Matt Badiali – Chevron and Venezuela Renew an Old and Rocky Relationship

With our continued focus on the energy and critical metals I’ve asked Matt Badiali, Editor of the New Energy Newsletter, Published under Mangrove Investor, to send me his articles. This article is focused on the oil sector and a key news event with Chevron and Venezuela.

We hope you enjoy this article.

Be sure to check out Matt’s website – Mangrove Investor.

When you owe me a million dollars, it’s your problem…but when you owe me three billion dollars, it’s my problem.

At least that’s the approach oil giant Chevron Corp. (NYSE: CVX) took with Venezuela. The oil-rich country’s history with oil companies isn’t good.

In 1976, they nationalized the oil industry. They forced all the foreign oil companies into minority partnerships. That nationalization created Petroleos de Venezuela (PDVSA). PDVSA instantly held 60% equity in any oil venture.

Venezuela’s oil minister, Juan Pablo Perez Alfonso, was a co-founder of the oil cartel OPEC. However, the government-run PDVSA was a disaster. The Cato Institute estimates that individuals embezzled $100 billion worth of oil revenues from 1972 and 1997.

It’s an obscene amount. And it only got worse from there.

In 1999, the country elected leftist Hugo Chavez president. He pillaged PDVSA for his own use. And he replaced career oil industry experts with his own supporters. In 2007, Chavez expelled ExxonMobil and ConocoPhillips and nationalized billions of dollars’ worth of oil projects. Chevron, Statoil, BP, and Total agreed to his terms. Those companies agreed to give Venezuela 83% of their projects (worth $30 billion).

However, under Chavez, the industry declined massively. He brought in international service companies to attempt to improve production. But in 2009, he reversed course. He seized the operations of those oil service companies in 2009 to get out of massive debts owed. According to Reuters, PDVSA owed at least $8 billion to service companies like Williams Companies, Schlumberger, and Halliburton.

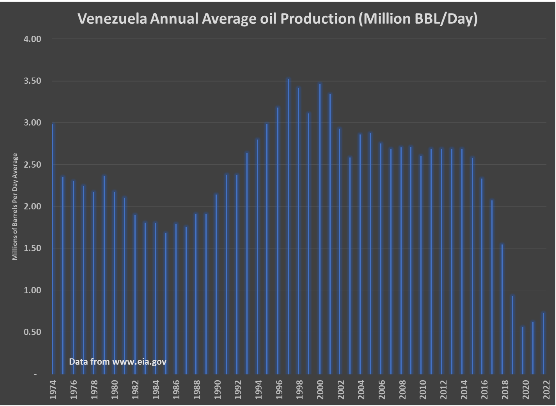

By 2017, Venezuela experienced gasoline shortages. You can see the massive collapse in Venezuela’s oil production in the chart below:

Today, Chavez is long gone. His replacement, Maduro continued the mismanagement of PDVSA and the oil industry. However, Chevron managed to continue to work in the country. They currently have four non-operated joint ventures in Venezuela. But those operations were effectively dormant.

But on May 10th, Reuters reported that the company announced that they will help Venezuela boost oil production.

The deal will help Chevron recover $3 billion in debt owed by PDVSA by 2025. The deal gets Venezuelan oil to the U.S. and generates royalties for Venezuela. In addition, the plan will boost oil production to 200,000 barrels per day by 2024.

This agreement required the U.S. to relax its prohibition on Venezuelan oil exports. The deal specifically bans cash payments to the Venezuelan government. However, it will be a much-needed economic boost to the bruised Venezuelan economy.

The deal appears to be great news for Chevron, which could recover a massive amount of cash. But the additional barrels from Venezuela should continue to dampen oil prices. Oil investors looking for higher oil prices should keep an eye on this situation.

The air is no longer fogged with uncertainty. Powell has decided that anything is better than a panic. He is going to ease up on rates. The course of stocks depends almost entirely on the money situation. The can is being kicked down the road once again, as if it wasn’t inevitable. The soothsayers at The Fed capitulated. The hard decisions will be made not by words but by the market. DT

Chevron could use that Venezuela cash to pay Ecuador the billions they owe for the mess they left there.