Christopher Aaron – Dow:Gold Ratio, Long Term PM Investors Need To Consider This Chart

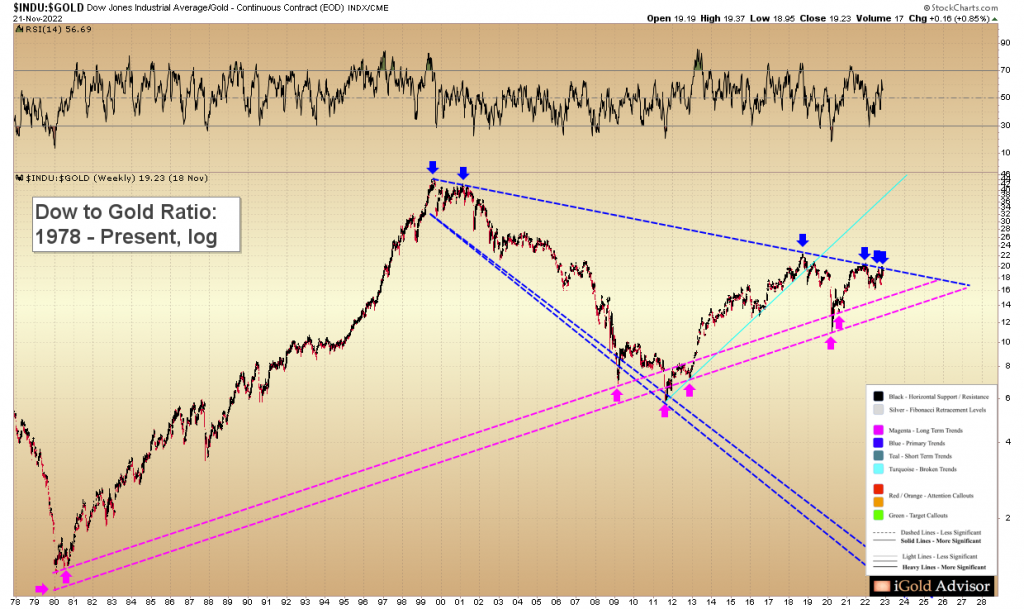

Christopher Aaron, Founder of iGold Advisor and Senior Editor for GoldEagle.com joins us to share his big picture outlook for the precious metals. He sent us the Dow:Gold ratio chart, which is posted below, dating back to 1978. There are a couple key takeaways from the chart especially in the time period where gold almost doubled but the ratio did not move to favor gold. Christopher does a very good job of outlining why he thinks this chart is important.

We also discuss a very important level broken in bond market that signifies the end of the 40+ year bond bull market.

Click here to visit iGold Advisor to follow along with Christopher’s outlook for metals and markets.

Thanks for that feedback Larry. We think very highly of Christopher and his skills and experience as a technician, and have had him on the show a few different times, but will work to get him on more regularly moving forward.

Christopher also created a Youtube video of this interview, and overlaid a number of helpful charts and graphics, as well as doing an expanded introduction and wrap-up, before and after the KE Report talk.

It’s worth watching the video to see the charts and technical indicators paired up with his comments.

Long term wise, Christopher is going to be right. There aren’t very many asset classes and being in cash is not an option. General equities will always the place where big money will go. It’s out of favor right now but that will change. World population is shrinking and that’s not a good news for commodities overall. Gold will be there but it’s not reaching $5k or $10k like all pundits are saying.

The debt is what it is all about, there is $300 trillion in debt worldwide. The US dollar is finished you will never be able to pay off the debt. (America’s debt is $30 trillion and counting) The people who destroyed the US dollar are still in charge. America still thinks The World revolves around their dollar. Read all the charts you want. The US can’t change a situation which has been caused by deficit spending and foreign wars and there hasn’t been an end to this since The Second World War. In fact, it is still going on with the conflict in Ukraine. So sad! DT

May be the greatest guest ever hosted…..Thank you…and I hope he returns for more big picture views…