Dakota Gold – Visual Overview of 2026 Catalysts and Value Drivers At The Richmond Hill and Maitland Gold Projects

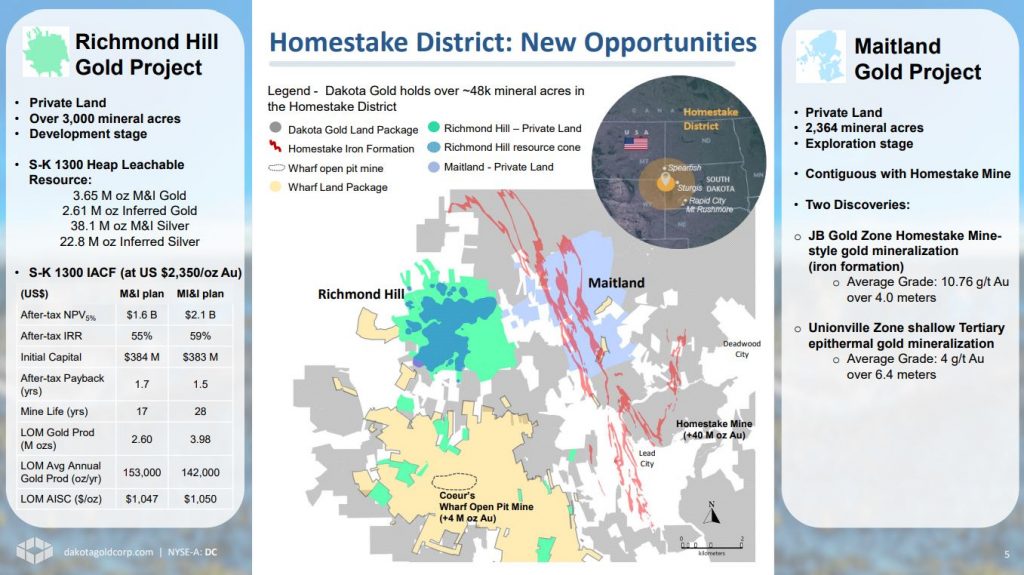

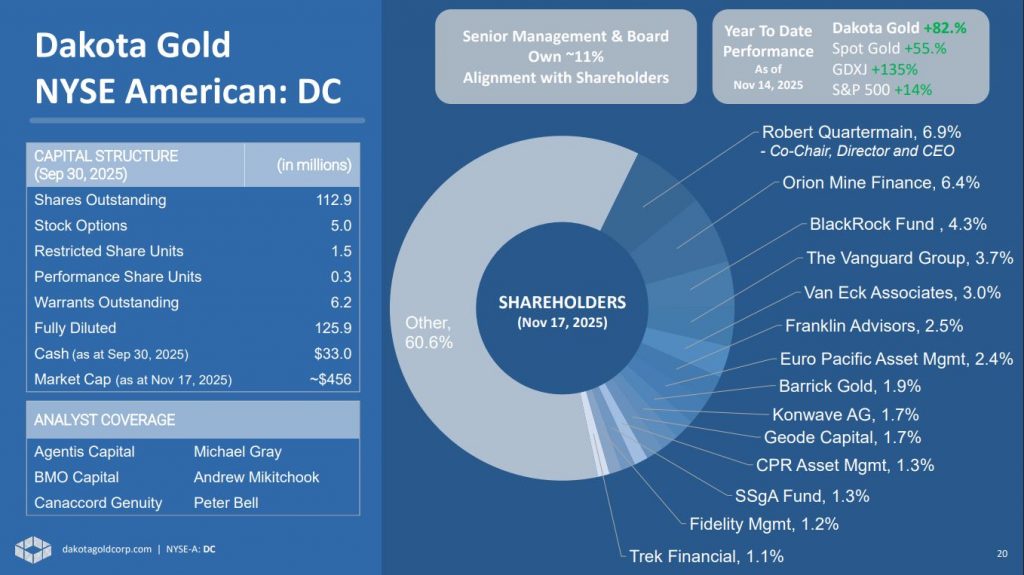

Jack Henris, President and COO, and Shawn Campbell, CFO of Dakota Gold (NYSE American: DC), both join me for a visual overview of the key 2025 initiatives achieved, and look ahead to the key exploration and development workstreams for 2026 that will feed into updated economics on their Richmond Hill Oxide Heap Leach Gold Project. We also outline the long-term optionality of their Maitland Gold Project, which will also being receiving some exploration work and maiden resource this year. Both projects are located in the historic Homestake District of South Dakota, near existing mining infrastructure.

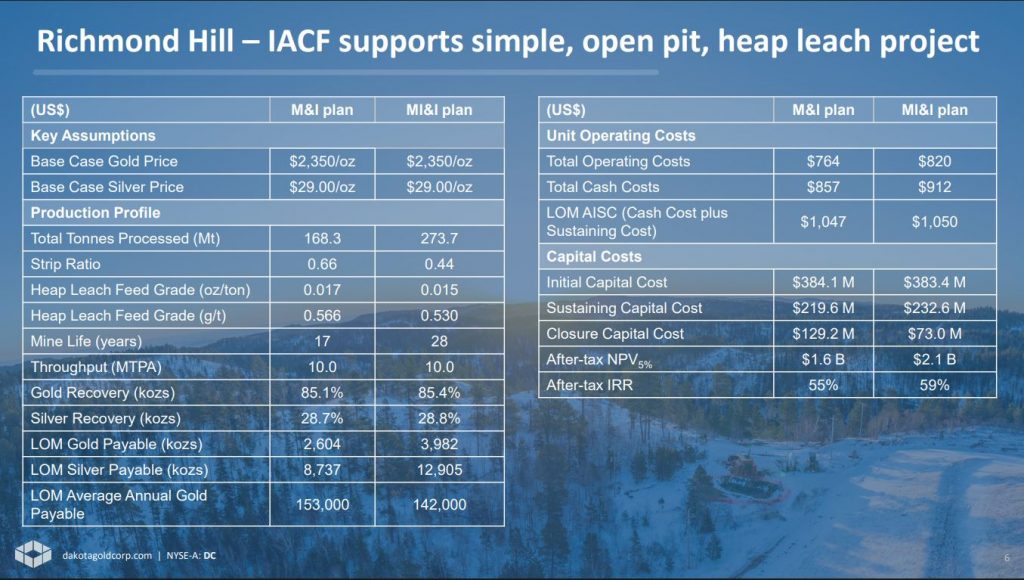

Richmond Hill is one of the largest undeveloped oxide gold resources in the United States being advanced by a junior mining company, with over 6 million ounces of gold and over 60 million ounces of silver moving along the pathway of development into heap leach production as soon as 2029. Principle Projects are on Private Land which equates to a positive attribute for efficient permitting with State and County organizations.

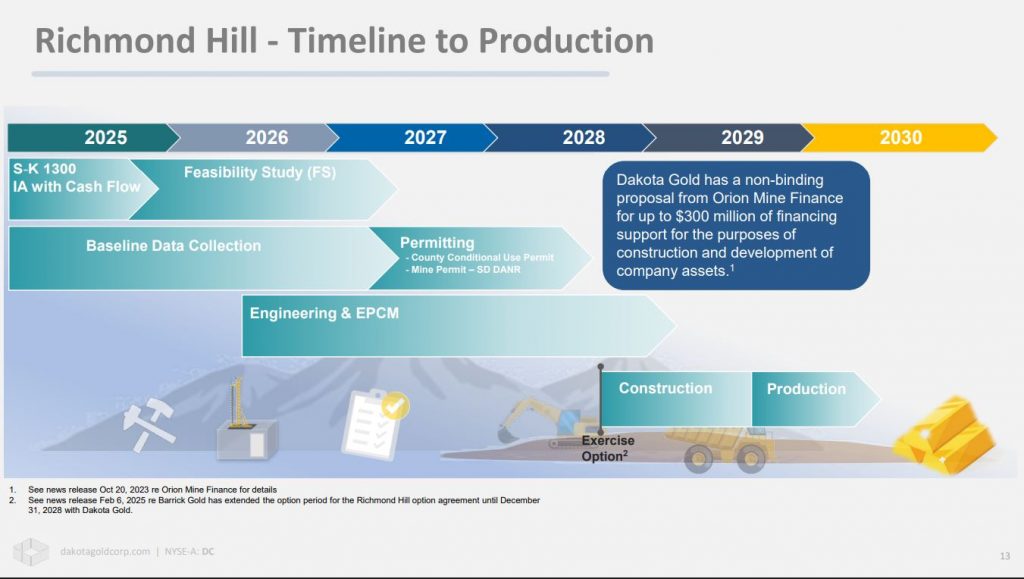

The 2026 Richmond Hill drill campaign includes a total of 15,481 meters (50,790 feet) of drilling in 109 holes.

- Infill drilling will convert inferred to measured and indicated resources for the initial 10 year mine plan area, expansion drilling will focus on the north Project area, and condemnation drilling will test areas for infrastructure suitability to ensure optimal site design for the Feasibility Study.

- All drilling required for the purpose of the Feasibility Study is expected to be completed by Q3 2026.

The Company will complete a Pre-Feasibility Study for Richmond Hill in the second half of 2026.

- With the resource expansion drilling in the north intersecting significantly higher grades than resource cutoff.

- This resource drilling will be complimented with an extensive metallurgical test program, so that the Company will undertake a PFS with a focus on the first ten years of mining.

- This work will allow the Company to report reserves in 2026 and will inform the Feasibility Study to be completed in the first half of 2027.

The Company will launch a 2026 Maitland drill campaign of 5,578 meters (18,300 feet) in 44 holes.

- The goal of this infill drilling, when combined with historic drill results, will be to define a maiden resource for the Tertiary-aged Unionville gold Zone.

Jack and Shawn highlight how these robust gold and silver resources, advantageous site infrastructure, and robust project economics, point to a future low-cost, long-life mining operation that can deliver high margins and generate meaningful revenues.

- We review how the higher-grade mineralization that is being delineated through drilling in the northeast corner may accelerate the economics and shorten the payback period outlined in the SK 1300 Initial Assessment with Cash Flow from last year.

- We look at how higher underlying metals prices affect the economic sensitivities of this project in a major way.

- We review the potential for a rerating in valuation metrics when looked at through the lens of peer gold developer comparisons.

If you have any questions for Jack or Shawn regarding Dakota Gold, then please email those in to me at Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Dakota Gold at the time of this recording, and may choose to buy or sell shares at any time.

For more market commentary & interview summaries, subscribe to our Substacks:

The KE Report: https://kereport.substack.com/

Shad’s resource market commentary: https://excelsiorprosperity.substack.com/

Investment disclaimer:

This content is for informational and educational purposes only and does not constitute investment advice, an offer, or a solicitation to buy or sell any security. Investing in equities and commodities involves risk, including the possible loss of principal. Do your own research and consult a licensed financial advisor before making any investment decisions. Guests and hosts may own shares in companies mentioned.

Click here to follow the latest news from Dakota Gold

.

.

Leave a Reply