Millennial Precious Metals – Exploration Update On High-Grade Wide-Intercept Drill Results At Mountain View

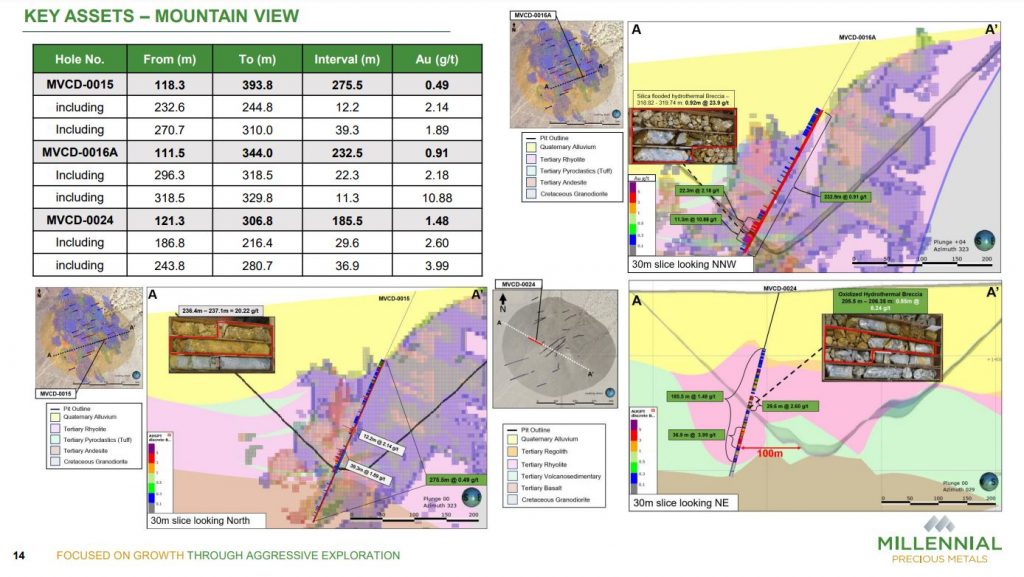

Jason Kosec, President and CEO of Millennial Precious Metals (TSX.V:MPM – OTCQB:MLPMF), joins us to review the recent high-grade and wide-intercept drill results at the Mountain View Project in Nevada. Drillhole MVCD-0024 returned an intercept of 1.48 g/t Au over 185.5m (mixed oxide-fresh material) including a high-grade intercept of 3.99 g/t Au over 36.9m and 2.60 g/t Au over 29.6m.

We discuss that the company plans to continue to test these deep hydrothermal structures, as well as the higher grade mineralization extending to the Northwest. The 2022 Phase 1 drill program at Mountain View consisted of 27 holes totaling 7,200 meters with the objective of resource conversion, collecting geotechnical and metallurgical data, validating grade continuity, and extending the mineralization laterally to increase the pit size.

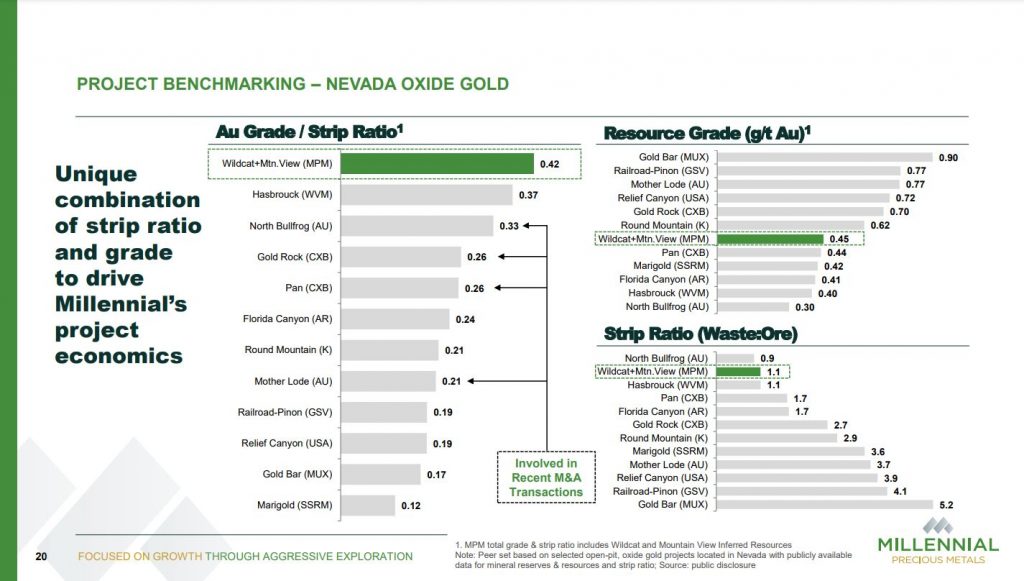

Next we have Jason explain the attractive low strip ratio, and that when that is factored in to the potential economics, that the grade after dilution is very attractive when stacked up against other similar projects in the Great Basin that are in production or in development. The Company has 7 projects in total, but currently has 1.2million oz total gold resource, from the 2 primary flagship properties: the Wildcat Property (~776,000 oz at 0.40g/t gold) and Mountain View Property (~427,000 oz at 0.57g/t gold). There will be an updated resource estimate coming out in Q3, and the Preliminary Economic Study coming out in Q4.

If you have any follow up questions for Jason, or want more information on any aspect of Millennial Precious Metals, then please email us at Fleck@kereport.com or Shad@kereport.com.

https://millennialpreciousmetals.com/investors/#latest-news

I agree DT……………money supply growth at 18 % annually for two years is the culprit according to Dr. Hanke…………….They will never admit it though, that they created this mess…416 Economists at the FED all missed this coming ………………………..what a joke…………now the inflation cat is out of the bag, Feds job is help mainstreet and lower down, who are taking it on the chin with inflation. On the way up, when they were filling the punch bowl………….they looked after us fatcats with investments and assets…………we will get thrown under the bus somewhat while they rescue mainstreet……….Just the old vicious cycle of things ! David Rosenburg……….S & P at 34 to 3500 baked into the cake over next few months, Martin Armstrong………….Dow 27000 coming into focus ! Keep heads down for a while, while bottom pickers get their fill !

Hi Larry, The Big Bull Market is dead. Trillions of dollars worth of profits, paper profits have disappeared. Investors who had dreamed of retiring to live on their stock profits and crypto’s now will find themselves at the beginning of the road to riches. When the stock market suffers heavy losses we all suffer and so does our hope for a better future, until the pendulum returns to the upswing but that could take a dozen years. DT

Some interesting widths.

It looks like the stock market is collecting itself at least for today. I’m sitting this period out, I’m worried that the stock market is going to register a few more painful tumbles, problems in the World and in the economy are organic and deep seated. We might even see a Little Bull Market that fools the investors into thinking normalcy is coming back. DT