Calibre Mining – Multi-Year Growth From Grade-driven Production Increases, Ongoing Exploration, And Resource Expansion

Ryan King, VP of Corporate Development and IR & Tom Gallo Senior VP of Growth at Calibre Mining (TSX: CXB – OTCQX: CXBMF), join us to review the multi-year growth plan from grade-driven production increases, an intense exploration focus, and expansion of resources. We discuss how the Company has continued to grow the resources and associated metals grades over the last few years, all while while bringing more satellite deposits into production utilizing their hub & spoke strategy. Ryan and Tom outline how both the Pavon Central and Eastern Borosi development projects will continue to allow the company to expand, and also outline many of the other targets being focused on in the larger exploration strategy for the balance of 2022.

We also touch upon the resource expansion and exploration success the Company is having in Nevada around the operating Pan Mine, and the Gold Rock development project. Calibre Mining has an ongoing 85,000 meter exploration program at multiple properties in both Nicaragua and Nevada, with over 15 drill rigs turning.

If you have any follow up questions for Ryan or Tom on Calibre Mining, then please email us at Fleck@kereport.com or Shad@kereport.com.

https://www.calibremining.com/news/

Corporations aren’t in the business of buying gold to protect their assets, but if you are a corporation in order to lend your money out you would need an increase of possibly 8 or 9% above the rate of inflation. That means lending out at 24 or 25%. Corporations aren’t the government that can just print money to cover their losses. That takes us into the World of loan sharking and mafia control, and that is not going to happen. It doesn’t matter how you look at this problem. It can’t be solved. DT

Cash has been a good place to be and for the PMs July could be the first month of many to come to take nice positions in some of these juniors. Some of these charts seem to be sending a message that July could be a cathartic month. It’ll be time to be in constant “nibbling” mode. Powell might be thinking he is Paul Volcker reincarnated. However, we should soon start to see some good news on the inflation front since the Y-O-Y comparisons should finally show some slowing of inflation and give eternal hope to the gold lovers that Powell may not be Paul Volcker reincarnated after all and that he will moderate his “hawkish” statements. The odds of gold challenging pricing at the lower BB of the monthly charts is still quite high.

I’ve only got about 4% free funds available in my trading account, but I’m prepared to begin some of that July nibbling….

https://media.tenor.co/images/2ffab4f9cf380b048abcc415a668111f/tenor.gif

Still 100% but swapping things daily. So much candy in the store but trying to be more selective of the most safe of the speculative. Kind of like the world buying the worthless dollar …. What are the choices. Despite buying less risky of the risky, my account continues the same trading patterns as if a magnet moves from stock to stock, steadily depleting total value while total shares grow. I am still watching Eloro drop as drill results improve. I am going to buy back into Eloro before the reset. Goal 1…

Yeah, I’ve mostly just been horse-trading one stock for another, or selling earlier stage companies with lackluster results and dwindling cash, to rotate those funds into stocks that I have higher conviction in with better results and execution. I’ve reduced down my overall stocks held from over 90 to the low 70’s now to get into more concentrated positions and take advantage of the sell-offs in so many resource stocks.

In that Jesse Livermore waiting period where he claimed to make the most money. I’m nibbling on a bag of sunflower seeds. Chinese make high quality sunflower seed products.

Critical Investing Moment: you can eat the whole thing and not spit the shell in a can …. Right.

When Jesse Livermore was discussing “being right and sitting tight” he was discussing that in the context of being in the larger blue chip names, and it is surely not been good advice for resource stocks for the last few decades. Most of the resource stocks are trades for periods of 3-8 months, maybe a year or two in special cases, but most of the best sector gains are not with the longer term “buy and hold” approach. We are so beat up here though after 2 years of correcting, that getting positioned now and holding for year or two will likely pay off handsomely. Still that was a terrible plan in most commodity stocks over large periods of time be it gold/silver stocks, oil/nat gas stocks, copper stocks, nickel stocks, pgm stocks, uranium stocks, lithium stocks, etc… Holding them for 10-20 years is nothing like holding the S&P or Dow for 10-20 years. Apples and oranges…

(CXB) (CXBMF) Calibre Reports High Grade Drill Intercepts at its Gold Rock Project, Nevada; Advances Technical Studies with Positive Metallurgical Results; High-Grade Drill Results Include 2.19 g/t Gold over 44.2 metres and 3.36 g/t Gold Over 22.9 Metres

29 Jun 2022

https://www.calibremining.com/news/calibre-reports-high-grade-drill-intercepts-at-its-4400/

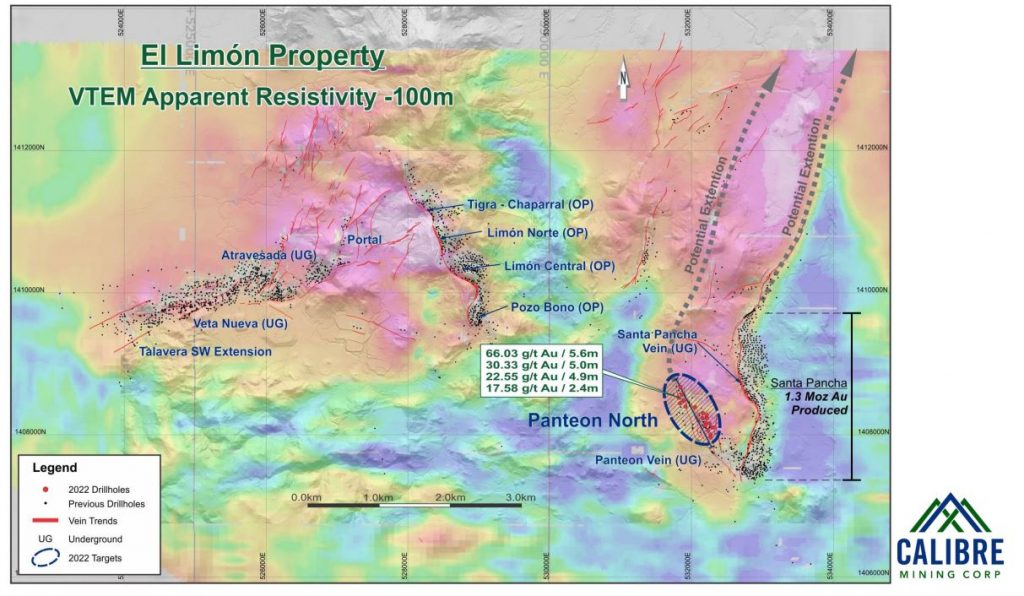

(CXB) (CXBMF) Calibre intersects Bonanza-Grade Gold at The Limon Complex; Reinforcing the Strong Potential to Add Resources and Expand the Panteon Mine

27 Jun 2022

> North Pit Zone

2.01 g/t Au over 45.7 m in hole GR21-002; 0.99 g/t Au over 18.3 m in hole GR21-001;

1.45 g/t Au over 38.1 m in hole GR21-008; 1.75 g/t Au over 19.8 m in hole GR22-037; and

1.74 g/t Au over 35.7 m in hole GCM21-001; 0.71 g/t Au over 16.8 m in hole GR22-038.

> Central Zone

2.94 g/t Au over 18.0 m in hole GCM21-002; 0.64 g/t Au over 35.1 m in hole GR21-027;

1.26 g/t Au over 35.1 m in hole GR22-031, 2.19 g/t Au over 44.2 m in hole GR21-021;

1.53 g/t Au over 18.3 m in hole GR22-001; 1.64 g/t Au over 19.8 m in hole GR22-024; and

1.00 g/t Au over 24.4 m in hole GR22-025; 0.90 g/t Au over 18.3 m in hole GR22-030;

> South Pit Zone

3.10 g/t Au over 18.3 m in hole GR22-005; 3.36 g/t Au over 22.9 m in hole GR22-007; and

1.40 g/t Au over 27.4 m in hole GR21-025; 1.61 g/t Au over 35.1 m in hole GR21-029.

https://www.calibremining.com/news/calibre-reports-high-grade-drill-intercepts-at-its-4400/

Morning Briefing: Exploration Drill Results from Kodiak Copper, Calibre Mining, Goldshore and more

Mining Stock Daily • w/ Trevor Hall – 9 hours ago

Ex. I know you’ve been discussing AXU a lot recently—it’s sure getting to where I can hardly resist not taking a nice position in it due to all the hate for it and my inherent contrarian nature. If they indeed are able to produce the way they want to in 2023 this stock could be an excellent purchase down here.

Hi Doc. Yeah, AXU has been a big disappointment for more than a year now, with their failure to properly develop the underground opening up enough stopes in advance, or stockpiling enough ore in advance to truly run enough throughput of 400 tpd in their mill. As a result they’ve totally done a bellyflop into the proverbial swimming pool by failing at their attempt to go back into production.

I don’t disagree, that if they can get it all sorted over the next 6 months with their milling suspended, and get the work completed that they should have had done last year before trying to go into production, that they could have a good “relaunch” in 2023. Their goal is to get production going again the beginning of next year, and the management team feels they should be able to produce 4 million ounces of silver equivalent at a profit.

The compounding issue beyond failing to ramp up into production as planned, was the tough metals markets (which punished most companies), but then having to finance again when they were supposed to be sufficient from operational revenues at a very low share price = even more dilution to existing shareholders. The going concern is that they could end up getting into a financial pinch and needing to raise yet again, which would really vex existing shareholders.

My strategy at present is to hold my AXU for the balance of this year to see how their development strategy goes, and to see if silver prices get a lift by year-end. However, it has occurred to me to just take the tax loss now, wait 31 days, and then just repurchase for the eventual rerating. I’m still mulling that 2nd idea over, but was hoping it would at least see a dead-cat bounce to sell into for the tax loss.

Obviously buying down here is sure not pricey considering the resources they have in the ground and the fact that they do have the mill built and operational, and the choke point was on them having enough ore to successfully run things at the rated throughput. However, if they do need to finance again before restarting the milling in January of 2023, then it could mean a further slide. Also, if Silver does break down to $18.50-$19 as some technicians are calling for, then it could also get spanked on that situation (as would most of the silver stocks).

I’ve got 20 silver mining stock positions and Alexco has been the biggest loser of the lot, but it does make it an intriguing contrarian play down here…. IF they can get their ship turned around by the beginning of next year.

I believe the stock will continue to drift down and when it is completely exhausted and trading sideways I’ll take a position.

Sounds like a good plan Doc and may your trading be prosperous. I’m starting to think taking the tax loss now, then waiting 31 days, and then reinitiating the position may be the best route forward for me with AXU at this point.

My fear would be doing that, and then seeing a larger producer come in and scoop them up during that “wash rule” time period for a 30%-50% premium, and thus missing the opportunity to be made whole, but it may be worth that brief time risk to sell now and reposition by late July/early August. Ideally, it would be nice to see a good pop in it first to sell into though.

Even the smart sheep on this site never utter The dreaded “D” word like it can’t happen again. They believe that The Fed can fix the system. Life is full of fools. Especially if you have a huge portfolio that is dependent on a system that we all know is terribly flawed but you don’t want to talk about the negative when you are holding a huge portfolio of unsold securities. DT

I don’t remember anyone on here believing the Fed can fix the system, and conversely, most think they can’t and are reaching a tipping point or check mate moment (likely after the September rate hike) where they will have to decide if they want to keep hiking rates to supposedly fight inflation, or if they’ll pause or eventually reverse course when the Fed funds rate does too much damage to the economy and markets or reaches a point where their debt service becomes unpayable. (most calculate that breaking point for debt service would be around 3.5%-4%)

As for whether we’ll see a Depression, we’ve asked a ton of our guests about that, and most are more in the camp that we are already in Stagflation (high inflation, raging energy costs, slow to low growth, and rising unemployment), and possibly heading for a Recession.

Since most of these terms are academic in nature anyway, the question is when does a Recession become a Depression?

This is up for debate and somewhat subjective what a Depression actually is, because there is no clear-cut answer. Maybe that is why more people are not in that camp yet.

Most analysts use at least 2 consecutive quarters of declining or negative GDP as a guideline for a Recession, but there isn’t even consensus there. There is no clear definition of a Depression and the Great Depression was considered 2 back to back recessions and was a term created for that event.

Here is an interesting passage on this topic for consideration:

__________________________________________________________________________________________

WHEN DOES A RECESSION BECOME A DEPRESSION?

Colin Lloyd 21/08/2020

– Defining a depression as opposed to a recession is open to wide interpretation

– Recessions are a natural part of the credit cycle

– Depressions are destroyers of a nation’s wealth

– Fiscal policy can help ease the pain of ‘creative destruction’ but long-term planning is key

“Despite the Federal Reserve’s valiant efforts, the simpler and more commonly accepted definition of a recession is a consecutive two quarters of decline in GDP. When it comes to depressions, however, there is little consensus; the two most common descriptions are: A decline in GDP of more than 20% A period of more than two years of declining GDP.”

_________________________________________________________________________

“When your neighbour loses their job, it’s a recession.”

“When you lose your job, that’s a depression!”

– Harry S. Truman (33rd President of the Unites States)

_________________________________________________________________________

“A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. A recession begins just after the economy reaches a peak of activity and ends as the economy reaches its trough. Between trough and peak, the economy is in an expansion. Expansion is the normal state of the economy; most recessions are brief and they have been rare in recent decades.”

____________________________________________________________________________________

> And turned to Gregory Mankiw to distinguish between the two states of economic contraction:

“There are repeated periods during which real GDP falls, the most dramatic instance being the early 1930s. Such periods are called recessions if they are mild and depressions if they are more severe.”

________________________________________________________________________________________

“Despite the Federal Reserve’s valiant efforts, the simpler and more commonly accepted definition of a recession is a consecutive two quarters of decline in GDP.”

“When it comes to depressions, however, there is little consensus; the two most common descriptions are: ”

– A decline in GDP of more than 20%

– A period of more than two years of declining GDP”

https://www.bbntimes.com/global-economy/when-does-a-recession-become-a-depression

Based on all those definitions, and the reality that Q1 GDP was already negative – 1.5%, and that the estimates for Q2 GDP have been adjusted down from 2% to 1.5% to 1.3% to 1.2% and eventually to 0%, then if we see Q2 GDP go negative, many will proclaim we are in a bonafide “Recession.”

It would take much more negative economic activity to get a 20% fall in GDP or more than 2 years of declining GDP, so it is waaaaay to early to call it a “Depression” at this point. We’d need a lot more carnage over a lot longer period to time to waive that banner.

El-Erian – Recession May Not Be Here Yet — But Stagflation Is

Julie Hyman · Yahoo Finance – Sun, June 26, 2022

“While economists debate the likelihood of a recession in the next year, the U.S. is stuck at an uncomfortable way station – stagflation. As the word implies, this economic predicament features slowing or stagnating growth and high inflation.”

“The U.S. economy contracted by 1.5% in the first quarter, with headline consumer prices rising by 8.6% in May. Investor concerns over the Federal Reserve’s ability to engineer a so-called “soft landing” — which averts recession while slowing inflation — have been rising, and Fed Chair Jerome Powell acknowledged the difficulty in testimony before Congress this week.”

“The baseline is stagflation — what we are experiencing now,” Mohamed El-Erian, economist and president of Queens’ College at Cambridge University, said in an interview with Yahoo Finance Live (video above). “So you have a baseline that is not very comfortable, stagflation, and then you have a balance of risk which is the wrong way — recession.”

https://www.yahoo.com/finance/news/recession-stagflation-el-erian-june-2022-130731066.html

1970s-Style Stagflation Now Playing On Central Bankers’ Minds

The Conversation – June 28, 2022

“Stagflation” is an ugly word for an ugly situation – the unpleasant combination of economic stagnation and inflation.

The last time the world experienced it was the early 1970s, when oil-exporting countries in the Middle East cut supplies to the United States and other supporters of Israel. The “supply shock” of a four-fold increase in the cost of oil drove up many prices and dampened economic activity globally.

Stagflation was thought left behind. But now there is a real risk of it coming back, warns the central bank for the world’s central banks.

“We may be reaching a tipping point, beyond which an inflationary psychology spreads and becomes entrenched,” says the Bank for International Settlements BIS in its latest annual economic report.

“The danger of stagflation comes from this inflationary cycle becoming so entrenched that attempts to curb it through higher interest rates push economies into recession.”

https://theconversation.com/1970s-style-stagflation-now-playing-on-central-bankers-minds-185868

Gold Down, as Central Banks Take Aggressive Stance Against Inflation

By Zhang Mengying – Investing.com – Jun 30, 2022

“Gold was down on Thursday morning in Asia, set to fall for a third straight month, as investors assessed bullion’s outlook with major central banks adopting aggressive means to bring down soaring prices.”

“U.S. Federal Reserve Chair Jerome Powell warned that inflation could be long-lasting, and it was important to bring down inflation despite the economic pain during the European Central Bank (ECB)’ s annual forum in Portugal.”

Generalists Don’t Understand This Is The Tightest Oil Market In Decades: Eric Nuttall

BNN Bloomberg – June 29, 2022

“Eric Nuttall, senior portfolio manager of Ninepoint Partners, joins BNN Bloomberg to discuss why generalists have it wrong when it comes to the state of the oil market. Nuttall says this is the tightest market we have seen in decades.”

This is the expert that Eric listens too, haha… She is spot on, we are 1m barrels a day away from energy chaos.

Thanks Dan. Yes good segment with Amrita & Eric, and she made some good points about how inelastic oil demand will be regardless of if we see a recession, and why she sees oil prices staying elevated for longer and even going higher into the $130’s and $140’s. That seems to line up with Sean Brodrick’s outlook in this weeks editorial with us here at the KE Report.

Do you know what is really crazy, suppose you are a corporation, one of the many that can’t make money with the products they sell. In the past if you had a healthy cash balance and wanted to lend that money out, with inflation running at about 16%, nobody could pay you enough money to make lending affordable. This is a depression that is coming! DT