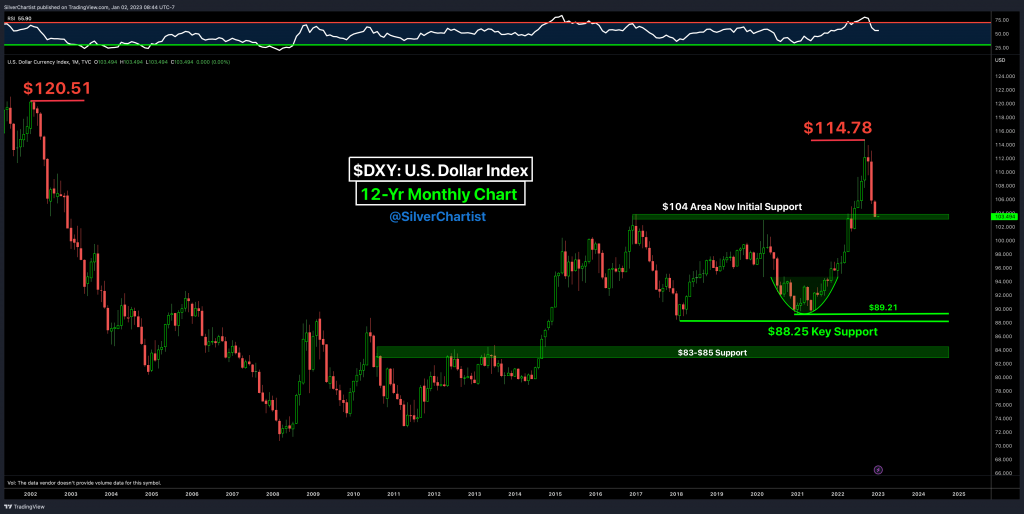

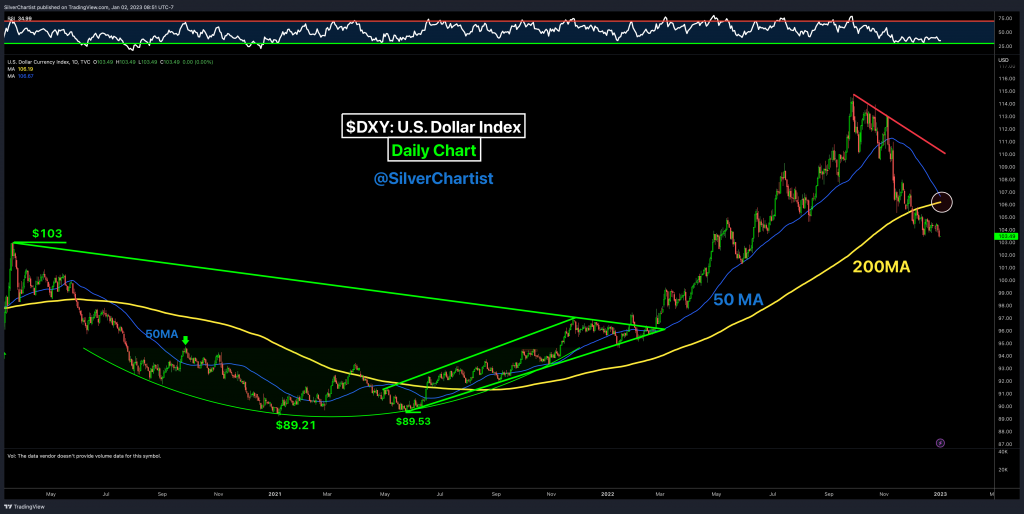

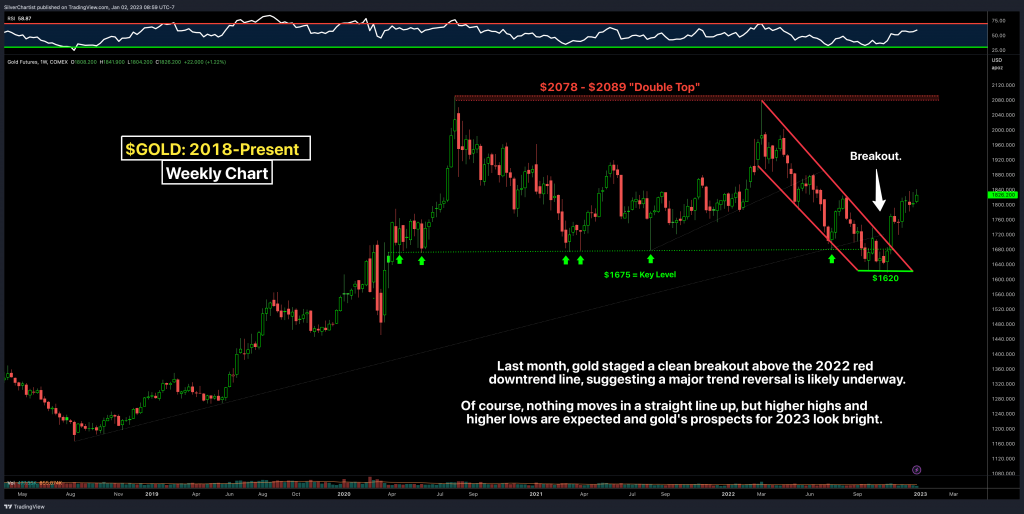

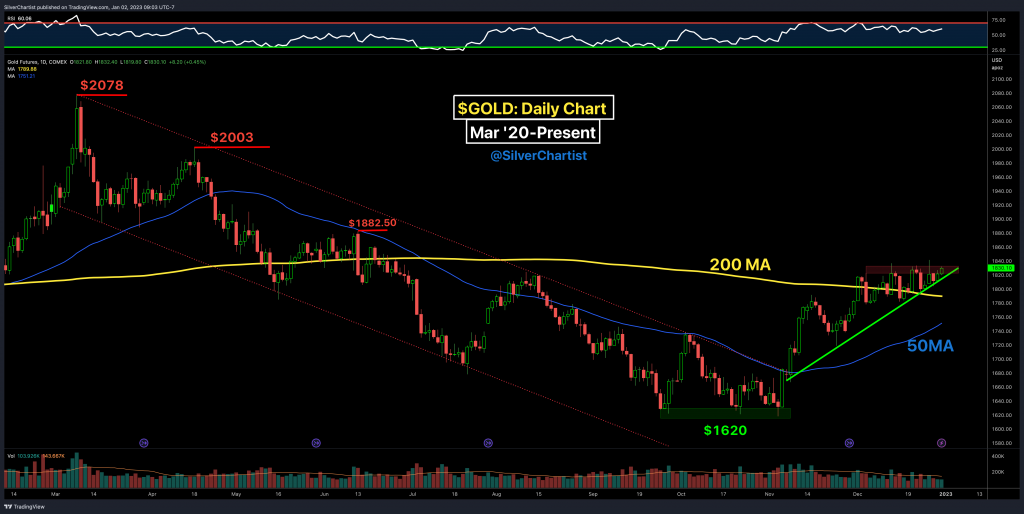

Steve Penny – Macro And Technical Analysis for US Dollar, Gold, Silver, Platinum, and Uranium

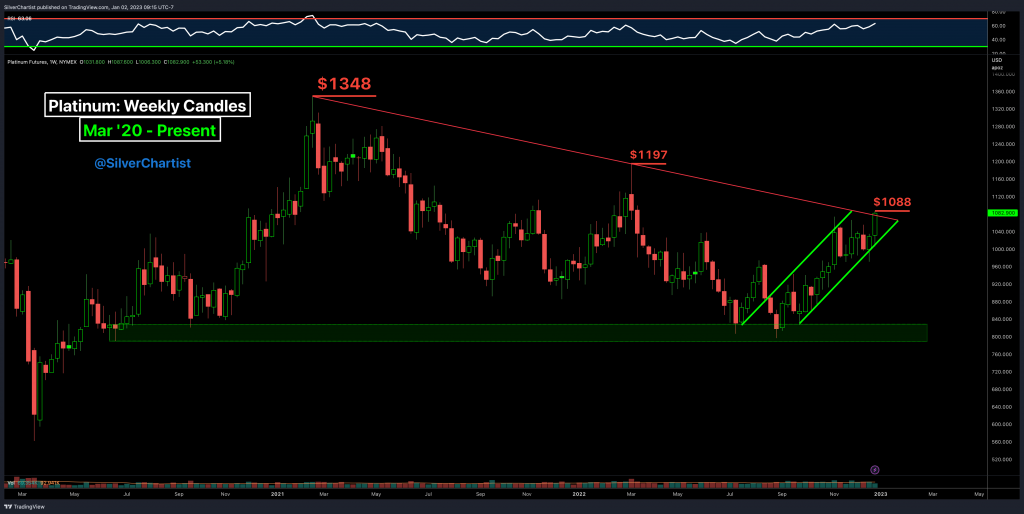

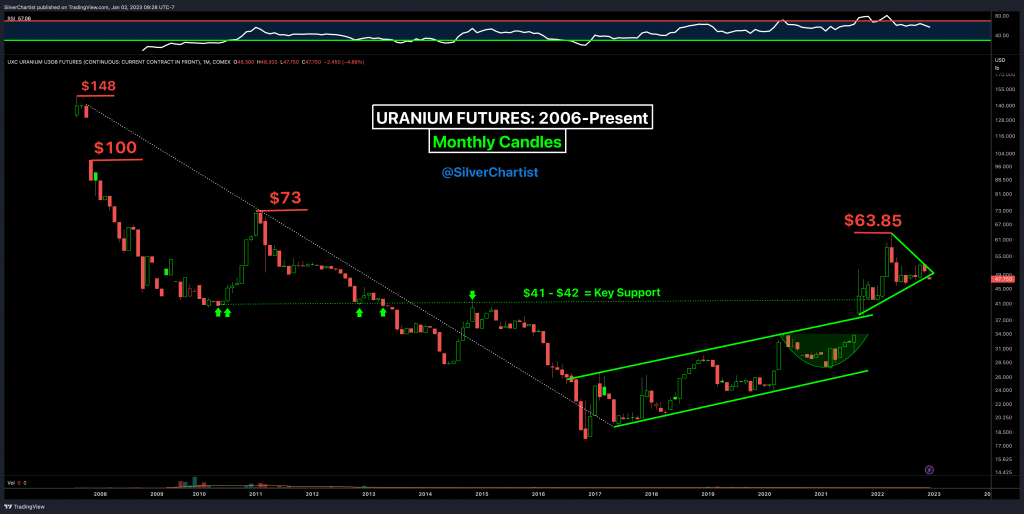

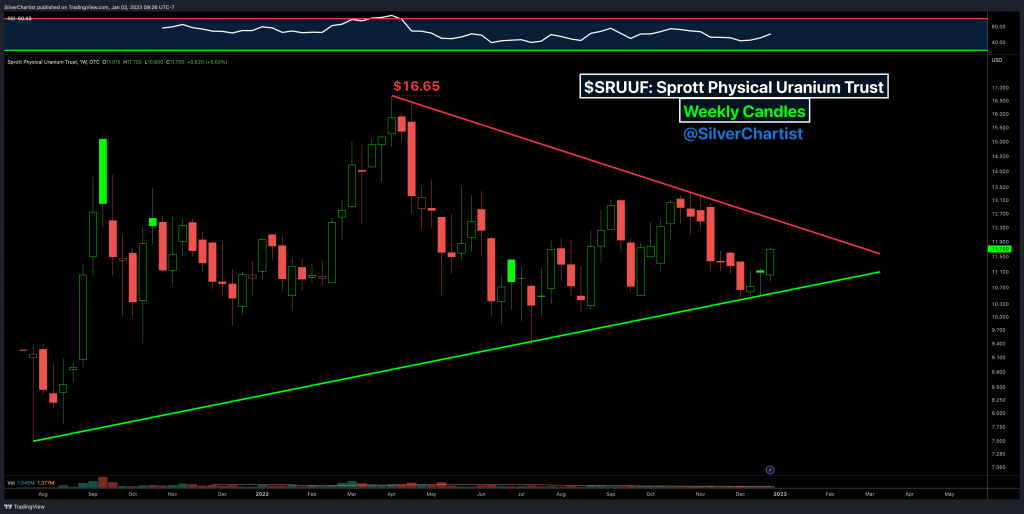

Steve Penny, Publisher of The SilverChartist Report, joins us to share a handful of key charts on the US Dollar monthly, weekly, and daily, and Gold, Silver, and Platinum weekly and daily charts, Uranium, and (URNM) the Sprott Uranium Miners ETF. [all charts are posted below so you can follow along]

We intermix some macro fundamental discussion into the conversation around these various markets to get an overall take on where the drivers of each sector will come from, in relation to price movements, and some thoughts on trading strategy.

.

Click here to visit the SilverChartist website

.

Here’s another good summation of the turbulent year that was 2022 from our buddy Goldfinger:

______________________________________________________________________________________________________

Year End Post: The Worst Year For Investors In More Than 150 Years

by @Goldfinger on 30 Dec 2022

“If anything, 2022 has wiped away many illusions that people had about a variety of topics including the value of various cryptocurrencies, covid vaccines, and various trading strategies that revolved around making memes and HOLDing no matter what.”

“If 2022 was a year of wiping away illusions and exposing the massive amount of misinformation and blatant fraud out there, I predict that 2023 will be characterized by a return to the truth (in the form of real assets and sound money) and a renewed focus on mental health.”

“Personally, I know of several friends who were part of this crypto/Gamestop/memestonk frenzy. All of them have experienced roller coaster rides throughout 2020-2022 and eventually generated large trading losses that forced them to return to the workforce in the second half of 2022.”

“In a way, it’s sad to see so many people ‘fail’ at something that gave them so much hope. But the market is a cruel mistress, and I know of no other way to become a profitable market participant than to experience some epic failures early on in one’s journey. Too many people suddenly woke up to an “everything bull market” in 2020/2021 and thought that stocks and cryptocurrencies only went up. However, the reality is something very different. 2022 has been a year of reality setting in and delivering a great deal of hard lessons in the process.”

https://ceo.ca/@goldfinger/year-end-post-the-worst-year-for-investors-in-more-than-150-years

Gold Rush: Volume Bought By Central Banks At A 5-Decade High

ER Velasco – The Deep Diver – January 1, 2023

“According to data provided by the World Gold Council (WCG), demand for the precious metal has outstripped any annual quantity in the previous 55 years. Last month’s estimates were also significantly higher than central banks’ official published statistics, generating industry conjecture about the buyers’ identities and objectives.”

“Central banks are buying gold at the quickest rate since 1967, which would suggest the geopolitical backdrop is one of mistrust, doubt, and uncertainty,” according to Adrian Ash, head of research at BullionVault, a gold marketplace.

https://thedeepdive.ca/gold-rush-volume-bought-by-central-banks-at-a-5-decade-high/

Thanks Ex for that article….it explains the massive intuitive run upward in Gold! NOT.

(Edit: 🙂 )

Sure thing DT… always glad to share an article or two… 🙂

I’m not sure if central bank buying is a key driver behind the recent price appreciation in Gold over the last 2 months, as it was more a technical catch up to what Silver and the larger mining stocks had already been doing since September, but it likely was a contributing factor.

The real question people should be asking themselves (especially if they think gold is out-dated or a “barbarous relic”) is — Why are central banks continuing to buy gold at a record pace?

Yes they can

The PMs are continuing to rip higher in overseas trading.

Gold futures at $1850

Silver futures at $24.60

It will be interesting to see where the markets open up tomorrow (and if there is an early morning hit) and also where they close the first trading day of the new year.

Ex, the November Gold low may be the bottom, but remember: https://www.youtube.com/watch?v=sq3cQVrnaWs

Yes, Buckle up for safety. 😉

Dollar Index : Winter 2023 : How High?

https://tinyurl.com/2v25vube

Bouncing With Gold!

Looks like the recent pattern for my miners is continuing into the new year …

Up at open but split.

Take to even early morning.

Build to upside toward close.

Will see.

Happy New Year to the KER Crew!

We thought we’d kick off 2023 with a bang, by having our buddy Steve Penny (aka TheSilverChartist) back on the show to break down his technical outlook on a number of markets. We think Steve is a very sharp technician with a fantastic grasp on the fundamentals, and we are blessed to have him share his charts and ideas with us here at the KE Report.

Wishing all our listeners and contributors a very prosperous year to come. Ever Upward!