surprise me if you turn out to be correct.

Big All

Cyclesman,

You are one smart man. I couldn’t agree more.

This market today was fraud plus a TD Amritrade-esque retail stop loss target panty raid.

When the market is raided like this it suggests GATA’s is correct…. it does not disprove anything they have alleged. When the Fed is actively “easing” the equivalent of our 1980

acknowledge accumulated debt on an annual basis and gold is being disparaged this period will be looked back with disbelief. Dare I say it is the decay of the social fabric that allows such fiscal fiasco monetary mayhem to occur. No spilt milk here…back to the bid Monday. 500 paper tons sold in a couple hours but it takes 7 years to make physical deliver Germany of her gold…come on now people….the volatility here will work in the other direction. Down $84 today….$85 Billion in QE per month in perpetuity. $84 down day is a precursor to $100 up days…the bankers were getting the wedgy out of their shorts.

Perhaps,

But for every buyer, there is a seller; for every seller there is a buyer. When there is nobody there to buy – down goes the price. Gold is a thin market, very easy to manipulate and very volatile. Gold has been traded in paper FAR LONGER than when Nixon took the U.S. off the gold standard. Every market can experience manipulation in some form or another. But the trading blogosphere and chat rooms have been filled with traders watching $1530, 1525, and 1500 levels of gold ALL WEEK LONG. As traders they take the position based on whether support or resistance holds. You can’t fight sentiment and running stops isn’t illegal. It’s not hard to look at a chart and determine where most traders have their stops. A little push and the volatility steps up.

HGD, gold bear plus ETF, is going parabolic but is not fully overbought yet.

Dan

I put all my 2013 TFSA contribution into bonds; so far so good.

Even the worst bond etf makes TSX gold sector look sick.

http://stockcharts.com/freecharts/candleglance.html?XBB.TO,XCB.TO,XGB.TO,XHB.TO,XLB.TO,XRB.TO,XSB.TO,XHY.TO,TLT,MHY/UN.TO,MIG/UN.TO,CBO.TO|D|J[xgd.to]

Maybe this will show the link that was intended:

Irwin…..AL still loves ya…..he believes in diversification…….and bonds are a way of being diversified…..

.

🙂

T.U.

thumbs-up

or

tits-up

..not sure!

well,,,,marc and irish will agree either way……

The latter Irwin!

Big Al

Good call Irwin.

Dan

Thank you The Tall!

Big Al

Being perfectly honest, Irwin, I have to say congratulations!

Big Al

ooops! I probably should clarify;

I didn’t mean that I bought all those bond ETFs .. I just linked to those charts as an example of what bonds are doing.

Truthfully, I have no idea how the bonds I did purchase are doing, except that they’re up from where I bought them.

Hey Big Al,

I thought I would be proactive….Where is Silverfox? This is his/her stage today. Go ahead kind sir/maam..but, be gentle. :). But, please, remember, one day doesnt make a trend.