Steve Penny Reviews The Technical Outlook On Gold, Silver, and Uranium

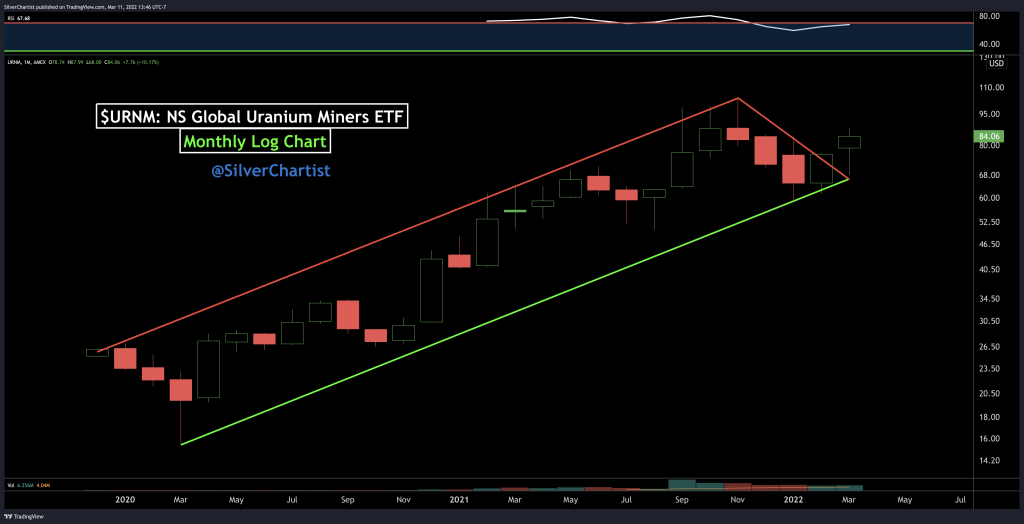

Steve Penny, Publisher of the SilverChartist Report, joins us to share a number of key charts on Gold, Silver, GDX, Uranium, URNM, and the Uranium:Gold ratio. (all charts are posted below so you can follow along). We intermix some macro market insights and recent news related to the precious metals, uranium, and the commodity sector. Steve stresses the point of knowing yourself and having a personal investing strategy, along with ways to manage risks using technical analysis to pick entries, accumulating in tranches on dips, and not chasing overbought rallies. We wrap up with some general comments on the wild moves higher we’ve seen in the commodity sector this week and that despite this big move higher recently, longer-term there is still plenty of room for commodities to continue gaining ground on other asset classes.

Click here to visit the SilverChartist website and sign up for Steve’s free email list. That is the best way to get a handle on Steve’s research.

Silver Technical Analysis for March 14, 2022

March 11, 2022 by FXEmpire

Uranium Market Minute – Episode 90: Spot Uranium at a 10-Year High

Justin Huhn – Uranium Insider – March 10, 2022

Uranium Market Minute – Episode 91: Kazakhstan Update & Disruption Potential

Justin Huhn – Uranium Insider – March 11, 2022

Ex should be happy with Excellon today. Also, PZG had a pump & dump

Hi Buzz – I’ve been out of EXN Excellon since last year in October when they announced uncertainty on whether the Platosa mine would keep producing after a few more quarters, and I had scaled out of much of that position in July and August before that at higher prices than where it bounced up to on Friday.

However, I’m thrilled for the company getting revalued higher finally, and celebrate the move higher for the investors still holding for the big 40% blast up on Friday (although in the aftermarket trading it sold off 13% from the closing price).

Gold Technical Analysis for the Week of March 14, 2022

March 11, 2022 by FXEmpire

https://youtu.be/eq_dcUoTpVo