Craig Hemke – Precious Metals Surge Higher This Week Supported By Several Key Data Points

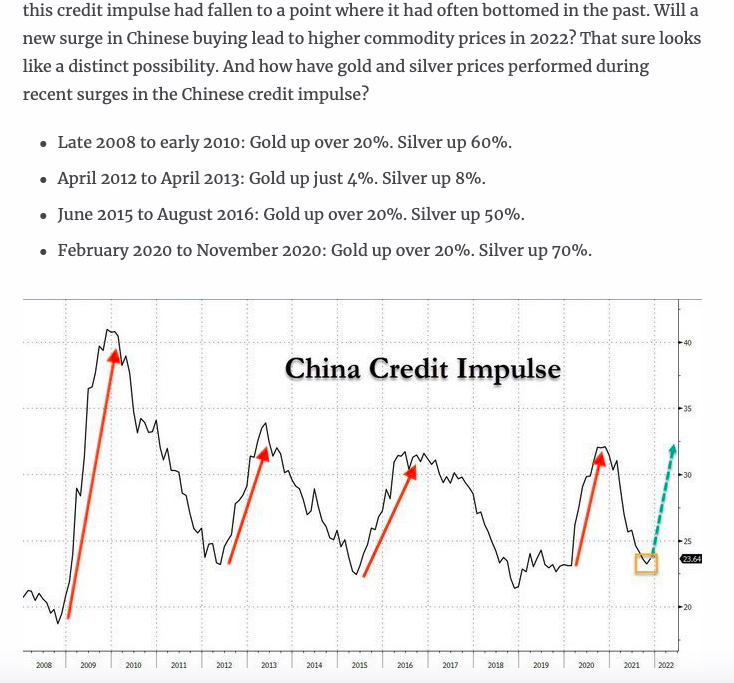

Craig Hemke, Founder and Editor of TF Metals Report, joins us to unpack some of the macro factors that could be behind the recent move higher in the precious metals and commodities. We start off by looking at a chart of the Chinese Credit Impulse as it relates to moves in gold and commodities and it has seen a turn higher underpinning a move higher in the metals. China’s central bank is running a counter strategy to other central banks and is still loosening and cutting rates, so this could be moving the markets more than some realize.

We then shift over to how the market is also watching oil and gas keep running higher, tending to lead the commodities sector direction higher in tandem. The surging energy sector is supporting the realization to generalist that inflation is, in fact, more heated and stickier, which is why there are expectations of Fed to do 4 rate hikes in 2022 to fight inflation.

Next we have Craig review what he sees in the COT Commitment Of Traders report, which has been relatively neutral, but there has been a slight change lately where swap dealer banks have gone net long. We also outline how Silver has been moving well lately, but is now approaching the 200 day simple moving average, which is overhead resistance, and it could be rejected back, or could pick up speed if it is able to break above this level. We wrap up with a broad look at what’s on tap for next week in the general markets, geopolitics, Feb futures contracts rolling to the April, and expectations for the coming FOMC meeting.

Click here to read over Craig’s full 2022 forecast.

.

China Biggest Property Developer Swoops In With Mini Buyback As Bonds Slump

.

By Marc Jones and Andrew Galbraith – Reuters – January 17, 2022

.

https://www.reuters.com/markets/europe/china-biggest-property-developer-sees-bonds-slump-2022-01-17/

China’s central bank cuts key lending rates, including one for the first time in nearly 2 years

.

Saheli Roy Choudhury – CNBC – January 19, 2022

.

https://www.cnbc.com/2022/01/20/china-economy-pboc-cuts-loan-prime-rates-lpr-for-1-year-5-year.html

Talk about ‘slam on the brakes?’ How about scum China getting a free pass on laboratory COVID?????

Remember, it was China buying gold ‘hand over fist’ at 1060$.

The Bitcoin Gurus Are Using a Flawed Formula

.

Katusa Research

.

“The model getting the markets all hot and horny is called the “Stock-to-Flow Cross Asset Model”, or S2FX for short.”

“The author (who remains anonymous) says that this model can accurately price not just assets like Bitcoin, but also things like gold and silver.”

“If that sentence above hasn’t gotten alarm bells ringing in your head yet, it should….”

.

https://katusaresearch.com/the-bitcoin-gurus-are-using-a-flawed-formula/

That model above that Bitcoin HODLers are so keen on, states Bitcoin should have already traded up to $240,000, where as, what we’ve seen is a 45% crash in Bitcoin from $69,000 on November 9th to $38,330 as of this morning. Remember last year when Bitcoin bulls kept trumpeting the narrative that it was the real inflation hedge? (Yeah…. Not so much…)

.

https://www.coinbase.com/price/bitcoin

Now Bitcoin is down even further to $36,407…. only $2000 away from a full 50% move lower off the all time high back in November of $69,000. That may be an interesting spot to go bottom fishing, but even the current oversold level is looking pretty good for potentially staking out some crypto related positions again.

I believe we are ready for metals to breakout and start a 5 year bull market run.

But, always a but, I still worried in short term the big bullion banks are going to use every effort to knock down metals in short term, watch out when fed starts thier rate hikes that banks don’t use that time frame to beat gold down.

I don’t see a crash in stock market only a much needed 10-15 percent correction but even if fed raises rates 3 times at only quarter percent that nothing, still really cheap money out there. Also if supply chain ease then stocks will start to stabilize and run higher and virus eases after winter things won’t look that bad. Only think that can throw ringer is if inflation does not ease but keeps roaring higher and if Russia invades Ukraine and China starts to get aggressive with Tawain then gold can hold thier gains and take off and bullion banks will have to give up on holding gold down.

All the markets look problematic at this point. The conventionals look like they’re ready to drop off a cliff and you don’t even have an interest rate increase yet. The fANG stocks technically look horrible right now with netflix already plummeting. I mentioned on a commentary last year that 2022 could be the year of the unwinding of all kinds of asset classes and the technicals right now are signalling that potential. Cash is now king. There are some biotech companies already taken to the cleaners that are very interesting here but that could get even cheaper in the next few weeks. The Russia/Ukraine story is nothing but hype and nothing will become of it accept an agreement through negotiation which will give Biden a much needed and trumpeted foreign policy win of a “nothing burger” crisis. The Chinese are already begging the West to cautiously raise interest rates and not be too aggressive.

Agreed Doc. The markets are struggling and there are so many signs under the surface of the general markets facing weakness (market breadth bad, so many stocks getting hammered despite the illusion of strength in the indexes from the large-cap mania stocks, growth stocks like Cathy Wood Arc Innovations funds got smashed the last few months, “stay at home” stocks like Peleton and Zoom got creamed, meme stocks like Gamestop, AMC, and Hertz beaten down, biotech stocks bleeding out, Tesla finally correcting, the Cryptos crashing, and all that remains are the FAANGs to give up the ghost).

It will be interesting to see how things develop next week after the FOMC and fedbabble get hashed and rehashed…

To be or not to be…in cash. Is that the question?

Hi blazesb – It’s definitely not a bad time to have a cash position on the ready, especially if many of the general markets correct by 10%-20% over the next year 3-6 months.

.

I’ve got emergency cash reserves for real life needs, and some capital socked away in retirement funds that could be liquidated in an extreme event but they’d be heavily taxed so it would need to be extreme to tap those. As for the trading account, I’m only about 3% in cash, and 97% fully deployed, so that is a very very risky position to be in, and leaves me exposed to big draw downs in the resource sector. It’s a bet I’m will to take and I’d be fine sitting through a 10-15% corrective move in most stocks, but if it gets more intense then that, I’d have to shed positions to bail water.

.

Having said that, when we saw moves like we did on Tuesday and Wednesday and even Thursday morning in the PM stocks or base metals stocks, then to be overly allocated in cash can have one at risk of missing the explosive move higher that are the easiest money from oversold conditions. When many mining stocks were up double digits on Wednesday, one wouldn’t have wanted to be in cash and chasing that kind of action higher. Granted it has corrected back down, but what if the last 2 days had also seen big moves even higher? That would be where being on the sidelines is the wrong call.

.

Think about periods in the recent past, like what we saw in the rally coming out of late September into Oct/Nov in mining stocks, or the bounce we saw in March of 2021 in April/May, or especially during the pandemic crash from late February into mid March of 2020. Remember all those people freaking out and going to cash in March 2020? That was the complete wrong call, and it was the time to be buying with both hands, as I stated at that time and did personally.

.

How about the fall of 2018 when people were still spouting nonsense like “we’re 7 years into the bear market…” huh? The bear market in PMs clearly ended when gold bottomed in Dec 2015, and for the mining stocks in Jan 2016, but most can’t see the forest through the trees when these trade set ups are occurring due to recency bias, or following the wrong kinds of metrics to look for a turn.

.

The last 6 months in the PMs has been particularly vexing to both bulls and bears alike because it has really been a sideways channeling range between $1750-$1850, or if expanded $1721 – $1880ish. Until Gold breaks down below $1721 and then $1675 then the bears are wrong-footed. Until Gold can break above the $1855 trendline that Jordan outlined, but really $1880 and $1900 on a weekly or monthly closing basis then the bulls still have more work to do as well.

.

Personally, I’m not getting overly excited until Gold clears that $1920-$1921 resistance and then $1962-$1966 congestion zone, but I’m in position for a move there during 2022. I believe the pathway higher medium term is more likely than a move down in to the low $1600s or the $1567 50% retracement of the move from the Major low at $1045 to the Major High at $2089. So at this point my cash position is rather small in the trading account, because I’m pretty much fully allocated to the PMs, and have what I want at this point in the other base metals and energy metals plays… for now.

Ex,

You have a way of expressing yourself in detail “ Example of this post” with common sense and precision!

This is one of your best post I have seen and I’m 100% backing it up..

I’m going to go out in a limb and challenge the non sayers and bearish gold investors, I believe and take this statement please and record it, that February is going to be one of the most explosive moves in gold/silver and more specifically the miners we have seen in years. If I’m wrong I will live with such call but if and thats an if I’m right, I only ask maximum schillings in the old days moneys worth 🙂

We are headed higher period!

Glen

Thanks for those remarks Glenfidish, as they are appreciated. Also thanks for the bullish call for February, as that would be great and I’m in position for it, so let it roll…

Glen, the bears are the ones sticking their necks out. You feel like it’s you only because you’re going against the herd.

The silver-gold ratio is great for cutting through the price noise that gets the herd confidently off sides and it is clear, the sector has gone “risk on” and today’s action wasn’t bearish in the least.

The bears should have been buyers following the December low as well as the recent one. Let’s see what they do with the current pullback. It probably won’t be right, obviously.

SLV vs GLD:

https://stockcharts.com/h-sc/ui?s=SLV%3AGLD&p=D&yr=1&mn=0&dy=0&id=p10032925410&a=1101063168

GDX might need to take a break versus QQQ but it’s a poor analyst that can’t see the very bullish bigger picture implications of the following chart.

https://stockcharts.com/h-sc/ui?s=GDX%3AQQQ&p=D&yr=1&mn=9&dy=0&id=p78669412334&a=978546851

Ex, nobody can ever accuse you of hedging on where you stand with your market bet. Same hold true with Doc, even though he sits somewhat at the opposite end of this gold teeter totter market.

I’ve been with your view with the eventual gold perspective except for the need to swing for the fences with the pop up rallies for most of this past year and the short lived jubilation they’ve brought.

Best to let things unfold until real signs where producers show greater appreciation than the commodity on a relative basis, no matter how laboured the gold advance may be.

I did my pair trade shorting the techs and buying some long dated gold calls couple months ago ending with basically free gold calls. And missed the sweet spot by covering the tech side prematurely with my chicken play with this weeks gold pop up day. Added aem, dsv, and ngd stock at the close today. Hoping to get in the earth minerals, ucu and tmrc next week with a third position. Will add with gold close above 1850 or a marginal break of 1800 with a bail at 1750 or so.

The crypto market is not going away. Another day like today with BTC front month going 36k to 30k or so (July low) is worth a bet, at least for a pop up with a tight stop.

The convential markets correcting with interest rate and fed babble which is BS. This is a correction, any collapse will come with the anticipated mayhem that will result later this year from the mid terms and accompanying election results war. Just my view.

Good discussion

I can’t decide, if I should go with Ex’s or with Doc‘s position at the moment

Thanks for those comments Jonsyl, and those are some quality PM names you picked up positions in (aem, dsv, and ngd) for that exposure. Yeah, shorting the tech stocks was a good call on your part, as they’ve had a rough go of it lately, which is unusual as they are the darling sector of the stock markets. Yeah, as for the cryptos, I agree that they are going away, but they sure got slammed hard down 48% from $69,000 down to $36,000. As you mentioned a move down to $30,000 would be a gold round psychological place to get positioned in Bitcoin and related equities like GBTC and the crypto miners.

Hope you’re right on the Ukraine story but your position brings up this question: This movement of resources by Putin has cost his treasury Bea coup bucks. What has he gained if he doesn’t at least take the eastern provinces that pro-Russian separatists already control? He didn’t do it to make Biden look good.

I don’t believe Putin is interested in the separatist’s property excepting as a land bridge to Crimea. He doesn’t give a rip about some of the old members of the Soviet Union since all they were were “expense items” and one of the reasons the Soviet bloc went bust. He’s more concerned about how close to his borders NATO is. Also, the separatists from eastern Ukraine are welcome to be citizens (many have immigrated) as long as they speak Russian. Even Zelensky realizes the hype and just informed his citizenry that it was all media hype.

Thanks for the reply. Hadn’t seen anything on Zelensky yet. Still hope you are right. Have a good weekend.

Russian troops and equipment gotta sit somewhere, might as well be on the Ukraine border. The fuel to ship them into position is basically free so I don’t see the added costs of this deployment.

I might add that the crytos are just another asset class to be crushed.

Doc – I’d submit that the 48% crash in bitcoin from $69,000 on Nov 9th down to $36,000 earlier today is already the cryptos getting crushed.

Ex, I”m afraid we have more to go in the crytos—-as for the PMs, I’ll say it again. The BBs on the monthly charts have narrowed considerably and the pricing in the PMs will in all likelihood make a directional decision in the first quarter of this year with February most likely the harbinger of things to come. If it makes you feel any better, I recently took a position in MUX.

Mux looks like a safe bet down here. I’m a little under water, not much…

Thanks Doc. I don’t currently have any crypto exposure, but did in the 2nd half of 2020 and parts of 2021. I’m looking for a spot to get in for a tradeable rally. I respect both your call and Matthews call for lower crypro prices. I’m thinking of starting to wade in soon just get a position going, but I’ll hold back on getting too exposed until lower prices.

.

As for MUX welcone back. I’m on my 4th round with this company, but have a core position un place that I’m trading around with partial positions. I have beefed it up the last few months and I had added a bit more to my McEwen a few weeks back. It is one that has been punished longer than most would have expected, even in light of the challenges over the last 2 years.

.

Maybe we should invite Rob on the show to get us all an update on all their projects and operations. I betting on them as a turnaround story, just like Americas Gold & Silver and Superior Gold.

For reference point that I use the Cad at times to follow direction of miners. There could be a possibility that it moves down and finishes the monthly showing a Doji candle and I would not be one bit surprised at $79 and change..

This event would allow the dollar to climb slightly higher as Matthew had mentioned and fool the retail investors as always. From there we would launch the most aggressive move in a long time in gold/silver and miners.

But we may not have to do that as I mentioned two days ago to Matthew the $1850 region slightly below that in this current move is a mid/major resistance due to a bearish order block the bears are trying desperately to defend. We break this technical block and the miners will unleash. We break the $1880-$1920 and miners will move faster then cash can be deployed. This is my honest and best case I can present to all.

Glen

Glenn, I would be shocked for the miners to”move faster then cash can be deployed”—-right now there are just too many stocks looking like they technically could care less—the other thing that concerns me is that this move by the PMs once again has seen too many stocks yawn—-in fact most PM stocks are now lower then the move in November when gold moved higher then the recent price. Also, so far; volume has been pathetic in this move up. We need an increase in volume to make a move higher legitimate. Then one has to ask what is the catalyst since a large increase in inflation last month did nothing. The markets look forward and the PMs are trying to tell us something with their lethargic action.

What that is only one can guess. There’s still hope though with the narrowing the BBs that we break to the upside.

I sold some miners Wednesday that didn’t do well on the big day. Maybe should have sold everything on that day. If that kind of day happens again soon I will sell into it and buy back cheaper.

Welp, looks like back to survival mode, for the time being. Got to roll, roll, roll—-

GDX:QQQ weekly:

https://stockcharts.com/h-sc/ui?s=GDX%3AQQQ&p=W&yr=3&mn=9&dy=0&id=p80554104599&a=1101101871

A pullback in this ratio next week would be a gift to those looking to sell the stock market and buy the gold miners.

China Warns West Against Rapid Interest Rate Rise

Xi Jinping says major economies need to be wary of ‘negative spillovers’ hitting global recovery

.

Phillip Inman – The Guardian – Mon 17 Jan 2022

.

“China has warned the US and Europe against a rapid rise in interest rates that would ‘slam on the brakes’ of the global recovery from the pandemic.”

Central banks should maintain the monetary stimulus or risk “serious economic consequences” from the spillover effects with developing markets bearing the brunt.

In a virtual speech to open the World Economic Forum’s Davos Agenda, the Chinese president, Xi Jinping, said that” while global inflation risks were emerging, policymakers should strengthen economic policy coordination and develop policies to prevent the world economy from dipping again.”

.

https://www.theguardian.com/business/2022/jan/17/china-warns-west-against-rapid-interest-rate-rise