Arizona Sonoran Copper – Key Metrics From The Cactus Project PFS, Envisioned Mine Plan, Exploration Update, Permitting, Capital Raise, Pathway To Development

George Ogilvie, President and CEO of Arizona Sonoran Copper (TSX:ASCU – OTCQX:ASCUF), joins us to outline the key metrics from the Pre-Feasibility Study (PFS) on the Cactus Project in Arizona and the envisioned mine plan. We also get an exploration update, more clarity around the permitting process, discuss the recent capital raise, and review the pathway to production.

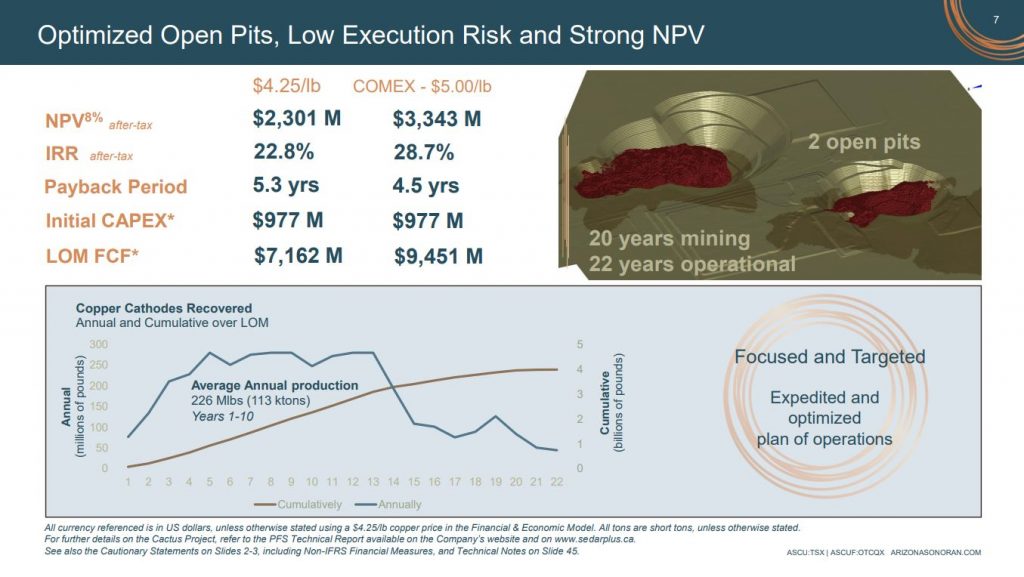

PFS Highlights include:

- Simple open pit / SXEW operation producing approximately 103,000 tonnes (226 million lbs) of estimated average annual copper cathodes over the first 10 years of mining, which would make Cactus the third largest cathode producer in the USA

- Industry-leading capital intensity of $10,894 per tonne of copper cathodes produced

- $574 million of average annual EBITDA1

- Strong economics to support the continued development of Cactus with a focus on simplicity and executability of the open pit copper cathode project, on private land in Arizona

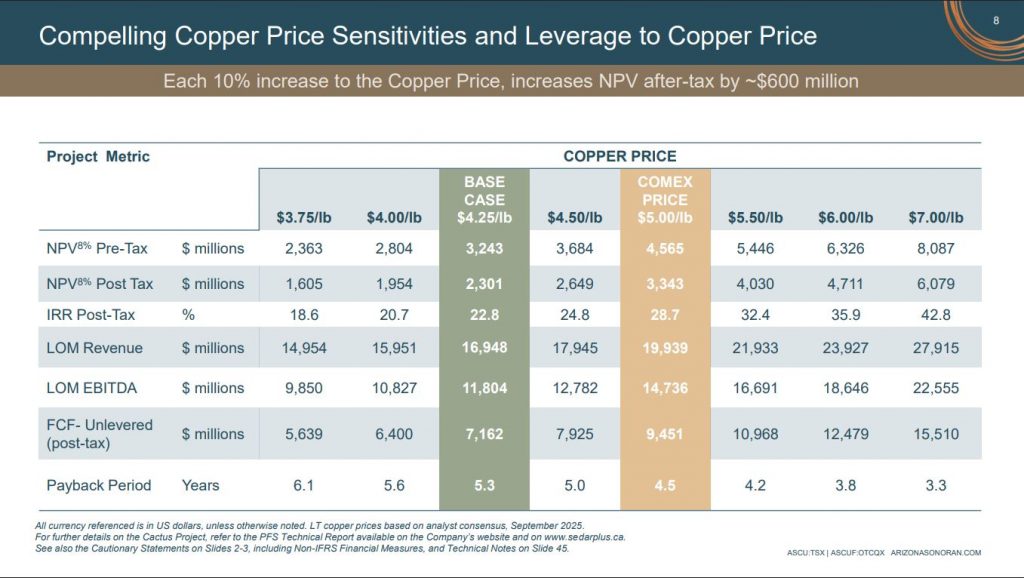

- Cactus Project is well positioned over the 22-year Project Life of Mine (“LoM”) to generate value at a variety of copper prices:

- Conventional, Cost-effective Mining and Processing: Open-pit, Heap Leach and SXEW Operation with Oxide and Enriched Materials from Cactus and Parks/Salyer open pits over 22 years of processing

- Cash costs (C1) of $1.34/lb, All in Sustaining Costs (“AISC”) of $1.62/lb and All in Costs (“AIC”)1 of $2.01/lb

- Initial mineral reserves of 513 million tons at a grade of 0.52% Total Copper in the Proven and Probable category for 5.3 billion pounds of contained copper

- 65% conversion of leachable M&I mineral resources to mineral reserves, with increased grades reporting to the heap leach pads

- Significant benefits to the local community and economy of Arizona, including projected creation of an estimated 600+ direct jobs

- Future mine expansion opportunities outside of the current mineable copper reserves, including late mine life primary sulphides, Cactus East and other exploration targets

- Final investment decision as early as Q4 2026 with targeted first cathodes in 2029

George reviews how the incorporation of the newer MainSpring area into the larger Parks-Salyer deposit, over the last 2 years has allowed for a shift in strategy from underground mining over to an open-pit mining method. They are reviewing moving the center of the open pit more towards the high-grade portion of the Park-Salyer deposit, the infill drilling showed it expanding towards that direction, which presented better economics and a faster payback period, as outlined in the PFS.

George also provides some updates on permitting for the project, and the importance of it being on private land to help expedite the process, and that they should be submitting their applications later this year for administrative acceptance by early 2026, and then approval 6 months later. This permitting process will time out well with the release of their Bankable Feasibility Study.

Next we discussed the news on December 2nd, which announced that the Company closed its previously announced private placement of common shares of the Company pursuant to which the Company issued, on a “bought deal” basis, 25,746,300 Common Shares, including 3,358,200 Common Shares granted to the underwriters, at a price of $3.35 per Common Share, for aggregate gross proceeds of C$86,250,105. This gives the company the runway to execute on all coming workstreams heading into the Bankable Feasibility Study and the capital stack coming together for a construction decision late next year.

If you have any follow up questions for George about Arizona Sonoran, then please email us at Fleck@kereport.com or Shad@kereport.com.

- In full disclosure, Shad has a position in Arizona Sonoran Copper at the time of this recording and may chose to buy or sell shares at any time.

For more market commentary & interview summaries, subscribe to our Substacks:

The KE Report: https://kereport.substack.com/

Shad’s resource market commentary: https://excelsiorprosperity.substack.com/

Investment disclaimer:

This content is for informational and educational purposes only and does not constitute investment advice, an offer, or a solicitation to buy or sell any security. Investing in equities and commodities involves risk, including the possible loss of principal. Do your own research and consult a licensed financial advisor before making any investment decisions. Guests and hosts may own shares in companies mentioned.

Click here to visit the Arizona Sonoran website to read over all the recent news.

.

.