A new contributor to the site – Doc Jones shares his thoughts on Tarachi Gold

I am very happy to introduce Doc Jones to all of you. A lot of you may know Doc Jones from other metals forums and his company reports.

I was recently introduced to Doc Jones and had a long call with him discussing his investment strategy and the level of due diligence he does when looking into a company.

I was so impressed with his insights and strategy that I will be bringing Doc Jones on the show as a regular guest. This will start in a couple weeks. In the the meantime I asked Doc Jones to send me a recent article to post on the site. I hope you all enjoy! I am very excited to have Doc Jones as a future guest to the site.

Please let me know your thoughts on the Company he is focusing the article below on – Tarachi Gold.

Did you say “FREE SHARES of TARACHI GOLD $TRG?” (updated now deal is in.)

In the following Due Diligence Report, I will propose that Tarachi Gold shares are essentially free… (Teach to Fish topic covered: Economic Project Analysis)

First off I own TRG and I am a private investor, no one pays me for coverage. Learn more about me and my investments at: https://ceo.ca/@drjimjones

Let’s start with INVENTA CAPITAL, they are the group that brought TARACHI public. They are an up and coming Think Tank of Tier 1 geologist, mine builder, multi-million oz discoveries and venture capitalist founded by Michael Konnert and Craig Perry. They are very well respected and envied in the industry.

INVENTA CAPITAL

Inventa Capital is a venture capital advisory firm dedicated to the acquisition and development of assets in the natural resource sector. Inventa was founded in 2017 with the goal to discover emerging opportunities in the natural resource sector. Today, Inventa has grown into one of the premier mining groups with a first-rate portfolio of companies and a world-class team. In 2020, Inventa raised over $100 million for its group of companies.

Inventa provides its companies access to corporate services, corporate development opportunities, financing support in the market, and marketing initiatives which include; contact management, internal media creation, and finance marketing.

An incomplete list of companies under their umbrella: Vizsla Resources, Tarachi Gold, Surge Copper, Gold Bull Resource…

Note: “Know the people you are investing in”

(Gwen Preston interviews Michael and Craig for 1:15hrs at the 40min mark they discuss TARACHI)

Micheal Konnert

Founder of Vizsla Resources Corp., Inventa Capital Plc, and Cobalt One Energy Corp, Michael A. Konnert is an entrepreneur and businessperson who has been the head of 5 different companies and occupies the position of Chairman at Tarachi Gold Corp., President, Chief Executive Officer & Director at Vizsla Resources Corp. and President at TinOne Resources Corp. Michael A. Konnert is also on the board of Quartz Creek Development Ltd. and Summa Silver Corp. and Partner at Inventa Capital Plc.

In his past career, he was President, Chief Executive Officer & Director at Greenbank Ventures, Inc., Chief Executive Officer at Cobalt One Energy Corp, Director, VP-Finance & Corporate Development at Benz Mining Corp., and Investor Relations Contact at Riverside Resources, Inc.

Michael A. Konnert received an undergraduate degree from Royal Roads University and an undergraduate degree from the British Columbia Institute of Technology.

Craig Parry

Craig Andrew Parry is an entrepreneur and businessperson who founded 7 companies, among them: NexGen Energy Ltd., Tigers Realm Coal Ltd., and Blockhead Technologies, Inc., and who has been at the helm of 8 different companies. Presently, Mr. Parry is Chairman of Skeena Resources Ltd., Chairman of Blockhead Technologies, Inc. (which he founded), Executive Chairman of TinOne Resources Corp., Chairman of Skarb Exploration Corp., Chairman for Gold Bull Resources Corp., Chairman for Vizsla Resources Corp., Partner at Inventa Capital Plc (which he founded) and President, CEO & Non-Independent Director at IsoEnergy Ltd. Mr. Parry is also on the board of Surge Copper Corp. and GPM Metals, Inc. and Member of Australasian Institute of Mining & Metallurgy.

Mr. Parry previously held the position of Chief Executive Officer, Executive Director & MD of Tigers Realm Coal Ltd. (he founded the company in 2012) and Director at Tigers Realm Minerals Pty Ltd. (a subsidiary of Tigers Realm Coal Ltd.), Manager-Business Development at G-Resources Group Ltd., Principal at Rio Tinto Ltd., Senior Advisor at EMR Capital Pty Ltd. (he founded the company in 2012), Executive Director & GM-Business Development at Tigers Realm Group (he founded the company), Principal Geologist–New Business at Oxiana Ltd. and Non-Independent Director at NexGen Energy Ltd. He received an undergraduate degree from The University of New South Wales.

NOTE: What this means is Tarachi has access to many high-quality geologists, and other resources to quickly build a resource and to keep their back of house cost low.

NOTE: DEC, 2, 2020 Tarachi Appoints Michael Konnert as Chairman and Cameron Tymstra as CEO

We know who Michael is but who is Cameron?

Note: Notice Cameron’s Linkedin profile, his work history of building, management and his execution of Tailings Operations.

LEARN TO FISH MOMENT With Doc Jones: If you haven’t included LINKEDIN as part of your Due Diligence process, start now. A lot of information can be learned about the folks who you are putting your money behind by reviewing their work history and contacts. The purpose is to ask yourself: Is this person capable, are there any red-flags, up until a few months ago they were managing a Waffle House?

Let’s meet some key Executives…..

THE TARACHI TEAM

Cameron Tymstra, CEO at Tarachi Gold Corp.

Work Experience

Chief Operations Officer, Latin American Minerals, Paraguay Management of the rebuild and commissioning of gold tailings reprocessing pilot plant and exploration operations.

Mining Engineer, Magnetation, Inc. Plant 4 – Grand Rapids, Minnesota Producing iron concentrate from 30,000tpd of iron ore tailings mined with truck and shovel in Minnesota.

Education

South Dakota School of Mines and Technology, Master of Science – MS Field Of Study Mining Engineering and Management

University of Toronto , Bachelor of Applied Science – BASc Field Of Study Mineral Engineering Activities and Societies: Lassonde Scholar. Co-Chair of the Canadian Mining Games.

Michael Konnert, CHAIRMAN (see above)

Lorne Warner, VP EXPLORATION & DIRECTOR

Lorne McLeod Warner graduated from the University of Alberta in 1986 with a BSc in Geology. Lorne is a registered professional geologist in B.C, NWT, and Nunavut with over 30 years of experience in mineral exploration, underground and open-pit mining with Noranda Exploration and Placer Dome Inc. His career started in mineral exploration in British Columbia but has now worked throughout the Americas, Africa, Asia, and Australia. As the vice president of several junior mining companies, his team discovered the western extension of the Detour Lake gold deposit, now in production in Ontario. As well, the Falea North Zone – Uranium, Silver, Copper Deposit and the Fatou Main Gold Deposit in Mali.

TARACHI GOLD who?

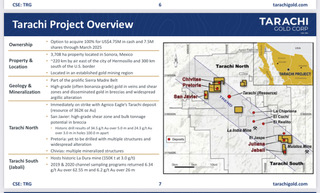

Tarachi is an unknown Mexican focused gold exploration company that went public in mid-2020 in an $11 million dollar IPO, whose core assets were originally slated to be part of Vizsla Resources but with Vizsla’s early exploration success were placed into a separate company so they would get the attention they deserve.

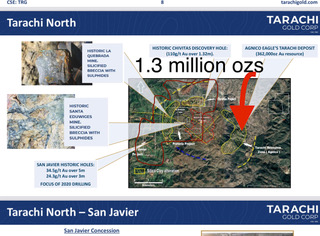

Since going public Tarachi has grown its footprint to 3,708 ha of High-Grade Gold Exploration in the Sierra Madre Belt of Sonora, Mexico. Importantly, on a macro-level, over 100 million ozs of gold and several billion ozs of silver have been discovered on the belt, on a micro-level, within their district over 30 million ozs of gold and over 500 million ozs of silver have been discovered. Their land packages are surrounded by AGNICO EAGLE who has been under-reporting and hiding a 1.3 million ozs gold deposit that neighbors one of our blocks….but, I’ll get into that later on.

Since going public not only have they expanded their land position but have made a transformative acquisition that is a Jr. Mining Investors and Jr Exploration Companies dream. A low cap-ex, a near-term cash-flowing asset that will fund the companies exploration and growth plans for many years to come internally. The Transformative Acquisition of the Magistral Tailings Plant which included 1,000 tpd plant, tailings pond, and 600 ha property Located in northern Durango State, Mexico (easily accessible by highway), Historical (non-NI 43-101) tailings resource estimate of 1.3M tonnes at 2.05 g/t Au = +87000 ozs gold

Note: Later I’ll break down in detail the potential of each of these divisions and why I say the stock is free at its current evaluation.

Some webinars to watch:

Tarachi Golds’ goal is to become a 100-150k gold oz producer in the next few years through the drill bit and/or from acquisitions made from internally generated cash flow.

I think they will achieve that goal or be bought out.

The data points as of Feb 7th, 2021

Ticker: TRG (CSE), TRGGF (OTC-US)

Share Price: $0.29 Canadian (recent high of $1)

Basic Shares Outstanding: 78.9 Million (pro forma Tailing acquisition)

Cash: $8 Million

Market Cap: $22.88 Million Canadian

Enterprise Value: $14.88 Million Canadian

Percentage of Cash/Market Cap. = 35%

Options: 5.1 Million (4.4 million weighted average exercise price $0.39)

Warrants: 26.2 Million (weighted average exercise price $0.47)

*Total Value of if all were exercised exceeds $12 Million

INSIDER OWNERSHIP (Management, Directors & Advisors) = 22.5%

Last Financing Details

Note: Already free-trading in Dec 2020 causing a sell-off to its current price of $0.29 from warrant clipping and tax-loss selling.

“Tarachi Gold Corp Closes Oversubscribed C$9.48M Private Placement”

“VANCOUVER, BC, Aug. 14, 2020 /CNW/ – Tarachi Gold Corp. (CSE: TRG) (FRA: 4RZ) (the “Company”) is pleased to announce that it has closed its non-brokered private placement (the “Private Placement”) issuing a total of 23,718,605 units (the “Units”) at CAD$0.40 per Unit for total gross proceeds of CAD$9,487,442 Each Unit consists of one common share (the “Shares”) and one-half common share purchase warrant (the “Warrants”) with each full Warrant entitling the holder to purchase one share of the Company at a price of CAD$0.70 per Share for a period of 24 months from the date of closing of the Private Placement. All securities issued will be subject to a four-month hold period pursuant to securities laws in Canada.”

“As you can see, cashed-up, 44% of the Market Cap is cash, majority of options and warrants reasonably priced and out of the money, larger insider ownership, no free-trading over-hang…look good right?

”An excellent start, but Doc, how are the shares free?”

“Glad you asked.”

Financial Analysis of Magistral Tailings Plant

Assumption: Gold price for 2022 average $1850 us

The grade of the stockpile to be processed is about 2.05 g/t, 1.3 million tons = 86’000 ozs.

Recoveries are expected to be 75-77%, average= 76%,

Gross Gold ozs = 86,000 x 76% recovery = Net Gold ozs 64’500

Cash Cost = $1000 (although in interviews the new CEO whose professional experience is with tailing ops has stated sub $1000 cash cost, last week when we chatted after he returned from Mexico he reaffirmed a sub $1000 is highly likely)

Gross Cashflow per ozs at $1850 gold = $1850-$1000= $850/ozs.

Total Gross Cashflow over the life of tailing project= $850 x 64,500 net ozs produced = $54,825,000 USD

TOTAL NET CASHFLOW over stated life of trailings = $54’825’000 x .80 (to subtract 20% to include all royalties and taxes = $43,860,000 USD / $55,956,710 CAN Dollars

NOTE: Total unencumbered Free Cashflow of $55.95 Million , current Enterprise Value of $14.88 Million.

“Huh? ….Hold on I gotta clean my glasses….HOLY COW!!! I’m so sorry, I made a mistake, the shares aren’t free, you get paid 4X to own them.”

THESIS TEST Downside/Upside -/+ $350 on Gold Price, Assumption $1850 USD/OZ

At $1500 oz USD Gold Net Cashflow = $32.9 Million CAN = 2.4 x current Enterprise Value

At $2200 oz USD Gold Net Cashflow = $79.1 Million CAN =5.3 x current Enterprise Value

Note: Correct you get paid to own them

Annually Economics Analysis

1000t/g x 365 day a year x head grade of 2.05g/t x .75 recovery rate / 31.1 = 18’044 oz/year produced.

Annual Gross Cashflow per Year = 18,044ozs x $850 cash = $15,337,400 USD

Net Annual Cashflow per Year = $15,337,400 x .80 = $12,269,920 USD / $15.65 Million CAN Dollars

NOTE: Once in production approx. 1 year from now the company will be generating MONTHLY FREE CASHFLOW in a steady-state gold price of $1850 oz/USD of $1.3 million, month in and month out. INCREDIBLE!!!

How long will they produce for? Total net ozs produced/ annual production = 64,500/18,044 = 3.6 years

Project Life: 3.6 years. Net Free-Cashflow $55.95 Million, Cap ex: $2-$4 Million

Net Cashflow per share on the project: $0.71 (current share price is $0.29 that included $0.13 of cash) THAT IS STUPID CRAZY CHEAP! You are paying $0.29 for $0.84 of cash without even considering exploration success or expansion of Tailing Ops.

FURTHER UPSIDE to TAILINGS OPERATIONS: This area has multiple historical tailing stockpiles within trucking distance the can be acquired to extend cashflow life past a decade, the original mine from which the current tailing originated is just 500 meters from their property boundary and TARACHI is looking into acquiring it to add fresh high-grade ore to the feed and project life. They will always own the Mill complex forever and fresh ore from nearby small deposits can be acquired. There are lots of stranded deposits that can be bought for pennies on the dollar to feed it eventually.

The bottom line is, even without these possible additional sources beyond what’s being acquired, you have a JR exploration company that is self-funding for many years, which means maintaining a very tight share structure, little to no dilution for years to come as there grow and acquire more assets.

NOTE: They have $8 million in cash already, it’ll cost $2-$4 Million to get it running leaving them with $4-$6 million for exploration, more than enough to fund them into first pour and cash flow generation for years. This is why I bought TRG and its now one of my largest holdings. Exploration is risky and capital intensive so having long-dated predictable non-dilutive positive cashflow is paramount and means any upside from exploration will be fully captured in the share price going forward. Team. Assets. Capital Structure. Upside.

EXPLORATION ASSETS

3,708 ha property located in the Eastern Sonora Mining district bordering Alamos’ Mulatos mine and Agnico Eagle’s La India mine (+30M oz Au and +495M oz Ag discovered across the district ) they have commenced 5,000 m initial drill program focused on five high-grade targets, Bulk-tonnage breccias, and high-grade shear zones .

Remember this for later: Notice AGNICO EAGLES La INDIA Mine in the middle

-San Javier: previous drilling intersected 34.5 g/t Au over 5.0 m and 24.3 g/t Au over 3.0 m in holes 100.0 m apart.

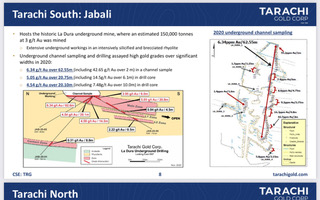

-Jabali : 6.34 g/t Au over 62.55 (including 42.65 g/t Au over 2 m) in 2020 channel samples at the historic La Dura mine and 5.05 g/t Au over 20.8m in 2020 core drilling.

-Open in all directions with minor historic drilling to date.

They Initiated a 5,000m drill program, completing 1,711.2 m in 2020.

Assays are still pending for ten drill holes completed in December.

NOTE: Assays have been received and will be released in the next 10 days or less I believe.

Encountered consistent gold values over considerable drill intervals at Tarachi South, La Dura Mine where underground channel sampling also returned 6.34g/t Au over 62.55m.

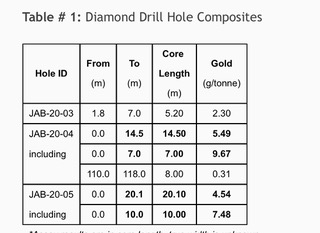

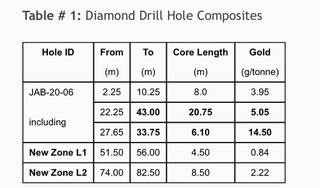

FIRST DRILL RESULTS FROM LA DURA MINE their Southern property 2020 program

Tarachi’s First Drill Results Return 4.54 G/t Gold Over 20.1 Metres at Historic La Dura Mine in Sonora, Mexico

Tarachi Drills 5.05 G/t Gold Over 20.75 Metres and Discovers Additional Gold Zone at Historic La Dura Mine in Sonora, Mexico

NOTE: Excellent wide intervals with mineable grades. Geology is the perfect environment to trap the gold.

AGNICO EAGLE GATE…The plot thickens…

Now let’s go to Tarachi North where the AGNICO EAGLE Tarachi deposit is located and currently has a 362k gold oz resource reported in 2020. Its just a gold bar throw away, but that’s not actually true, their deposit is at least 1.3 million ozs of gold. Shame on you Agnico Eagle! You didn’t think Doc would do his due diligence on all the surrounding deposits, did you! Shame! Shame! Shame! ( Game of Thrones reference…First I Google-searched then went to sedar, sec archives)

The world had forgotten, NO ONE KNEW THIS. Neither the venders or TARACHI GOLD knew, makes sense how they were able to get the land.

Below inside the large red outline is TRG land, all the rest is Agnico Eagle, they have one side of the quartz porphyry (small red irregular circle) housing a large silicified Breccia complex. Where their Tarachi Deposit is, we have the other side with 2 large silicified Breccia complexes.

“…the gold system at Tarachi Deposit is best classified as a wallrock gold porphyry deposit suggesting that it has the potential to grow into a much larger deposit….Tarachi has 400,000 oz. gold in indicated (34.5 million tonnes at 0.4 gram per tonne) and another 900,000 oz. in inferred (72 million tonnes at 0.4 gram per tonne). Metallurgical work is underway, with results due by year-end…Analysts believe Tarachi could become a stand-alone or satellite project to La India…”

Note: This is a game-changer. Having a multimillion oz deposit next-door that shares the same geology, centered around a porphyry is huge, and nobody knew Agnico’s valuable secret. Research. Research. Research.

Look at the high-grade historical drilling on our package, we could have both a large multi-million oz bulk tonnage deposit and the high-grade low-sulphidation epithermal high-grade deposit here. The prior drilling was shallow and never tested the boiling zone!

Assays are pending from this area and the next drill program will be testing deeper horizons, the Boiling Zone.

Below are the historical facts filed with the SEC, SEDAR by AGNICO EAGLE about their closely guarded secret about their TARACHI DEPOSIT

I dug through the Agnico Eagles filings and it appears they put a resource on it in 2013 and continued to drill it out a few 1000 meters a year from 2013-2015. Then they stopped because they failed to get the remaining 50% surface rights they needed to build a mine. The 1.3 million gold oz resource stays constant until 2016 where the size drops, I believe, as a function of the cut-off grade used to calculate was raised to reflect the lower gold price. Note, In 2013 when they had 1.3 million ozs they used a $1350/oz gold price and/or they restated the resource lower to reflect only resources in the area they had secured the surface rights to.

I think they are banking the land until such a time that they can get the access agreements they need to build a mine and continue to expand the deposit.

They did the metallurgy in 2014, but didn’t release the results publicly. The results must have been good enough to warrant pursuing the surface access right they would need to build a mine. That’s very interesting.

They never publicly released the drill results from 2013-2015 on their Tarachi Deposit exploration programs after the 1.3 million oz gold resource was stated.

Based on current information, using a $1500/oz gold price, a lower cut-off grade than used when Agnico put the 1.3 million oz gold resource on their property, the lower input cost related to the oil price, the current exchange rate on the USD to Mex Peso, lower grade ore is included, and finally add in their unreleased 6000-8000 meters of drill results from between 2013-2015; it wouldn’t be a shocker if the current Agnico Eagle Tarachi Gold Deposit is actually over +1.5 million ozs.

The economics have drastically improved on labor cost and energy, considering all the above it is at least 1.3 million ozs currently and economical.

All information below on the TARACHI DEPOSIT is found only in the Supplemental Report filed annually with the SEC from 2013-2017, none of it appears in the Annual Reports a la “Cut and Paste”.

2013

The assumptions used for the 2012 mineral reserves and resources estimates for the Tarachi properties reported by the Company in 2012 used more conservative metal price assumptions of $1,345 per ounce of gold, C$1.00 per $1.00, 13.00 Mexican pesos per $1.00 and €1.00 per $1.30.

NOTE: Current USD to Peso is 1 : 21 today, Gold $1815

The La India property consists of 53 mining concessions totaling approximately 60,407 hectares in the Mulatos Gold Belt in Sonora, Mexico. The La India mine project includes the Tarachi deposit and several other prospective targets in the belt. At Tarachi, indicated resources are 47.2 million tonnes grading 0.39 grams of gold per tonne and inferred resources are 81.7 million tonnes grading 0.36 grams of gold per tonne. A metallurgical testing program on Tarachi composite samples has been initiated.

2014

At the Tarachi deposit in 2014, the budget is $2.1 million for 4.0 kilometers of exploration drilling. An additional $2.3 million is planned for 4.0 kilometres of exploration drilling in the Tarachi region in 2014.

At the Tarachi deposit, the surface rights in the project area are owned by the Tarachi Ejido (agrarian community) and private parties. All measured indicated and inferred project resources lie within privately owned or ejido possessed land. Surface access lease agreements have been executed with the property owners or possessors for approximately 50% of the identified target areas. The existing agreements permit exploration and drilling activities; if mining activity is contemplated in this exploration area the Company will be required to negotiate further to acquire the surface rights needed for project development Then in 2019 they don’t mention Tarachi at all in the annual report.

2015

At the Tarachi deposit, indicated mineral resources are 47.2 million tonnes of ore grading 0.39 grams of gold per tonne and inferred mineral resources are 81.7 million tonnes of ore grading 0.36 grams of gold per tonne. A preliminary metallurgical testing program on Tarachi composite samples has been completed and negotiations for land access are ongoing.”

2016

At the Tarachi deposit, indicated mineral resources are 47.2 million tonnes grading 0.39 grams of gold per tonne and inferred mineral resources are 81.7 million tonnes grading 0.36 grams of gold per tonne. A preliminary metallurgical testing program on Tarachi composite samples has been completed and negotiations for land access are ongoing.

2017

At the Tarachi deposit, the surface rights in the project area are owned by the Tarachi Ejido (agrarian community) and private parties. All measured, indicated and inferred mineral resources lie within privately owned or ejido possessed land. Surface access lease agreements have been executed with the property owners or possessors for approximately 50% of the identified target areas. At the Tarachi deposit, indicated mineral resources are 22.7 million tonnes grading 0.4 grams of gold per tonne and inferred mineral resources are 6.5 million tonnes grading 0.33 grams of gold per tonne. A preliminary metallurgical testing program on Tarachi composite samples has been completed and negotiations for land access are ongoing.

The Tarachi Deposit, located near the La India mine, contained indicated mineral resources of 22,665,000 tonnes grading 0.40 grams of gold per tonne and inferred mineral resources of 6,476,000 tonnes grading 0.33 grams of gold per tonne. Gold cut-off grades used for mineral resource estimates were fixed at 75% of the applicable mineral reserve cut-off grade.

Note: VERY, VERY, Interesting right? If they can’t land access then they will have to look elsewhere in the future for ore to feed for La India Mine.

Note: Tarachi Gold TRG originally approached Agnico Eagle to buy their seemingly small 362K deposit, figuring they’d want to shed a small dormant asset and we told and I quote from my conversation with TRG CEO Cameron last week, “It’s very interesting Jim, we were told by Agnico, flat out, it’s not for sale, the Tarachi Deposit is core to our company’s business.” The phrase, “Where there’s smoke there’s fire.” comes to mind.

Here’s a treat: A new Dramatic Play, by Doc Jones

The Phone Call

In the Tarachi Gold office Geologists are busy interpreting assay results as others are busy stacking gold bars in a safe. Suddenly the phone RINGS.

Geo #1: “Can you get that?”

Geo #2: “Sorry, I got my hands full counting these new gold bars from the tailing operation, let the machine get it.”

Geo # 3: “Good idea, this data too interesting.”

The answering machine picks up:

Recorded Message: “Hello, you have reached Tarachi Gold, please leave a message.” Beep.

Agnico Eagle: “Hi, It’s Agnico Eagle. We were wondering if we could take the whole team to dinner tonight and talk something over? Call us back…. as soon as you get this, okay? Thanks.”

CLICK.

The Tarachi Team looks at each other.

Geo#2: “That’s weird. Why would they be…”

Geologist #3 pops his head up from the new data with a huge smile. He is just beaming.

Geo #2: “What is it?”

Geo #3: “I think I know why they called. Guys, come and look at this new data from the assay lab!”

They all both pour over the assay results then high-five each other. Again the phone RINGS and the answering machine picks up.

Recorded Message: “Hello, you have reached Tarachi Gold, please leave a message.” Beep..

Agnico Eagle: “Hi, It’s Agnico Eagle again. Call us back as soon as you get this, not sure if I said that? We’ll pick you up, no trouble, we are just hanging around La India… been very slow lately, like a ghost town…anyway… call us back.”

The SUM-UP

1) I proved through sound economical analysis that TRG shares are more than FREE you will get paid to own them.

2) There is incredible upside from ongoing exploration and newsflow will be constant and consistent, assays pending, drilling resuming

3)The covid delays in labs, covid delay of closing Tailing Deal, Free-trading of PP took the share price down from $1 a few months ago to the current $0.29 where it is extremely attractive and undervalued for so many reasons covered above.

4)In exploration there are no guarantees, it’s an incredibly risky and capital-intensive business fraught with failure and broken dreams. But if you want to invest in this sector find a company with a HIGHLY EFFECTIVE TRUSTWORTHY TEAM, A SOLID BALANCE SHEET, NEAR TERM CASH FLOW POTENTIAL, and A LAND PACKAGE that reasonably has the geological potential to deliver a multi-million oz deposit that is economical at $1500 USD GOLD and most importantly is UNDERVALUED TO THE CURRENT SHARE PRICE. TRG Tarachi Gold is that company and more.

TRG Presentation: https://static1.squarespace.com/static/5e9f73e2fd46470a6b9e30cf/t/600209ce6e5b082a6d3c2181/1610746321813/Tarachi+Gold+Presentation+Jan+15+2021.pdf

Good Luck, do your homework, always double-check anyone’s numbers. Learn to fish. Animals that run with the herd are food for the wolves. Think for yourself.

Best,

Doc Jones

Twitter: drjimjonesceo

Hello b,

Sounds like you have had some bad experiences investing, there are too many bad actors out there, one should be careful and educate themselves.

Mexico is a large country, some area are very hard to work in but the Sonora Sate is very stable and mining friendly, Silver Crest, Magna, Agnico Eagle, Minera Alamos, Argonaut, Premier, Hoshschild to name a few have worked there for years.

As far as a “Sales Effort” this is plain vanilla financial analysis. No magic. Pretty straight forward and broken down, all sources, assumptions and hard data used noted and provided. Pretty straight forward and laid out so anyone can understand and have the ability to dig deeper. I would hope you would focus on more the data then the last line of encouragement “Think for yourself.” I’d be more interest in comments that factually challenge the data and open a dialogue for further analysis.

“…protect themselves in court…” That’s funny…I don’t work for anyone, don’t get paid for my research by anyone. It’s all factual. “they have these tons at this grade at this cost of proaction, therefore it’s extremely undervalued bases on just the predictable future cashflow. Then there is the additional upside of exploration.”

If through reading and DOUBLE CHECKING my research an investor learns the formulas and critical thinking professionals employ to achieve positive outcomes, If an investor is better prepared to make future investment decisions, than I guess I have been paid.

I get paid this way: A smarter investor class across the board ensures only the best companies will come to market. Thus all stakeholders will benefit, capital will not be senseless destroyed or abused. The best companies are rewarded, they create jobs, tax rev, local businesses thrive, everyone benefits.

Never act on any information you read until you vet it for yourself. Sounds simple but you’d be surprised how many investors don’t do this, so it’s worth reminding folks to do that.

“Not all ozs in the ground are created equal.”

Thanks for the comment b.

Best

Doc Jones

Thx for the reply Mr Jones.

I actually stayed in Sanora for about 3 mths years ago.

In any case my question as to why are so many people saying do your own D.D.

Its simply an observation that its become standard to say it.

I obviously agree with all youve said.

My comment concerning the cartels is now or should be part of DD in Mexico, cartels have attacked mines for their PMs.

GNG closed down because of them, there are others I have forgotten now.

In Mali I ran into a phospherous operation that was closed down by isis.

It reopened when the french military got invovled.

I joked with a friend of mine that he did all that DD but missed that great dust cloud heading in the direction of the operation.

These risks are real and should be considered, that was simply my point, not that there was an issue with your work.

Thx for the info on it.

And yes, I have had some “bad experiences” lost money, I have also had some good experiences, made money.

All in all Im still in the game after all these years. 😉

Great research and insights from Doc Jones, as per usual, and I’m really happy to see his hard work getting covered here at the KE Report. I’ve sure learned a great deal following Dr. Jim Jones over at ceo.ca, regarding looking at undervalued companies, as well as looking out for red flags in certain companies.

I look forward to hearing from Doc Jones if he comes on the show down the road to share insights, and appreciate his hard work in the resource sector.

Ever Upward!

Ex, there has been a bit of buzz about Tarachi Gold, you picked up on it from Goldfinger (I believe) over @ ceo.ca. I would be interested to hear your thoughts, you are always on the cusp! DT

Sorry Ex, disregard my above post, sometimes I think you are everywhere at once. DT

No worries DT. I had posted that @Goldfinger had actually liked @DrJimJones report on Tarachi, which is posted here up above. I believe Blasesb may have posted something else about it as well. It has been a company I’ve been reviewing for the last 2 weeks, thanks to Doc Jones good work.

Doc is incredibly helpful and researched. Does his homework 👍🏼

No one does dd like drjimjones. He has the ability to find great value in companies and enjoys sharing his data for free. He is the the farthest thing from a salesmen of any kind. He is retired now but his passion is investing. Imho now he has the ability in retirement to share his research with others.

I have all of the Docs articles printed.

No exaggeration, 10 months ago, I did not know what “gpt” stood for or what an “assay” was. With a burning desire to become a successful, sophisticated private investor I reached out to Doc and long story short and with the utmost humility, I have come an extremely long way and I find myself able to answer questions of those who have been investing in the sector for over 2 years. Free of charge.

I recently discovered a company on my own using the teachings of Doc and have already experienced 5x returns on this position, got my principle back and have free riding shares with lots of upside potential.

His data will change your life.

Wanton89 and Profound, welcome to the Ker Report, feel free to join in at anytime. DT

+5

Hi DT…I agree with you , it’s allways good when we get new blood on the site. We all grow more knolageable , when we feed of each others ideas….Prufound / wanton89 Stick around & share info.

BTW…” Nobody knows everything , But combined we know a lot “…Irishtony.

Ditto IrishT. Glad to see you are still holding down the fort at the welcoming wagon.

When I first popped on here back in 2011, you and OOTB were the first ones to welcome me to the site, and it was really appreciated. Cheers mate!

Hi EX……AH , the good old days of Shad / OOTB / madirishtony…We had some bloody good laughs then…Winding Big AL up.

Yes, we’ve had some good laughs and good conversations, and the big owl was usually trying to keep up with all our banter. Haha! 🙂

Thanks for the warm welcome. I have definitely signed up to the site and look forward to being a regular and looking forward to the wealth of knowledge people like yourselves provide us young bloods. I am still very new but very committed to learning and having more insights than the “average person”. As Howard Marks puts it:

“A good way to think about the superior investor described above is as someone whose insight into tendencies permits him to tilt the odds in his favour”. (Great read recommended by Goldfinger on ceo.ca)

Appreciate you guys. Have a great weekend.

Great to have you posting here Wanton89 and great Howard Marks quote.

Thanks drjimjones for another outstanding research digging investment with minimal downside rush and exceptional upside potential. No one can find stuff like you. It amazes me your passion in retirement to still find companies that are undervalued and I for one am so glad that now in retirement you are able to share your data.

Agreed Raleigh111. Doc Jones is a sharp guy, and I look forward to gleaming more insights from his research for when he comes on the show or puts out more company reports. Ever upward!

Welcome in Raleight111………….Stay have some fun.

I’ve found further info on the Tarachi Deposit next store in the SEDAR archives.

source. https://www.sedar.com/CheckCode.do There is an assay table from drilling.

Greyd Resources released this info then shortly after Agnico Eagle made a robust takeover offer.

Notice the language used to describe The Tarachi project ….”Tarchi Area… Gold porphyry mineralization, which starts at surface and is open at depth, has now been intersected over an area of approximately 800 x 800 metres. Highlights from recent results include RC-10-584 with 74.7 m at 1.03 g/t Au including a high grade core of 22.9 metres at 2.58 g/t Au, and RC-11-588 with 44.2 metres at 0.93 g/t Au. New results also include intercepts from RC-11-590, a similar mineralized zone 700 metres northwest of these holes. This entire 251 metres hole intersected anomalous gold averaging 0.30 g/t Au, including a 16.8 metres interval of 1.01 g/t Au. The hole bottomed in a 24 metres interval averaging 0.64 g/t gold. Another large step-out hole, RC-11-595, intersected 0.56 g/t Au over 106.7 metres, including 26 metres of 1.01 g/t Au, and bottomed in an 18 metre interval averaging 0.53 g/t Au. This new drill hole is located 350 metres to the north of the area with the highest concentration of drilling and significantly expanded the extent of confirmed gold mineralization.”.

“ Exploration and drilling since June 2010 has largely focused on the Tarachi prospect, located 10 kilometers north of the resource area that was analyzed in the (PEA) and represents a separate gold-rich mineral system. Tarachi is a very large mineralized system that encompasses zones with significant gold content.”

Tarachi Gold the company has the other side of this Porphyry system.

Porphyry in red, Tarachi deposit in breccia on left is actually 1.3 million ozs as filed in 2013 by Agnico Eagle, our land on right, blue outline, we have 2 breccia’s. These area combined could hold +5 million gold ozs of bulk tonnage open pit resource. I know, sounds like a lot but geological it’s possible especially with one side that have already defined over 1.3 million ozs. If it’s leachable even .4 g/t makes excellent irr’s. Then there’s the high-grade deeper horizons: https://cdn-ceo-ca.s3.amazonaws.com/1g2hfkr-3D1D5602-2F4A-456B-A28D-169B1154DC6A.jpeg

No guarantees but that a lot of smoke. Assays out this week and next phrase of the drill program should include the breccia’s in image above.

Interesting.

Best Dr Jones

I had an hour long zoom with Michael Konnert (Chairman TRG and CEO Vizsla) yesterday, he had reached out to me regarding my in depth research on TRG. A few key points 1) He confirmed that Agnico Eagle denied their request to walk their Tarchi Deposit or entertain the sale of it to TRG, AG:”Tarchi Deposit is core to our company” 2) They are actively pursuing a second tailing pile close by to extend Mill’s 4 year cashflow life, and shopping around for trucking distance fresh ore to extend cashflow and/or a deposit near mill with a PEA or FS so they could go quickly into production using the 1000 ton a day mill they now own (after tailings). (kind of brilliant right? Run tailing ops, generate 54 million in free cashflow over 4 years while exploring in current land packages and also have 4 years to develop a close by deposit for mill they own and transition seamlessly from a tailing ops to a producing mill ops, all internally funded.) 3) not widely known both Vizsla and TRG share a well known Mexican Prospector that for the last year has been actively been in the field searching for prospects to add to either company portfolio 4) Mike seems excited about the next round of drilling that will now vector in on high sulphide Breccia Pipe System as well as other targets. Note: He was very clear about the desire to build a producing company and not just sit on land and do nothing, “..we are advancing TRG quickly and efficiently, employing capital discipline that protects our share structure…” I believe him, look at Vizsla, 7 drills running now? hitting great structures, building out that resource quickly, a deal in place from day 1 for them to acquire a mill and go into production quickly…. A key investor he noted increased their position in TRG by 1 million shares as well….interesting news…Judge folks by their actions…they seem to be living by their word… looking forward to the PEA on Tailings and next drill results. Best Doc

Speak of the devil…I left our conversation with a few questions that he said he’ll get back to me on and now promptly he has sent me the answers: “…Lorne is on site reviewing targets as we speak in light of the new information around the discovery of the breccias. We will resume drilling shortly at La Dura (south) with 2 rigs and one rig at San Javier (north)…” As I said above, they seem to be living by their word, 3 rigs running shortly. Very good news. Lots of news flow coming. Strong management first always. Best Doc

Think for myself. ok

Where are the cartels in relation to these guys?

There are companies in Mexico that have stopped work because of the cartels.

It seems that after big sales efforts it has become standard to say “do your own dd, think for yourself”

Is that to protect themselves in court when their plans fall apart?