Steve Penny Provides Technical Analysis And Charts On Gold, Silver, Platinum, And The Uranium Miners

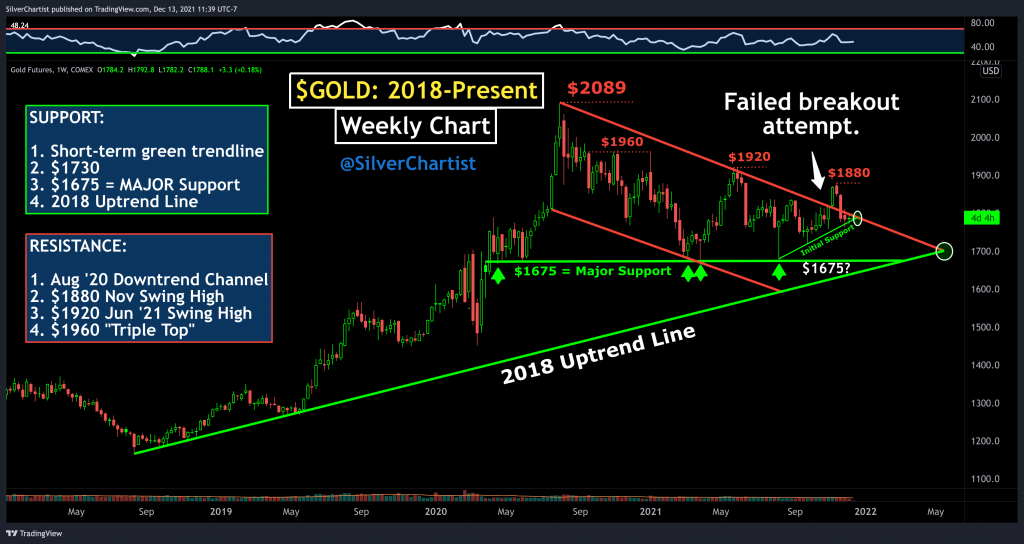

Steve Penny, Publisher of the SilverChartist Report, joins us to share a handful of charts (all posted below so you can follow along) starting off with both the daily and weekly gold chart, highlighting the price action building energy in the compression triangle and the key levels of overhead resistance and of support down below at the triple-tested $1675. Next we move over to the weekly chart of silver, and how it’s been contained by the downtrend line since the silver squeeze high in February, and that after moving up recently in the bearish rising wedge pattern, it has broken lower from the resolution of that pattern and is near support at $21.81.

Next we switch over to the platinum / gold ratio chart for a look at an interesting technical setup and discussed a few macro drivers for platinum. We wrap up the technical analysis portion of the discussion with a look at (URNM) NS Global Uranium Mining ETF as a proxy for the basic trend higher in most uranium stocks since March of 2020, and how things may be set up after the recent corrective move in the sector.

Towards the end of discussions, we talked strategy around how Steve manages risk in his portfolio by diversifying across a few different stages of mining companies and commodities, the value he sees in utilizing a separate trading account from his longer term holds to act on promising risk-reward set ups, and we discuss the importance of having an exit strategy plan and derisking ones portfolio as a bull market matures.

Click here to learn more about the SilverChartist Report.

Pro Trader Nick Santiago Foresees $1450 Gold as His Next Buy Target

.

Mining Stock Education – Dec 12, 2021

.

“Professional Trader Nick Santiago foresees gold going down to $1450/oz before gold becomes the ‘trade of the decade.’ Nick shares how he is trading in this interview and some of what he expects for 2022. Nicholas Santiago started trading in 1991. In 1997, he became a licensed Series 7 and 63 registered representative. He successfully managed money for a large, affluent private client group. Nick is an expert in Technical Analysis. He is a highly regarded and accomplished technician in the studies of Elliot Wave, Gann Theory, Dow Theory and Cycle Theory. Nick now co-heads the education department at InTheMoneyStocks.com and enlightens thousands of members, along with providing consulting services to hedge funds and institutions.”

.

https://youtu.be/c2iL6SlOEXc

Why 2022 Could Be a Good Year for Gold and Silver – Precious Metals Monthly Projections

.

Sprott Money – Dec 9, 2021 #TechnicalAnalysis

.

“After another funky month, the lost year for precious metals comes to a close. But will 2022 be any better? Host Craig Hemke and analyst Chris Vermeulen of the Technical Traders break down all the gold and silver charts you need to put 2021 behind you.”

.

https://youtu.be/817XcyCnc88

Ira Epstein’s Metals Video (12/13/2021)

.

#TechnicalAnalysis – Gold, Silver, Copper, Platinum #Charts

.

https://youtu.be/Jx1sSLMsRqY

Brien Lundin: Fed Powerless Against Inflation, Gold Will Win Eventually

.

Investing News Network – Dec 8, 2021

.

“Inflation has been a major theme throughout 2021, and as 2022 approaches investors are looking for guidance on what the new year will bring and how to prepare.”

“Brien Lundin, editor of Gold Newsletter, said he doesn’t think the US Federal Reserve will be able to get a handle on inflation, and explained that the central bank is likely to turn back at some point in the process of tapering or hiking rates.”

“It’s realistic that they could try; I don’t think it’s realistic that they can get too far down the road toward normalization,” he said.

.

Uranium Market Minute – Episode 49: FADE the Prevailing Trend

.

Justin Huhn – Uranium Insider – Dec 13th, 2021

.

https://youtu.be/kdrDAlZQKMw

I would like to see Cory and Shad interview John Williams Shadow Stats, I think it would be appropriate to get an inflation reading that isn’t from the government and includes Housing and Food. Somehow I don’t think that is part of The Korelin Agenda. DT

Thanks for the suggestion DT. We have mentioned and referenced John Williams better inflation calculations before in segments, but flawed as it is, most algos and generalist investors use the CPI figures as a reflection of inflation. I’ll run the idea by Cory about potentially having John W. on to discuss the more complete picture of inflation.

My portfolio was up marginally today thanks to a good day for NVO.

Congrats Terry. My portfolio was slightly down today due a number of miners in the red. Not terrible, but not so fun regardless.

Great interview including the interchanges. Makes one think about their plan …

Much appreciated Lakedweller2. Steve Penny is a very sharp guy, and in addition to the great charts he shared, I particularly liked his cogent thoughts on portfolio allocations, managing risk, and having a rough exit strategy on any trade as one hits the buy button.

.

His comments were refreshing on how he observes that many new or novice investors are not truly being aware of the risk profile they are creating by only piling into the earlier stage explorers/developers. His point about having a portion of ones portfolio allocated to the producers and royalty companies were quite refreshing, and I very much agree personally.

.

We hear all the time about investors going “all in” on just a handful of explorers and then being devastated when they all turned down by 60-80% in corrective moves. They are the highly risky speculations he mentioned, and his personal exposure of 20% to the earlier-stage companies is pretty close to my personal allocation as well. Much more of the weighting in my portfolio is to the growth-oriented producers, royalty companies, and more advanced developers with solid assets underpinning their companies. As Steve pointed out, many of those companies can still have plenty of leverage to the metals prices, but are not as risky as the drill plays.

.

It is worth noting that both Jordan Roy-Byrne and Dave Erfle have both pointed out this exact same thing, having more a focus and weighting on the growth-oriented producers and advanced developers, with a small sprinkling in of exploration and discovery stocks. It’s the same with Doc Postma, where he prefers mostly producers and advanced developers, with a few speculative explorers mixed in.

.

However, often people don’t really hear or heed that message, preferring to speculate on only longshots, and to only pile into 10-20 drillplays. Then those exact same people are the ones bellyaching that when the larger companies or ETFs are getting a bid at turns higher in the sector, while their cash-starved and dilutive junior drill plays are still in the dumps and not moving. We see it every single time in the early stages of advancing bullish legs higher or in the regular relief rallies. Some things never change… Haha!

.

Now, obviously a drillplay that hits paydirt can move more than the larger cap names IF they are one of the very few that hit it out of the park. More often the best short-duration gains are in the hot mania drillplays, with a good promotional narrative and a solid management team and a jockey that is widely touted.

.

Most of those are just a good story stock with a widely embraced blue-sky narrative, and they rarely become economic mines, and more often dilute down longer term “buy and hold” investors in capital raise after capital raise, then reverse splits, then more acquisitions of properties, then more capital raises, more dilution, and more stories…. rinse and repeat.

.

However, the advantage of earlier stage discovery stories and drillplays is that they can capture the speculative desires and greed of investors with their vision/dream and then climb to ridiculously high over-valued nosebleed levels on the pop, before gravity/reality sets in on the other side of the parabola for the drop.

.

When one of the select few companies out of the 1000 explorers gets the wind in their sails with a good narrative, and the retail hordes start dog-piling in knowing very little about the actual projects or economics, but become religious devotees to the story or management team, then the moves higher can be stellar. Then it becomes “to the moon” and valuations be damned, and logic is replaced by emotions and speculative momentum. Everyone loves a lottery ticket that pays off like that, and you gotta be in it to win it.

.

This is also what creates the irrational but very exciting moves into different area plays. We’ve seen it for years in areas like Timmins, or the Golden Triangle, or remember the Pilbara a few years back, or look at how 2021 was all about Newfoundland and the Victoria Australia area around the Fosterville mine. It’s worth noting that now that we’ve seen the big takeover transaction of Great Bear by Kinross, and Barrick positioning with strategic stakes into the 2 companies on either side of Great Bear, I’m sure the Red Lake area will pop as an area play once again, from all the near-ology plays. “XYZ corp is going to be the next Great Bear….”

.

It is fun and can be rewarding to have some exposure to those exploration play though. Explorers can have the same kind of multi-fold gains like we saw in the pot stocks a few years back, or periodically in biotech stocks, or earlier this year in the meme stocks, or cryptocurrencies/defi stocks. The explorers are like the long-shots at the horse track that don’t have big odds of winning, but they pay off the best if they are a dark horse that comes from behind and crosses the finish line ahead of pack.

.

Having said that, I’ve really appreciated the comments lately from Jordan, Dave Erfle, Doc Postma, and Steve Penny in regards to getting one’s portfolios anchored with the quality growth-oriented producers and solid advanced developers first and then taking a smaller portion of the portfolio allocation to speculate on the drillplays. In reading the comments on most chat boards though, it would appear many investors are ignoring that advice and are still all in on explorers.

.

It always amazes me that people nod their heads in agreement that most of the big moves higher in the PM sector start in the royalty companies and producers first, and then trickle down to developers, and eventually the more speculative explorers and prospect generators. If anyone thought about it for about a minute, then it makes all the sense in the world, because when generalist investors come in they buy the larger companies or the ETFs like GDX, GDXJ, and SIL that are filled with producers, royalty companies, and most advanced developers. Generalist money is not going to immediately go way down the risk curve by positioning into Bill & Ted’s Excellent ExploreCo, and they don’t care that much about the miners, so they stick with the established names, and those are what get the bid first at upturns in the sector.

.

Knowing this to be true, when we start carving out a bottom off corrective moves, when those royalty companies and producers are on clearance sale, investors snub their noses at those larger companies that will move first, instead of acquiring them. Huh? Then many resource investors watch them respond and move up first on any price rebounds from the sidelines, while stating the sector is dead, even when there are double-digit gains often in the producers, developers, and even junior royalty companies. What sense does that make? (none).

.

If those are the stage of companies that are going to move first in a new up-leg in the PMs or in Copper or in Oil, then why in the world are resource investors not stocking up on the smaller to mid-size producers with good exploration upside or royalty companies that have corrected in price during the pullbacks? It’s a mystery in human cognitive dissonance. Why not weight things more heavily in the stocks that will move first and have far less risk if the selling is not over, and then eventually trim or sell those companies down to rotate further down the food-chain as the move up starts building more steam and gaining traction in a more confirmed move higher? It’s mostly due to the herd behavior of humans and the madness of crowds preferring to pile into trending meme stocks, Dogecoin and Shiba Inu coin, or the hot narrative drill plays of the day. To each their own…

Hi Ex, your above post is without a doubt the best investment advice I have ever read, well put together, straight forward, and to the point. The essence of writing is to get your points across in the fewest possible words, clearly, and easily understood. Well Done Whippersnapper! DT

Thanks DT, much appreciated. Although…. I could have probably made the point in fewer words. Haha!

Aussie U miners down Tuesday

PDN -10%

VMY -7%

BOE -5%

Thanks for the early heads up on the selling in the Aussie Uranium stocks. If we see some of that selling transfer over to the North American U stocks, then it may be a good day to go accumulating into the sector weakness.

Yeah unfortunately I think I was a day early jumping back into uranium royalty….got back to last weeks lows and I couldn’t resist…..still let the fomo get the better of me sometimes….should have waited for another 10% drop really.

“See a play, wait a day.”

Good one BDC. Although, it depends on which day you see that play…

What if it’s on a saturation day? 🙂

Ex, Sector Saturation is primary; however, occasionally a standout situation arises where a ‘Double-Down’ play can be used: break the ‘Pullback Rule’ (C point buy next day) for a same day C point buy, which may even go a bit lower than A.

.

I did this yesterday with HMY, which individually has hit MaxSat(7) twice, along with completing a clear pattern. The second 50% will be deployed higher or lower, possibly followed by the rest of the account if things look good. Of course, stop loss levels must be observed. I’m hoping for some déjà vu all over again…lol.

.

PM sector downside saturation has yet to unfold: https://tinyurl.com/2vc9pznu. I expect such today through Thursday, with emphasis on FOMC Wednesday.

Thanks for those thoughts on saturation BDC. I’m still learning the nuances of your system.

FYI: I sold out. Now flat.

The more I see the less I like.

Powell could be errand boy ‘Volcker’

who will whack these Col. Kurtz markets.

https://www.youtube.com/watch?v=JzavWBsm88w

I added to some more Uranium stocks into the selling last week myself Wolfster, building back positions I had trimmed down on the surge. I agree with the point that Steve Penny made that many of the chart indicators are still a bit overheated on the weekly and especially the monthly charts of the U-stocks, so a bit more duration in the selling pressure, and more of a corrective move (another 10-20% down) would be ideal for doing some remaining bottom-fishing. I’d like to see some more of the hot fomo money that came rushing into the sector in 2020 and 2021 get shaken from the tree before adding my last 25% allocations to the sector.

.

However, I may grab some shares soon in enCore, as I sold out of my Azaraga Uranium again, (that they are acquiring) and EU had been pretty overbought and frothy, and this corrective move is getting it down to a more reasonable level for accumulation. My main uranium positions haven’t changed – Energy Fuels, Ur-Energy, Uranium Energy Corp, Denison Mines, Nexgen, Purepoint. I’ve considered adding in Global Atomic for another developer, and UEX for a peppy explorer/prospect generator, but would want to see an even bigger sector washout to add too much more to my U positions at this point in the cycle. I had a position in the earlier-stage Standard Uranium twice earlier in the year but sold it for a trade, and am still not sure they’ve found enough to be relevant.

SPQ(Others): https://tinyurl.com/n3usfa27

U3O8 saturation is back. Bottom soon?

Yep, I could see the Uranium stocks selling down again today and then having a short term relief rally for a bit after that. I’ll likely add to a few positions today into the continued weakness.

Beastly again! Next URNM target: 66.48 (if clear break here).

PPI worse than expected so they hit commodities. Oh yeah, Fed Meeting going on and personsal interests outweigh everything else.

Another great day………………….

….. Happy Holiday…..

Impact, IPT. I doubt this will do any good for the stock price but maybe next year, haha…

https://finance.yahoo.com/news/impact-silver-discovers-san-ramon-140000518.html

Yep, some nice new silver intercepts from Impact Silver, but not the best day to have released them.

I have a bunch of real estate money coming in in January and I’m considering to not put a thin dime into the precious metals, there is always something going up and pms are not! IMHO…

That’s how sentiment works. It’s harder to buy when investors can “buy low” because most don’t want to buy when things are at a deep value. In contrast it is much easier for most investors to buy once a sector has rallied much higher because it feels good once things are in a positive momentum, and gets even easier the more it rockets higher, but that is really when savvy investors should “sell high” to the momo traders.

The problem is the rebound will probably be over by mid January and a new down leg starts. I don’t have the funds now so I will prudently look for opportunities that may not include commodities.

A good case study has been Uranium, where most wouldn’t touch it when the miners were low, because traders extrapolated out the recent price action and applied it to the future forever. Nothing lasts forever, and the cure for low prices are low prices. Then when the stocks had really run higher in 2020 and even earlier 2021, more investors started following the space, but were still nervous to get in. However, once the stocks then had an even higher run to really overbought levels once the buying from the Sprott Physical Uranium Trust caused the effect most projected it would, THEN retail investors felt like it was a good time to get into the Uranium stocks. I was happy to sell them 85% of my shares in mid-September, and then buy back up to 60% holding a few weeks later when they crashed by 25%, then I rode them up into October and unloaded more taking it down to 40% position sizing, and then over the last month from mid November into mid December, I’ve been adding from 60% to 65% and now 75% positioned again. I’ll likely be around 78%-80% positioned again after today as I like buying into weakness.

Like I said, it is all about timing and I will look at many possibilities and choose what looks the best, not what I have been married too. I can’t buy now so will miss this buying opportunity anyways.

Dan – Well, it definitely depends on someone’s timeframes for a trade, and goals, but we have absolutely no way of knowing if a rally will end mid-January or go for 2-3 months for a solid Q1 run. There are many that believe we may see a brief relief rally from late December into mid-January as you mentioned, followed by more sideways to down wear and tear in the PMs. Who knows? (nobody does).

.

It is all just probabilistic set ups, and right now, the mining sector is not pricey, but many other sectors (like tech) definitely are frothy on almost any metric one wants to use. When the moment of truth arrives the middle of next year, where the Fed is going to try and hike rates in the Spring or early Summer, that will likely be the catalyst that pressures the general stock markets, and lifts the PM sector, so buying in January, would likely be very well-served for those with a time horizon of 9-12 months or longer. If one had a time horizon of 2 years, it could actually be a fantastic time to be buying, but that is up to each individual of course.

.

Bottom line, the stuff that is “hot” right now will be “not hot” in a year or so, and the stuff that is on clearance sale right now, has a good chance of being the next “hot” thing in a year or so. NFTs won’t always be the rage…. Most Defi companies that are hot now will be garbage and out of business in a couple years…. There could be massive changes in social media stocks or retail companies or software companies in a couple of years that dethrone household names at present, and allow for new up and coming names to rise. It’s unlikely the better gold and silver producers or more advanced development projects are going to zero, so as the rate hikes get closer in mid 2022, the price of gold should start to find some legs, and the beaten down mining stocks will start to move higher once again. If we do have a protracted selldown for the next few months then that will be an excellent place to investors to pick their spots.

Here’s another Silver explorer putting out good news on a tough day in the PM sector…. Summa Silver.

.

(SSVR) (SSVRF) Summa Silver Intersects 50 Meter Vein Zone with Visible Mineralization in First Hole at Mogollon, New Mexico

– 14 Dec 2021

.

https://ceo.ca/@newsfile/summa-silver-intersects-50-meter-vein-zone-with-visible

I found a chart for the TSX Venture Index.

This is an advanced chart of the TSX.v, the first one I found with indicators.

PPI………… stuff it in santa’s bag……….. New I phone going out of sight…. lol……

Trick and track………. it is in the bag……

Gold gets cheap enough , and I will be able to plate my car in gold leaf…..

Nice OOTB. I wanna see a picture of your car once you plate it in gold leaf, taken on your new I-phone from Santa.

I have decided to forgo my purchase of the I PHONE, … and plate my flip phone as well…… lol….

I will send you a picture of my car, with my old Kodak instant picture from the 70’s…. 🙂

That’s a solid plan OOTB. Yes, I only want to see the Polaroid picture of the gold plated car. 🙂

George Barris plated one for Elvis!

https://www.schmitt.com/inventory/ds-1965-cadillac-eldorado-convertible-elvis-presleys-dream-car/

+1

– 1

Jerry, gold leaf plated bison horns!

Now that would be a great symbol……….of AMERICAN FREEDOM……….. 🙂

Well we have drill results from kodiak trickling in.

https://ceo.ca/@newsfile/kodiak-drills-126-m-of-087-cueq-within-537-m-of-045

Some nice longer copper intercepts from Kodiak, and 2.5 times the grade of their neighbors that are currently in production. Exploration has been looking good, but the market barely noticed.

Gold price reversing after smash wrong direction pre-open. Probably the claim would be that the algo guys thought the PPI was going to improve as inflation “used to be” transitory. They realized their mistake only after running as many commodity stops as they could before open so their cousin Fred could get an early xmas present. Bananas all around!

Added: Interest rates up all around. What else with inflation.

The sign is back………….. $1775 -6……………. lol……….

Uh-oh. Argonaut Gold (AR) has taken it in the shorts today down 24.8% on the news released that their capital needed for Magino is more than previously stated due to inflation, they may now have a funding shortfall, and are making a management change at the top. Brutal…

.

___________________________________________________________________________________________________________

.

(AR) (ARNGF) Argonaut Gold Provides Updated Magino Construction Capital Estimate and Announces Leadership Change

.

Dec 14th

.

https://ceo.ca/@newswire/argonaut-gold-provides-updated-magino-construction

-14 Dec 2021

I sold a big chunk of my Argonaut into this under-capitalized situation, even though I really like the longer-term fundamentals and growth projections for the company. I had a nice gain still, even despite this fall by 1/4 in market cap today, and am rotating those funds temporarily into other growth-oriented producers until the dust settles on AR.

Ex, even though Argonaut is an established producer this setback seems to fit a scenario you have often observed–stock rises on anticipation of production but falls on inevitable bumps in the road.

Hi Blazesb. Yeah, there is often that pre-production sweet-spot, or “golden runway” period where a company in development will run up in anticipation of first pour, and then typically correct back down after going into production as they hit the inevitable “unforeseen” setbacks, teething issues, grade issues, throughput issues, low grade ore used to commission the plant, etc…

.

However, this move down in Argonaut today was an anomaly, as they are already a producer, and Magino is already 11 months into construction. The company just announced that they are $300 Million short of the funds to finish construction and that it will need to raise more capital, which will be dilutive to existing shareholders. This cost overrun is a direct result of inflation of input and construction costs, increased energy costs, and covid 19 policies affecting labor and protocols, but it is a pretty big capex shortfall for (AR). It’s hard to fathom how they miscalculated by this much when only going into construction earlier this year. If they needed to raise $50 million or something like that, it likely wouldn’t have been such a big deal to the market, but to raise that much capital now, mid-build is not a good situation to be in. It takes me back when Nemaska Lithium had issues building their plant and then went sideways for a long time, but ultimately never got the mine/mill finished, or when Primero was cash starved trying to optimize San Dimas, and ultimately ran out of capital, so they got raided and San Dimas was snatched up by First Majestic.

.

The other really bizarre and unfortunate thing included in this press release was the fact that they announced the Founder, CEO, & President, Pete Dougherty, was suddenly gone as of this news release. It makes no sense that he was suddenly removed from the picture, and I can’t imagine him just getting bored or frustrated when the company that he started and has been at the helm of for over a decade; especially when Argonaut is getting ready to bring on such a key project and effectively double their production output in the next 2 years. Reading between the lines, it appears the board removed Pete from his role, but the messaging on this and the timing was terrible from the company. It would be like stating First Majestic ran over on budget for a new mine, and oh, by the way Keith Neumeyer was removed, without even stating why? Really crazy.

.

Argonaut Gold has been doing everything right for the last few years, optimizing mines, lowering costs, operating frugally, hitting with exploration, and Magino has been slated to be a major transitional asset when it comes on-line, so the price in the stock has been climbing higher for a few years now as the company successfully hit milestones. How in one press release today suddenly changed all that is shocking, and caught most market participants and shareholders of (AR) off-guard.

.

Suddenly out of left-field, one of the better run mid-tier gold producers with 14 million ounces of gold resources in the ground, 4 successful mines, and 2 big development projects…. came come out with a true stinker of a press release that they are $300 million short of capital on building Magino, that they have a major fly in the ointment, that the Founder/CEO/President is suddenly relieved of duty with no explanation why, and then stock selling off 24%+ made for a uniquely dismal day for Argonaut shareholders (including me). I still sold for a gain, and maybe it will rebound tomorrow, but in case this gets dragged out for months, it seemed the best strategy was to exit and rotate into other growth oriented producers.

Thanks Ex. Gold and silver producers and explorers are so bombed out these days…it doesn’t take much to knock them down. $300 million is certainly ‘much’. As you say it’s hard to fathom such a huge costs discrepancy this late in the process.

I’ve been stalking Argonaut for a while, it and a couple of last years winners Jaguar and Santacruz. Thanks to DocJones i pivoted last spring, sold 2/3 of both JAG and SCZ and piled into Emerita. Now I’m contemplating completing the round trip and getting back into JAG, SCZ and Argonaut.

I should mention a position in Argonaut would complete a larger round trip for me. I sold a 2016 double in Argonaut and loaded up on Trevali for a triple. Those were the days.

Poor Trevali. In 2016 zinc price nirvana, the absolute fullest fulfillment of wishes was a zinc price of $1.20 lb. Well they got their wish.

Now zinc is $1.50 yet Trevali trades at a pre-share consolidation price of .15. Zinc miners were crushed because of Trump’s trade war but i still consider the acquisition at that time of two African mines from Glencore the beginning of Trevali’s end. Talk about the cycle turning. I thought TV had timed the cycle perfectly and positioned themselves for the zinc bull market…which they did but Trump had other ideas. Then covid.

I am hesitant on SCZ. I expect the acquisitions from Glencore will close only to be followed by a large increase in refining fees next spring courtesy of Glencore.

We shall see. Thanks for your always insightful comments.

Good thoughts Blazesb. Well, you may be correct that Glencore may raise their smelting and refining fees to Santacruz Silver, but they are also entrusting SCZ with 5 producing mines, 3 mills, 2 exploration projects and 2 power plants, so that is completely transformative for Santacruz to compliment their existing Zimapan Mine. That will give them 6 mines (technically they still have Rosario, which would be a 7th mine, but I’m not sure how many resources are left to mine there as they’ve been mining it for years).

.

As for Jaguar (JAG), I like it a lot for growth and leverage to rising metals prices in mid-late 2022 and into 2023, and I’ve been adding to it some recently myself.

.

As for Argonaut (AR) I sold today because personally I don’t like the uncertainty of the capital raise, and don’t like how they announced booting the Founder/CEO/President Pete without any explanation, reason, or solid replacement lined up. Very strange, but providing they give the market more clarity on this and once I see the capital terms for the balance of the capex now needed for Magino, then I’ll be more apt to get positioned again. Argonaut has been one of the more well-run companies in the gold mid-tier producers space for years, and they’ve done many things right, so it was not easy for me to liquidate my larger weighting in AR today. Again, I still made good money on it on this trade, and in a dozen prior trades the last few years.

.

Congratulations on the Emerita (EMO) trade. You and Doc Jones and David here have all done fantastic in that one. I’ve been waiting for more of a sustained corrective move in it to think about getting in, having only done 2 quick flips in it earlier in the year.

.

As for Trevali, I had sold out for tax loss selling reasons, but just jumped back in on 12/07/2021 after they finished their consolidation and rollback. Also, as you mentioned, Zinc prices are much better today than in prior years, but they’ve not moved up much yet, as they are still paying down debt. Look, they almost completely bit the dust a year or two back during the tougher base metals market, so I’m just glad they’ve persevered and like Santacruz Silver, they are an incubator company for Glencore with their non-core assets. The assets still have room to expand, so my thesis is that as (TV) continues to pay down it’s debt overhang, it should be able to spread it’s wings more. Also, the tighter share count now, should help attract larger funds that were not going to touch it at the previous lower share price.

.

Cheers!

In recognition of the Fed meeting, I sold some Great Bear to pay property taxes and add to NG Energy International. I felt better about the add to NG Energy than the taxes. I probably feel even worse about the Fed meeting.

Couldn’t resist and sold a wee bit more of Great Bear and added to: Dolly Varden, NG Energy, Group Ten, Great Bear Royalty and Santacruz. That’s what they get for taking us down today… left overs add to Honey Badger…

Left overs left over: a few more copper lake…

Thanks for sharing what you have been trading Lakedweller2. Today was a very odd trading day for me because I sold partial positions in Great Bear and Dolly Varden, and ended up just liquidating the whole Argonaut position I had. Those are all companies I like a great deal, but Great Bear is being taken over, Dolly Varden just acquired Homestake, and Argonaut has a mess on their hands as outlined in detail up above. Still it was odd to be selling any of those, much less 3 of my favorite positions. I also trimmed back some of my Fosterville South position, as it isn’t acting or hitting like I had hoped for.

.

I did add some to my positions in Impact Silver, Aris Gold, and Alamos Gold today.

Had to do it: sold a wee bit more of Gbr and put in emo …

Good news for ipt.

Good info list.

thx

Rumor has it that the Fed will reduce their monthly bailouts of the banks in the near future .

I think it would be appropriate in order to restore the confidence of the people that they allow audits of their past, current and future activities to prove it.

SILJ has possible fork support in the 11.50 to 11.28 area tomorrow.

https://stockcharts.com/h-sc/ui?s=SILJ&p=D&yr=1&mn=6&dy=0&id=p40478807682&a=1079343974

There are pivot supports on the intraday charts at 11.65, 11.59, 11.49 and 11.28 among others.

Thanks Matthew. I hope it rebounds off the fork during Powell’s report and sticks to the ceiling.

GDXJ broke fork support while making a new low so get ready for more downside tomorrow.

https://stockcharts.com/h-sc/ui?s=GDXJ&p=D&yr=1&mn=1&dy=0&id=p72046733935&a=1074224641

Maybe get some Macd help or another line will magically appear. If it does have more downside, maybe they will release the trap door under Powell and he can see how it feels to be the GDXJ…

FED Powell and Master rule?

Force forward beyond their reign.

Page Boy Beasts from beyond the ID:

https://www.youtube.com/watch?v=W4ga_M5Zdn4

Gold looks like it is heading for 1758-1752 tomorrow and maybe as low as 1730 (briefly).

https://stockcharts.com/h-sc/ui?s=%24GOLD&p=D&yr=0&mn=11&dy=0&id=p89839820092&a=1073778663

KTN is up 20% in two days.

https://stockcharts.com/h-sc/ui?s=KTN.V&p=W&yr=6&mn=1&dy=0&id=p77576657191&a=946990113

Gold & Silver Are on The Verge of An Upside Breakout says Analyst Michael Oliver

.

Mining Stock Education – Dec 8, 2021

.

“Analyst Michael Oliver sees gold and silver on the verge of a potential upside breakout while the general equity markets are teetering on a breakdown. If the precious metals prices don’t collapse within the next two weeks, then the breakout is likely to happen soon. Michael also provides commentary on the general equities, sovereign and corporate bond markets and commodities.”

.

0:00 Introduction

1:00 Silver & gold on verge of upside breakout

6:07 Stilling expecting $8k gold and $200 silver targets?

9:22 Violent top in the stock market

12:36 T-bonds

15:32 Commodities in 2022?

17:42 MSA likes NatGas

20:21 If stock market breaks, then pension fund crisis

25:20 Michael’s newsletter and his winning $JO call

.

https://youtu.be/XvPWZvvRg0Q