Uranium Energy Corp – Nuclear And Uranium Fundamentals – Growing US Production Profile With Canadian Development Portfolio

Scott Melbye, Executive Vice President of Uranium Energy Corp (NYSE American: UEC) and President of the Uranium Producers of America, joins me for a longer-format discussion on the fundamentals driving the expansion of nuclear power and more demand for uranium, as well as the Company fundamentals for Uranium Energy Corp as they are growing their US production profile and continuing to explore and develop their Canadian portfolio of projects.

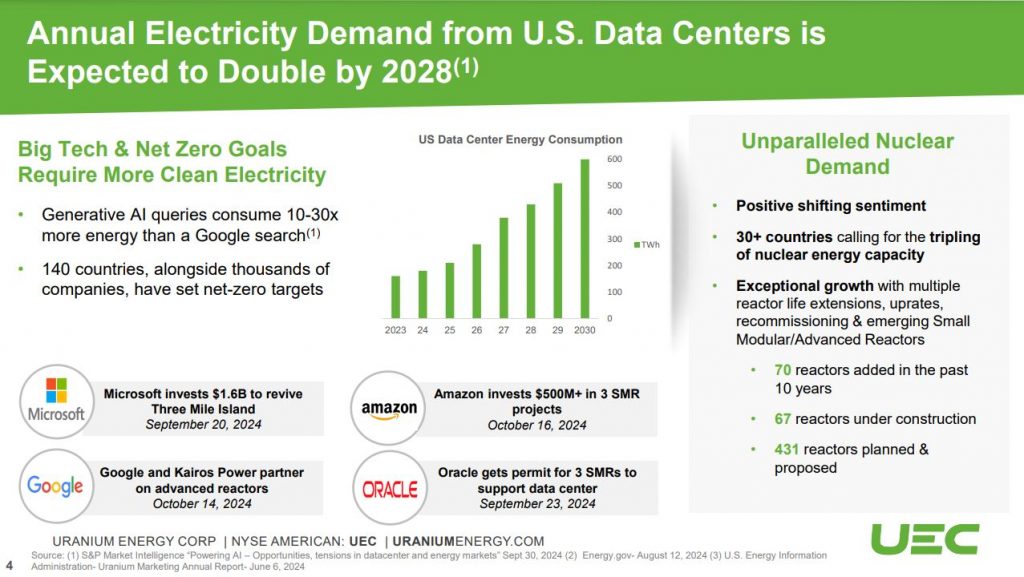

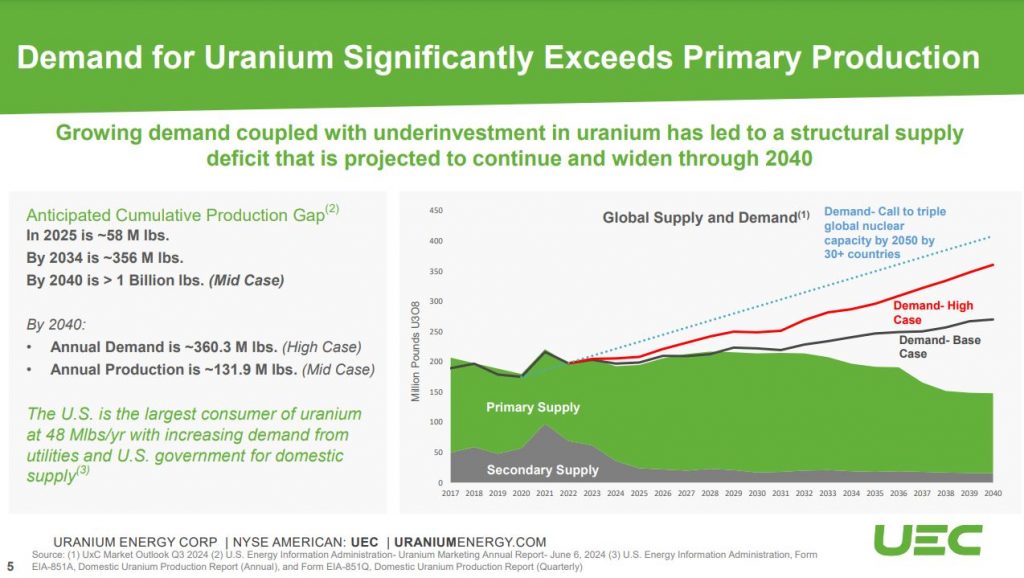

We start off in a multi-faceted conversation on the perfect storm of tailwinds gathering behind nuclear power with 30 countries, including the US, committing to tripling their nuclear power energy output by 2050, and more need for carbon-free baseload electricity to satisfy green energy transition policies and growing demand from AI datacenters. We then contrast that demand growth with geopolitical tensions taking French uranium supply offline in Niger, the US sanctions on Russian enriched uranium fuel, and retaliatory bans from Russia on exporting uranium fuel to the US, and Kazakhstan state producer Kazatomprom missing guidance, and maintaining more output to Chinese partners than to its JV with Cameco, moving more fuel to the East versus the West.

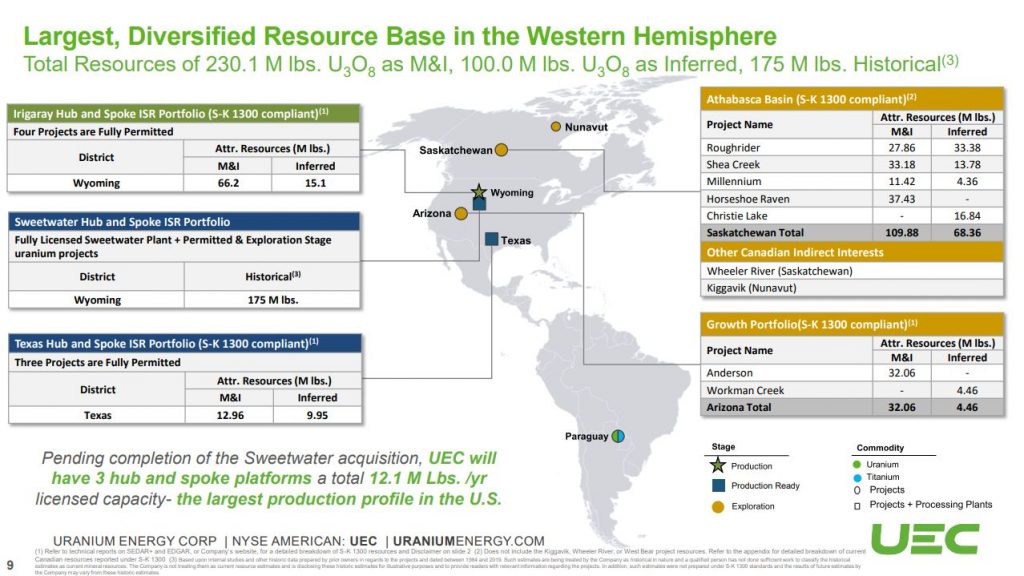

This all highlights the importance of US domestic uranium producers, along with legitimate Canadian development projects, and the premiums those North American companies and projects are likely to keep garnering from investors. The conversation then transitions to Uranium Energy Corp as the largest and fastest growing uranium producer in the US, and Scott outlines their anticipated production growth from 1 million to 5-7 million pounds over the next 5 years domestically, and the potential to then ramp that up to about 12 million pounds of production once their Canadian Roughrider project is developed and put into production. Then there are even further development projects of merit within their Canadian pipeline of projects acquired from UEX 2 years back.

Scott breaks down the potential at a number of their US and Canadian projects, speaks to the pedigree and experience of their management team, the financial health of the Company, key strategic shareholders, their ETF inclusion, and analyst coverage.

If you have any questions for Scott regarding Uranium Energy Corp, then please email those in to me at Shad@kereport.com, and we’ll get them addressed by management or covered in future interviews.

- In full disclosure, Shad is a shareholder of UEC at the time of this recording.

.

Click here to follow the latest news from Uranium Energy Corp

.

.

Geopolitics and Uranium: Scott Melbye on Russia’s Supply Ban and U.S. Response

Kitco News – November 26, 2024

“Russia’s uranium export ban has rocked global energy markets, exposing critical vulnerabilities in U.S. energy security. Scott Melbye, Executive VP of Uranium Energy Corp (UEC), discusses the urgent need for a robust domestic uranium fuel cycle to reduce reliance on foreign suppliers like Russia and Kazakhstan. With uranium prices already breaching $100 per pound and a 50-million-pound supply deficit, Melbye explores how the U.S. can respond to growing nuclear energy demand.”

“Melbye also highlights UEC’s leadership in North American uranium production, from restarting mines in Wyoming and Texas to advancing the Rough Rider project in Canada. He outlines the role of nuclear energy in powering the green transition, the rise of small modular reactors (SMRs), and the potential impact of President-elect Trump’s pro-energy policies. This is a must-watch for insights into the future of uranium, energy security, and the nuclear power industry.”

COSA and Denison in a JV on some of DNN eastern Athabasca properties. Seems like a change of direction for COSA who were previously excited about their western Athabasca properties, which now are on the back burner in favor of this more advanced Denison tie up.

Thanks for bringing up that Cosa / Denison JV. I’ve got Keith from Cost coming back on the show next week to discuss.

I think this is just an enhancement of their portfolio of projects, but definitely not an abandonment of their other projects. They’ve just started the exploration work programs on Ursa with winter and summer drilling and they are going to be following up on that, but they also have the Aurora and Orbit projects they’ve done airborne geophysics surveys on for targeting next year…. not to mention 8 other projects. Now maybe some of those other projects further down the batting order will be spun out to other companies, to make room for these new JV ones with Denison, but we’ll get more info from Keith this next week on how it is all coming together.

Per Jander – Uranium Spot & Term Market, Outlook For 2025

CEO & Market Expert Interviews – Triangle Investor

Interview with uranium trader Per Jander, Director at WMC which is Technical Advisor for Sprott Physical Uranium Trust. Recording date: November 26., 2024.

Chapters:

0:00 Intro

0:38 Spot market

2:32 Buying bigger quantities of uranium

4:12 Term market

6:34 Price reporting transparency

7:30 Ceilings & floors in recent term agreements

8:32 ANU fund selling inventory

9:39 Outlook for 2025

12:08 How many RFPs are out and how big are they

13:37 Conversion

14:28 Uranium incentive price

15:36 Chinese locking up supply

18:06 Next move for Orano

https://youtu.be/LgfKH74VWwA