Luca Mining – Review Of Q3 Operations and Financials, Ongoing Metallurgical Studies, Development Work, Expanded Exploration Programs

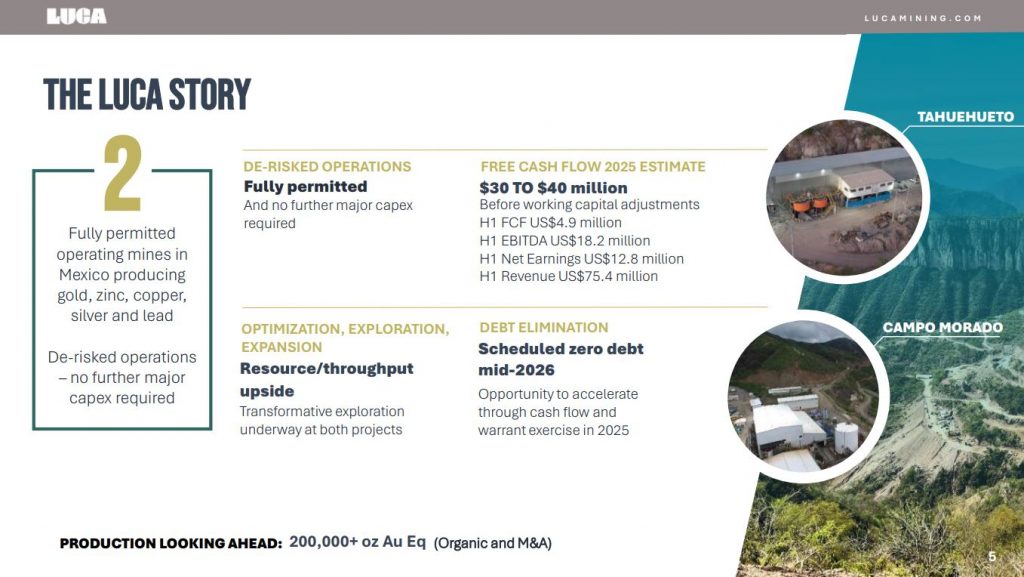

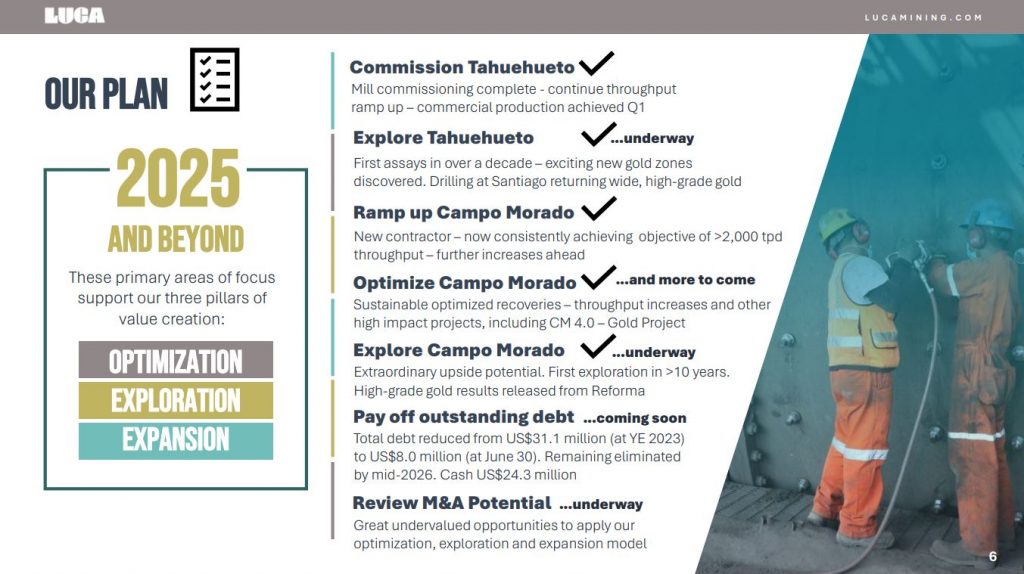

Dan Barnholden, CEO of Luca Mining (TSX.V:LUCA – OTCQX:LUCMF – FSE:TSGA), joins us to review their Q3 operations and key financial metrics, further debt repayment, ongoing metallurgical studies and development work, expanded exploration programs. He provides insights on key upcoming growth initiatives through improving grades and better precious metals recoveries across both of Luca’s producing assets – the Campo Morado and Tahuehueto mines, located in the prolific Sierra Madre mineralized belt in Mexico.

Third Quarter 2025 Highlights

- Safety: continued emphasis on safe, disciplined operations with strengthened housekeeping and visible leadership engagement across both sites.

- Throughput increased: consolidated tonnes milled of 250,807 (+66% vs. prior year), supported by increased plant availability at both mines which has resulted in higher metal output:

- Gold increased 51%, Silver increased 97%, Zinc increased 78%, Lead increased 81%, Copper increased 43% over Q3 2024.

- Profitability indicators: Adjusted EBITDA of $4.3 million for the quarter and positive year-to-date adjusted net earnings of $12.8 million, a reflection of greater operational performance.

- Revenue momentum: Revenues of $35.0 million (+94% vs. prior year), supported by higher sales volumes and increased realized precious-metal prices (gold +28%, silver +18%).

- Campo Morado performance: production in Q3 improved year-over-year (+75% ZnEq pounds) on higher grades, notably zinc (+30%) and silver (+27%) and increased volumes (+43% tonnes milled per day). Cash costs decreased to $1.09 per payable ZnEq pound (-14% vs. prior year) with AISC of $1.43/lb slightly increased (+8%) from the same quarter in the prior period, reflecting increased sustaining capital development and the commencement of a significant exploration program at the mine (all of the Company’s exploration expenditures are included in AISC).

- Tahuehueto ramp-up: 77,548 tonnes milled, setting a record of 969 tonnes milled per day in the quarter (+187% vs. prior year), with AuEq production up 74% year-over-year. As a result of increased volumes, direct cost per tonne reduced to $149 (-22%). Lower grades in the quarter, as well as increased capital development and exploration, resulted in an increase in AISC (+35%) year-over-year. Increased grades and the benefit of this capital development are expected to decrease AISC at Tahuehueto in the subsequent periods.

- Investment for reliability: sustaining capital investment of $8.7 million in the quarter ($19.0 million YTD) to accelerate underground development and exploration drilling, positioning both mines for improved grades and operating flexibility.

- The Company made significant progress in exploration, with multiple high-grade intercepts at both operations.

- Repaid $2.5 million in debt.

- Operations going forward: Both Tahuehueto and Campo Morado are expected to enter higher-grade areas which, combined with the strong milling rates observed at both mines, is expected to drive increased production, improved recoveries, and lower unit costs through year-end.

Dan goes on to highlight both the expanded CAD$25Million exploration program, with both underground drilling and surface drilling going on at Campo Morado and Tahuehueto, in the first meaningful drill campaign in over a decade. In addition to targeting new high-grade gold and silver areas, like the Reforma zone, there is also a concerted effort to expand mineralization and extend the mine life for both projects. The company is also engaged in ongoing metallurgical testing to improve recovery rates for their 5 metals, and 3 concentrates.

If you have any question for Dan regarding Luca Mining, then please email those into us at Fleck@kereport.com or Shad@kereport.com.

- In full disclosure Shad is a shareholder of Luca Mining at the time of this recording and may choose to buy or sell shares at any time.

For more market commentary & interview summaries, subscribe to our Substacks:

The KE Report: https://kereport.substack.com/

Shad’s resource market commentary: https://excelsiorprosperity.substack.com/

Investment disclaimer:

This content is for informational and educational purposes only and does not constitute investment advice, an offer, or a solicitation to buy or sell any security. Investing in equities and commodities involves risk, including the possible loss of principal. Do your own research and consult a licensed financial advisor before making any investment decisions. Guests and hosts may own shares in companies mentioned.

Click here to follow the latest news from Luca Mining

.

.