Steve Penny – Technical Analysis for S&P 500, Bonds, US Dollar, Silver, Gold, and Mining Stocks

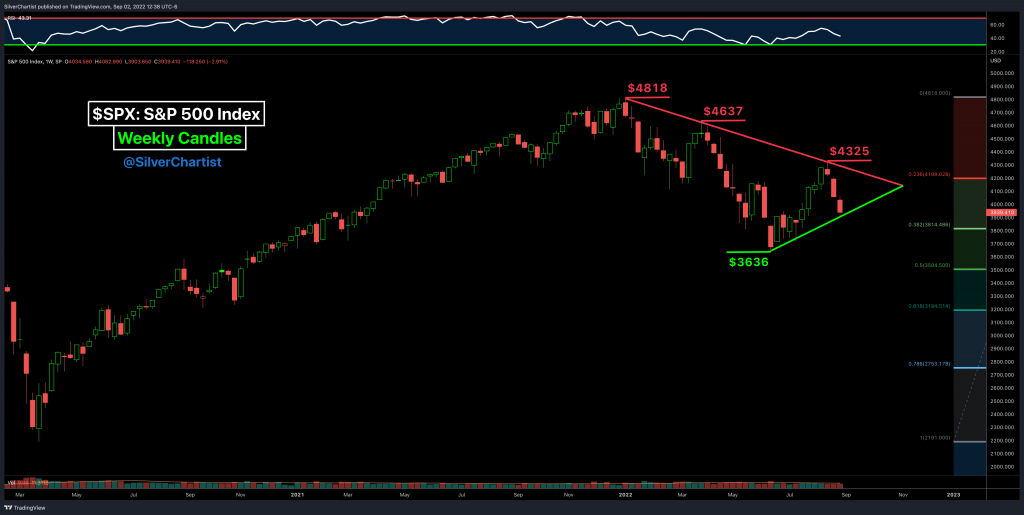

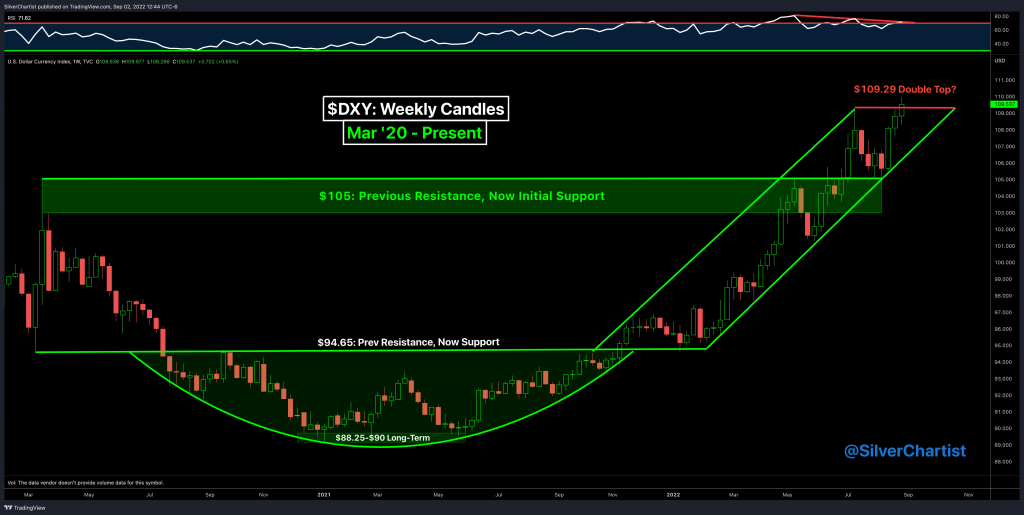

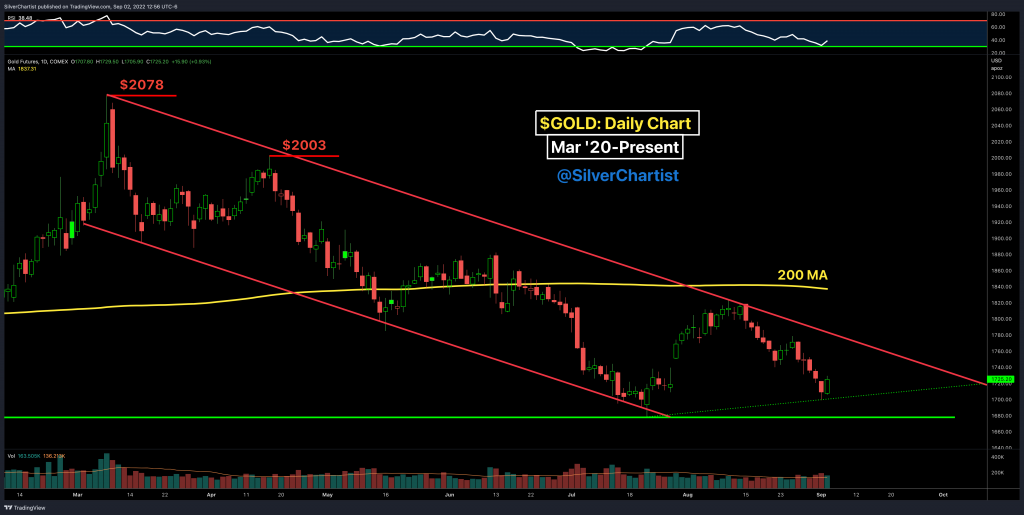

Steve Penny, Publisher of The SilverChartist Report, joins us to share a number of key charts on the (SPX) weekly chart of S&P 500, (TLT) monthly chart reflecting long-dated bonds, (DXY) US Dollar Index weekly, Silver monthly and weekly charts, (SILJ) Junior Silver Miners ETF weekly chart, and the Gold weekly and daily charts. [all charts are posted below so you can follow along]

We intermix some macro fundamental discussion in around these various markets to get an overall take on where the drivers of each sector will come from, in relation to price movements, and some thoughts on trading psychology and strategy towards the end.

Click here to visit the SilverChartist website

Thanks to Ex and team for the guest interviews this week… and to the broader Ker family, thanks for your sharing of views and ideas!

Much appreciated Canuckski. Yes agreed that there were some good interviews this week with guests, and some solid contributions here on the blog from various contributors. Ever Upward!

Dollar Index may have topped. Will post tomorrow morning.

The potential of a “double top” in the dollar chart that Steve mentioned is worth noting, but he did agree that if the dollar breaks any higher that the next major lateral price resistance is up around 120 as so many technicians are honed in on.

The dollar rolling over to ease some of the pressure being exerted on the metals and commodities sector, but with Europe and Japan such a mess, I don’t see where the reversal in the Euro and Yen and Pound versus the Dollar are going to come from.

I’ve asked about a half dozen guests during our interviews what would make the dollar roll over when the other currencies are tanking so much quicker and the other nations were in even more dire straits with regards to inflation and the economic output. So far, nobody has had a clear answer as to what would trigger the other currencies to start gaining on the greenback, other than someone (I believe it was Craig) mentioned that if the ECB and Bank of Japan and Bank of England were to surprise investors with more aggressive rate hikes, then that could be a potential catalyst for a reversal in trend.

Copper finished the week one cent above its 200 week MA…

https://stockcharts.com/h-sc/ui?s=%24COPPER&p=W&yr=6&mn=9&dy=0&id=p03982409473&a=551528662

UUP finished precisely at a big fork resistance…

https://stockcharts.com/h-sc/ui?s=UUP&p=W&yr=6&mn=0&dy=0&id=p47863526712&a=1081263976

Steve is a great guest…I appreciate his views…what is not to like…glta

The TLT trade is something I will look into for sure…

Agreed Larry. Steve is a fantastic guest, is a sharp technician, has good grasp of the fundamentals, and looks at the things from both a shorter-term trading perspective, and a longer term value investing point of view. Good stuff for sure, and we are thrilled that he comes on the show every few weeks to share his charts and TA with us here at the KE Report.

Another set of great charts from Steve Penny for investors to consider and follow along with as we discuss them.

How are other technicians here viewing the S&P 500, Bonds, US Dollar, Silver, Gold, or PM mining stocks?