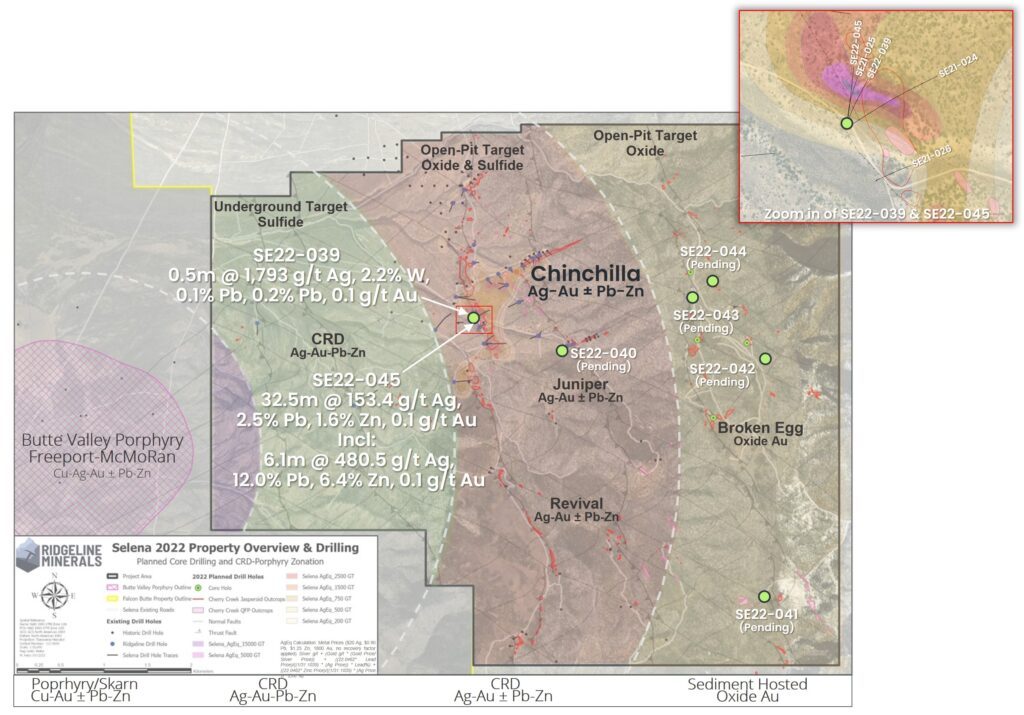

Ridgeline Minerals – High-grade CRD Mineralization Drill Results From the Chinchilla Zone, And Assays Pending From The Juniper and Broken Egg Targets

Chad Peters, President and CEO of Ridgeline Minerals (TSX.V:RDG – OTCQB:RDGMF) joins us to unpack the recent exploration news release from January 24th, where the first two diamond core drill holes of the 2022 drill program at the Chinchilla Zone CRD Target, at larger Selena project in Nevada, intersected silver (“Ag”) – gold (“Au”) – lead (“Pb”) – zinc (“Zn”) carbonate replacement style mineralization. Highlight intercepts at the Chinchilla Zone include high-grade zones of 6.1 meters grading 480 grams per tonne (“g/t”) Ag, 12.0% Pb, and 6.4% Zn, 0.1 g/t Au in SE22-045 and 0.5m grading 1,793 g/t Ag and 2.2% W in SE22-039. The Chinchilla Zone target will be a continued area of focus for future drilling.

Next we shifted over to the pending drill results still to be released both from the Juniper target, which is also thought to be a CRD zone, and then the 4 holes still to release from the more early-stage gold oxide Broken Egg targets.

We wrap up by reviewing the exploration program at the Company’s Swift Project, where their JV partner, Nevada Gold Mines (NGM), a joint venture between Barrick and Newmont, highlighted the recent 3 holes drilled here on their slide deck when discussing their recent exploration along the Cortez trend. NGM has a $20 million earn-in option for 60% interest from Ridgeline Minerals on Swift, and we await more news to be released from this program.

If you have any follow up questions for Chad regarding Ridgeline Minerals, then please email us at either Fleck@kereport.com or Shad@kereport.com.

.

Click here to visit the Ridgeline website and read over the recent news.

.

Yep, Dolly Varden is up another 14% today. Cha-ching! As an investor in Dolly I’m thrilled to see them getting rewarded by the market, and they’ve still got more holes to release from 2022, before then start working on 2023’s drill program.

DV has really been in beast mode the last few months, and rightly so… they’ve put out a continued swath of impressive bonanza grade silver drill results at Torbrit along the Kitsol Vein, on their step-out drilling at Wolf (which is substantially growing the importance at that silver deposit), and now really solid gold drill intercepts from Homestake, which they picked up from Fury last year. They are surrounded by Hecla that has shown interest in the project in the past, before they had so much additional exploration success or even had Homestake. What’s not to like?

As for Silver Tiger, they’ve been slaying it with really meaty silver drill intercepts for the last 2+ years, and they may actually have the proverbial “tiger by the tail…”. They’ve doubled in share-price off their low a few months back, but could easily double again this year, and then double from there again the following year. I hold SLVR in my portfolio, and am biased as such, but the drill results and newsflow is a fundamental under-pinning of why they are getting traction with investors. I’m interested to see how their maiden resource estimate eventually comes out, but it could really raise a few eyebrows.

Chat mentioned the success I-80 gold has been having defining their nearby CRD type deposit in Nevada, and while some retail investors don’t get animated by polymetallic base metals deposits, the major metals producers and more savvy institutional investors sure do.

Look at some of these recent hit from IAUX.

__________________________________________________________________________________________

(IAU) (IAUX) i-80 Gold Discovers Additional High-Grade Mineralization at Ruby Hill

19 Dec 2022

“New Target Returns 12.3% Zinc over 39.6 meters.”

https://ceo.ca/@newswire/i-80-gold-discovers-additional-high-grade-mineralization

Here are some other headline holes that I-80 Gold put out the middle to end of last year:

______________________________________________________

i-80 Gold Expands High-Grade Gold Mineralization at Ruby Hill

29 Nov 2022

Results Include 9.0 g/t Au over 51.2 m, 14.4 g/t Au over 14.2 m & 11.0 g/t Au over 9.9 m

_____________________________________________________________________________

i-80 Gold Corp’s Bonanza-Grade CRD Mineralization from the First Follow-Up Holes at Recently Discovered Hilltop Zone at 100%‑Owned Ruby Hill Property, Nevada

21 Nov 2022

> Highlights from recent core drilling in the “Upper Horizon” at the Hilltop target include:

Hole iRH22-51, which returned 33.0 g/t gold, 3010.0 g/t silver & 63.5% lead over 0.6 metres and 3.1 g/t gold, 683.3 g/t silver & 37.6% lead over 14.6 metres.

Hole iRH22-53, which returned 1.9 g/t gold, 631.3 g/t silver, 7.4% zinc & 33.0% lead over 18.3 metres

Hole iRH22-54, which returned 0.6 g/t gold, 374.1 g/t silver, 3.9% zinc & 20.2% lead over 20.8 metres, and

Hole iRH22-55, which returned 60.2 g/t gold, 908.7 g/t silver, 1.1% zinc & 15.7% lead over 10.0 metres, including 83.2 g/t gold, 1261.0 g/t silver, 1.5% zinc, & 22.1% lead over 7.0 metres

_________________________________________________________________________________________

i-80 Gold Discovers New Gold High-Grade Zone and Expands Mineralization at Ruby Hill

5 Oct 2022

Highlight Results include 11.8 g/t Au over 18.3m, 11.9 g/t Au over 16.8m & 14.8 g/t Au over 12.3m

For a little further color, Chad Peters used to work with Ewan at Premier Gold on some of these Nevada projects, before Premier was taken over by Equinox Gold, and their Nevada projects were wisely spun out into I-80 Gold Corp.

Now Chad is taking that background knowledge from Premier, and the success that I-80 Gold is still having in Nevada on their Ruby Hill CRD type deposit, and applying that to the Selena CRD type mineralization that Ridgeline Minerals is exploring for. Nice to see a little success and synergy in the mining sector, and once again…. in the favorable jurisdiction of Nevada.

I’m looking for Stillwater to get some traction. It is one of the few untouchables, just have to stick with my knitting on this one. DT

Agreed. I’m just holding Stillwater Critical Minerals at this point… as the resource update was impressive but the market has not fully appreciated or valued them anywhere close to their intrinsic value.

Again, they have $20 Billion in gross metals value in the ground (according to Mike in our last discussion) and they are being valued at $46 Million market cap. That is laughable… but eventually, over time, he mentioned they were going to work on closing that value gap through better education to investors about what they’ve already defined in their updated Resource Estimate.

It looks like silver stocks are leading the way, it must be investors positioning, themselves for the higher leverage. I see Dolly is getting some attention, I also added to my Silver Tiger today. DT