Blackrock Silver – Final Batch Of M&I Conversion Drill Results Demonstrate Higher Silver And Gold Grades, More Up-Dip Mineralization, And Continuity At The Tonopah West Project

Andrew Pollard, President and CEO of Blackrock Silver (TSX.V:BRC – OTCQX:BKRRF), joins me to discuss the final batch of high-grade silver and gold assays returned from the M&I Conversion drill program on its 100% owned Tonopah West project in Nevada, United States. Importantly, the company has also released tables with all the M&I drilling data that will be feeding into the updated resource estimate due out at the end of Q3 in September.

HIGHLIGHTS:

- TXC25-139 cut 9.05 metres grading 367 grams per tonne (g/t) silver equivalent (AgEq) (182.8 g/t silver (Ag) & 2.04 g/t gold (Au)) from 187.5 metres, including 0.82 metres grading 2,886 g/t AgEq (1,411 g/t Ag & 16.13 g/t Au), Ag/Au ratio 90:1;

- TXC25-150 drilled 2.84 metres grading 671.5 AgEq (367 g/t Ag & 3.41 g/t Au) from 162.3 metres, including 0.76 metres grading 1,554 g/t AgEq ( 819 g/t Ag & 8.14 g/t Au);

- TXC25-146 intercepted 1.16 metres of 1,111 g/t AgEq (615 g/t Ag & 5.50 g/t Au) from 189.5 metres;

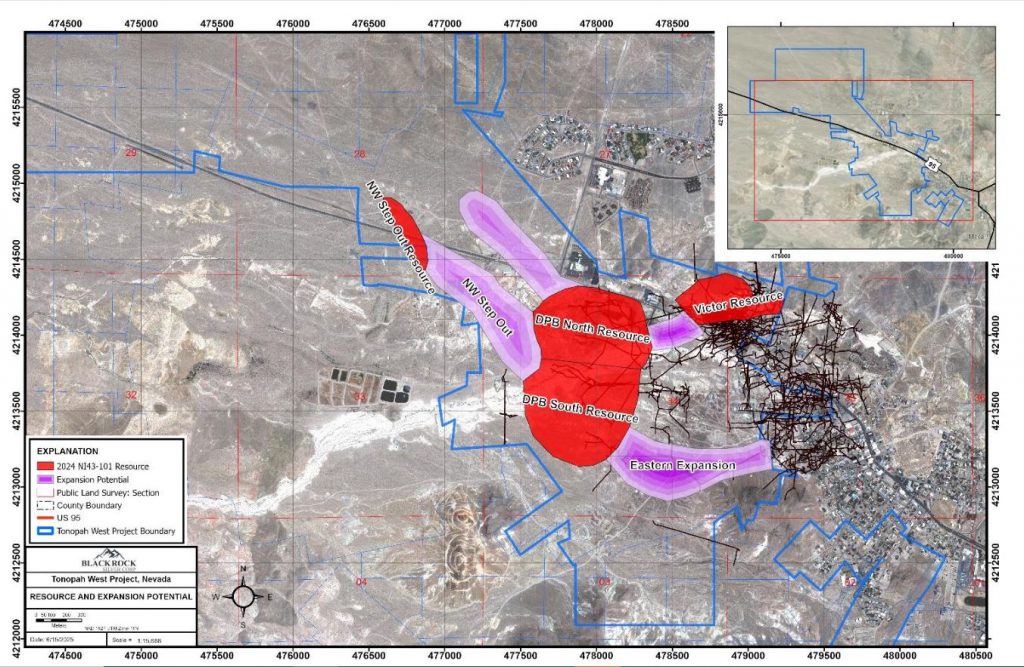

- Results from the entirety of the M&I Conversion Program have validated the geologic model, successfully establishing continuity of the high-grade shoots bearing robust geometry over 350 metres. The shoots remain open to the Northwest and downdip;

- Significant new zones of near-surface mineralization were encountered during the M&I Conversion Program at higher-than-average grades up-dip from the existing resource shell;

- Modelling of the M&I Conversion Program drillholes is now underway with an updated mineral resource estimate on Tonopah West on track for Q3, 2025; and

- Assay results for 7 drillholes from the Company’s Northwest step out resource expansion area are currently pending.

We review that in addition to higher confidence ounces, where there is now tighter drill spacing and ounces are going to be moving into the measured and indicated categories from inferred, that the resources will be growing in size, raising the overall high-grade deposit to even higher average grades, and there is more up-dip mineralization that will be factoring into the early year economics of the Project. These various data points will be incorporated into the upcoming updated resource estimate due out by September, and will be answering some of the unanswered questions, with a high probability of facilitating a rerating in the valuation of the Tonopah West Project.

If you have any follow up questions for Andrew regarding Blackrock Silver, then please email them into me at Shad@kereport.com.

- In full disclosure, Shad is shareholder of Blackrock Silver at the time of this recording, and may choose to buy or sell shares at any time.

Click here to visit the Blackrock Silver website to read over the recent news we discussed.

.

.

Tapping Into Australia’s Next Great Gold Story – Golden Cross (AUX.v ZCRMD) Investor Snapshot

As detailed by Wealthy Venture Capitalist, Golden Cross (AUX.V) is gaining attention as the next potential high-grade gold discovery play in Australia’s Victoria Goldfields—just 10km from Southern Cross Gold’s $1.3B Sunday Creek discovery: https://wealthyvc.com/stocks/golden-cross-resources-tsx-vaux-tapping-into-australias-next-great-gold-story/

Why Investors Are Watching:

Flagship Reedy Creek Project: Adjacent to Sunday Creek, with historic intercepts up to 174.4 g/t Au over 2m and strong structural similarities.

Drill-Ready & Fully Funded: A 6,000m drill program has kicked off and is on track to scale to two rigs by September with assays expected from August to December.

Tight Share Structure: Only 60M shares outstanding, ~33% insider-owned—positioned for strong torque on discovery.

Top-Tier Team: Led by ex-Snowline CFO Matthew Roma, and former K92 and SilverCrest leadership, with a proven exploration model and deep capital markets experience.

Technology Edge: Utilizing VRIFY AI tools—the same tech behind Sunday Creek’s breakthrough—to fast-track target generation.

With exploration underway, news flow imminent, and a structure built for upside, Golden Cross offers early exposure to a potential breakout gold discovery in one of the world’s hottest exploration jurisdictions.

I don’t understand why the price of oil hasn’t gone much higher given the geopolitical issues in The Middle East, and elsewhere. Either people aren’t informed, or The World sees regime change in The Persian Gulf region as being a good thing, or it could be little by little and then suddenly a lot.

or maybe we will find out on Freaky Friday! LOL! DT 🙄