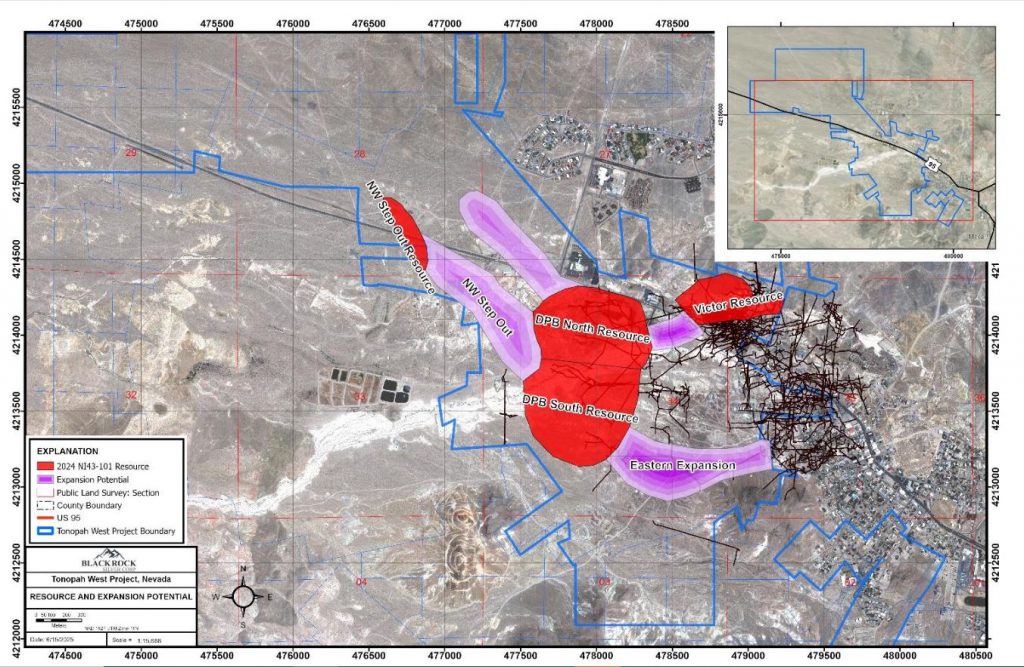

Blackrock Silver – 500 Meter Step Out Drilling at Tonopah West Intercepts 10.12 Meters of 467 g/t AgEq and Establishes Continuity Northwest Of DPB Resource

Andrew Pollard, President and CEO of Blackrock Silver (TSX.V:BRC – OTCQX:BKRRF), joins me to discuss the final set of assay results released from its Resource Expansion Program showing significant width and high-grade silver and gold drill intercepts in step-out drilling at its 100% owned Tonopah West Project in Nevada, United States.

Blackrock’s resource expansion program at Tonopah West, which commenced in September 2024, consisted of 18 drillholes totalling 10,802 meters (35,438 feet) of drilling, targeted expansion potential along a one-kilometer northwest trend between the Denver-Paymaster and Bermuda-Merten vein groups (“DPB”) south resource area and the Northwest (NW) Step Out resource area.

HIGHLIGHTS:

- TXC25-144 cut 10.12 metres grading 467 grams per tonne (g/t) silver equivalent (AgEq) (283 g/t silver (Ag) & 2 g/t gold (Au)), including 3.51 metres of 1,020 g/t AgEq (620 g/t Ag & 4.43 g/t Au);

- TXC25-145 encountered multiple zones of high-grade mineralization which included 0.67 metres of 3,264 g/t AgEq (2,008 g/t Ag & 13.93 g/t Au) within 11.58 metres grading 327 g/t AgEq (186 g/t Ag & 1.56 g/t Au) and 2.32 metres grading 401 g/t AgEq (242 g/t Ag & 1.76 g/t Au);

- TXC25-153 drilled 0.7 metres of 724 g/t AgEq (437 g/t Ag & 3.18 g/t Au) within 5.73 metres of 156 g/t AgEq (96 g/t Ag & 0.67 g/t Au);

- Step-out drilling has established continuity of high-grade gold & silver mineralization over significant widths that runs 500 metres along drill-defined strike from the existing DPB resource shell to the northwest; and

- Targeting is now underway to bridge mineralization on remaining 500 metres of vein corridor to NW Step Out resource area.

We review that in addition to higher confidence ounces, where there is now tighter drill spacing and ounces are going to be moving into the measured and indicated categories from inferred, that the resources will be growing in size, raising the overall high-grade deposit to even higher average grades, and there is more up-dip mineralization that will be factoring into the early year economics of the Project.

These various data points will be incorporated into the upcoming updated resource estimate incorporating the M&I drilling due out by September, and then there will be a second resource update early next year that incorporates all the expansion drilling towards the NorthWest Step Out, and the Eastern Expansion area off DPB South towards the Ohio mine area. After both resources have been released, then all of that data, combined with recent hydrology work, permitting work, and other derisking will be factored into an updated PEA.

We wrap up discussing the larger vision to get permitted to go underground and start working a trial mining study, where the bulk sample should be sizeable, and will verify assumptions on geology, ground conditions, recovery rates, and will be a payable event from the processed mineralized material. These various catalysts are all opportunities for the company to rerate higher, in addition to just rerating more in alignment with the metrics the handful of other high-grade silver peers are receiving at present.

If you have any follow up questions for Andrew regarding Blackrock Silver, then please email them into me at Shad@kereport.com.

- In full disclosure, Shad is shareholder of Blackrock Silver at the time of this recording, and may choose to buy or sell shares at any time.

Click here to visit the Blackrock Silver website to read over the recent news we discussed.

.

.

Correct me if I’m wrong but is it not just the American copper producers who actually benefit from the big pop in copper. Rest of the producers get the LME price which actually dropped on the news and is down????

It’s a good question Wolfster. I’m not sure anyone has all the dynamics figured out on how the US tariffs will effect this market. Overall the higher copper prices though should be a boon to the industry, and they were destined to happen anyway, regardless of this latest news from the White House.

Copper pricing above $5 has already happened 2 other times in the last year, and it is likely going to go up into a new range in the $5s for fundamental supply/demand reasons. Really, $6+ copper is likely coming in the not so distant future.

The copper coming into the US from abroad will have that proposed 50% tariff, so that hurts some foreign countries like Chile or Peru that ship some copper here, but it also hurts some US companies that need to send a copper concentrate over to Asia for processing, because after the cons get set to the smelters, that domestically produced copper, will still be subject to those same tariffs when it gets shipped back over.

This is why I like Arizona Sonora so much as they are going to produce copper cathodes in the US domestically without the need for shipping concentrates to Asia.

This also highlights why some of these tariff policies are not that well though out, because it will hurt a lot of other potential future US copper producers that need to do concentrates. Additionally there isn’t good smelting and refining domestically, and while this administration may want that, nobody wants a melters smelter in their backyard, and it is unlikely we’ll see a bunch of new ones. We may see that one in Arizona that was closed go back online though, as Arizona is the hub for domestic copper supply.

Glenfidish Jun 28, 2025 28:13 AM Silver is in process of a very nice daily bull flag and even better a nice long hourly bull flag similar to the move from $32 ish to $37 ish.. The flag although not 100% guaranteed shows a takeoff in 7-12 days.

If we take into account markets closed on weekends we are then on day 8. im betting takeoff is monday or tuesday making it day 11 or 12.

get ready for liftoff

I’ve loaded up with Santacruz, Impact and Silver Tiger with some Kootenay Resources (KTRI) left over from a spinout.

SLVR, Silver Tiger

+3 Dan. Santacruz, Impact, and Silver Tiger all solid silver stocks.

As for Kootenay Resources I’m not sure what all is going on with that one. I’ve got it from the spinout from Kootenay Silver as well, and have been meaning to ask Jim about that. Maybe we can work in a question on that company during our next Kootenay interview.

There was some news recently not to be released in the US about an official silver/gold project with lots of land near Fraser Lake, BC 100% owned by Kootenay Resources.

Copper: My thinking on the tariffs is that they appear to raise price and in US the copper mines will gain from the increase but so will all mines if price increase is worldwide. Now there are global shortages. So in US, miners could undercut import prices but outside the US they could undercut the US prices as well as stop selling to US. But the producer in all cases will not pay the increase … only end users. So if tariffs are placed on metals and the US has shortages, the US will have greater shortages and end users in the US will leave the country, Now if it is food or something, the people needing to eat will pay more or die. So bottom line is that if tariffs result in price increases, it is good for miners no matter where they are and even better if shortages. So I added to some of my copper stocks today.

Good thoughts Lakedweller2. Yes, there may be some copper supply that now gets diverted from the US to other countries, so in a way, it will likely end up harming the manufacturing sector. I don’t see the advantages to the US to place 50% tariffs on incoming copper, when we need it for so many applications.

These questions need to be asked:

1. If tariffs are paid to the US Treasury, what is being done with the money.

2. If programs are being closed and people being fired “and appropriated funds already approved and sent to OMB”, have those funds been returned to the Treasury or used for some Executive Branch activity where the funds were neither Authorized or Appropriated”. (It’s a follow-the-money audit/theft -proper procedure)

The point being, who or whom benefits from a tariff, a closing/alteration to a program, a reduction in force etc “when funds were already appropriated or bypasses Congress in the authorization and appropriation process. If surplus appropriations are not returned to the Treasury then it could be a transformation from mis management claim to theft. (Food for thought)

Nvidia’s market cap went over $4 trillion yesterday. DT

I know it is a ways off, but I’m wondering about the deposit at depth. I know the first hole drilled near the bottom was a huge hit, but what does Andrew think of the “at depth” exploration timing, if at all before production.