AbraSilver Resource – Expanded Resources At The Diablillos Project Have Grown to 350 Million Silver Equivalent Ounces

John Miniotis, President and CEO of AbraSilver Resource Corp (TSX: ABRA) (OTCQX: ABBRF), joined us to review the new expanded Mineral Resource Estimate, development work building towards the Definitive Feasibility Study, and the ongoing 20,000 meter Phase 5 drill program at their wholly-owned Diablillos property in Salta Province, Argentina.

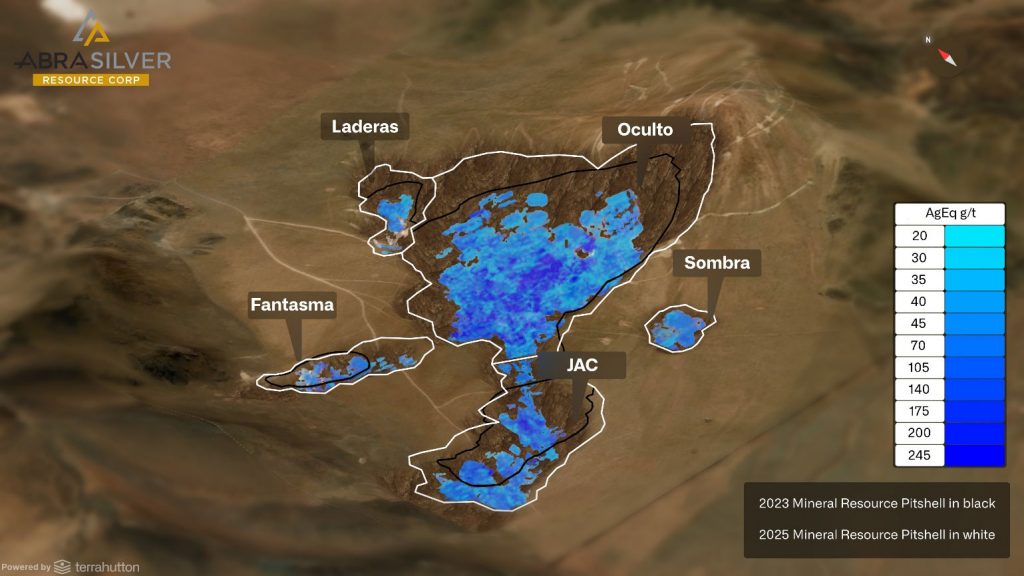

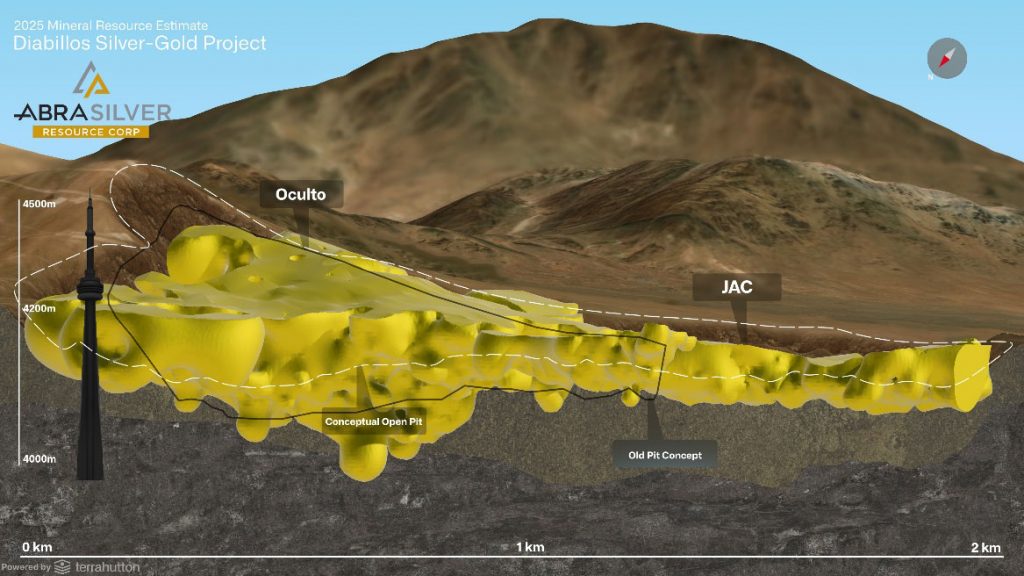

The updated MRE now totals 104 million tonnes (“Mt”) of ore, containing approximately 199 million ounces (“Moz”) of silver and 1.72 Moz of gold (350 Moz silver-equivalent “AgEq”) in the Measured & Indicated (“M&I”) category. This total includes a maiden heap leach Mineral Resource estimate and reflects significant increases across five deposits (Oculto, JAC, Fantasma, Laderas and Sombra) located at Diablillos.

Key Highlights of the Updated MRE (Combined Tank and Heap Leach):

- Total M&I Mineral Resources (tank and heap leach) now stand at 104 Mt grading 59 g/t Ag and 0.51 g/t Au, containing 199 Moz Ag and 1.72 Moz Au (350 Moz AgEq).

- Tank leach Mineral Resource estimate totals 73 Mt grading 79 g/t Ag and 0.66 g/t Au, containing 186 Moz Ag and 1.55 Moz Au (327 Moz AgEq).

- Maiden heap leach MRE adds 31 Mt grading 13 g/t Ag and 0.16 g/t Au, containing 13 Moz Ag and 162 koz Au (23 Moz AgEq).

- Based on lower-grade material contained with the constraining Whittle open pit, previously classified as waste, now recognized as potentially recoverable though a low-cost processing route.

Key Changes Compared to Prior MRE (Tank Leach Only):

- 25% increase in contained silver in M&I Mineral Resources to 186 Moz Ag from 148 Moz Ag.

- 14% increase in contained gold in M&I Mineral Resources to 1.55 Moz Au from 1.36Moz Au.

- 27% increase in M&I silver-equivalent ounces to 327 Moz AgEq from 258 Moz AgEq.

With three drill rigs now active across the broader Diablillos land package, and the potential to add a fourth rig in the future, the Company is entering another exciting new phase of exploration growth. In addition, the Company is doing all the derisking work programs in parallel with exploration for their ongoing Definitive Feasibility Study due out in early 2026, which will be followed by a PEA on the heap-leach economics, and another updated to the mineral resource once all the Phase V data is incorporated into that study.

If you have any follow up questions for John regarding at AbraSilver, then please email us at Fleck@kereport.com or Shad@kereport.com.

- In full disclosure, Shad is a shareholder of AbraSilver at the time of this recording.

Click here to visit the AbraSilver website and read over the most recent news releases.

.

.

You certainly called this one Doc, here, ten or so days ago. It was inevitable, this correction…nothing goes straight up.

Regardless the resumption of this precious metals bull market sometime this fall also feels inevitable .

Cheers.

What tells you this bull market isn’t over yet is the fact that all the PM stocks have not shared in the move higher of the metals. We have not seen a blow off phase yet but that will come for the patient.

What’s not to like about EQX, especially with new management? I wouldn’t mind it going down some more. BTG is another one….and NST.ASX

Yeah, I’m happy to see Darren at the helm of EQX now, as he did a far better job running the ship and optimizing & expanding new mines at Calibre than Greg did with the suite of mines at Equinox 1.0.

It’s no secret that Calibre was one of my favorite growth-oriented gold producers, and while I was not a fan of the merger with Equinox, it is hard to ignore their asset base has potential to surprise to the upside both from the Calibre side of the equation and even the Equinox side of the equation… especially with Darren and some of the old calibre team in there to get things right-sized.

Also, Equinox has been disproportionately shunned when so many sector investors have been bashing on EQX for so long. Some of it was deserved from the challenges they had at Los Filos, and Greenstone taking longer to ramp up than initially slated, but much of it is an over-reaction and too much negativity around the stock. Ross Beaty isn’t going to sit back and watch his final swan song go down the drain….

Personally, I had sold all my Equinox shares when the news broke about the merger (so glad I did as it has continued to correct down since then), but I let my Calibre shares convert over to EQX, but probably should have sold them before the merger to buy back in, as I figured there’d be some selling pressure for a while.

The issue was then I would have had a larger taxable event I didn’t want to deal with this year when I already have a lot of trading gains to digest, and no real areas left for tax losses, having cleared them all out in 2022-2024. As a result, I’m going to hang onto my EQX shares for the rerating higher, and the promises from both sides during the merger that the pro-forma company would still have the potential to essentially double just to get its P/NAV valuation multiple up in alignment with other senior gold producers, as it has essentially become the new Major on the block.

We’re at a corrective moment for the metals and the metal stocks. There may be some pain for awhile going forward, however, it’ll probably be the last good chance to add and solidify your stock positions. I believe 2026 will be a very good year.