Steve Penny – Macro And Technical Analysis for Gold, Silver, and Uranium

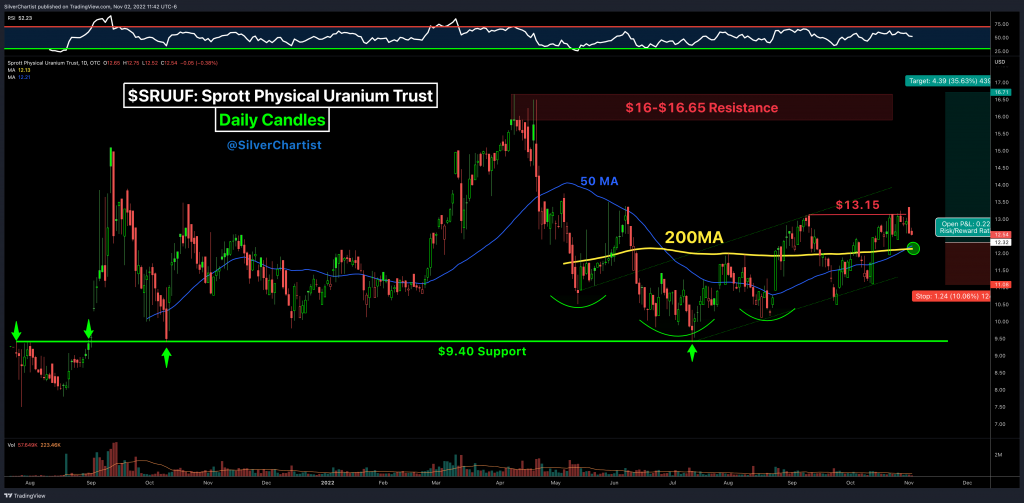

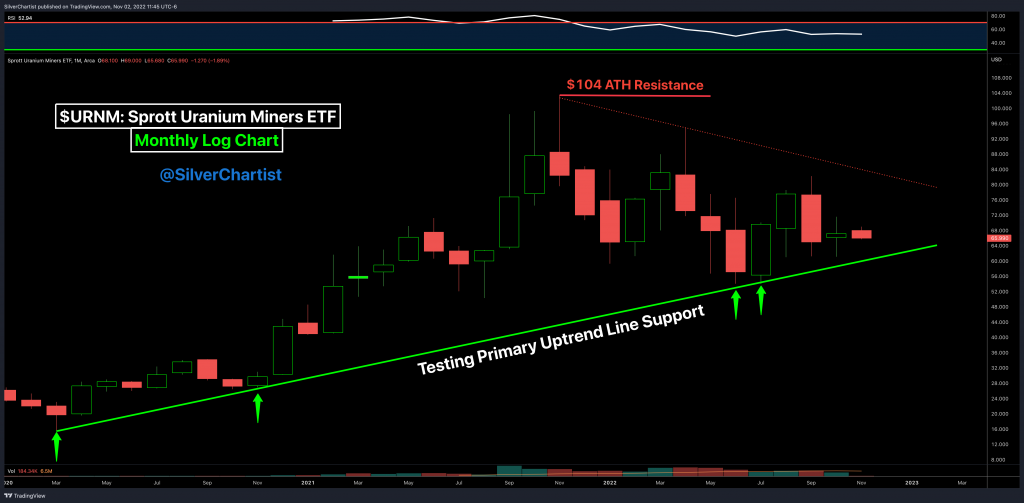

Steve Penny, Publisher of The SilverChartist Report, joins us to share a handful of key charts on the Gold weekly and daily charts, Silver weekly chart, (SRUUF) the Sprott Physical Uranium Trust, and (URNM) the Sprott Uranium Miners ETF. [all charts are posted below so you can follow along]

We intermix some macro fundamental discussion into the conversation around these various markets to get an overall take on where the drivers of each sector will come from, in relation to price movements, and some thoughts on trading psychology and strategy.

Click here to visit the SilverChartist website

This is the widest gold chart that I have seen in years………..jmo

https://www.kitco.com/charts/popup/au24hr3day.html

It makes it tough to know where things are going when they shouldn’t be here in the first place.

ditto………. wild and wacky………

Agreed OOTB. I was busy recording calls with folks and didn’t get to listen in to Powell’s comments, but saw the price of gold and silver sell off, then they went screaming higher, and then they turned around and dove lower towards the end of the day.

It’s normal to see some head-fakes and big swings around the Fedspeak… but this was particularly wild today. Apparently he made some remarks that were seen initially as slowing down the rate of continued hikes which was bullish, but then quickly walked those comments back and got more hawkish about not thinking about pausing anytime soon, so things turned more bearish. I’m sure we’ll hear from plenty of people opining on it in the days and weeks to come.

It’s par for the course as different Fed speakers (including Powell) often say one thing, and then flip-flop on what they just said shortly thereafter, and end up doing exactly what they said they wouldn’t. I’m far less interested in what they say, and more interested in what they actually do, because anyone listening to the Fedbabble for the last 2 years has been constantly wrong-footed and surprised.

> Remember that they “weren’t even thinking about… thinking about hiking rates until 2023.” (wrong)

> Then in Feb/March of 2021 they were convinced inflation was “transitory” and was just going be a few months of supply chain issues to work out. (wrong – then they flip-flopped).

>> Over a year later when things like services, rent, housing, domestic food, wage increases, etc… that have nothing to do with supply chains kept elevating, they conceded that inflation was sticky… and they didn’t understand it that well… No chit… anyone could have seen that higher inflation was going to happen when they backstopped trillions of dollars of new debt from wreckless fiscal spending and all those stimulus bills.)

> Then they stated in late 2021 they’d be tapering through the 2nd quarter of 2022, and would consider hiking rates by 25 basis points after that if warranted. (wrong – then they flip-flopped)

> Then in Jan & Feb of this year they dismissed the idea that they’d have to speed up their tapering and get it done in Q1 (wrong – then they flip-flopped and ended it by March)

> When questioned about who would buy those bonds when they pulled out of their QE they said there was plenty of foreign demand (wrong – the bond bubble burst and they are down far worse than general equities this year)

> Then as they started hiking rates they dismissed the idea of a 50 basis point hike (wrong – that is precisely what they ended up doing).

> Then they scoffed at the notion of a 75 basis point hike (wrong – they flip-flopped and leaked it to the WSJ a week before hand to prepare the markets for saying one thing and doing another).

–> So as is painfully clear, the Fed has a nasty habit of saying one thing to try and jawbone the market into submission, when they know full well they’ll be taking different action.

The market using Fed funds futures has been far more accurate, and has been pricing in a 75 basis point hike in November, a 50 basis point hike in December, and maybe another 25 basis point hike in Q1 of 2023, and despite their hawkish talk, that is likely what they’ll do… which means they are going to start slowing down the amount of these hikes over the next 2-3 meetings.

Ex

Ditto on the “fedbabble”

I stopped listening to the babble a long time ago……. Since they are just a FAKE ORGANIZATION,,,,

to rape every citizen…. with the help of the FAKE ..”the” USof A…..Corporation……

And thanks for the comment………… 🙂

Agreed OOTB. Sad but true.

Thanks for the agreement……….. 🙂

Yet, many commentators on the financial channels hold these liars in reverence despite their terrible track record that indicates they must be doing all these flip flops intentionally. Maybe they should have taken online financial courses instead of goin to a 150 year old brick building catering to wealthy families…

Ever wonder why theses so called experts on the MSN,….think they know anything…..

Pawns in the game……. telling the sheeple , and playing them along with a story that

is FAKE as HECK……….

Financial News,…. lol….

Yes Dan, many of the mainstream financial outlets put these central banksters on a pedestal and hang on their every word as if it comes down from on high…. I just figure, these people are not idiots, so if they are saying something they know can not be true… knowing they are going to take a much different action, then they are purposely misleading the markets and trying to jawbone things into submission. Not a surprise as politicians do the exact same thing, but this is the point of watching what they actually do and deeply discounting what they actually say.

WHole world has wacked out……

+1 Indeed.

The Cole Porter musical “Anything Goes” opened on Broadway in 1934, same year that Hitler came to power. I’m reminded of four lines of lyrics from the title song:

The world has gone mad today

and good’s bad today

and black’s white today

and day’s night today

Now more than ever

Too Many Rich People Bought Airbnbs. Now They’re Sitting Empty

Megan McCluskey – Time – Wed, November 2, 2022

https://www.yahoo.com/news/too-many-rich-people-bought-205754619.html

The Real Estate Markets Seeing The Biggest Downturns In Home Prices And Property Values

Eric McConnell – Benzinga – Wed, November 2, 2022

“Investing is always cyclical and even investments like real estate which have performed over time will have bad cycles. It certainly appears as if the Federal Reserve’s decision to raise interest rates has ended the boom period of strong profits that investors enjoyed after the 2008 crash. It’s impossible to avoid the truth that many real estate markets that were scalding hot as recently as a year ago have gone ice cold.”

“Rate increases became an unofficial “curfew,” sending almost all the partygoers home early. But even in that framework, there will be markets that don’t experience as big a fall as others. Benzinga takes a look at some of the real estate markets that are seeing the biggest downturns and what that means for the real estate game…”

https://www.yahoo.com/finance/news/real-estate-markets-seeing-biggest-192226470.html

I can see the crowd gathering at the penny slots for gold equity fire sales.

Year end extravaganza coming.

weekly /GC

Hey larry……… i did enjoy your comment the other day……..

A good RANT is always a good sign, you are alive……… 🙂

well jerry…..i am not pleased i got pissed at the lack of growth in some management….but, why is it my concern to even be troubled w…well, perhaps i discovered i enjoy the site, the expression it allows and the fellow peeps…we are all in this early ‘blade runner’ era chit show together…..there are almost no truths and no answers…..it is a people /political dilemma…it may be unsolvable wout blood spilling…i mean civil war in usa…….and we need to adapt….being frustrated w what others grasp or do not grasp is not my business actually….why should that matter to me….just not pleasant to watch people buy into propaganda and then take action against their best interests….

i need to chill…we got bigger fish to fry in the months ahead….

Hello larry

Thanks for the reply…….

I think you deserve to be pissed…. IMO…….

Especially, when you know what you are talking about,… and you have some real slow sheeple….that are way behind the curve…. and have been for a long time…. I doubt they will catch up, just too much homework required, as I have said before.

Anyway,… I really did not see that much wrong with rant,..sometimes you just need to get it off the chest …and keep on , keeping on….

Best , and thanks for staying around…

and I agree, …. Big Things are going to happen, and most are not ready…

I have been watching Nine Mile move during a day of miner suppression. May be something fundamental going on with it. That would be nice.

Brixton hit an eight month high today, up 21.21% this week so far…

https://stockcharts.com/h-sc/ui?s=BBB.V&p=W&yr=6&mn=3&dy=0&id=p36155465901&a=635402369

Good finish on Brixton today. Let’s hope it keeps going despite everything going on out there.

Equity Investors Are Betting Heavily On A ‘Soft Landing’ For The Economy

Jesse Felder – The Felder Report (11/02/2022)

https://thefelderreport.com/2022/11/02/equity-investors-are-betting-heavily-on-a-soft-landing-for-the-economy/