Mako Mining – Record Revenues From Q2 2025 Operations At San Albino, Mining To Commence At The Moss Mine, and Key Permitting Progress At The Eagle Mountain Project

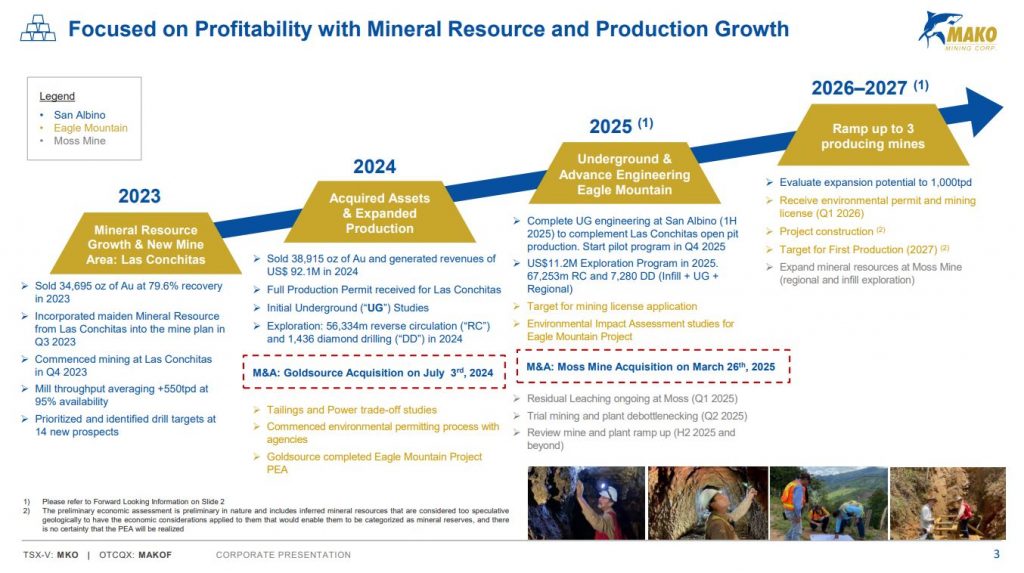

Akiba Leisman, President and CEO of Mako Mining (TSX.V:MKO – OTCQX:MAKOF), joins us to review the record Q2 2025 financials and operations results from the San Albino Mine in Nicaragua, along with some ongoing residual leaching during the period from the recently acquired Moss Mine in Arizona. We also unpack the anticipated mining to begin this quarter at the Moss Mine, and what to anticipate for the several months of ramp up of increased production. Additionally, we delve into the next key steps for permitting and development work at the Eagle Mountain Gold Project in Guyana; set to be in construction in 2026 and production by H2 of 2027. This is a longer-format interview where we get into many nuances of operations in all 3 jurisdictions.

Q2 2025 San Albino Operational Highlights

- 54,354 tonnes mined, containing 10,911 ounces (“oz”) of gold (“Au”) at an average grade of 6.24 grams per tonne (“g/t”) Au and 12,491 oz of silver (“Ag”) at 7.15 g/t Ag

- 52,705 tonnes milled containing 11,153 oz Au and 12,847 oz Ag grading 6.58 g/t Au and 7.58 g/t Ag

- 41% and 59% from diluted vein and historical dump and other, respectively

- 595tonnes per day (“tpd”) milled at 97% availability, with a mill recovery of 80.3% for gold

Q2 2025 Mako Financial Highlights

- Mako total gold sales of 11,476 oz Au for total revenue of $38.1 million in Q2 2025

- San Albino Mine sales of 10,104 oz Au at $3,323 per ounce

- Moss Mine sales of 1,372 oz Au from residual leaching activities at $3,321 per ounce

- Delivered final 13,500 oz silver payment to Sailfish Silver Loan for a total of $0.4 million in Q2 2025

- $1.5 million release of collateral at Moss Mine from Trisura Guarantee Insurance Company

- Cash Balance of $28.6 million as of June 30th, 2025

There is also a substantial exploration program underway all around the San Albino Project in Nicaragua, around the San Albino Mine, as the Las Conchitas concessions, and of particular interest at the El Golfo concessions.

Akiba points out that the Moss mine has been producing gold the last few month through residual leaching at its beneficiation facilities, but their team is going to start mining again this quarter, and then it will take several months for new materials moved onto the leach pads to charge up increased production again. A technical report and Pre-Feasibility Study is slated to be put out later in the year around October, after a few months of ramping up mining and assessing the resources in place. When the Moss Mine has been debottlenecked over time from a mining and permitting perspective and is producing at the grade and rate they believe is possible, it could almost double their current production profile with approximately another 40,000 ounces of gold production per year out of Arizona.

Mako is also currently derisking their Eagle Mountain project in Guyana, and working on the next key deliverable of an agreement between the government and local stakeholders, and doing all the background environmental and engineering work to being the process for their EIA permit. Once it is received back and a construction decision is made, there will be roughly a 1 year build, and then production is slated for Q2 of 2027 at an estimated 60,000 -65,000 ounces per year. When this added to the production out of Nicaragua and Arizona there is clear line of sight to growing into a mid-tier gold producer.

If you have any further questions for Akiba regarding Mako Mining, then please email them into us at either Fleck@kereport.com or Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Mako Mining at the time of this recording and may choose to buy or sell more shares at any time.

Click here for a summary of the recent news out of Mako Mining.

.

.