AbraSilver Resource – Final Silver And Gold Drill Assays From Phase 5 Exploration Program, Building Towards Resource Update, DFS, EIA, and RIGI Approval

John Miniotis, President and CEO, and Dave O’Connor, Chief Geologist of AbraSilver Resource Corp (TSX: ABRA) (OTCQX: ABBRF), join me to review the final silver and gold assay results from drill holes completed as part of the Phase V diamond drilling program at its wholly-owned Diablillos project in Salta Province, Argentina. We discuss how these drill results will be incorporated into the upcoming Mineral Resource estimate (“MRE”), underpinning the Company’s Definitive Feasibility Study (“DFS”), which continues to remain on track for completion in Q2/2026.

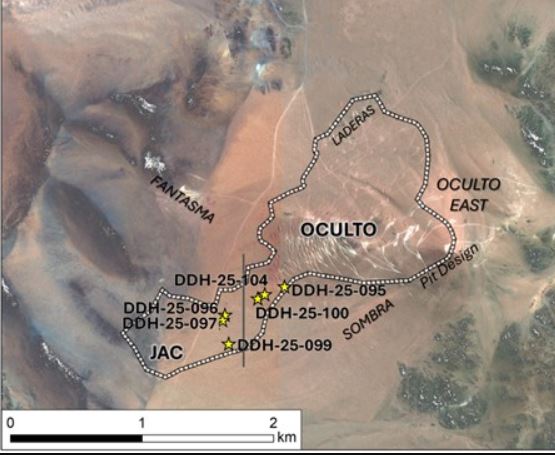

This Phase V drill program has been mostly focused on the Oculto East and JAC zones at their wholly-owned Diablillos property and the final holes demonstrated that JAC is not closed off and yielded more high-grade intercepts:

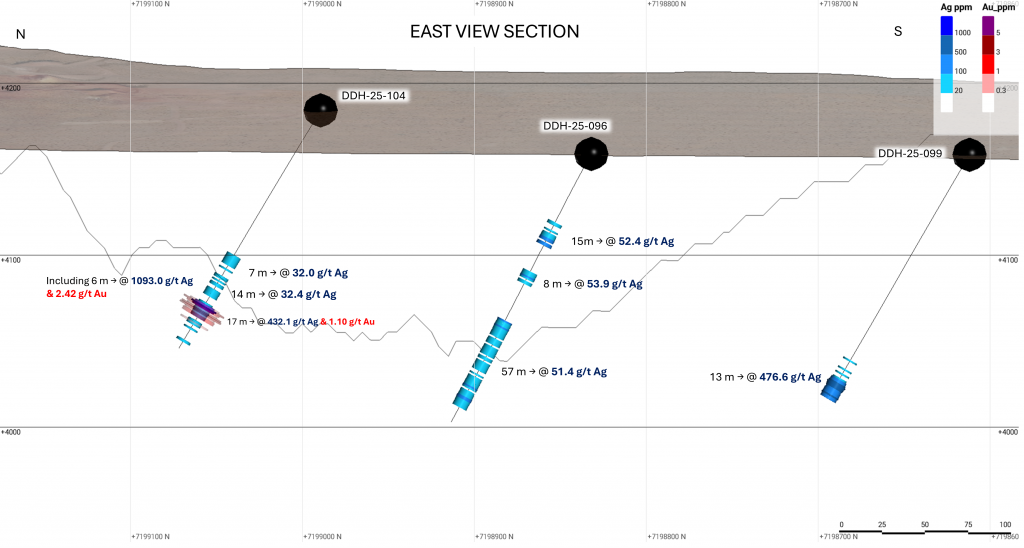

- JAC: Strong near-surface silver mineralization continues to expand the Mineral Resource growth potential, including:

- DDH 25-096: 57.0 metres (“m”) of 51 g/t silver from 109 m downhole

- DDH 25-099: 13.0 m of 477 g/t silver from 151 m downhole

- DDH 25-104: 17.0 m of 432 g/t silver & 1.10 g/t gold from 131 m downhole, including 6.0 m at 1,093 g/t silver & 2.42 g/t gold

We review how these results continue to expand oxide-hosted silver and gold mineralization to the southwest, along the corridor between JAC and Oculto. Dave points out that prior results in this program also expanded mineralization to the east of the Oculto deposit, extending the high-grade gold zone and highlighting the continued strong exploration upside potential across the Diablillos system.

The exploration team now believes these higher-grade gold intercepts are just the top of a porphyry deposit at depth, and pointed to the deeper hole targeting a different porphyry target at Cerro Viejo. Additionally, we circle back to the Sombra target identified in the Phase IV drill program last year, and how it is possible that there is a parallel trend that could extend from Sombra up to Oculto East, and that more drilling will focus on that thesis in the Phase VI drill program to come.

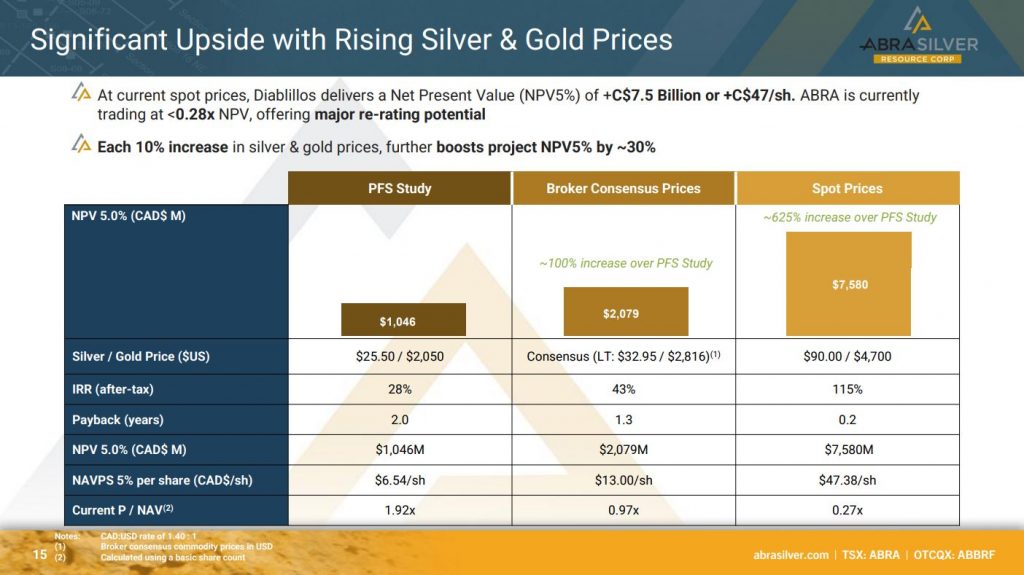

John takes us through the busy year the company has in front of them due to a series of upcoming catalysts all the way though the end of 2026. The drilling data from Phase V will be compiled into an updated Resource Estimate that will come out in parallel with their Definitive Feasibility Study due out in the 2nd quarter of 2026.

Additionally, the Company is waiting on their EIA permits and RIGI approval, which will be the triggers for a decision to begin construction next year. John reiterates why the RIGI laws in Argentina are so economically advantageous to the Company, relaxing currency controls, reducing export duties to 0% over a couple years, and reducing taxation to 25% over a 30-year stability period.

Wrapping up John unpacks why all these catalysts will provide opportunities for the company to rerate higher, and he highlights the current valuation has the company is receiving, which is more in line with silver trading in the low $20s; which is stark contrast to spot silver prices trading well north of $100 an ounce.

If you have any follow up questions for John regarding at AbraSilver, then please email them into me at Shad@kereport.com.

- In full disclosure, Shad is a shareholder of AbraSilver Resource Corp at the time of this recording and may choose to buy or sell more shares at any time.

For more market commentary & interview summaries, subscribe to our Substacks:

The KE Report: https://kereport.substack.com/

Shad’s resource market commentary: https://excelsiorprosperity.substack.com/

Investment disclaimer:

This content is for informational and educational purposes only and does not constitute investment advice, an offer, or a solicitation to buy or sell any security. Investing in equities and commodities involves risk, including the possible loss of principal. Do your own research and consult a licensed financial advisor before making any investment decisions. Guests and hosts may own shares in companies mentioned.

Click here to visit the AbraSilver website and read over the most recent news releases.

.

.

Peter Krauth on Why Silver Mining Valuations Haven’t Caught Up

Kitco Mining w/ Paul Harris – Jan 28, 2026

00:26 – How Silver Entered a New Market Phase

01:01 – Supply Deficits, Flat Mine Output, and Inventory Drawdowns

02:11 – Global Silver Demand and China’s Role in the Supply Chain

06:30 – Volatility, Corrections, and How Investors Should Position

14:18 – M&A Trends and Why Silver Producers Are Moving Down the Food Chain

21:39 – Risks, Industrial Headwinds, and the Silver Investment Case

24:51 – Silver Demand from Solar, Data Centers, and Emerging Technologies

Gold at $5,555

Silver at $118

Platinum at $2709

Copper at $6.30

Stellar price action in the metals… let’s see if the mining stocks get the memo today…