Dolly Varden – High-Grade Silver Drill Intercepts From Stepping Out From The Wolf Deposit

Shawn Khunkhun, President and CEO of Dolly Varden Silver (TSX.V:DV – OTCQX:DOLLF), joins us to review some recent high-grade silver drill results at the Wolf Vein, and to further outline this year’s exploration program at the Kitsault Calley Project (the newly combined Homestake Ridge and Dolly Varden Projects) in the Golden Triangle of BC.

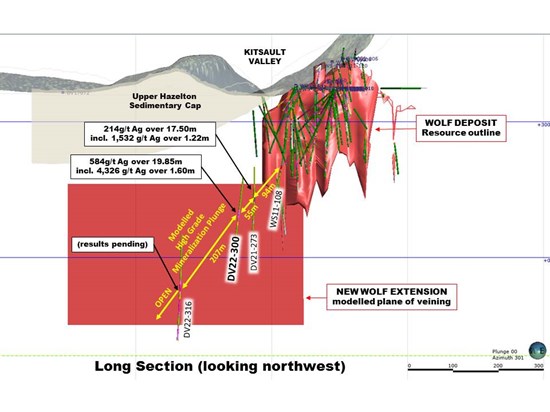

With an expanded 35,000 meter program under way, the assays announced new September 13th, from drill hole DV22-300 encountered a wide interval of multi-phase veins and breccia, intersecting 19.85m (13.90m true width) averaging 584 g/t Ag, 0.92 %Pb, 0.56% Zn and 0.19 g/t Au, with bonanza grade silver mineralization grading 4,326 g/t Ag, 4.21% Pb, 1.36% Zn and 1.00 g/t Au over 1.60m (1.12m true width). As the exploration team drills deeper, grade is continuing to increase in a substantial way, and the company is keenly awaiting Drill hole DV22-316 which will also be testing the extension at depth.

Shawn also updates on how the 150 meters of step out drilling at the Wolf vein, away from the known deposit is continuing to explorer the gap area between the Wolf and Torbit deposits, and also points out the other drilling success the Company has been having on the Kitso Vein at Torbrit. We also discuss that about half of the drilling so far this year has also been focused at the newly acquired Homestake property on a few different key targets and that all those drill assays will be released over the next few months.

If you have any follow up questions for Shawn about Dolly Varden, then please email us at Fleck@kereport.com and Shad@kereport.com.

Click here to visit the Dolly Varden Silver website to read over Company news.

If a country backs, it’s financial system with gold it will help reduce the business cycle’s dependance on political policies. Prosperity comes from business not political parties who claim they are pro-business. DT

Some good points DT. Yes, central banks in many Eastern countries and even some developed Western countries have been buying up gold, but many countries hold zero to little of the precious metal which is the ultimate money and “un-currency” with no 3rd party counter-risk from bad politicians and their terrible policies.

DT

I think you are right about the West having to play catchup now in the gold area. I think our Western Central Banks thought all they had to do was suppress the price of miners with computer programs, transfer physical to elites, blowout the economy and fabricate an electronic currency and that would end 3rd party risk on phony fiat creations. Looks like criminal fraud might not stand up to a bird in the hand – physical. Now if all the Politicians they bought could tell the difference between a criminal scheme and a strong economic system, we may have a chance to survive.

I just had another listen to the interview with Sean at Dolly Varden, and can’t imagine someone else listening and not coming away impressed. They have plenty of cash to navigate the next 12 months, have about half their drill assays to still report from Torbrit, Wolf, and Homestake over the next few months, they are finding good mineralization as they step out from the known deposits, they are doubling the grade at depth, and this will all feed into a revised resource estimate for next year. At that point, once the market can size up just what they’ve done with all this additional drilling, I could see one of the larger producers coming in as a suitor (most likely their neighbors at Hecla).

Dolly Varden Silver @SilverVarden 8:19 PM · Sep 23, 2022 · Twitter

“Watch: Rick Rule has recently taken a position in Dolly Varden Silver $DV.V $DOLLF…

For two reasons: size and grade!”

Lots of talk here about Brixton recently and now Dolly. Both are in roughly same area….so my point is, one or the other? Or just buy both.

They are at different spots along the risk curve and stage they are at, and have exposure to different commodities. Dolly Varden is more silver focused, with some gold, zinc, lead. Brixton has more diversified mix of metals, with exposure to copper at Thorn, and gold at both a different area at Thorn and Atlin, along with silver at Langis and Hog Heaven. Both have the potential to go up multifold from present levels, but with Brixton being a microcap, it could likely go up more on a percentage basis in a big bullish move in the sector. DV is a bit more defensive in the prolonged downturns, but still peppy enough on big uplegs in the PMs.

Dolly Varden is a more derisked asset, focused on one primary project, whereas Brixton has a few different earlier stage projects it is exploring a little bit each year, like Thorn, Atlin Gold, Langis, and then the more derisked Hog Heaven JV.

I haven’t really followed Brixton that closely for the last 2 years, but Cory & I did speak with Gary last year to get an update, and their approach is to do smaller raises and pepper the drilling around to the different projects to keep testing new targets. Gary conceeded that they’d really need to be a much larger company with much larger budgets and drill programs to really get a handle on Thorn due to it’s large size and several different deposits and mineralized zones. I think the play there is to eventually attract a larger company to partner with there. I’m not up to speed on any of the recent work done at Atlin or Langis lately, but those were still earlier stage discovery drill plays. Hog Heaven is most advanced project in Montana, JV’d with Robert Friedlands company.

Dolly Varden has 138 million ounces of Silver equivalent resources in the Golden Triangle, with around 36,000 meters of drilling they’ll be wrapping up within the next month ot two at different zones on the project – primarily Torbrit, Wolf, and Homestake (where they also have some gold). They have a lot of drill assays to release over the next few months as a near-term catalyst, and those results will feed into an enlarged resource estimate next year, as their next big milestone.

They are now putting out some bonanza grade intercepts at depth (like the recent 4,326 g/t silver over 1.6 meters), so I’m intersted to see how the drilling at depth proceeds, with some of the drill holes still to report on. I’m curious to also see how the drilling at Homestake (which they just acquired from Fury) comes back this year. Ultimately, once the updated resource estimate is released next year, I see DV as a takeover candidate (most likely Hecla next door).

So there is nothing wrong with owning either, or both companies, and there are not many junior companies operating in Canada with exposure to silver.

I just went and checked on the more recent news from Brixton, and it would seem they have optioned Atlin to Pacific Bay, so they have some exposure to it still, but won’t actively be drilling it. I didn’t see much info from Langis, so it appears most of their efforts this year have been more focused in at Thorn, and it is their more clear flagship project. I’ll be intersted to see if they sell Hog Heaven to Robert Friedlands company in the next year or so. That would be a nice synergistic win for both companies.

I have both. Both cheap, like so many others

I don’t know how others are playing the gold and silver stocks these days, I think a lot of governments in The West will need to play catch up with The East in terms of physical gold holdings. Gold is more important than The Western World realizes. At some point we must go back to a gold standard. All this talk about multiple currencies as a World Reserve Currency won’t work. Some of the western countries hold no gold, they will need to start buying. This will drive demand. Gold will move first as the return to a working financial system takes hold. DT