Dakota Gold – Exploration Results From The Richmond Hill Project Demonstrate Higher Average Gold Grades In The Northeast Corner

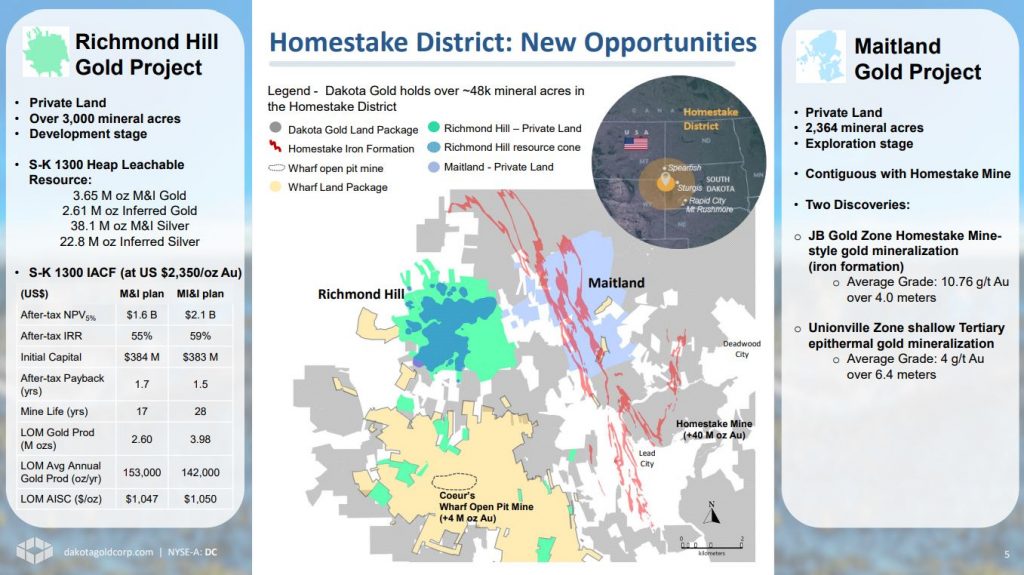

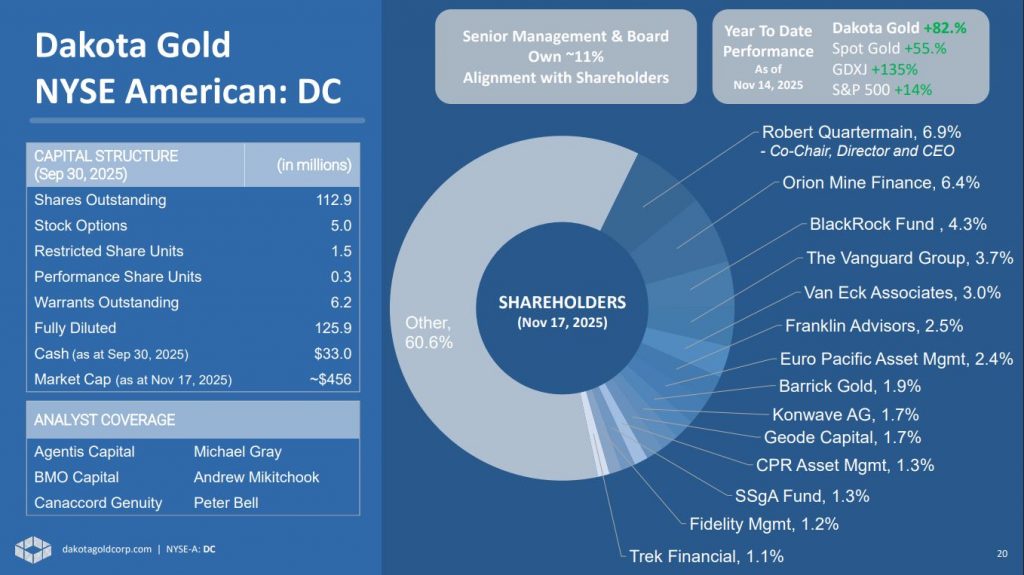

Dr. Robert Quartermain, Co-Chairman, Director and CEO of Dakota Gold (NYSE American: DC), joins me for an exploration and development update from their Richmond Hill Oxide Heap Leach Gold Project. He also outlines the long-term optionality of their Maitland Gold Project. Both projects are located in the historic Homestake District of South Dakota, near existing mining infrastructure.

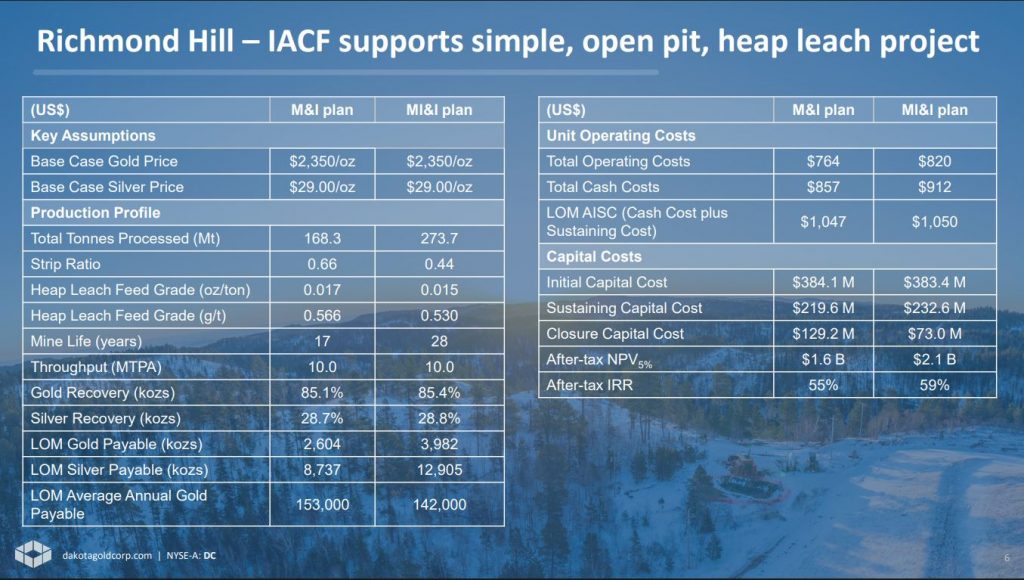

Richmond Hill is one of the largest undeveloped oxide gold resources in the United States being advanced by a junior mining company, with over 6 million ounces of gold and over 60 million ounces of silver moving along the pathway of development into heap leach production as soon as 2029. M&I plan identifies 168.3 million tonnes at a grade of 0.566 grams per tonne gold (“g/t Au”) for a total of 2.6 million ounces produced over a 17-year life of mine. MI&I plan identifies 273.7 million tonnes at a grade of 0.530 g/t Au for a total of 3.9 million ounces produced over a 28-year life of mine. Principle Projects are on Private Land which equates to a positive attribute for efficient permitting with State and County organizations.

On November 19th, assay results from 26 drill more holes were reported as part of the ongoing 2025 drilling campaign at the Richmond Hill Project, including the first assays from expansion drilling in the northeast corner of the Project.

Highlights from this update include:

Expansion and infill drill holes in the northeastern corner of the Project area are intersecting significantly higher-grade gold than the average resource grade including RH25C-278 intersecting 1.75 grams per tonne gold (g/t Au) over 19.9 meters (35 gram meters) and RH25C-295 intersecting 2.15 g/t Au over 30.0 meters (65 gram meters). The expansion drilling surrounding the area has the potential to add to the resource based on prior drilling and current resources in the area, and is only limited by drilling and remains open.

Metallurgical drill holes across the northern Project area continue to intercept high-grade gold, de-risking the Project and providing greater confidence in the resource including RH25C-270 intersecting 2.26 g/t Au over 29.2 meters (66 gram meters) and RH25C-288 intersecting 4.15 g/t Au over 14.5 meters (60 gram meters). The metallurgical drilling results demonstrate the low-risk nature of the deposit with widespread mineralization.

Drilling continues to confirm high-grade gold mineralization in the northern portion of Richmond Hill, supporting the Company’s plan to prioritize initial mining in this area. Dakota Gold currently has two drills operating on site and expects to complete approximately 27,500 meters (~90,000 feet) of drilling during the 2025 campaign.

Robert highlights how these robust gold and silver resources, site infrastructure, and low cost project economics, point to a low-cost, long-life mining operation that can deliver high margins and generate meaningful revenues. He points out how the higher grade mineralization in the northeast corner may accelerate the economics and shorten the payback period outlined in the SK 1300 Initial Assessment with Cash Flow earlier this year.

- Strong Economics: At a base case gold price of $2,350 per ounce, the project has an after tax NPV5% of $1.6 billion and IRR of 55% for the M&I plan, and $2.1 billion and 59% respectively for the MI&I plan. At recent metal prices of $3,350 the NPV5%’s increase to $2.9 billion and IRR of 99% and $3.7 billion and 107%, respectively.

- Low-Cost: Initial Capital of $384 million, including $53 million contingency, with life of mine All-in Sustaining Costs (“AISC”) averaging $1,047 for M&I plan and $1,050 for MI&I plan.

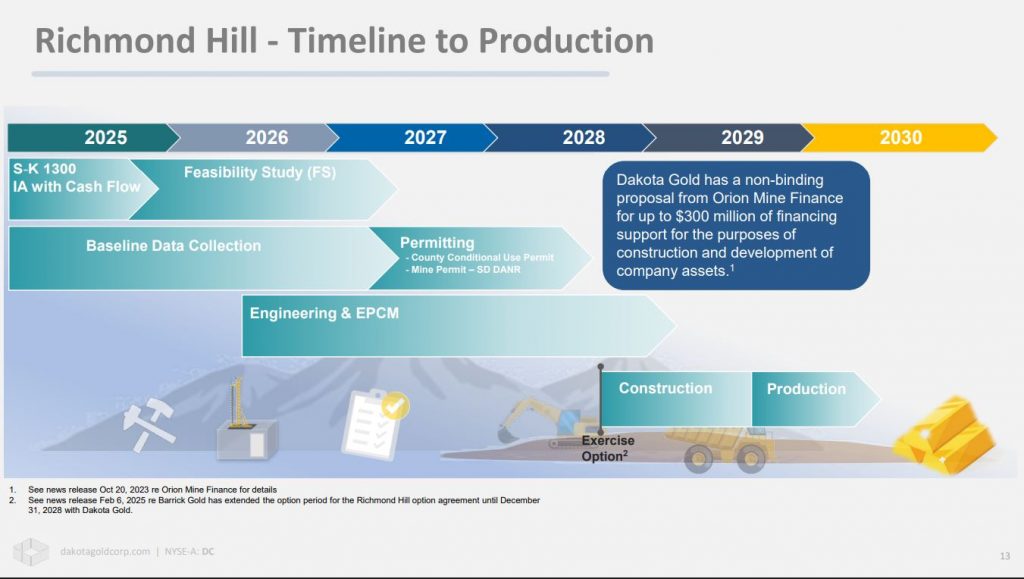

With the metallurgical drilling for the 2025 campaign now complete, the company is advancing heap leach column testing and looks forward to sharing those results as they are completed. The company is rapidly advancing its Richmond Hill project toward eventual surface heap leach gold operation as soon as 2029. Building on the robust IACF, ongoing exploration, metallurgical tests, and derisking workstreams will be incorporated into the Feasibility Study planned for completion in early 2027, with construction starting in 2028 and first production targeted for 2029.

At the Maitland Gold Project the Company is currently assessing the exploration data collected to date from the JB Gold Zone and the Unionville Zone with the intent of outlining an initial inferred gold resource. The work is expected to be completed in the fall of 2025. To date the JB Gold Zone has encountered a number of high-grade intersections which average 10.76 g/t Au over 4.0 meters.

If you have any questions for Bob Quartermain regarding Dakota Gold, then please email those in to me at Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Dakota Gold at the time of this recording, and may choose to buy or sell shares at any time.

For more market commentary & interview summaries, subscribe to our Substacks:

The KE Report: https://kereport.substack.com/

Shad’s resource market commentary: https://excelsiorprosperity.substack.com/

Investment disclaimer:

This content is for informational and educational purposes only and does not constitute investment advice, an offer, or a solicitation to buy or sell any security. Investing in equities and commodities involves risk, including the possible loss of principal. Do your own research and consult a licensed financial advisor before making any investment decisions. Guests and hosts may own shares in companies mentioned.

Click here to follow the latest news from Dakota Gold

.

.