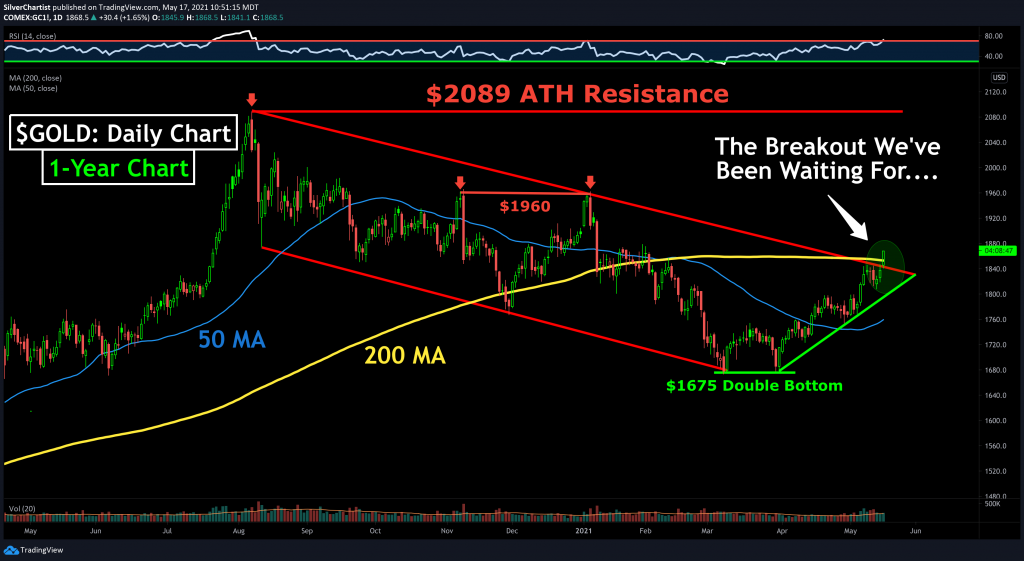

A focus on the key breakout and current uptrend for gold

Steve Penny, Publisher of The SilverChartist Report kicks off today by sharing his analysis of the breakout in gold. He outlines a couple key charts that are featured below. We also discuss silver and it’s uptrend.

Click here to visit the SilverChartist Report website and learn more about the analysis Steve does for subscribers. I recommend signing up for his free email blast at the very least.

Great question. Who is closer to production? Maybe that will answer the question. So the bet is whether Novo has good initial production success or are the shorters/bashers correct. I am waiting for an answer…for years.

Hey Ex Re: your question about how people’s holdings are doing I have a mixed bag on the PM side as half have reacted nicely to the up move in physical price but the other half are lagging and nowhere near last August’s levels…..it’s the copper explorers that are my big green with kodiak alive again and black wolf hitting a new 52 week high.

W:

Thanks for that input. I thought I was the only one with this divergence issue…I am not crazy…Well, yes I am. Rephrase “I am not hallucinating”…uh…””I am not alone”…there…

Thanks for the feedback Wolfster, and congrats on Black Wolf (your namesake) Haha! Yes, Kodiak has had a nice run recently as well. Good stuff!

Yes, the PMs are still a mixed bag, but I’ve seen FAR more than half of my portfolio ripping higher the last 2 months, but admittedly have most of the weighting in more mid-tier producers, smaller producers, and developers, than just the earlier stage explorers. Maybe that is where the disconnect is, if folks have more earlier stage discovery drill plays, then some of those may not have moved off the bottom as hard yet. Eventually their day will come though, just further into the cycle.

I agree about the Copper stocks doing well, and rightly so as Dr. Copper has put on his dancing shoes for the last few months, and especially recently breaking out to new all time highs. Most of the Copper producers and advanced developers have continued to run for some time now, but there haven’t been many investors on these pages celebrating the moves higher this year. Maybe folks don’t hold them despite all the discussions on how important Copper is and how ripe the market was for a rerating higher, from both the supply and demand side of the equation.

I’ve seen large moves for months in my Platinum/Palladium/Nickel plays as well, and even the Zinc miners have had a nice uptrend recently. Also the end of last year into this year the Uranium and Lithium stocks have been on rocket rides higher as well. A few have commented on those moves higher, but many of them are 3-10 baggers so it’s odd to note the lack of enthusiasm around these sectors, when on Twitter those have been en vogue for some time.

Really, for the last few years, it is has been Diversification that has been a lifesaver in my portfolio, as not every sector ran at the exact same time, so it allowed a lot of rotation trading and rebalancing to maximize runs, and exploit the pullbacks. That is likely what has allowed my portfolio to keep hitting new highs regularly (as it has hit another all time high today, just like yesterday, and last Friday).

People parrot silly mantras like “Diversification = Di-worseification,” and other such nonsense, but where are those turkeys at now? How has their focused basket of gold explorers done the last year? If they went “all-in” on cannabis or clean energy how has that gone for them the last few months? How about folks that averaged up in the cryptos as the only true way, dumping everything into one sector, only to get crushed the last 2 weeks in the carnage? That is how to blow up a trading account and take oneself out of the game.

These ding-dongs beating their chests about going all in on a Meme-stock, or an Altcoin, or a particular Gold Explorer, or a hot Vaccine Stock that was going to change the world, are now silent as a church mouse, because they got their a$$es handed to them; when simultaneously other sectors were ripping higher. If they had been diversified, then they could have trimmed back some of their winners in some sectors and then rotated winning trades into the laggards with ease.

Yes, a truly concentrated position {when timed perfectly in the perfect stocks} will outperform a diversified one, but most investors do not pick perfect stocks or time them anywhere close to perfectly, as we all know. What those proponents fail to report are the crazies that throw everything into 1 or 2 stocks and then those stocks get cut in half, or go down more 60% or go down 80% from where they borrowed on their credit cards to get positioned in a stock that “can’t lose.” They’ll point only to the times their wreckless bets actually pay off, but ignore all those investors that get runover as roadkill, and leave having lost far more than they should have been speculating in the first place.

Yes, a diversified portfolio may not produce “life-changing” gains, like going all-in on a speculative drill play, or an altcoin, or new pot stock or biotech vaccine stock may produce, but it won’t clean your clock with one rout either. Anyone with reasonable capital to deploy is not going to be that reckless anyway, as that is pure speculative gambling. I’ve had 80-100 stocks in my trading portfolio for more than a year, and the overall portfolio is up over 385% since the March sector lows. I’m sure there are traders with concentrated bets in a drill play, or crypto, or biotech stock that are up 600% or 1000% or 2000% etc…. but I’m thrilled with my overall growth because I didn’t bet the farm on any one stock, and appropriately managed the risks across different stages of mining, and different commodity/energy/tech sectors, and traded around core positions to buy the dips and sell the rips, maximizing returns, instead of just sitting through all the volatility like a bump on the log.

I was active in the cryptos with a small portion of funds from last fall through April in various forms, but figured it was only a matter of time before the next big correction came. The gains were there to be had, and I could have been more aggressive, but didn’t want to bet the farm, and still scalped some great gains out of the sector. Some folks did much better and kept piling on, but maybe they forgot what happened after 2017 or what just happened the last 2 weeks in stomach churning corrections. Others scoffed from the sidelines and missed easy gains on a trend that was playing out. I’m happy to take the boring middle path and get a few fishing poles in the water, makes some gains, and then find the next pond to fish in.

Now in contrast, I did recently time out the cannabis stocks wrong as they’ve continued to correct down over the last few months; but because I didn’t go “all-in” with concentrated positions and buy everything in 1 tranche, I’m still able to layer into positions and average down in them, and will catch the next leg higher. If they never go higher, then the position sizing in them is not going to sink the portfolio. That is the point of diversification.

Because I was diversified in in PGMs/Nickel, Copper, Zinc/Lead, Uranium, and Lithium stocks that ripped higher for the last 4-6 months, I was able to trim off profits in those sectors after stocks ratcheted up 300%-500%, enabling those funds to now be invested into the “Clean Energy” space in Solar and Wind [now that those have pulled back down]. If I was “all-in” on Gold explorers then many of them may not have run enough to peel off profits to redeploy in other sectors.

After being out of town last week and the weekend, but knowing the stocks had a big Friday, I had expected to see more investors excited about their gains on the Friday or weekend show blogs, but it was really quiet.

Then yesterday when most PM stocks were rocking higher it was super quiet again. It just seemed like we’d see a bit more of a positive sentiment return, but in a way, that just speaks to how sour the sentiment had become and maybe folks weren’t buying in Feb/March/April when the companies were on sale and then riding them higher?

Maybe investors don’t own enough of the producers or royalty companies (that move first when new generalist money starts to rotate into the space)?

Maybe some folks are over exposed to just grass-roots drill plays?

Hell, maybe folks don’t have any mining stocks at all? Who knows?

It just seemed like the last few trading sessions were good for a number of people on many platforms, with some stating yesterday was their biggest upday in years, and then it was like a ghost-town in here. Very odd reaction with such bullish action in the stocks.

I hear you on the cannabis. I got the sell part right for the MSO’s but held on to IMCC thinking the Nasdaq listing would send it higher. Should have known there’d be a PP for the new American players at a discounted price

Yep, I got spanked on IM Cannabis and Fiore Cannabis, but did pretty good on Delta 9, and got a tracking position started in Emerald Health today. Mostly I’ve been swing trading 2 of the ETFs (POTX) and (MJ).

Speaking of Doc Jones, he just put up a 40 minute oral summary on his ceo.ca site concerning his views of the Emerita project. Worth a listen.

Was someone speaking of Doc Jones?

I’m a fan of his work & research, and will go check out his views on Emerita, but after skimming over 5 of his detailed research reports, I get the general value proposition 🙂

I’m looking to get back into Emerita, as I was only in for a brief swing trade, and will join you lads soon.

FWIW:

To continue my nagging theme: 48% positive green and 52% negative red. De Javu again type stuff

I just checked an my portfolio is more like 2/3 up, and 1/3 flat to down. Overall another green day… Maybe I should trim back a few profits if others aren’t seeing this trend.

Or maybe we should all just be buying the Excelsior ETF. 🤔

Excelsior ETF would have worked better.

That ETF is curated with blood, sweat, and tears…. and actively managed by a lunatic. 🙂

Actually, if I had put everything in Vizsla about 6 weeks ago, it would have come close to doubling my account…or if I was JP Morgan and just requested a bail-out, I would have got enough to buy a House across the street from the Monaco Casino. Hard to choose.

Well yes, that is the value of the “concentrated” position sizing approach, and as mentioned above in my rant, those can be the “life-changing” gains people talk about, but one has to pick the perfect stock, at a fantastic entry, and sell at the perfect time, which for most people is not doable.

One could say the same thing about what happened during the pandemic crash of 2020 in mid March. If someone had sold everything and piled into just 1 or 2 key Copper, or Uranium, or Lithium, or even Silver/Gold stocks that were 5 or 10 baggers then they could have made 500%-1000% returns. Of if people had piled into Bitcoin at $3000 and sold at $64,000 as a binary bet, then they’d have made a fortune. That all makes good bar talk for the few investors that actually pull off an out-sized focused gain like that, but again, nobody discusses the pour souls that go all in on a mining, or biotech, or crypto stock and lose 60%-90% of their money, or worse the ones that leveraged on margin or borrowing from credit cards to speculate on a concentrated position and compound their losses. That is far more common in speculation than the “big wins.”

For most investors being diversified will limit some of the upside, as well as limit the downside, but allow for rebalancing in their portfolio as one pops, while another drops. It is also important to diversify across different commodities or different sectors, as has been evidenced over the last few years, where not every sector is running hot at the same moment. We mentioned it is like a giant game of “whack-a-mole” where one sector runs, then another, then another, and that is where sector rotation comes in.

Also diversification across stages of mining is a very wise idea as not every part of the gold or silver sector moves at the same time or same rate. We’ve discussed the bullwhip analogy so many times where the big boy producers and royalty companies move first (where generalist money and passive ETF money gets parked), then the mid-tiers/smaller producers (which have some ETF exposure, but also cashflow and they can immediately monetize the higher metals prices), then the developers (as their project economics get re-rated), then the explorers explode at the tip of the whip when they make a discovery in a frothy market.

It always amazes me when people say “yeah, yeah, yeah, I get that…” but then when a new upleg starts in the metals and they don’t own any producers or developers, and then complain that they aren’t seeing gains in the mining stocks. You ask them what they own and they are all drill plays. Well what in the heck did they expect, that their highly risky lottery tickets were all going to be winners while sitting around waiting on assays and raising more money to burn (dilution)?

It isn’t just Gold & Silver but most sectors. We just saw it happen with the Base Metals over the last year. Copper and Nickel and Palladium/Platinum, and Zinc/Lead and Iron have all been running hard, and the vast majority of the base metals producers are up big time, and even the related base metals ETFs like COPX or DBB or PICK are up handsomely. Despite this, people will say their stocks are still down or in the red, and you ask what they own, and they have early stage exploration stocks that can not monetize the higher prices like the producers, and may or may not find anything that ends up being an economic deposit. For the record I’m not against owning exploration stocks and have about 2 dozen myself, but they are much smaller position sizes, and not the way to capture the initial moves in commodity, and not a surprise when they may sit lifeless for a quarter or half the year, or crater down by 30-50% out of lack of interest. That isn’t the same thing as getting a good base of producers in one’s portfolio first, and then building in some developer and explorers for extra torque.

I’m ranting again, and will leave it there…

I wrote a long thing about the alternating day scenario and why it was not a statement about relative quality or what stage of development. I gave altered my holdings and reduced the size of my account by 1/3 to try to move to those stocks that are going up…they still alternate days. But, anyway the Monaco comment was just to throw humor into the situation. You are right that “what if statements” are a waste of time. My issue is “I have not encountered an alternating dar scenario in stocks in 20 years and find it abnormal”. Either a stock is good or it is bad… but it doesn’t go from one category to another every other day…at least not before the last year. Now maybe it is because most are explorers…but why would explorers alternate days. Why not make every day bad for them if they are not in favor. Bottom line: I have the feeling there is intervention when stocks as a group (a group I change) act in an abnormal pattern. Is Great Bear only good on even # days. Is Banyan only good on Tuesday and Thursday. Those are the types of questions you ask yourself when a 50/50 rotating pattern appears unrelated to any rational theory except computer programming that is only as meaningful as the program. (I am gaining ground, I just have no explanation for daily movement). No more Monaco jokes. Maybe Hoboken.

Hi David. I thought the JP Morgan Monacco Casino line was funny, and please don’t think my comment was directed at you personally; as it was more general in nature, and was not picking at you in particular. You may have misinterpreted my ranting. Haha!

My comments were just a general rant about position sizing, diversification across stages of mining, and diversification across different asset classes to take advantage of sector rotation in the whack-a-mole game of the markets. I’ve just noticed a bifurcation in comments on a number of sites lately, or even from the private comments I get over at ceo.ca, where one group is really hitting it big on the base metals and precious metals producers and developers, or in the energy or battery metals, while other investors seem in the doldrums stating that they haven’t seen much life in mining stocks. When you drill into their portfolios that they discuss holding, then the common ingredient is being overexposed to just early stage explorers, many of which are waiting on a drill campaign or assays, etc…

As for the alternating days in a basket of companies, that is quite common in almost any sector miners, tech stock, bank stocks, healthcare, cryptos, etc… so I don’t read much into that. Yes, it’s nice when a rising tide lifts all boats, but that rarely happens except at the most bullish parts of a move, and the early movers have ways to monetize the moves higher in the metals or specific catalysts driving their outperformance. Even then, a company with great news out one day can overdo it one day with an outsized move higher, and then see profit taking on the succeeding day, which is just normal market functions.

It’s the nature of the markets to have many competing forces that cause investors to buy or sell, and it is far too complex a system to game it to that degree of forcing days to alternate in a given stock, especially the ignored resource sector where most institutional funds or hedge funds would not even waste their time programming algos on the microcap miners. Often I look for double digit gainers or losers in my portfolio to trim or buy, because it is common to see that outsized move (up or down) reversed the next day or two. That kind of whipsaw is actually a good thing to capitalize on, because the best stocks for swing trading are the volatile ones, and it is much more challenging to trade a flat and boring stock or ETF.

long LTHM

Supercycle Or Bull Market?

By: Trish Saywell – May 17, 2021

“Soaring prices this month for copper and iron ore are leading some people to think that we are on the verge of a new supercycle. But as our new reporter Henry Lazenby reports in this week’s issue of the newspaper, conversations with analysts suggest we aren’t there yet and prices are likely to taper.”

“While we may not be in the early stages of a supercycle or even heading that way, we are certainly in the midst of a bull market the likes of which our industry hasn’t seen for many years, and demand for certain metals — particularly metals important to future technologies (MIFTs) and those used in energy storage and transmission for the switch to cleaner energy sources — suggest that the ‘good times’ are likely to stick around for a while.”

“The metals sector has the greatest potential to continue outperforming most commodities as we see it, particularly in the longer term,” Mike McGlone, a senior commodity strategist at Bloomberg, wrote in the May edition of the Bloomberg Commodity Outlook 2021 released at the end of April. “In a world of accelerating electrification and decarbonization, we see copper as a top commodity candidate for sustained price appreciation … The trend in industrial metals outperforming energy is set to speed up with the U.S. joining others focused on a greener future.”

https://www.northernminer.com/editorial/1003831003/1003831003/

Doc, you asked me if you should buy more NSRPF. I just did and bought more IRVRF this morning.

long MNMD

Hi Tom. What do you like about Merchants & Marine Bancorp, Inc, or what do you see as the catalyst for growth or differentiator beyond the other bank stocks?

boring day. Something waiting to happen. Bears, gold especially, in hibernation fingers crossed for the big pullback. Suspect they’ll all be back with any couple day dip.

The slow crawl up is tough to play. You need guts like Matthew or Ex. Not in that league.

What is Bonzo buying? Just bought some IRVRF@1.59.

Should I buy more NULGF? or would NSRPF be better?