Silver Tiger Metals – Regional Exploration Program Has Commenced Along Trend To The North and South Of The El Tigre Mine

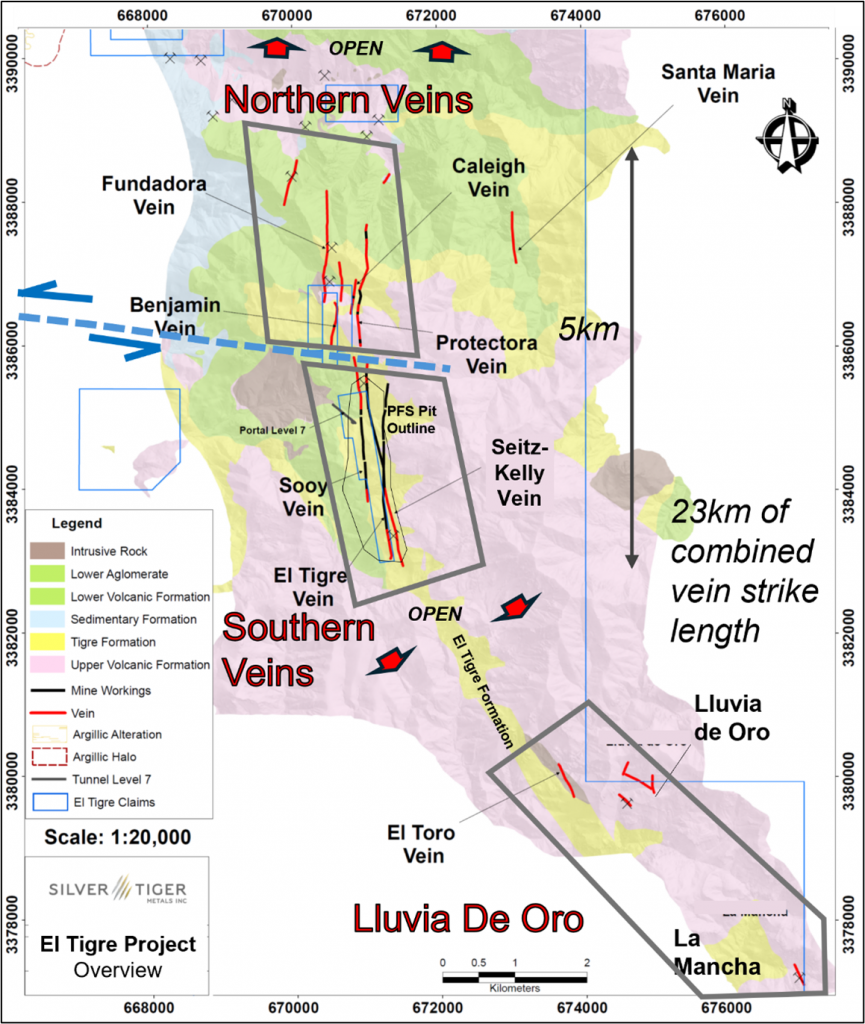

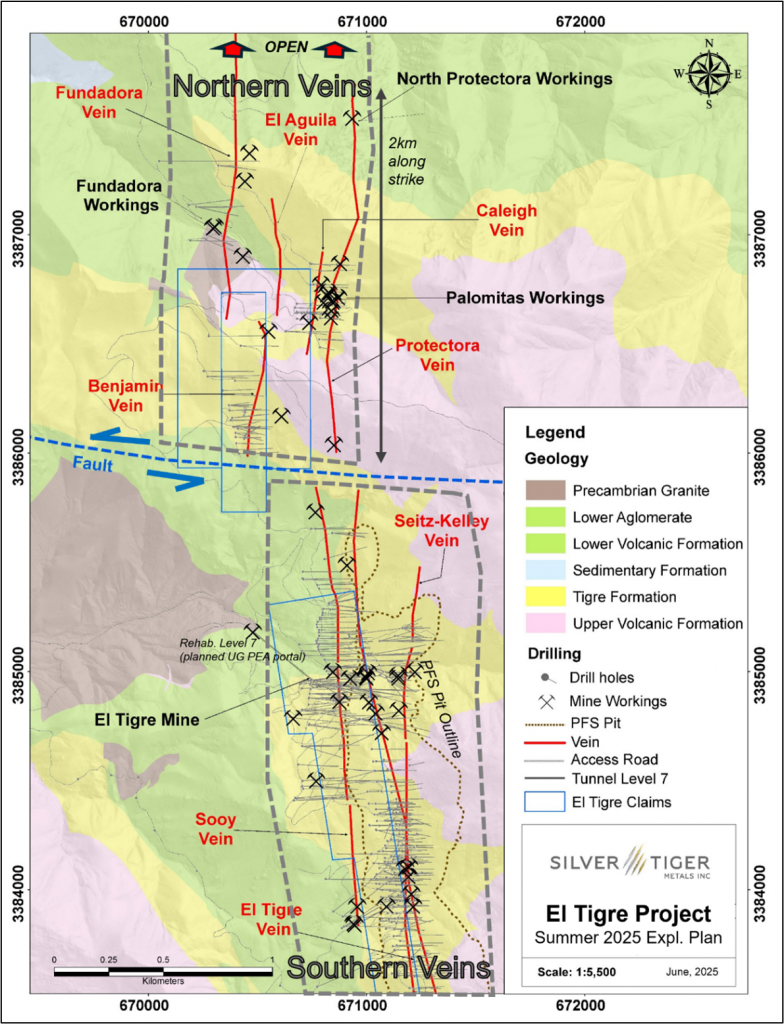

Glenn Jessome, President & CEO of Silver Tiger Metals (TSX.V:SLVR – OTCQX:SLVTF), joins me to review the news released this morning announcing the preliminary results from its 2025 Summer Exploration Program on the prospective Northern Veins, located 2 kilometers North of the historic El Tigre Mine. This news also outlines the initial exploration plans to test several undrilled greenfield areas on the Southern Veins on its 100% owned, silver-gold El Tigre Project located in Sonora, Mexico.

The Northern Vein Area has over 10 kilometers of combined strike length confirmed by surface mapping and sampling, drilling and the presence of underground workings mainly on the Fundadora, Protectora and Caleigh Veins. This area is considered brownfields with 15% of the mapped strike of veins being drilled. These veins are the faulted offset of the El Tigre Mine Veins and exhibit the same structure, mineralogy, grades, orientations, strike length and width (1-2 metres) as the well-defined El Tigre Mine Veins that account for bulk of the Corporation’s Mineral Resource Estimate. Current exploration work on the Northern Veins, consists of mapping and sampling both surface and historic underground workings to define drill ready targets for Q4-2025.

The Southern Veins which includes Lluvia de Oro, La Mancha and El Toro is considered greenfields with veins striking for over 10 kilometers and no drilling ever conducted on this area. This prospective area is evidenced by historic workings and high-grade channel sampling. The El Toro, Lluvia de Oro and La Mancha Veins are hosted in the El Tigre Formation, a permissive formation that is the host for the Stockwork Zone, which is the basis of the Company’s PFS. There is ongoing mapping and sampling at these Southern Veins, with drilling slated to begin in early 2026.

We wrap up recapping all the exploration, development, and derisking work that is going into the upcoming imminent Preliminary Economic Assessment (PEA) for the underground mine. The team at Silver Tiger has been compiling the last 5 years of work delineating the 113 million ounces of silver equivalent resources in the high-grade veins, shale, and sulphide zones underground portion of El Tigre, the metallurgical studies, and engineering work to be able to release the PEA by month’s end. This report will center around the already permitted underground scenario utilizing an 800 tonnes-per-day (tpd) mill, and focusing on the initial first 10 years of mine life.

If you have any follow up questions for Glenn regarding Silver Tiger Metals, then please email them into me at Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Silver Tiger Metals at the time of this recording, and may choose to buy or sell shares at any time.

Click here to follow the latest news from Silver Tiger Metals

.

.

$1B won’t go very far after pork barrel, kickbacks, bribes, etc have been paid.

When HydroGraph trades it’s like watching and hearing a gun go off! POP,POP, POP, POP, POP, POP!!!!!! LOL! DT 🤣😍👍😊👌🫵

Oh No Mr. Bill, there are new buyers coming in quickly after a short day of consolidation. HydroGraph is whipsawing higher! DT

NEWS IS OUT!

HydroGraph Partners with Hawkeye Bio to Power Novel Graphene Biosensor Solution for LEAP(TM) Lung Cancer Test from Ease Healthcare.

I’m also sure HydroGraph will be eligible to receive funding from The US Department of Energy. There are so many uses for pure graphene that it is mind BOGGLING! LOL! DT

Thanks, DT. The effect of any news strengthens the base. The add/buy level rises accordingly. How long will it be before a transnational snaps this one up? BDC

https://www.tradingview.com/x/gHfp2XPu/

HydroGraph : Good News Effect

Hi BDC, check your charts to see if tomorrow will be a gap up or down. I have my own thoughts on this, but I would like to hear it from the chart wizards. DT

Will do. Often the first ABCD will remain in effect even after others appear.

For HGRAF that is 15~129~72 with the initial result 173. More later.

Will continue at El Conin. (Money!) BDC

Looking at HG website it appears they will supply graphene powder and collaberate with end users of their product. But there is a lot of work to be done in the development process and scaling up quantities of this powder to meet demand.

B: That appears so, and the current risk may simply be that a transnational comes in and makes an offer impossible to refuse. Sans that, it’s a joy to watch, and I will document the pricing all the way. BDC

(EQX) Equinox Gold Delivers Solid Second Quarter 2025 Financial and Operating Results

August 13, 2025

Another bit 14% pop on earnings, just like Coeur and Hecla and so many of these PM producers… making the point once again, that NO, these Q2 numbers were not properly priced into these stocks.

I asked so many of our guests and so many people in private conversations if they really believed that that these Q2 numbers were “all priced in already.”

A few agreed there may be some more upside, but the vast majority of people asked robotically answered that “Yes, the markets are forward-looking and everyone knows that gold and silver prices were higher last quarter so they have already priced it all into the producers valuations.”

Clearly the market had NOT priced in all these earnings, which was the point I was driving at over the last month when asking people that. I kept looking at the valuations shaking my head at how they were not screaming higher considering the margins, revenues, and cash flows that we’d see get released.

Now many folks are either out of position and surprised by these big double-digit pops higher that would be a good year of returns for most investors, or they are stuck chasing these PM producers even higher realizing that they had undervalued their earnings and upside potential. (its the same thing that played out in Q1, and it is likely the exact same thing we’ll see play out in Q3).

Day 5 of take down. My accounts taken back to early June.

Hi Ex, a lot of people don’t think for themselves and they use stock answers when asked questions about the state of the market. Stock market Investing isn’t an easy game in fact I always tell family members it is the most dangerous game. If it wasn’t dangerous 95% of people would make money instead of losing it. We haven’t had a major crash in a long time and when it comes you want to be in cash beforehand, now how difficult and dangerous is that. DT

“A few agreed there may be some more upside, but the vast majority of people asked robotically answered that “Yes, the markets are forward-looking and everyone knows that gold and silver prices were higher last quarter so they have already priced it all into the producers valuations.”

HydroGraph is currently up 32.19% on the day. LOL! DT

Scorpio breaking out… good interview last week btw…

US launches $1B push to break China’s critical mineral grip

The US Department of Energy announced Wednesday that it will provide nearly $1 billion in funding to accelerate domestic critical mineral and materials production, marking the Trump administration’s most comprehensive effort to reduce America’s dependence on foreign suppliers. DT