Steve Penny – Technical Outlook On 10-Year Treasury Yields, TLT Long Bonds, US Dollar, Gold, Silver, And Uranium Miners

Steve Penny, Publisher of The SilverChartist Report, joins us to share a number of key charts on the 10-year treasury yields, TLT as a proxy for long-duration bonds, the US dollar, gold, silver, and uranium miners. (all charts are posted below so you can follow along).

We intermix some macro market insights and recent news to balance the technicals with the fundamentals. Steve also provides some insights into some of the strategies he has around short-duration trading versus longer-term investing, and some good principles to keep in mind along one’s investing journey.

Click here to visit the SilverChartist website

.

Steve Penny: Economic Collapse Has Begun. How Many Ounces Of Gold & Silver Are You Holding?

CFN – Compact Financial News Daily – May 20, 2022

Steve Penny – This Is Happening In The Gold & Silver Market

Investors Hub – May 20, 2022

Kevin O’Leary – More Financial Market Pain Ahead Until This Major Blowup Occurs

Stansberry Research – May 20, 2022

“We’re having a garden variety correction,” as the market tries to figure out what comes next, asserts Shark Tank star Kevin O’Leary, also known as Mr. Wonderful. “We’re getting close to a bottom,” he tells our Daniela Cambone, on the first edition of the new monthly series: WonderBerry. O’Leary questions what portion of inflation is transitory, as Target and Walmart saw severe downturns this past week, “not due to consumer demand, but increased costs.” “This market is not yet finished trying to find its equilibrium, and at the end of the day, inflation is [the Fed’s] number one mandate,” he states. The Biden administration’s efforts to still push the Build Back Better Act within this current environment is, “sheer madness,” O’Leary exclaims, saying it would be financial suicide for the nation.”

Danielle DiMartino Booth – The Fed Caused ‘Housing Inflation,’ This Is When Home Prices Will Drop

Kitco News – May 19, 2022

“The U.S. Federal Reserve is to blame for inflation and rising housing prices, said Danielle DiMartino Booth, CEO of Quill Intelligence, who said that 2023 is the year a housing crash could start.”

“Speaking to Michelle Makori, Editor-in-Chief of Kitco News at the Vancouver Resource Investment Conference, Booth, a former Fed insider, suggested that Powell could have tackled inflation sooner.”

Thanks Ex. This will keep us busy!

Yep. Lot’s of good Steve Penny interviews lately to digest. It’s great that he also invests his time periodically here with our audience at the KER. Cheers!

The Canadian market is trying to right itself but just when it looks like it may happen The American market takes over and the situation starts looking demoralized. Canada can’t divorce itself from the market actions stateside, we are too small compared to the elephant that lives next door and controls our economy. Speculation and inflation are running The American economy and The Fed is beaten. DT

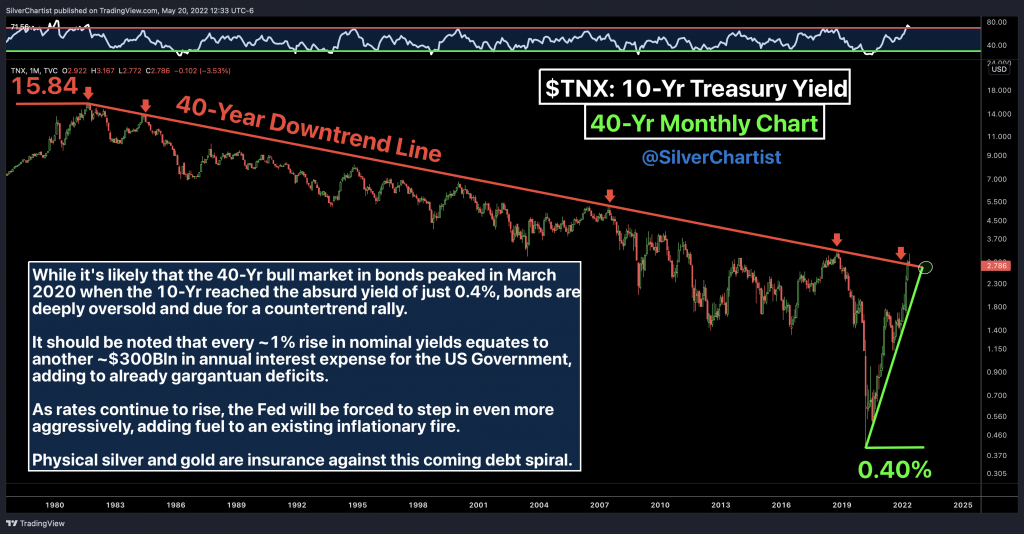

Those who think that rising rates are somehow negative for inflation (and therefore gold) need to read the second and third points on Penny’s first/top chart.

Hey Ex, Lobo Tiggre is out of the market, he is sitting on cash, nobody knows what’s happening except for the people who claim they do until the market spins their head around and they still come out smelling like roses because they claim they were always right anyway! YEAH BABY! DT!

DT, in the first 75 seconds, he made it clear that he did not sell everything. He just “pulled his shopping list” because he doesn’t want to commit more money to the market. I didn’t keep watching but I have a feeling he didn’t disclose the size of his cash position.

I stopped paying any attention to him over 10 years ago and he was no market expert back then, technical or fundamental. He and Doug Casey had a lot of “actionable” “real-time” hunches that were way off, as in 180 degrees off.

What I see on multiple sites is a lot of retail money happily completely in cash and expecting a crash or something close. Yes, more downside is a near term risk and a longer term certainty (my opinion) but markets don’t crash when so much retail money expects a crash. And when too many pros agree, the opposite is even more likely to happen.

The dollar is absolutely not something I want to buy right now either directly or indirectly through the sale of something. It could go higher but the downside risk is far greater than the upside potential.

https://stockcharts.com/h-sc/ui?s=%24USD&p=W&yr=7&mn=3&dy=0&id=p65911729804&a=932696065

Hi Matthew, Doug Casey lives in a different dimension, he has been touting the same old same old for a long time. I still listen to him but only very rarely. Thanks for the feedback. DT

Hi DT. I just listened to the Lobo Tigre interview and he stated he threw away his watchlist for now, but clarified he was not selling everything (twice to David where he felt it was important to reiterate that point).

It was an intersting interview where he echoed the point many have that sure we may have entered stagflation, and slowing growth with high inflation, and may see a stock market crash, but believes eventually the Fed has to reverse course.

I agreed with his points that in a waterfall decline, his shopping list would shift from junior PM miners to Uranium stocks and the larger Gold and Silver producers and royalty companies, as low risk quality would be on sale. I completely agree with that point, and that is precisely the strategy I deployed during the 2020 pandemic flash crash and it was very lucrative.

In a sell everything event where all stocks are hammered, then why take on the much higher risk of drillplays, when one can buy known ounces in the ground for gold and silver producers on sale? We’ve talked on this blog and in interviews ad nauseum for years that at key turns coming out of corrective moves. that it is the producers and royalty companies that get the bid first, and have seen that play out over and over again. We just saw the exact same thing happen coming out of the lows in miners coming out of the Q3 2021 close up through March/April of 2022 where it was the larger producers like Newmont or royalty companies like Royal Gold, Franco, Sandstorm that has big moves higher, while many of the juniors didn’t move that much or stayed under pressure.

As for Uranium stocks, they showed how much they can move from the 2020 pandemic crash to November if 2021, when spot prices climbed from $30 to $60. As Steve Penny also pointed out in our interview up above, URNM the Uraniun mining ETF went from $28 to $104… and that’s just an ETF…many individual names were 5-10 baggers during that 20 month period from trough to peak.

I bought the crap out of quality PM producers and the best developers, along with quality Uranium, Lithium, Copper, and PGM companies back in the pandemic flash crash, and then gradually pulled profits to rotate into more junior names. if we see that kind of collapse again, then I’ll deploy the exact same strategy personally. Go with the larger known quality and obvious energy metals sectors that will bounce first… then over time rotate more into junior PM stocks as the sentiment improves.

Intersting points to consider DT and Matthew.

In my retirement accounts, which are mostly exposed to US equities, (but with some emerging markets for international exposure), I’ve not really done many changes with them since 2020. When interest rates plummeted, I figured it was a top in the bond market, and decided to reduce down my bond exposure and increased my smallcap and midcap exposure instead.

That was the correct call at that time, but looking back, I should have taken action last year to rotate into defensive sectors like dividend paying energy stocks, utilities, and consumer staples. At this point maybe I should have sold them to raise cash, or rotate them into REITs or farmland or water or something in the commodities. Who knows where to hide over the next year or two?

As for my trading account, I’ve been very active in lately, but mostly horse trading portfolio laggards and dogs at a tax loss to refortify the Gold, Silver, Uranium, and Base Metals positions I like that have also sold off hard. I have raised some cash out of the selling to about 5% now, but have stayed mostly fully allocated and done a lot of buying in both late April through May. Maybe that will end up being wise or foolish… we’ll see over the fullness of time.

As for the US Dollar, it does seem to be getting top-heavy here at resistance as Steve Penny’s charts indicate above, and as we discussed in our interview on this daily editorial. I’ve got deep personal savings in cash that I’m not touching but do recognize it’s losing over 8% to inflation at present, so that’s the rub there. It may be that in an all out crash scenario, I pull that out to add more to my retirement funds or to speculate with, but it’s been ear-marked for real-estate since I sold my house in 2020. Tough times and tough decisions to make.

Ever upward!

The gold space is the place for the next big move (especially silver and the juniors) and the recent plunge just makes it more appealing. Silver’s COT report has improved dramatically for each of the last several weeks and that’s not “for nothing”, I can tell you that.

That sounds great. I’ve maintained a heavier weighting in the PM stocks than I’ve ever had in my portfolio, since Q3 of last year when I did a lot of reallocating in August & September; and then some more reshuffling of the portfolio deck during tax loss selling in December of last year.

I’m still more allocated to the Gold stocks than the Silver stocks, but have a healthy position in both as well as the royalty companies that have exposure to both metals. I’ve got roughly about 20 Silver stocks and 40 Gold stocks, but it changes from week to week.

Recently I’ve been continuing to beef up the PM producers and best-in-class developers, when they’ve sold off with everything else, but over time, as the next upleg gets moving, I’ll trim back some of the gold exposure to increase silver stocks, and reduce down some of the producers to move a little more into the explorers and optionality plays. I still have some explorers in the mix and a few optionality developer/explorers, but I’ve reduced down their position sizing even further, and don’t see the need to take on the extra risk with companies that don’t have defined ounces in the ground, when the quality companies are being thrown out with the bath water.

Looking forward to Silver taking the lead eventually, but with it breaking down below $21.41 support over the last 2 weeks, the concern many technicians have is that a move down to $18.75-$19 is a potential, and that would just further monkey hammer the silver stocks down even further if that was to play out. However, like I asked Steve Penny in the interview above, I wonder if the silver stocks already sold off hard in advance sniffing out this move down in the metal price, and if most of the damage has already been inflicted at this point. We’ll see how it goes…

By the way, the commercial silver short position is now smaller than it has been at any time since June 2019.

Thanks for sharing that Matthew, as I don’t really keep tabs on the COT positioning and we normally rely on Craig Hemke for that data. That would seem to be an encouraging position if the commercial silver buyers are far less short moving forward. It would be great to see a rally in silver catch a lot of retail or hedgefund shorts off-sides and give them a nice squeeze. 🙂

You’re right to not bother with it most of the time but it is useful now. You are also right to think it is encouraging because it is. [To say the least!]

Hi Ex, I never watched the video (LOL) but I read the blurb below the video where they claim Lobo Tiggre said “I don’t want to be putting anymore cash at risk right now……….. I sold everything.” I just saw that as an alternative view and because you were posting other information on the same topic I thought it was an interesting statement, from someone you have talked about in the past. But I’m glad that I posted that information even if it was erroneous because it got interest from you and Matthew and I like what you both had to say. It was a nice interlude because Matthew explained a few points on the way he feels without referring to his charts. By the way Matthew you are the best at analyzing graphs and charts. Take care! DT

Thanks DT and yes it was good that you posted the Lobo interview as it created a great discussion thread. The debate on whether it makes sense to put some cash to work here to buy the oversold conditions or to raise more cash is an intersting discussion to have. Personally my approach was to do a little of both… raise more cash by blowing out some portfolio dogs, and do some value buying for the longer term in the higher conviction names. Cheers!

Thanks DT. Get a load of commodities versus silver:

https://stockcharts.com/h-sc/ui?s=%24CRB%3A%24SILVER&p=D&yr=1&mn=11&dy=0&id=p35308347285&a=1077774311

wow…this is the first i listened to the silver chartist…..great charts and great analysis applied to them….aaand the fella will use the fundamental backdrop into the decision path…what is not to like….this guy is A+…missed him for 4 years here at ker…my loss….

That’s good feedback Larry. We really like Steve’s technical and fundamental analysis, and we’re happy he comes on the show every few weeks to share insights here at the KER.

Steve Penny – 5 Steps To Protect Your Money From Massive Coming Changes

I Love Prosperity w/ Jake Ducey

“Thanks to all the money printing and political shifts, you need to learn how to protect your money. In this video, Steve Penny shares 5 steps to protect your money from massive coming changes.”

https://youtu.be/lbNX5OdyRnY