Thesis Gold – 4.7 Million Ounces Of Gold Equivalent Resources At PEA-Stage Economics In Northern British Columbia

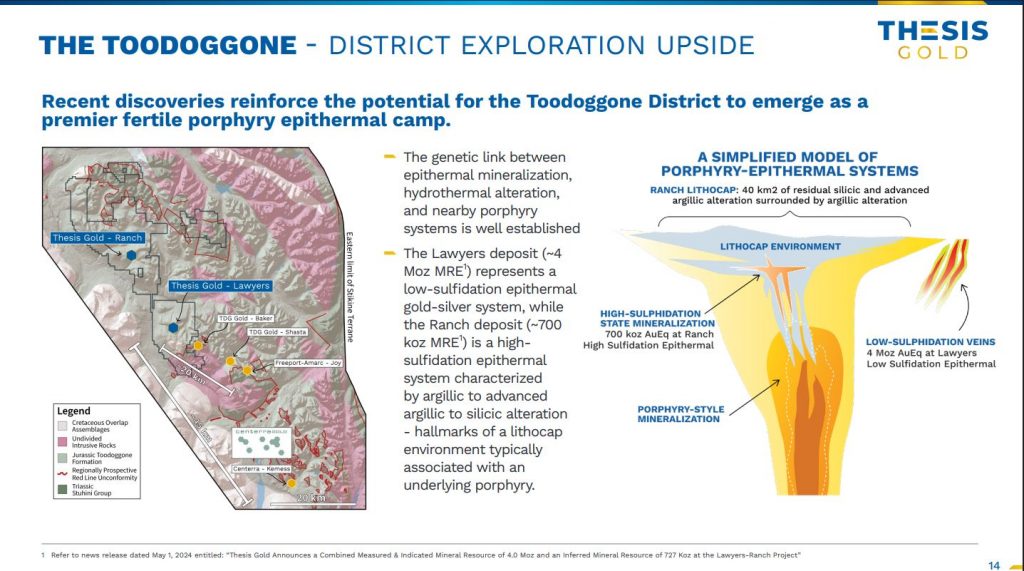

Ewan Webster, President and CEO of Thesis Gold Inc. (TSXV: TAU) (WKN: A3EP87) (OTCQX: THSGF), joins me for a comprehensive overview of the combined Lawyers-Ranch Project, which hosts 4.7 million ounce of gold equivalent resources at the Preliminary Economic Assessment (PEA) stage of economics in the Toodoggone Mining District of British Columbia.

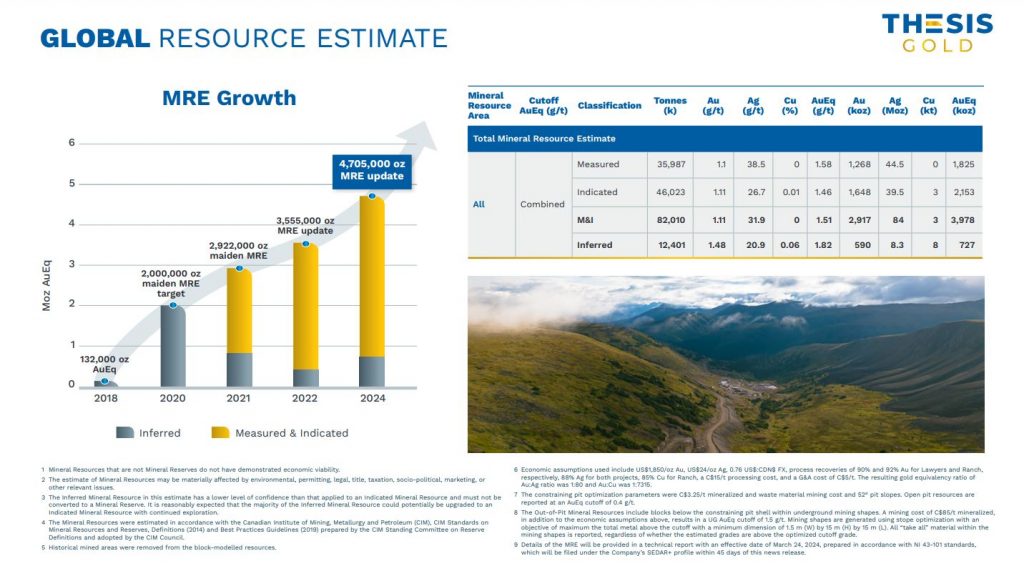

We start off discussing how this company came together, initially exploring and developing the Ranch Project, and then acquiring Benchmark Metals in 2023 to bring in the Lawyers Project. Then in May of 2024 the combined resource estimate of the Lawyers-Ranch Project was announced with 4.0 Moz AuEq Measured & Indicated (M&I) at 1.51 g/t AuEq, and 727,000 oz AuEq Inferred at 1.82 g/t AuEq. The deposit is primarily gold, but has a significant silver component (with 84 Moz in M+I category), as well as copper credit.

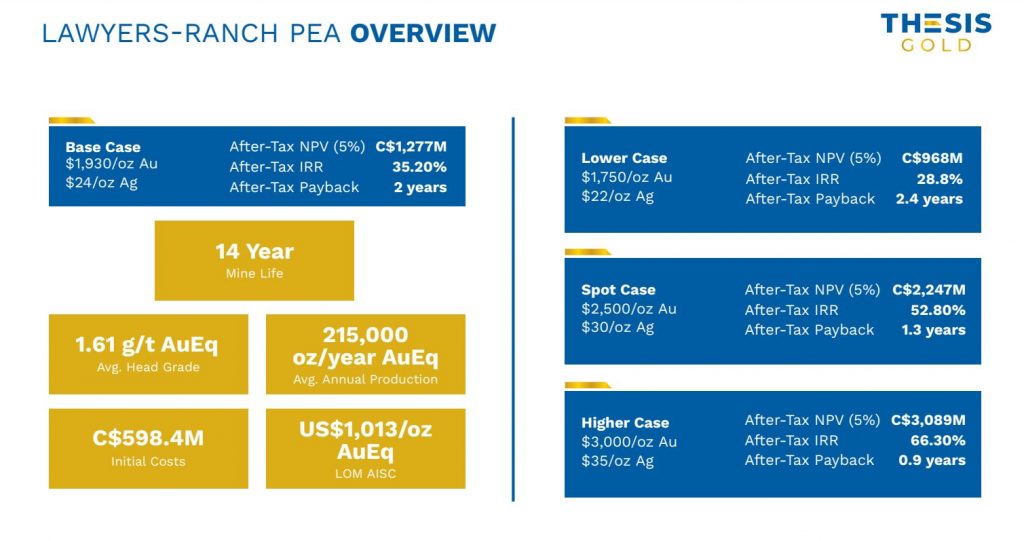

In September of 2024 the Company announced the Preliminary Economic Assessment, using metals price assumptions of $1930 gold and $24 silver, which projected an After-Tax NPV (5%) of $1.27Billion, and after-tax Internal Rate of Return (IRR) of 35%, and a payback period of 2 years, with All-In Sustaining Costs (AISC) of US $1,013 / Au oz (net byproduct credits) and over a 14 year life of mine. Ewan makes the point that at current spot metals prices of gold near $3,200-$3,300 and silver at $32-$33, that the project economics are significantly expanded. The company is doing a great deal of derisking work at present to build towards a Pre-Feasibility Study (PFS) by the 4th quarter of 2025.

The company is gearing up to kick off a summer drilling program focused on making new discoveries across their district-scale land package, seeking out other areas of potential expansion of mineralization. Additionally, more work will go into moving the permitting process along and initiating work on key permits as the year progresses. Ewan spends some time to unpack the infrastructure advantages in place with easy road access, an airstrip, and access to cheap hydro power.

Wrapping up we discuss some of the multiple institutions in place as shareholders along with senior gold producer Centerra Gold as a new strategic investor with a 9.9% stake, and expertise in the area. Centerra Gold owns the Gold/Copper Kemess Mine located in the Toodoggone District, ~45 km south of Lawyers-Ranch and Mt Milligan Mine ~270 km to the southeast. The company is cashed up with CAD $35Million in the treasury and plenty of capital to carry them through the various work programs for the balance of 2025 and into 2026.

If you have any questions for Ewan regarding Thesis Gold, then please email them into me at Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Thesis Gold at the time of this recording and may choose to buy or sell shares at any time.

Click here to follow the latest news from Thesis Gold

.

.