Thor Explorations – The Douta Development Project Continues To Deliver More Solid Drill Results, Segilola Production Is On Track For Annual Guidance

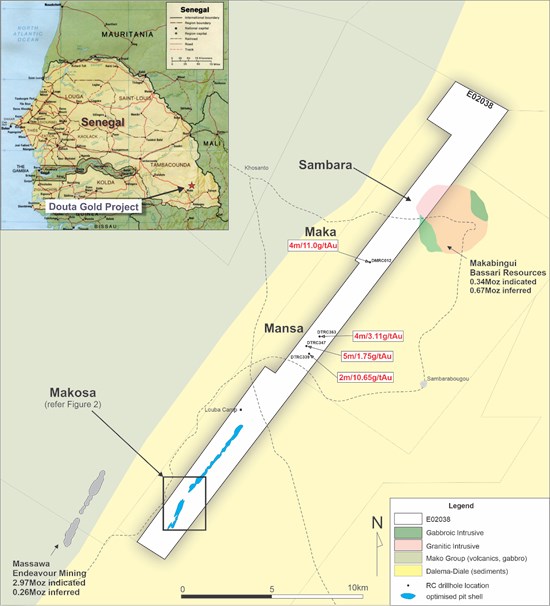

Segun Lawson, President and CEO of Thor Explorations (TSX.V:THX – US:THXPF), joins us to review the recent higher-grade and wide-intercept drill results at the Douta development Project in Senegal and provides an operational review Segilola in 2022. The Company is continuing to expand the resources at the Makosa ore body, which now has grown to a 7km strike length, and also incorporates the Makosa Tail area. 26,000 meters were drilled at Douta this year, doing step-out drilling and infill drilling at the Makosa deposit, as well as expansion drilling around 3 key new mineralized satellite discoveries at the Mansa, Maka, and Sambara targets. There are still drill assays pending for the 3 satellite deposits that will be reporting early in the new year.

The next key Company milestones will be to get all these new drill results released and then put into an expanded resource estimate update in Q1 of 2023, and then after that to wrap some economics around the Douta project in a Preliminary Economic Assessment for the market to evaluate. The goal is to expand the resources well beyond the previously reported 730,000 ounce Maiden Mineral Resource Estimate for the Makosa Deposit, and to now show the economic viability of the new satellite deposits at Mansa, Maka, and Sambara potentially feeding into a central processing plant in a hub and spoke strategy.

We wrap up by also highlighting some of the key near-term exploration and production catalysts at the producing Segilola Mine in Nigera, and how it is looking constructive for hitting their upper end of guidance for 2022. The operations and financial numbers will be reported to the market in early 2023.

If you have any questions for Segun regarding the ongoing work at Thor Explorations, then please email us at either fleck@kereport.com or shad@kereport.com.

*In full disclosure, Shad is a shareholder of Thor Explorations.

.

Click here to read over the recent news out of the Company.

Forget about political interventions or market manipulations, these questions mean nothing compared to where our World is headed. DT

(THX) Thor Explorations rounds out 2022 with fresh drill results from Douta Gold Project

Proactive Investors – 9 days ago

As always thanks for this interview.

Over and above that I really do appreciate this:

“*In full disclosure, Shad is a shareholder of Thor Explorations.”

With all the crazy sh!* going down on YouTube where “Influencers” are doing pump and dump anything and everything transparency is always appreciated!

Thanks for that comment Mike. We make an effort to disclose in the interview if either Cory or I or our show guests have positions in the companies we discuss for full transparency.

In this case, since Cory didn’t catch my note about disclosing my position during in the recorded interview, then I decided to put the disclosure in writing below the write up.

Also, our interviews are structured to cover a companies news releases, and are not intended to either pump or dump on a stock. In contrast to a lot of the uber promotional marketing pieces some platforms blast out urging people to buy the next 10 bagger or to completely sell out of a company that has cut ties with their organization; we’d rather simply ask questions that give company executives the opportunity to tell investors what they’ve learned and outline their forward strategies at their projects.

Cheers!

This digital world we are living in is so dependent on satellites and micro- chips that as we move closer to a World of Central Bank Digital currencies our adversaries only need to knock out our satellites or explode an EMP bomb 200-300 miles over any country, and nothing will move. We no longer manufacture enough micro- chips to replace those produced in Taiwan. Our very existence is dependent on third party nations, but our society is too dumb to see the trap we have set for ourselves. DT