Santacruz Silver – Growth Strategy At The Soracaya Development Project, and Exploration Initiatives Around The Bolivar, Porco, and Zimapan Mines

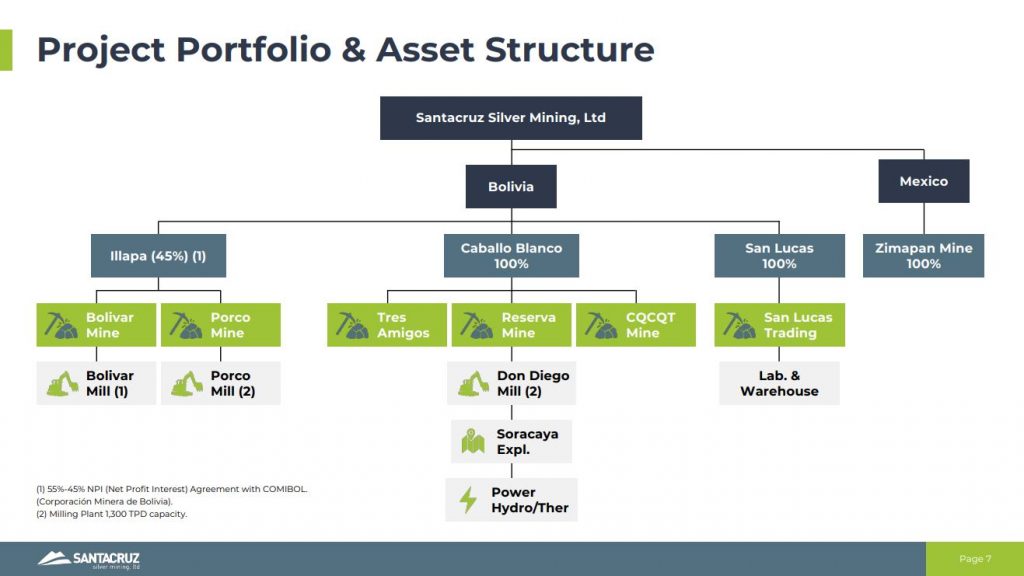

Arturo Préstamo Elizondo, Executive Chairman and CEO of Santacruz Silver Mining Ltd. (TSXV: SCZ) (OTCQB: SCZMF), joins me to focus on the growth strategy at the development-stage Soracaya Project, as well as the exploration upside and expansion potential around the Bolivar, Porco, and Zimapan Mines. Santacruz Silver operates 5 mines, 3 mills, and an ore feed-sourcing and metals trading business in Bolivia, along with 1 mine in Mexico, as an emerging mid-tier silver and base metals producer.

We kick things off with a review of the news out October 7th which announced the initiation of development activities and the pursuit of full production permitting at their wholly-owned Soracaya Project; located in the Potosí Department, Bolivia. These activities mark a key step toward advancing the Project to a production decision. With the preliminary mine plan in place and the permitting process underway, Soracaya is emerging as a cornerstone growth project for Santacruz Silver in Bolivia.

Soracaya is a high-grade, silver-rich project, featuring mineralization along reactivated faults with replacement and brecciated sulphides, geological characteristics typical of some of the world’s most productive silver deposits. Since 1999, more than 29.6 km of drilling across 90+ holes has provided extensive geological data, supporting robust resource modeling and preliminary mine planning.

Additionally, Glencore already put in the decline to access the high-grade veins, so there are some distinct brownfield site infrastructure advantages already in place. An internal study was completed by Glencore with an estimated capex of ~US$40MM for construction of a processing plant and tailings facility. Mine plan today envisions a roughly 12-year mine life with the idea to process about 850-1000 tonnes per day of material through the proposed mill. Arturo outlined that Soracaya’s high-grade resource, strategic location in Potosí, and synergies with existing operations and the teams experience as underground miners give them confidence in its ability to deliver long-term value for shareholders and stakeholders alike.

We also discuss the permitting process, along with the regional Potosí District and mining history, as well as the national election and constructive political developments inside of Bolivia.

Their team is now currently increasing exploration and development work around the Bolivar and Porco Mines in Bolivia, to expand resources and extend mine life. Arturo reiterated their philosophy of constantly exploring at each mine to reinvest in the future growth of the company.

Transitioning over to Mexico, we discussed the higher-grade 960 Level at the Zimapan Mine starting to contribute, and how this well-endowed mineralized zone will continue growing in their Q4 production profile from Zimapan for the balance of this year and for many years into the future.

Arturo also highlighted that with the strength of the balance sheet, with the final 2 payments to Glencore completed in September, and robust incoming revenues at these higher underlying metals prices. This gives them the optionality to review potential merger or acquisition assets if they are accretive and if their team can add value to those projects.

If you have any follow up questions for Arturo regarding Santacruz Silver, then please email them to me Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Santacruz Silver at the time of this recording, and may choose to buy or sell shares at any time.

For more market commentary & interview summaries, subscribe to our Substacks:

The KE Report: https://kereport.substack.com/

Shad’s resource market commentary: https://excelsiorprosperity.substack.com/

Investment disclaimer:

This content is for informational and educational purposes only and does not constitute investment advice, an offer, or a solicitation to buy or sell any security. Investing in equities and commodities involves risk, including the possible loss of principal. Do your own research and consult a licensed financial advisor before making any investment decisions. Guests may own shares in companies mentioned.

Click here to follow the latest news from Santacruz Silver

.

.

The US dollar and paper currencies in general used to be as good as gold because they were issued against gold reserves. But, for the last 55 years, the world’s shysters have been pretending that the USD is as good as gold even without gold backing. Consequently, US dollars are held in great quantities as the senior reserve asset around the world and other currencies are arguably issued against US dollars. Like Doug Casey said many years ago, if the dollar is an IOU nothing, then the Euro is a “Who Owes You nothing?”

SCZ rose enough today to backtest its broken H&S neckline and “618” Fibonacci fan line. If silver remains strong, maybe it will power through all resistance.

https://schrts.co/sYiTzdKR

Nope. Backtest then gap down. Textbook.

Avi Gilburt has warned that PM’s might’ve struck a long term top.

Avi……… “might”… not know what he is talking about…. “long term”… how long is long term.. 🙂

I think Avi is way too focused on price and nothing else. The metals are nowhere near a long term top.

I agree, & repositioning thru the bloodbath.

It’ funny how people get caught up in what the so called experts think, rather than weighing in with their own opinions after reading what others have to say. DT 😊

I added to Impact, Defiance and Kootenay today.

IPT finally reached its 200 day MA and might be completing a double bottom.

https://schrts.co/jtYhadSM

Re:Impact……zinc price climb being completely ignored????…. I know it’s still got silver but it’s zinc component must be profitable too now

Hi Matthew – I bought some Impact today too, but the weekly Bollinger Bands are still pretty loose so it seems like Impact might not go anywhere for several weeks yet. The weekly Ichimoku cloud also doesn’t seem all that supportive at this stage. Seems like Impact could drift lower while the bands contract. Granted the correction since the share offering has already lasted a few months so maybe time has done its job and it won’t be much more time before a bottom is in place. However, with Earnings not reported until the 19th next month I don’t really see any other news event to drive the stock until then. I hope I am wrong LOL!

Hi Charles, Impact might go lower but I bet it won’t allow the Bollinger Bands to close much before its next move up. The current setup is far better than the 2020 setup yet that 5x+ move began with the BBs even further apart. I just don’t see a protracted consolidation starting here.

https://schrts.co/FJDvhYUt

Coeur is down over 12 percent versus Impact today and appears to be putting in a double top.

https://schrts.co/RcIFPnck

GDX:GLD

https://schrts.co/tzhvHWeV

Gold is currently up $104.90 US. I guess America will have to print more currency to buy all those foreign cars, Hyundia, Subaru’s, Toyota’s, Honda’s, Nissan’s, Mercedes, BMW’s, Mazda’s And Volkswagen’s. The Emperor has no clothes and at some point foreign manufacturers will just say no to Uncle Sam’s currency. DT 🧨