AbraSilver Resource – A High-Grade Silver Discovery At The New JAC North Zone

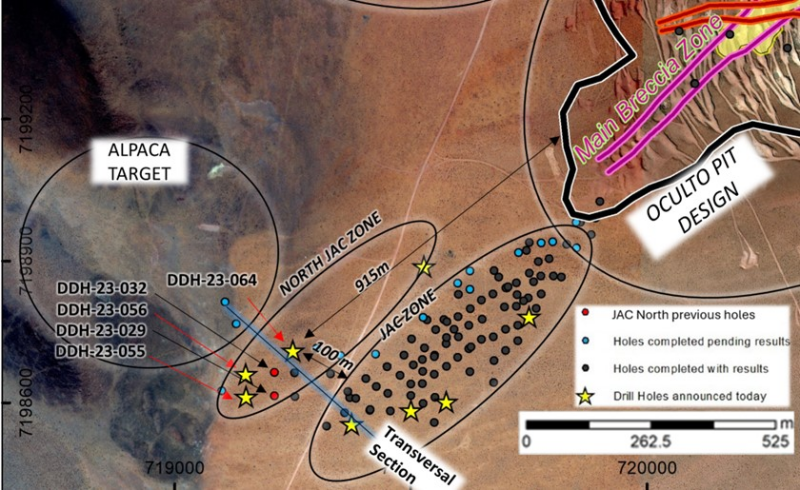

John Miniotis, President and CEO and David O’Connor, Chief Geologist of AbraSilver Resource Corp (TSX.V:ABRA – OTC:ABBRF), join us to review more recently returned high-grade silver drill intercepts from the JAC Zone at the Diablillos Project in Argentina. This includes 3 holes into a brand new discovery and new parallel mineralized area called the JAC North Zone, that is 100 meters to the northwest of the JAC Zone. As announced today, Drill Hole# DDH 23-064 intersected a high-grade interval of 12 meters at 1,042 g/t Ag in oxides starting at a down-hole depth of only 69 meters, including a 6 meter interval grading 1,880 g/t Ag.

Dave outlines why the exploration team is so encouraged by the continued success of the expanded Phase 3 drill program, with 22,000 meters and 115 holes drilled to date at the JAC Zone, this new JAC North Zone, and other targets like Alpaca and Fantasma. There are still more holes to report from this drill program that will feed into an upcoming maiden Resource Estimate on the JAC Zone targeted for October. There is also ongoing work incorporating other metallurgical data, environmental and permitting work, and other project derisking going on into a Preliminary Feasibility Study on the overall Diablillos Project encompassing both the Oculto and JAC deposits by year end. Current testwork confirms that the same process flowsheet can be used to process mineralization from the Oculto, JAC and Fantasma deposits.

John also takes some time to outline how much company value has been added since the prior PEA in 2021, growing the size of the Occulto deposit, defining a whole new higher grade pit in the JAC Zone over the last year, and now promising drilling success from exploration targets like the JAC North Zone, Alpaca, and Fantasma areas. There will be plenty of targets to follow up on in the next Phase 4 drilling campaign, and 2 key company reports and milestones on the horizon for the medium term.

If you have any follow up questions for John or Dave regarding at AbraSilver, then please email me us at either Fleck@kereport.com or Shad@kereport.com.

- In full disclosure, Shad is a shareholder of AbraSilver

.

Click here to visit the AbraSilver website and read over the most recent news releases.

.

Gold Ventures 🟡 @TheLastDegree Twitter · Aug 9, 2023

“Beacon analysts out with a 90c price target for $ABRA.v AbraSilver”

“Another new deposit possible with the newly discovered Jac North zone – open in all directions, and drilling at Alpaca hasn’t even started yet.”

https://twitter.com/TheLastDegree/status/1689294355666698240

In Search Of The Trading Holy Grail: Maximizing Profit Potential On Winning Trades

@Goldfinger on 9 Aug 2023

SilverCrest had superior results for the Q2 -2023.,Congrats for excellence In performance to the SilverCrest team.

I can see why Chris Ritchie may be concerned about a takeout of the company at these wholesale prices.

Here’s a nice table that shows the 20 best Silver drill intercepts in the first half of 2023:

Lots of well known company names that have put out repeated solid results prior to their latest zingers, like GoGold, Kuya, Aya Gold & Silver, New Pacific, Vizsla, Pan American, Dolly Varden, Adriatic, Eloro, Silver Tiger, Silvercorp, etc…

AbraSilver from this interview, had the 4th best silver drill hit from the first half of this year, and additionally was also in the top silver hits of any company in both Q3 and Q4 of last year… even as many investors are asleep on this story. This is not anywhere close to an efficient market.

https://cdn-ceo-ca.s3.amazonaws.com/1ibvko6-726AE5F3-1F54-484B-B177-7D8C85DB4CC3.png

This certainly is not an efficient market and probably won’t be one for some time. The charts of the metals and some of the stocks are looking very precarious right now with Newmont (as mentioned before) being a sentinel stock for the metals. Newmont looks like it wants to take out $40 and if we have a monthly close that is not equivocal below $40 we most likely will be looking at year end action that won’t impress anyone. Sentiment in this sector is close to dead and that speaks to it not being an efficient market. If we get the start of the real secular bear market in the general market (which is a real possibility), that will not be a positive for the metals market. It doesn’t help that interest rates continue to plow higher taking away any allure for the metals. However, it’s a great time to be accumulating some of these metal stocks (slowly) for the long term investor. One of the interesting technical charts is the monthly chart of CDE. The monthly BBs have narrowed about as much as they can and are squeezing pricing. This stock looks like it’ll be squeezed lower over time and attempt to challenge it’s low back in early 2016. One of the best opportunities to purchase these companies is probably going to be the months approaching the end of the year.

Good thoughts as per usual Richard/Doc/Charlie….

I wonder with Newmont how much of the pricing pressure is from higher costs at operating mines and general bad sector sentiment, but with the added pressure from their very large takeover of Newcrest?

They are in a slightly different boat than many gold producers and have struggled more (as it is common for the acquiring company to take it in the shorts, because they are diluting down the existing company and shareholders via spending cash reserves or giving away stock to bring in the new company’s assets and make the purchase). Obviously they think it is worth the candle or they wouldn’t make the acquisition in the first place, and that is true of each acquisition we see from any company really . However, sometimes investors bail if they don’t like the new combined entity as much, or if they feel the deal is lopsided one way or another… and then over time the new larger company starts to get traction and start clawing it’s way higher again.

>> For example when just looking at the period of time since the PM sector bottomed late last fall to present (when gold finally bottomed in early November at $1618), GDX and GDXJ have held onto more of their gains, still up 22% and 18% respectively, while Newmont is actually down about 3%.

In that sense, Newmont has not really been the best sentinel stock for the sector, and has underperformed. Really GDX is a better sentinel for the health of the overall larger Gold producers collectively.

https://stockcharts.com/freecharts/perf.php?NEM,GDX,GDXJ&n=200&O=011000

I do get that Newmont is the largest publicly traded gold producer on the planet, and is one that even generalists track, and thus it is a very important stock to follow. However, based on it’s micro-issues as a company, it isn’t really doing a great job of reflecting the macro sector picture over the last year or so.

Really, placing too much importance or emphasis on the performance of just one stock can be a bit tricky or provide a skewed view of what is going on across any given sector. We see this all the time where people equate a whole sector to how their main big stock position, or small handful of stocks are doing, versus what we are actually seeing across the larger breadth of the sector.

It reminds me of a lot of discussions that were peppering various chat forums about the health of the Silver miners through the lens of First Majestic’s weakness, on that nice bullish move up from late last September through April in the vast majority of silver stocks. On Steve Penny’s site, on Ceo.ca, and even on comments from Twitter and YouTube, those investors that only had exposure to First Majestic as their sole or at least most heavily weighted Silver producer, were far more glum and bearish than those with a well-diversified basket of silver stocks.

Many of these “tunnel-vision investors” were drawing conclusions about the sentiment and direction of all the silver resource stocks, through the prism of First Majestic as their sentinel stock. However, it was having micro-issues as a company (like the Jerritt Canyon Gold mine that they shelled out $500 Million to Eric Sprott to buy was not coming anywhere close to the throughput or economics needed or projected, some didn’t like the dilution of their silver focus to bring in so much new gold on a percentage basis, and then they had Mexican tax issues and labor issues, delays on their reselling of silver coins from the mint, etc…), that were not reflective of what was being seen in many other silver stocks or the ETFs SIL or SILJ.

Meanwhile, during that exact same time period, there were tons of Silver stocks up solid double-digits or even triple-digits from late Sept – April, but First Majestic was severely underperforming. There were plenty of folks (me included) very pleased with how the silver stocks were doing overall, or even in their portfolios that didn’t have any First Majestic exposure, of if they did it was just one of many in their portfolios. It was clear in many people’s silver sector gripes during that time, that they were not holding a diversified basket of stocks that were outperforming, nor were they even positioned in the ETFs, but instead were viewing everything through the not so rosy lens of First Majestics price trajectory, which was missing the forest for the one tree of AG.

I only bring this up because so many people we bring on the show or talk with, constantly point to Newmont’s performance (or underperformance really) and then are extrapolating that out across the whole sector. As already previously acknowledged… It makes sense to look at Newmont’s price action, as they are the biggest gold major out there. However, GDX and GDXJ are really better gauges of the larger gold producers/developers health, as diversified baskets of stocks, and Newmont still has a large weighting in GDX of over 10% (that weighting was even higher at around 13% until the recent rebalancing).

There are plenty of mid-tier gold stocks I hold or track that trounced how Newmont has performed since the PM bottom last fall, just like plenty of silver stocks have trounced how First Majestic has done. While they are key stocks to check in on, it doesn’t mean they are a good reflection of the whole sector of stocks that investors are positioned in. (in this case both drastically underperformed most of their peers over the last year).

I like the concept of sentinel stocks that give early signals to the direction of the rest of the sector… to a degree (and taken with a grain of salt), but ultimately the diversified ETFs like GDX, GDXJ, SIL, SILJ paint a much more holistic picture of the bigger names in the sector cumulatively and better represent their overall trajectory.

Great breakdown …… JMO

As always, you do a great job in breaking down the stuff… 🙂

Much appreciated OOTB. Right back atcha amigo! (you also do a great job of breaking things down for folks here)

CDE – STINK BID @$2.02, and I think it will go lower. CEO Mitch KreBS – a freakin JOKE

Yep, CDE has been a bit of a stinker lately too… but again, they’ve had some challenges to overcome, and it looks like they are set up for a better 2nd half of this year than the 1st half.

______________________________________-

“With the bulk of the multi-year expansion at Rochester now behind us, we look forward to beginning to deliver strong production growth and lower costs from Nevada’s largest primary silver mine,” said Mitchell J. Krebs, President and Chief Executive Officer.

“The team at Rochester is set to achieve a major milestone next month by recovering the first silver and gold ounces from the new leach pad and processing facility. The crushing facility is also expected to be complete this quarter, followed by a ramp-up of the newly expanded operation during the remainder of the year and into early 2024. Once ramped up, Rochester is expected to be one of the world’s largest operations of its kind with production rates approximately 2.5x higher than recent levels, a significantly lower cost structure, combined with the excellent potential to extend and enhance the mine life from its large, prospective, and under-explored land position.”

“Our Palmarejo gold-silver mine in northern Mexico – Coeur’s largest single operation – delivered another solid quarter and continues to showcase its large, prospective land position with additional positive exploration results, which were highlighted in a recent press release. Although Kensington had a weaker than anticipated second quarter, the team has worked hard to address first half operational challenges in order to deliver a stronger second half. Our Wharf operation in South Dakota – which is in its 40th year of operation this year and recently produced its three millionth ounce of gold – continued to deliver solid results during the quarter and received state approval to proceed with an expansion that is expected to add certainty and operational flexibility to its current eight-year mine life.”

See, end of the year after tax loss selling, let’s wait & see–

Yep… “Wait and see” has been the mantra for 2023 from so many.

We’ve had a number of guests cancel meetings with us over the last few months, at various points, as they wanted to “wait and see” how things developed with Fed rate hikes, with when the recession would arrive, with how labor markets changed, with when gold would break out to new highs, and on and on…

There is a lot of “wait and see” sentiment in the resource sector overall… not just in PMs but across the board. Many investors crave certainty, but that is not what Mr Market serves up, and many of the best laid plans get turned on their heads in any sector, as outlooks are dashed, and prior expectations get turned on their heads….

I guess when things are more obvious, that is when it feels most comfortable for the masses to take positions (be it gold stocks, oil stocks, crypto stocks, AI stocks, etc…), but by that point, most of the easy money and biggest moves have already played through. There is nothing wrong with waiting for a more established trend in trading to ride the momentum, or in waiting for macroeconomic certainty and definite closure before coming in off the sidelines…. but often it more lucrative to accumulate positions when there is more market uncertainty or when a sector is more out of favor but oversold to ridiculous levels.

I own many good juniors including Lion 1, Visla & Blackrock Silver. Like Ex, trading around. No way am I moving to sidelines down here

Any chance they will use more drills??

(Yes, I know it is expensive to drill)

It’s a good question Ulf the Wolf. Once the exploration team at AbraSilver completes the additional magnetic surveys and soil work and ground truthing to identify which targets that they want drill over the next few months, I’m sure they’ll have more clarity on what the Phase 4 drill program will look like.

I’ll try and remember to ask about how many drills will be utilized when we speak to them next, as they will be drilling at this new North JAC Zone, Fantasma, Alpaca, and some of those other targets around Occulto. I’m guessing they are going to need multiple drill rigs for all those different areas of interest.

Argentina????

Hey, lately Argentina has been tracking better than the de-evolution in other Latin American countries like Chile, Peru, and Ecuador. AbraSilver is operating in the best state/province in Argentina = Salta. There are many large and mid-sized resource and commodities projects humming right along in Salta, so from that standpoint, the jurisdiction risk is not nearly as troublesome as many may assume… just like many areas of North America are not as great or risk-free as many assume.

Gold Ventures 🟡 @TheLastDegree

“Jihaaa!!! Another new zone with bonanza silver over broad intervals. $Abra.v”

https://twitter.com/TheLastDegree/status/1689231132301148160