Avino Silver and Gold – Recapping Q1 2024 Financials and Operations, Looking Ahead To 5-Year Production Growth Plan

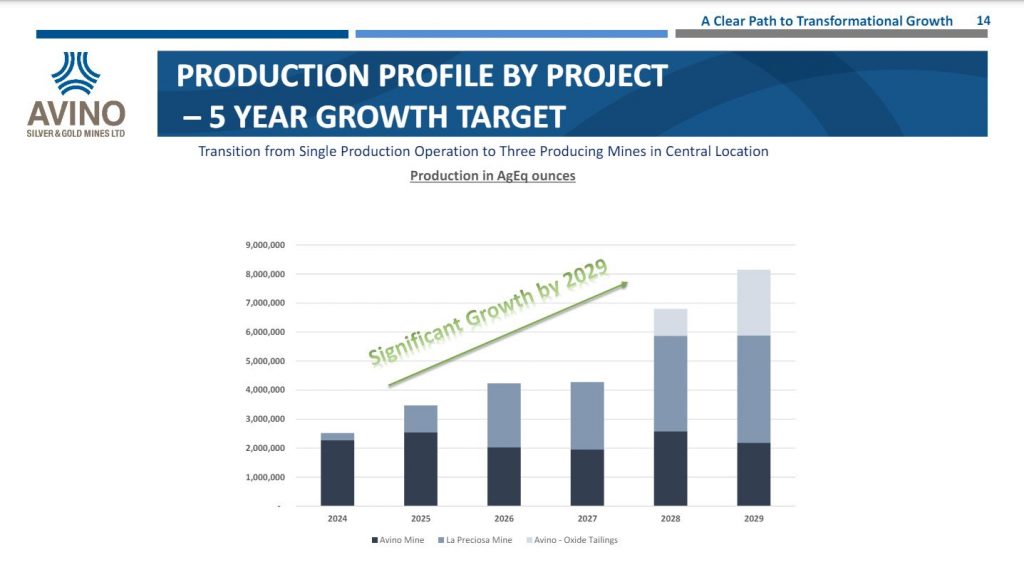

David Wolfin, President and CEO of Avino Silver and Gold Mines (TSX;ASM – NYSE:ASM), joins me to recap the key takeaways from the Q1 2024 financials and operations, and then takes a deeper dive into the Company’s 5-year production growth plan, to become an intermediate silver producer, in Mexico.

David outlines the consistent silver, gold, and copper production coming from the Avino Mine, the upcoming development of the La Preciosa Project later this year, with commercial production expected early in 2025, and then the Oxide Tailings Project a few years out that all contribute to the 5-year production growth plan. We spend some time having him outline all the historic drilling, met work studies, community engagement, and scoping work that has already been completed on La Preciosa, making it shovel-ready now. The Company is simply waiting on the final permits later this summer, to then begin putting in the decline and several months after that to start mining ore and shipping it over to the Avino processing plant. We also discuss the exploration upside at both the Avino Property and at La Preciosa for further potential to expand resources and mine life.

If you have any follow up questions for David or would like further information on any of the topics we discussed please email them to me at Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Avino Silver & Gold at the time of this recording.

.

Click here to follow along with the latest news from Avino Silver and Gold

.

Peter Schiff: Silver has New Support at $30

May 24, 2024 – SchiffGold

“In this episode, Peter recounts silver’s notable rise above $30/oz and addresses the latest FOMC minutes that were released this week, in which the Fed signaled that rate cuts could be delayed even further. Peter also calls out the SchiffGold Silver Breakout Sale to celebrate the metal’s long-awaited breakout. Silver’s rise to $32.50 on Monday has established a new support level at $30/oz:”

“Silver is back down at $30.73. That’s a pretty substantial pullback—about $1.80 or so— from the $32.50 that it traded for on Monday. …That doesn’t mean Silver can’t go below $30, but I think $30 is to silver what $2,000 was to gold. Once we broke up $2,000, $2,000 became support, and yes, every once in a while we dip below $2,000, but we never stayed below it for long, and it quickly came back.”

https://schiffgold.com/peters-podcast/peter-schiff-silver-has-new-support-at-30/

What’s nice to see with this pullback is a lot of the PM stocks “hung in there”. We’re facing the possible “summer doldrums” but this time may (overall) see an exception. The charts of the PMs look fine even though some technicians are moaning the fact that certain important levels have been broken. We will in all likelihood at the end of this month see 3 months in a row of higher closing highs which increase the odds of a down month. It actually would be healthy if we would see that. Regardless, I added today to one of my positions and will continue to add when technicals of a stock shows the likelihood of an interim bottom. The FED is getting worried since inflation is hardly a “dead horse” and the possibility of no cuts this year becomes all the more likely if inflation worsens again.

I bought Avino @ .83 and then a storm came through with 100 mph winds and knocked out my power for 7 days. I wonder why Coeur and PAAS sold the Precioso deposit in light of what ASM thinks?

GoldSeek Radio Nugget – Bob Moriarty: “I’ve never seen silver move this fast.”

May 20, 2024

https://goldseek.com/article/goldseek-radio-nugget-bob-moriarty-ive-never-seen-silver-move-fast