Magna Mining – Comprehensive Exploration and Operations Update At The Producing McCreedy West Mine, Exploration Results And Initiatives At The Levack Mine

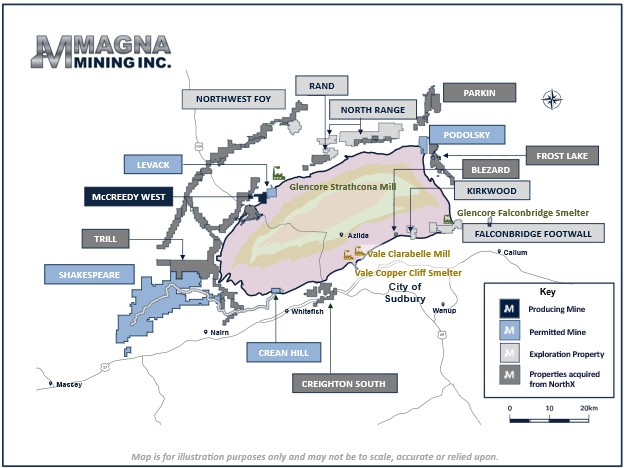

Jason Jessup, CEO and Director of Magna Mining (TSX.V: NICU) (OTCQX: MGMNF), joins me for a comprehensive exploration and operations update at their producing McCreedy West copper mine in Sudbury, Canada. We also review the ongoing exploration and development work at the Levack Mine, working towards and updated resource estimate in Q3 and mine restart plan by year-end for potential production in 2026.

We start off discussing the recent exploration results returning high-grade copper, nickel and precious metal intersections from an area located in the footwall, up-dip within the main 700 Cu-PGE Footwall Zone and within 150 metres of surface. The reported holes were drilled in support of production planning and potential production expansion into areas where narrow vein mining methods could be applied. Mineralization in this area contains high PGE grades hosted in copper and nickel rich veins. Intersections include 17.9% Cu, 0.6% Ni, 28.1 g/t Pt + Pd + Au over 1.8 metres in drillhole MMW-25-119 and 10.5% Cu, 8.3% Ni, 42.6 g/t Pt + Pd + Au over 0.3 metres in drillhole MMW-25-133. The underground diamond drilling program at the McCreedy West mine is supported by two drills and is currently focused on definition and expansion drilling in the 700 Zone.

Next we transitioned over to all the ongoing exploration focus at the past-producing Levack Mine, and we reviewed the initial assays from the near surface portion of the No.1 nickel-copper (“Ni-Cu”) zone, supporting the Levack Mine restart study.

Highlights from the new assay results include:

- MLV-25-21 – 2.3% Ni, 0.7% Cu, 0.3 g/t Pt + Pd + Au over 28.0 metres, including 6.6% Ni, 0.7% Cu, 0.6 g/t Pt + Pd + Au over 2.4 metres, and 3.3% Ni, 1.0% Cu, 0.5 g/t Pt + Pd + Au over 12.4 metres

- MLV-25-22 – 2.4% Ni, 0.8% Cu, 0.3 g/t Pt + Pd + Au over 15.5 metres, and 3.2% Ni, 2.2% Cu, 1.4 g/t Pt + Pd + Au over 1.9 metres

Jason outlined that in addition to the Keel Copper-PGE zone, initial mining from this zone could be accessed via a new ramp from surface which is being studied. The intersections reported are shallow at approximately 135-155 metres from surface and confirm Magna’s belief that there are significant areas of wide, high grade nickel mineralization at shallow depths remaining at the Levack Mine. There are currently two surface diamond drills operating at the Levack Mine, one completing near surface infill and metallurgical drillholes on the No. 1 and No. 2 and Main zones, and a second drill exploring the footwall environment between the No. 3 Ni-Cu Zone and the Morrison Cu-PGE deposit.

In addition to the surface diamond drills, an underground diamond drill will begin drilling at the Levack Mine within the current quarter, and a second underground diamond drill is expected to begin drilling in Q4. These drills will be focused on testing the area further downdip and on strike of the area below the No. 3 zone, as well as following up on the east side of the Fecunis fault, where historical hole FNX21200 intersected 33.4% Cu, 0.9% Ni & 23.9 g/t Pt + Pd + Au over 0.2 metres. This area is interpreted as potentially having a vertical vein system, subparallel to the Fecunis fault.

If you have questions for Jason regarding Magna Mining, then please email me at Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Magna Mining at the time of this recording, and may choose to buy or sell shares at any time.

Click here to follow along with the news at Magna Mining

.

.

https://www.tradingview.com/x/ZmfEkr2s/

HGRAF : Bottoming / Bottomed?

Shad getting a bunch of compliments on the Magna interview … on ceo.ca. + 1000 from that site. Magna opened in my OTC account up 15.5% but was immediately beat back. Shad’s interview helped in generating that positive response. Keep it up Korelin Report!

Much appreciated Lakedweller2. It is fun following along with Magna Mining as they have so many things on the go as a company and Jason did an excellent job laying out the value proposition and key upcoming catalysts.

Looks like some of the recent good news from some miners is giving managed money fits Pre-Powell speech. It sure looks like the sector wants to go up before they hear what he has to say.

SCZ earnings report landed today. The market likes it.

Indeed. SCZ up over 12% on the day.

That brought a smile to my face since it is my largest portfolio position. 🙂

Excellent!

I have been studying the volume of HG. There is a lot of interest, volume tells you that. The shorts have managed to knock the price down but Hg is still a very resilient stock it just keeps popping its head back up. This stock was due for a correction but it looks to me like there were a lot of investors waiting for this move and when it hit $1.43 CDN it started bouncing back, the fear of missing out was just so strong. I believe this is the real deal and there will be a lot of volatility along the way.

I am watching very closely for a spot to re-enter. Today I thought the stock showed strength in its recovery move. Tomorrow will be another interesting day. It looks like one of those Jesse Livermore moves where the smart money is buying back in. Everyday things change and it requires adjustment but the overall move seems very positive. These are just my assessments! DYODD DT