Jordan Roy-Byrne – Short-Term Pullback or Setup for a Major Precious Metals Run?

Cory

June 18, 2025

We’re joined by Jordan Roy-Byrne, CMT, MFTA, Editor and Publisher of The Daily Gold, for an in-depth look at short-term risks and long-term opportunities in the precious metals space.

Jordan kicks off with a cautionary technical read: major ETFs like GDX, GDXJ, and HUI are flashing overbought signals across all key moving averages. Despite this, he points out that not all stocks are stretched, especially among select juniors, which are just beginning to move.

We then dive into:

- Rotation into juniors and silver stocks, with Jordan’s proprietary junior silver index up 83% in just two months

- Silver’s breakout above $35 and upside targets toward $41, including key resistance and closing levels to watch

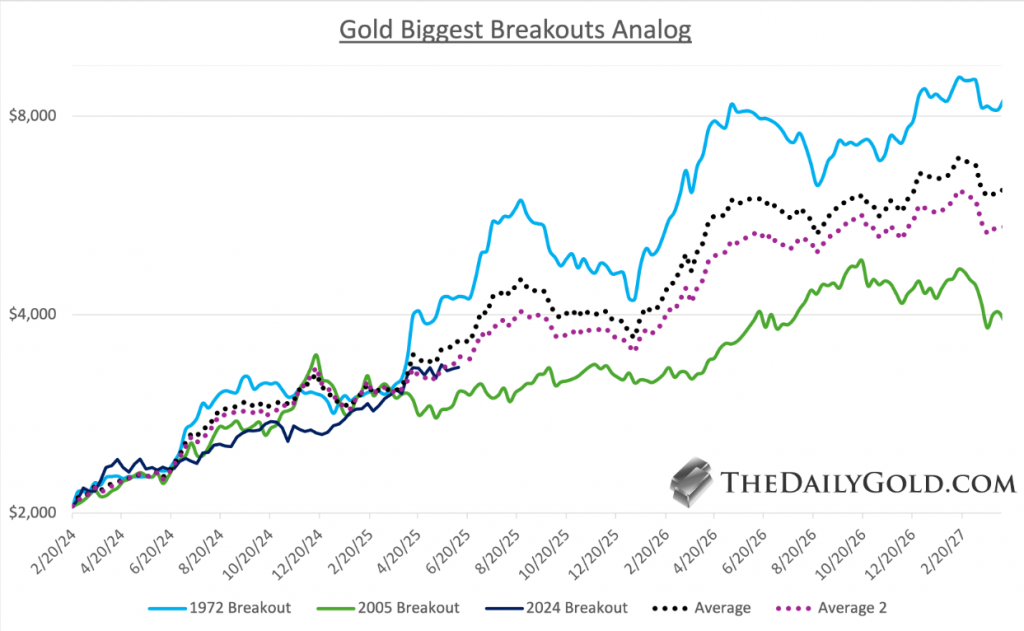

- A historical analog of gold bull markets, comparing today’s setup to the explosive 1970s and the slower 2005 cycle

- Why Jordan believes $4,500+ gold is possible, and how to manage the cyclical corrections likely to occur along the way

- The importance of individual stock selection and timely trimming as volatility increases in a true bull market

Jordan also highlights a critical takeaway: bull markets reward active management, and identifying which stocks still offer value will be key as momentum rotates.

For exclusive stock picks and deeper analysis, visit TheDailyGold.com.