Stillwater Critical Minerals – Unpacking The Key Takeaways From The Stillwater West Resource Update

Michael Rowley, President and CEO of Stillwater Critical Minerals (TSX.V: PGE – OTCQB: PGEZF), joins us to unpack the key takeaways from the recently announced Resource Estimate update at their flagship Stillwater West Project in Montana. As announced on January 25, 2023, this updated Resource Estimate show a 62% increase over the 2021 Maiden Resource Estimate to 1.6 Blbs Battery Metals and 3.8 Moz PGE+Gold. Base Case Inferred mineral resources of 1.6 billion pounds of nickel, copper and cobalt and 3.8 million ounces palladium, platinum, rhodium, and gold, in a constrained model totaling 255 million tonnes at an average grade of 0.39% total estimated recovered NiEq (or 1.19 g/t Palladium Equivalent).

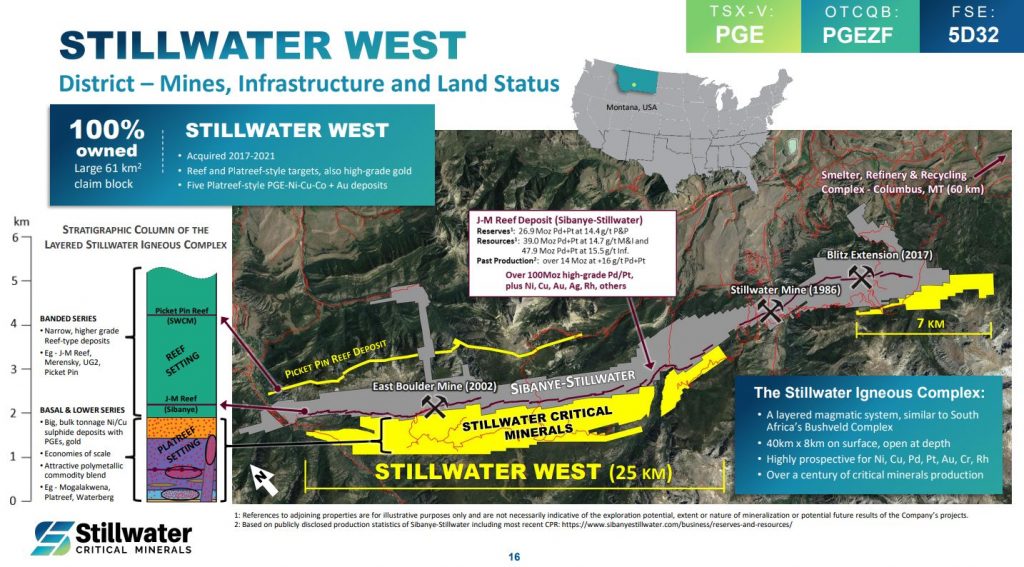

We compare this resource to other projects in North America, and there are surprising few peers with this type of mineral endowment. These leads us to further discuss the parallels between this Project and their neighbors, Sibanye Stillwater, that are currently producing nickel, copper, platinum, palladium, and rhodium at that highest grade PGM mine in the world. Mike makes the point that the mining approach for Stillwater Critical Minerals that is being proposed is more of a bulk mining deposit more akin to the South African Platreef battery metals and platinum group elements mines and development projects found on the northern limb of the Bushveld Igneous Complex. Mike addresses the question of whether Sibanye Stillwater could be the only suitor, and points out there are ongoing discussions with a number of major metals producers and so there are plenty of options on the table for the road ahead.

Next we discuss the exploration work successfully completed in 2022 at the Pine Target, which is an additional gold target returning high-grade gold, that is 2kms away and currently not one of the 5 deposit areas presently included in the resource estimate, but that more drilling will be focused here in 2023 to keep delineating this additional target area. The focus of the exploration team at present is continuing to expand the high-grade areas of the 9km strike length, and for better understanding the geological structural controls, with a wealth of potential targets for future drilling in that larger context for the 2023 exploration season. The key focus of exploration for 2023 will still be the primary other 5 target areas at their Stillwater West project, with a large exploration program to be announced later this year.

If you have any questions for Mike regarding Stillwater Critical Minerals, then please email us at either Fleck@kereport.com or Shad@kereport.com.

In full disclosure, Shad is a shareholder of Stillwater Critical Minerals.

.

Click here for company news from Stillwater Critical Minerals

.

Excellent value questions. I have a much smaller position than a year or two ago. Looking forward to correlation of value and price this time around. Of course, this could apply across the board in the metals.

+1

Stillwater Expands Resource, Nickel By More Than Half At Montana Project

Mining.com – January 26, 2023

“The new inferred resource estimate raised tonnage by 62% compared with figures from 2021, according to a company filing on Wednesday. Contained metal jumped across the board: nickel up 52%; copper 44%, cobalt 31%; platinum 66%, gold 30% and rhodium 76%.”

“These increases speak to the fantastic growth potential and under-explored nature of the Stillwater West project,” president and chief executive officer Michael Rowley said in a news release. “Its world-class endowment of eight critical minerals is unique in the United States as a district-scale asset located in an active, producing district that has a long history of large-scale critical mineral production.”

“The project about 320 km southeast of state capital Helena in the Stillwater igneous complex lies beside Sibanye-Stillwater’s Stillwater, East Boulder, and Blitz mines, the world’s highest-grade major platinum group metals operations and largest outside South Africa and Russia.”

https://www.mining.com/stillwater-expands-resource-nickel-by-more-than-half-at-montana-project/

Hi Ex, I have been lucky in that my family has understood the value to be unlocked at Stillwater’s project. They can’t believe how long these waits can be but I’m sure they will be pleasantly surprised when the hoofs start trampling in. DT

Good thoughts DT. I believe personally that the patience will pay off with the deposit that is coming together for Stillwater Critical Minerals.

I was stunned even after the interview at the disconnect between their current market cap at $42 million and the $20 Billion gross metals value in the ground ($27 Billion Canadian). When investors wake up to that, surely some of that gap can be closed with a solid re-rating higher.

You hit your nose on the hammer with that comment.

+2

Thanks Lakedweller2.

Great news! Great update!

Thanks Charles. Agreed!

Someone rationally explain to me why SIL and SILJ made a lower low vs silver despite silver being up around $7(!) between those two points (from September to December ’22).

I was expecting an EXPLOSIVE move higher in the silver miners, and not only have they not delivered, they are actually making lower lows vs the metal.

HL is the unicorn, and I believe it has many disgruntled mining investors piling into it by the day. It is so far in advance of the others technically as to be a joke. I’m so tired of hearing “they’ll catch up.”

Maybe HL is favoured by Wall Street and deep state people who want silver exposure.

Deep State: Is that near Oklahoma?

Deep State is just this side of the Rio Grande

I think SIL and SILJ have needed further proof from silver that this move is the real thing and we’re getting there. Such skepticism is normal at the most important lows because investors are so beaten up.

It’s interesting and positive that since the week of December 19th silver is down 1.2% while SILJ is up 5.1%. That’s based on weekly closes which is a conservative approach. The fact that the silver miners are up decently while silver is down is more bullish than the miners just delivering the typical/expected leverage to rising silver.

Based on daily closes SILJ is still up 10.5% versus silver since Dec. 19th. Again that’s not bad at all since silver has been trapped in corrective choppy sideways action.

The weekly oscillating indicators for SILJ:Silver are much more bullish than bearish but that’s not very helpful in the short term.

https://stockcharts.com/h-sc/ui?s=SILJ%3A%24SILVER&p=W&yr=5&mn=0&dy=0&id=p47354009413

I believe Hecla’s revenue from gold is roughly equal to its revenue from silver. Combine that with the fact that it’s the only silver play of its size and quality in the US and it’s easy to see why it has performed as it has.

I sold all of my trading position in HL when it went into the 6.40s the other day based on the risk-reward and got lucky with my timing. I really expected it to go a bit higher without me. Now I am hoping that the whole sector will get hit hard next week because we (bulls), even non traders, will all be better off if it does. A scary cleanout now would set the stage for a surprisingly strong reversal and finally some mainstream recognition of what’s happening. It would also probably coincide with a widely unexpected faltering of stock market which IS in a bear market.

Matthew – good comments on the needed sector cleanout in the event of a brief and mild corrective move, and agreed on your comments regarding Hecla (about the mix of both silver and gold) and the North American focus on the US and Canada. They should have the Keno Silver miner back in production again (post acquiring Alexco) in Q3, so that is another value driver for HL.

Great update and much appreciated Ex…..would you know the cash on hand and what the 2023 drill plan costs are????

Thanks Wolfster. I didn’t ask about the money in the bank on this interview, because we’d just asked him that in the prior interview from 01/18/2023, and he said they had $2.5 Million in the treasury, didn’t need to imminently raise and they wanted to see if some of these upcoming catalysts could give the share prices a bump before doing another raise.

Mike mentioned in that interview that they also had $8 million dollars in warrants that could come in if they could get their share prices up to $0.25 and $0.30. (they closed on Friday at $0.235, so not that far to go).

In addition the Cornell University study has them participating in some of the government funding towards their metallurgical work and recovery work, so that is another ace in the hole that they have.

Here is that interview for quick reference (those comments are towards the end of the discussion):

I think bullion banks are trying to push silver lower in effort to salvage massive net short on PMs

We could save a lot of time by asking JPM where silver is going.

…and ‘Pow’ PGE, Stillwater is pushing the bolly band up!;-D

I saw that Stillwater went up, and I got excited and added. Now … I will add more if it can finally move to a more appropriate price representing its value.

IMHO the weekly has more room to run.

The daily chart’s 50dma is going to take off soon.

It’s got a hammer thingy. Let’s see what tomorrow brings. The darn thing should be talking dollars rather than entertaining the “wants” of some Hedge Fund. Move em out … Rawhide.

Gave me another idea: get The Fed to buy a resort like in Jackson Hole and turn it into a prison for Bankers and maybe get some guilty pleas and stop the intervention. Just a thought.

Stillwater Critical Minerals (OTCQB: PGEZF) (TSXV: PGE)

Emerging Growth Conference – Jan 25, 2023 – Keynote speaker: Michael Rowley, President & CEO

“Stillwater Critical Minerals is rapidly advancing the Stillwater West PGE-Ni-Cu-Co + Au project towards becoming a world-class source of low-carbon, sulphide-hosted nickel, copper, and cobalt, critical to the electrification movement, as well as key catalytic metals including platinum, palladium and rhodium used in catalytic converters, fuel cells, and the production of green hydrogen. ”

https://youtu.be/CJScFFbubGU