Santacruz Silver – Record Q2 2025 Financials and Comprehensive Operations Review In Mexico And Bolivia

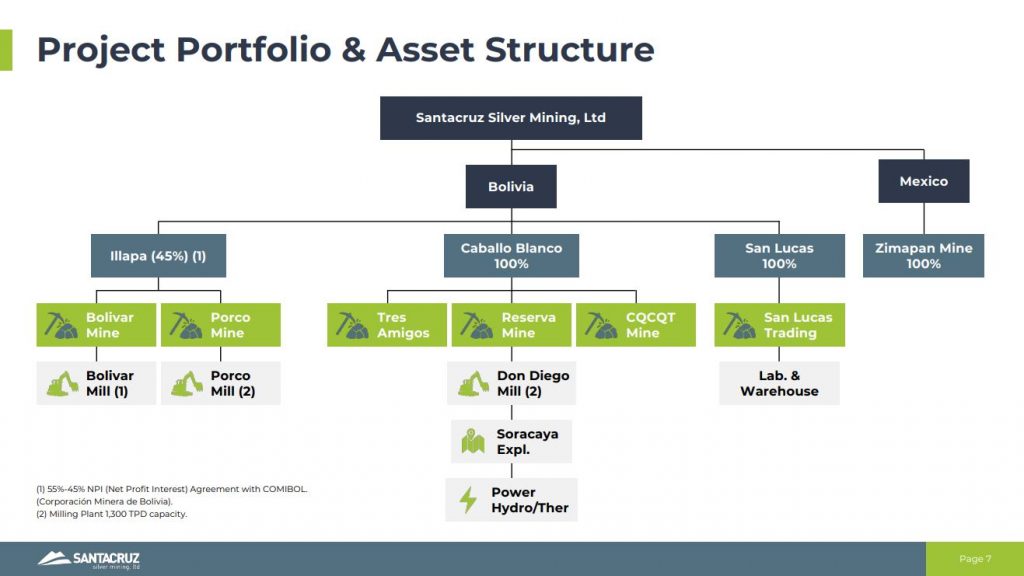

Arturo Préstamo Elizondo, Executive Chairman and CEO of Santacruz Silver Mining Ltd. (TSXV: SCZ) (OTCQB: SCZMF), joins me to recap the key record Q2 2025 financial results along with a comprehensive review of all operations. Santacruz Silver operates 1 mine in Mexico, and 5 mines, 3 mills, and an ore feed-sourcing and metals trading business in Bolivia, as an emerging mid-tier silver and base metals producer.

Q2 2025 Highlights

- Revenues of $73.3 million, a 4% increase year-over-year.

- Gross Profit of $25.3 million, a 59% increase year-over-year.

- Net Income of $21.0 million, a 1,348% increase year-over-year.

- Adjusted EBITDA of $26.8 million, a 68% increase year-over-year.

- Cash and short- and long-term investments of $57.8 million, a 691% increase year-over-year.

- Working Capital of $60.3 million, a 303% increase year-over-year.

- Cash cost per silver equivalent ounce sold ($/oz) of $19.48, a 10% decrease year-over-year.

- AISC per silver equivalent ounce sold of $22.95, a 8% decrease year-over-year.

Q2 2025 Production Highlights:

- Silver Equivalent Production: 3,547,054 silver equivalent ounces

- Silver Production: 1,423,081 ounces

- Zinc Production: 21,148 tonnes

- Lead Production: 2,773 tonnes

- Copper Production: 229 tonnes

Arturo discussed the very strong revenues, gross profit, net income, adjusted EBITDA, cash and cash equivalents, and working capital all up substantially in year-over-year metrics. In addition their cash costs and All-In Sustaining Costs (AISC) numbers came down in a meaningful way due to a combination of factors from mine optimization work paying off, to favorable currency exchange rates, and the positive impact of paying down the Glencore loan early, which will save the Company US$40 million. The Company plans to successfully complete the final 2 payments to Glencore by October 31, 2025, and will likely pay off both installments in the month of September. The company also announced a sale of 70 million Bolivian Bolivianos Promissory Note at 7.00% interest rate, a maturity date of June 15, 2026, just to give them treasury efficiencies for working capital in country.

Switching over to the operations for the quarter, there was better revenues from their San Lucas ore-feeding business, which is now absorbing the Reserva Mine ore to then blend it with ore from the small-scale miners. This leaves the ore from both the Tres Amigos and Colquechaquita mines to report to Caballo Blanco, making all operations much more efficient with better metals recoveries. The San Lucas production and revenues largely offset the lagging effects in the quarter from the water issues at Bolivar, which have now been mostly resolved, and those high-grade veins will be a bigger contributor to production again for H2 of 2025.

Transitioning over to Mexico, we discussed the higher-grade 960 Level at the Zimapan Mine starting to contribute, and how this will continue growing in the Q3 and Q4 production profile from Zimapan for the balance of this year and for many years into the future.

Arturo also highlighted that with the strength of the balance sheet, the coming elimination of the Glencore debt, and robust incoming revenues, that the Company is now currently ramping up more exploration and development work at their Soracaya Project, to put it on the pathway to primary silver production about a year and a half out. An internal study was completed by Glencore with an estimated capex of ~US$40MM for construction of a processing plant and tailings facility. Mine plan envisions a 7 year mine life with average annual payable production of ~4.5MM oz AgEq (based on consensus prices). Development is subject to permitting.

If you have any follow up questions for Arturo regarding Santacruz Silver, then please email them to me Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Santacruz Silver at the time of this recording, and may choose to buy or sell shares at any time.

Click here to follow the latest news from Santacruz Silver

.

.

I’m approaching 5 years owning SCZ. Best investment i have ever made and I just added more.

The reason this is the best investment i have ever made is because it is the best informed investment i have ever made. That’s on you Ex.

Year in year out you have kept us–Kereport readers–abreast of all SCZ developments big and small.

Thank you.

Thanks for those kind words blazesb.

It’s been fun following along with the evolution of Santacruz over the years, and now the payoff is starting to come in… and more investors are finally waking up to the transformation this company has gone through. The balance of this year should be pretty interesting as they pay off their remaining loan, get production going higher again, and into a higher metals price environment.

Silver futures up to $39.49 in overseas trading.

It would be great to see that pricing north of $39 hold into Thursday’s trading session.

Funny thing about SCZ. I almost unloaded my position when they bought the Glencore mines.

I had been traumatized by my experience with Trevali which had acquired two Glencore mines after i had acquired a boatload of Trevali in 2016/17.

Within 2 problem ridden years Trevali was broke. Oddly, i did ok. I was in early which helped. The glencore mines were touted as ‘company builders’ (sound familiar?), zinc really was rising and London warehouse inventories were at historic lows. It was understood at the time that China and it’s booming economy was going to soak up all the zinc in the world.

Oddly, what saved me was Trump announced his trade war. That kind of put a chill on the global expansion. Sounds familiar right? Anyway I got out of Trevali at $1.20 which was a two bagger. Trevali hung around $1.50 for a while before spiraling down the toilet.

So when SCZ bought the Glencore mines i thought ‘here we go again’. I was not a happy camper.

(By the way if you like your mining humour dark google Glencore’s history of settlements and payment of fines world wide without ever admitting wrong doing. They’ve paid billions. The list goes on and on and on as many years back that you care to look.)

That’s where Ex and the Kereport come in. SCZ’s Glencore acquisitions were covered thoroughly here, and being a believer in the inevitability of the current precious metals bull market, also covered comprehensibly here not just by Ex but by many fine posters…I hung on.

So here I are. SCZ is a huge success story and I believe the best is yet to come. This silver bull has major room to run and i wouldn’t miss it for the world.

Cheers!

Thanks again for the kind words blazesb, and for sharing your journey in Santacruz Silver. It has been a wild ride for sure, and there have been different chapters along the adventure. I was also concerned back in the day at the potential of a Trevali outcome from Santacruz after watching that company face plant post Glencore acquisitions, but I just felt the sum of the parts was too intriguing to ignore, and was stunned at the time and have been stunned for years that the market didn’t give them a better valuation on all those mines, mills, and power centers.

Great performance after SCZ breaking out past $0.60… a little toppy but has a solid 6 times P/E ratio.

Impact has been doing only okay comparatively.

SCZ, weekly…

If SCZ:IPT finishes the week near the current level of 4.50, it could have another leg higher (SCZ outperforming IPT).

https://schrts.co/YDRwbXcK

Thanks for that chart, first time I’ve seen this move from that perspective.

The first time I posted the SCZ:IPT chart here on the KER was back in 2020 and a few more times heading into the 2021 #SilverSqueeze mania, when their market caps were much closer together and Santacruz was a much smaller producer. SCZ smoked almost all of the silver producers on the post-covid rally, and has always had a lot of torque… even after having grown into being a multi-mine, multi-jurisdiction mid-tier producer over the last few years (post Glencore Bolivian assets acquisition).

Since then over the last 5 years that SCZ:IPT ratio has only grown in Santacruz Silver’s favor, but I do expect Impact Silver to start playing catchup in the medium-term, now that we have these higher underlying silver prices. In fairness, Impact is still just as animated by exploration success as production metrics, so it has a different profile.

To be clear, I really like both companies a great deal, but have had Santacruz as my most heavily weighted position for most of this year (Avino was the top rated position the first few months). I still see Santacruz as quite undervalued compared to its mid-tier producing peers and it has deserved a valuation around CAD$1.5Billion for some time now… and they are still just at CAD$600Million…. At least the market is finally starting to wake up to their ~18 million ounce AgEq production profile, and that they’ve almost paid off all their Glencore debt (and will have extinguished it by the end of next month).

There are companies that have had much smaller production profiles (like Gatos, Silvercrest, and Mag Silver) that were all acquired in multi-billion transactions over the last year. Also Santacruz has outproduced companies like Aya and Endeavour Silver the last couple years in silver equivalent ounces and has only a fraction of their valuations. There is definitely still room for it to re-rate higher about 3x to get more fairly valued with peer silver producers.

https://cdn-ceo-ca.s3.amazonaws.com/1kb1kmq-SCZ%20vs%20IPT%20ratio%20chart.JPG

What animates me personally with SCZ, as a long-time shareholder, is that they had these really solid record quarters in Q2, but so far in Q3 the average price of silver has been $2-$3 higher.

Also, they had a slower production quarter in Q1 and Q2 due to the water issues at Bolivar, but now those challenges are in the rear-view mirror. Q3 should have a higher production number of silver equivalent ounces with the higher average silver price. Then Q4 is typically their largest production quarter of the year.

Even though Santacruz Silver has outperformed most of their silver producing peers in 2025, I expect that these good catalysts in front of them could keep that trend going. Its been my largest weighted position for much of this year, and I don’t see any reason to change that. (not investment advice… just my personal thesis).