Santacruz Silver Mining – Comprehensive Overview Of Q3 Financials, 1 Mine In Mexico, And 5 Mines, 3 Mills, And An Ore Feed-Sourcing And Metals Trading Business In Bolivia

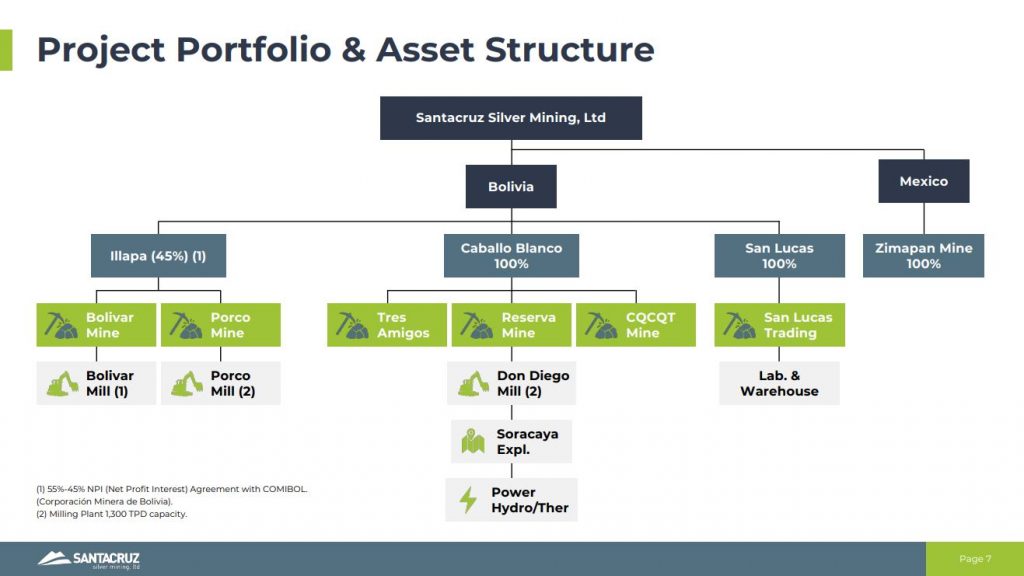

Arturo Préstamo Elizondo, Executive Chairman and CEO of Santacruz Silver Mining Ltd. (TSXV: SCZ) (OTCQB: SCZMF), joins me to recap the key takeaways from the Q3 2024 financials and operations at their 1 mine in Mexico, and 5 mines, 3 mills, and ore feed-sourcing and metals trading business in Bolivia. This is really an reintroduction of the Company, since is has transformed its portfolio of assets since 2021 and 2022 essentially stepping into the role as a mid-tier silver and base metals producer.

Q3 Production Highlights:

-Silver Equivalent Production: 4,644,013 silver equivalent ounces

-Silver Production: 1,703,387 ounces

-Zinc Production: 23,143 tonnes

-Lead Production: 3,027 tonnes

-Copper Production: 270 tonnes

Q3 2024 Highlights (all amounts in US$000’s unless otherwise stated)

- Revenues increased 21% or $13,836 to $78,244 in Q3 2024, compared to $64,408 in Q3 2023

- Adjusted EBITDA increased 242% or $11,181 to $15,810 in Q3 2024, compared to $4,628 in Q3 2023.

- Cash and Cash Equivalent increased 505% or $15,238 to $18,242 in Q3 2024, compared to $3,014 in Q3 2023.

- Working Capital was $24,191 at the end of Q3 2024, improving from a deficit of $43,168 as of December 31, 2023.

- In August 2024, Santacruz filed National Instrument 43-101 – Standards of Disclosure for Mineral Projects compliant Mineral Resource and Reserve estimates for its three Bolivian producing assets (Bolivar mine, Porco mine, and Caballo Blanco Group of mines)

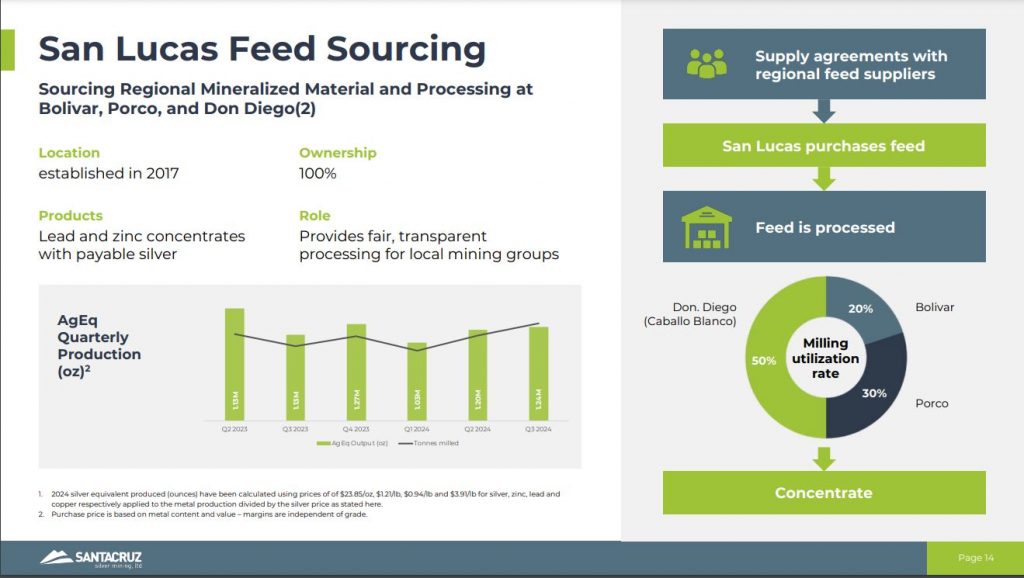

Arturo takes us through the important investment the Company made over the last year, but especially during Q3, into the Zimapan Mine in Mexico, as they work to lower costs and increase production output and revenues. He also outlines the key silver, zinc, lead, copper production profiles and growth and optimization potential at their 5 Bolivian Mines: Bolivar, Porco, Tres Amigos, Reserva, and CQCQT. We also review how their San Lucas ore feed-sourcing and metals trading business smooths out the processing throughput at their Bolivar, Porco, and Done Diego mills and processing centers, while helping support local mining initiatives in Bolivia.

If you have any follow up questions for Arturo regarding Santacruz Silver, then please email them in to me Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Santacruz Silver at the time of this recording.

.

Click here to follow the latest news from Santacruz Silver Mining

.

.

I just saw Trump’s Picks for his Cabinet . HUMMMM it makes one wonder , will ” HE ” fly them all over to Isreal , to have them sworn-in , in front of the Whaling Wall. !!!!!!!!!?

Which begs the question , would that be good or bad for G&S ?

Good for GOLD……….. the other countries know what is going on….. and they are not “buying the BS”

GOOD FOR GOLD……. and you better be stacking it…. 🙂 (not investment advice…. lol…)

The more I dig into BITCON…. the more I know it is just a PONZI scheme……

Yes, it is going up… until it does not…. The scheme is to have COUNTRIES be SUCKERED into it…

“you will own nothing”…seems to ring in my ears…. 🙂

Bitcon… inventor went missing…. hummm lol…

Bitcon…does not do what it was intended to do… lol…

I will post an video…. if , anyone is interested….. Best… Keep stacking… 🙂

When The Boston Globe first wrote an article about Ponzi’s exploits to expose the corruption most readers couldn’t interpret the article and they figured if he was paying so much more interest than the banks that they had better get in, his business exploded. It wasn’t till after he had been written up several times that the public started to realize what a scoundrel he was. DT

https://www.tradingview.com/x/5NUHm5q8/

Current Silver (Daily)

FREAKY FRIDAY AGAIN……………………….

What unknown thing will happen today……. always on a FRIDAY….. 🙂

I call this the era of “loose ends”, there are so many threads dangling, looking for guidance and direction but no one can figure out how they will affect our lives, and each one could change the fundamental values of the way we live. DT

I know we have some folks here at the KER that follow Santacruz Silver, and hope you all enjoy the interview above with Arturo. It took me a while and a lot of work to get connected and it was great bringing SCZ back onto the show again after being gone since 2015.

It’s really a whole new company after changing out their entire portfolio of producing mines in 2021 with Zimapan, and then in 2022 with the Glencore transaction adding in the 5 mines and 3 mills in Bolivia. Also learning more about their San Lucas ore feed-sourcing business where they buy ore from lots of local smaller miners, and then process it at their mills to resell was really interesting.

I’ll work to get Arturo back on the show at the quarterly operations and financials moving forward so we can all closer track the progress at Santacruz Silver. Cheers!

Yessssssss! Ex, thanks for bringing us up to speed on Santa, we are all waiting for The Santa rally, I’ve got my rally cap on. Bolivia is a great jurisdiction for mining these days especially when so many others aren’t. I think it is a great idea that they are processing ore from smaller local miners. This story just keeps getting better, glad to be holding Santacruz Silver Mining. Good days ahead for silver stocks and this one is a favorite. DT

Thanks for those comments DT. Yes, I think the processing of ore from the smaller miners is a true win-win-win for the Company, the smaller miners (who are now doing things more above board and Santacruz Silver is withholding their taxes and paying it on their behalf), and so the government is also a winner. That is good all around.

Yes, I’ve got my rally cap on as well haha! Santracruz is a heavier weighted position for me in my portfolio (so I’m biased in that respect), as I anticipate it having continued good torque to margin expansion in a rising metals price environment and as they work on lower costs.

Thanks for your work Ex, this company should start a climb to mid tear status in price over time.

Much appreciated Dan, and agreed on SCZ starting on the road to climb up to mid-tier status in valuation over the fullness of time.

I don’t think many PM investors have kept tabs on just how much they are producing quarterly now.

They also just finished up paying Glencore most of their royalties and payments here in Q3, so it will be interesting to see how Q4 and Q1 look when the financials come out.

Opportunities In Growth-Oriented Silver Producers – Part 6 (Avino Silver / Santacruz Silver)

Excelsior Prosperity w/ Shad Marquitz – 11/30/2024

https://excelsiorprosperity.substack.com/p/opportunities-in-growth-oriented-c76

https://www.tradingview.com/x/AYbVOPWP/

NatGas : More Upside Now Possible