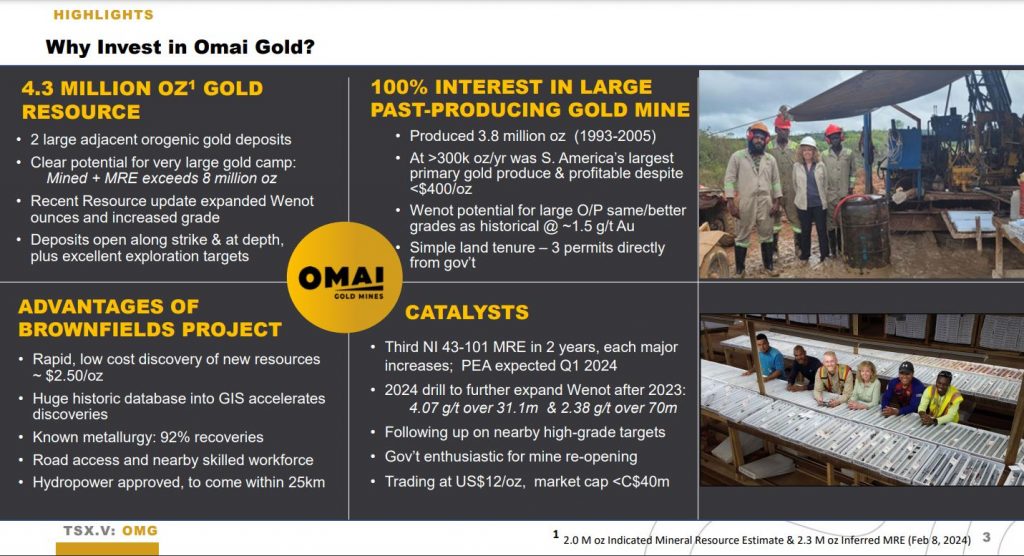

Omai Gold Mines – Introducing The Preliminary Economic Assessment On The Wenot Project In Guyana

Elaine Ellingham, President and CEO of Omai Gold Mines (TSX.V: OMG) (OTC: OMGGF), joins me for an introduction to this junior resource company focused on exploration and derisking the both the Wenot and Gilt Creek Projects across a vast mineralized gold trend in Guyana, South America.

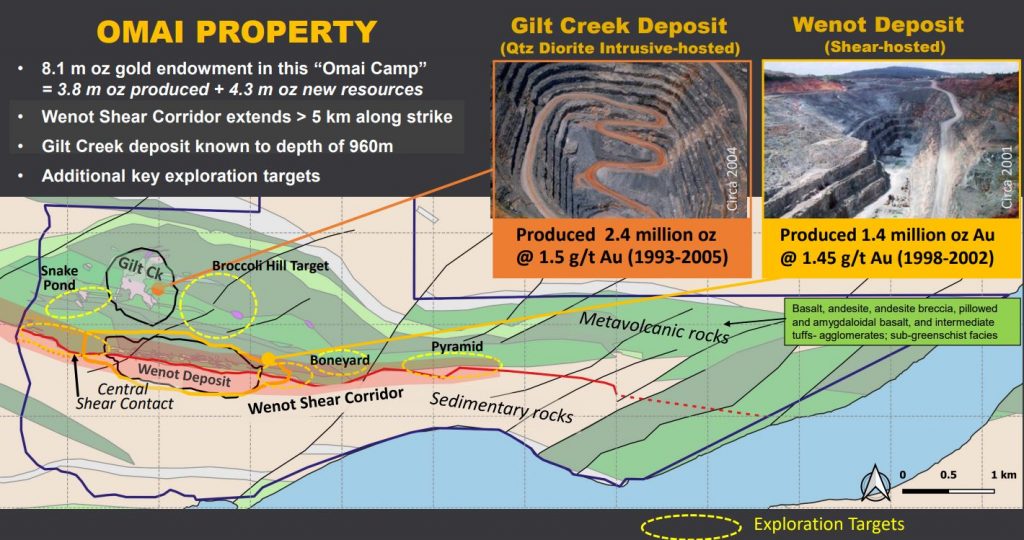

We start off discuss the large resource in place between the 2 Projects, at over 4.3 million ounces of gold, across this brownfields and past-producing site. Then we dive into the key metrics on the first pass Preliminary Economic Assessment, that is just on the open pit Wenot Project, and does not yet incorporate the Gilt Creek underground project economics at this point.

> PEA Highlights for Wenot Open Pit

- After-tax NPV5% of $556 million and after-tax IRR of 19.8% based on $1,950/oz gold with a sensitivity case at $2,200/oz gold giving an after-tax NPV5% of $777 million and IRR of 24.7%

- Initial capital (“Capex”) of $375 million and sustaining capital of $172 million over life-of-mine

- Projected average gold production of 142,000 oz per year over a 13-year mine life

- After-tax payback of 4.3 years at base case $1,950/oz gold (3.5 years at $2,200/oz gold)

- Average cash operating costs of $916/oz gold and all-in sustaining costs of $1,009/oz

- Cumulative cash flow of $1.07 billion after-tax over 13 years on base case assumptions

- Total payable gold production of 1.84 million ounces

- Average head grade of 1.51 g/t Au and 92.5% process recovery

- Average strip ratio for the open pit life-of-mine estimated at 7.8:1

Next we talk about the infrastructure and social advantages of this brownfield site in Guyana, the support of locals and the government to move this mine back into production. We touch upon the ongoing permitting, metallurgical work, and other derisking work the company is doing in the background, in addition to the exploration upside at both the Snake Pond and Blueberry Hill areas that could bring more shallow high-grade ounces into the front end of the mine plane and further improve the project economics.

Elaine also gives us her industry background along with profiling the experience of Omai Gold Mine’s management team and board of directors. Additionally, she breaks down their relationship with strategic shareholder Silvercorp Metals, and Sandstorm Gold, in addition to other key strategic institutional funds and high net worth shareholder. We wrap up getting the financial health of the company, share structure, and key news on tap in the year to come.

If you have any questions for Elaine regarding Omai Gold Mines, then please email me at Shad@kereport.com.

.

Click here to see the latest news from Omai Gold Mines.

.

Gold and silver have been relentless! For those of you who listen carefully I mentioned even pros like garoth soloway are learning hard the wall of worry as gold and silver are refusing to allow shorts in. Bull markets are a beast when they get going. Sometimes these corrections come from the least expected numbers.

It is quite possible gold pulls back slightly who’s knows before really making that push towards the $2500 area all in due time.

This was and still is a buy of a lifetime in the miners.

Matthew

13 hours ago

The 100 day MA has been capping Brixton since September so I’d like to see a close or two above it for starters. Then the .16 – .17 area needs to fall (that’s Canadian $ of course).

https://stockcharts.com/h-sc/ui?s=BBB.V&p=D&yr=1&mn=5&dy=0&id=p17526288274&a=1650395849

Any second or day this is taking off!