West Red Lake Gold Mines – Commercial Production Milestone Achieved In January, With Ramp Up To Full Production In Mid-2026 And Further Growth Initiatives For 2027

Shane Williams, President and CEO of West Red Lake Gold Mines (TSX.V:WRLG – OTCQB:WRLGF), joins me to highlight the major company milestone last month of declaring commercial gold production at their 100% owned Madsen Mine; located in the Red Lake Gold District of Northwestern Ontario, Canada. Additionally, we discuss both the exploration and development upside to access new high-grade areas of Madsen, and also to incorporate the satellite Rowan deposit into the expanded growth in their production profile over the next couple of years.

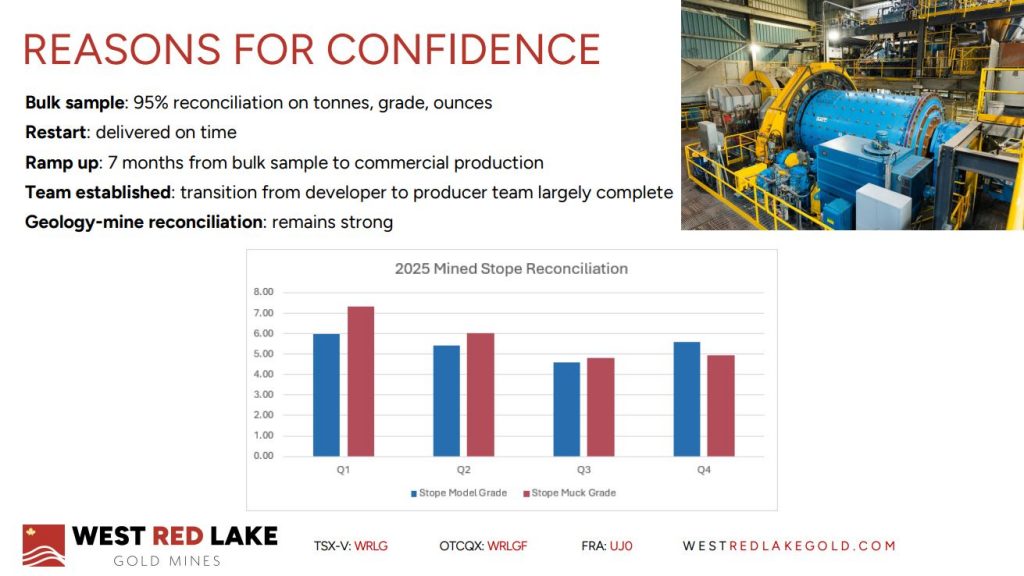

The Company announced on January 12th that the Madsen Mine achieved commercial production as of January 1, 2026. The mill averaged 689 tonnes per day (“tpd”) in December 2025. This represents 86% of permitted throughput of 800 tpd and meets the Company’s internal commercial production requirement of 30 consecutive days of mill throughput at 65% or greater of permitted capacity. Operational stability, the other internal requirement, is also in place at Madsen. Consistent strong mill recoveries, which averaged 94.6% in December, enabled production of 3,215 ounces of gold.

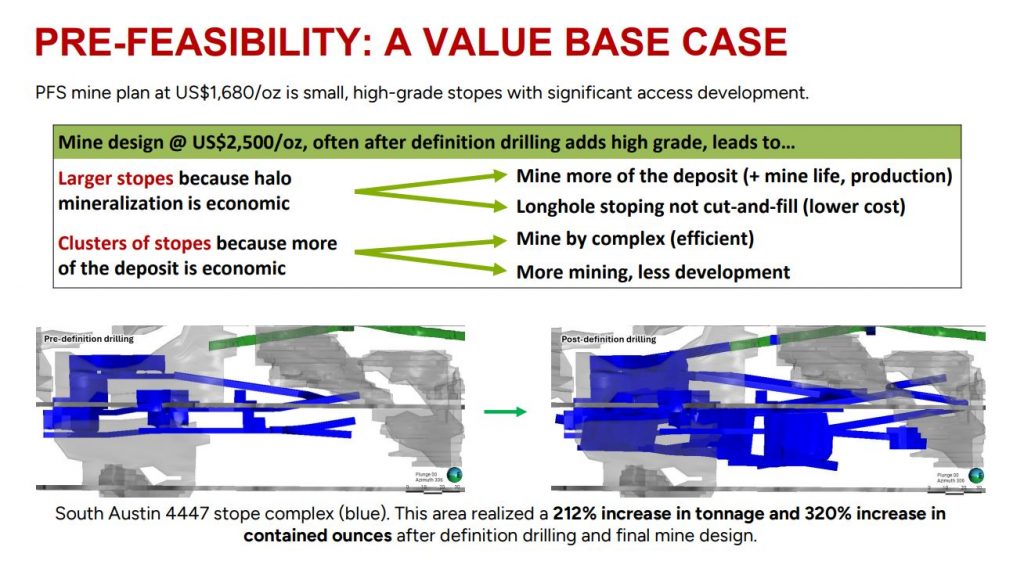

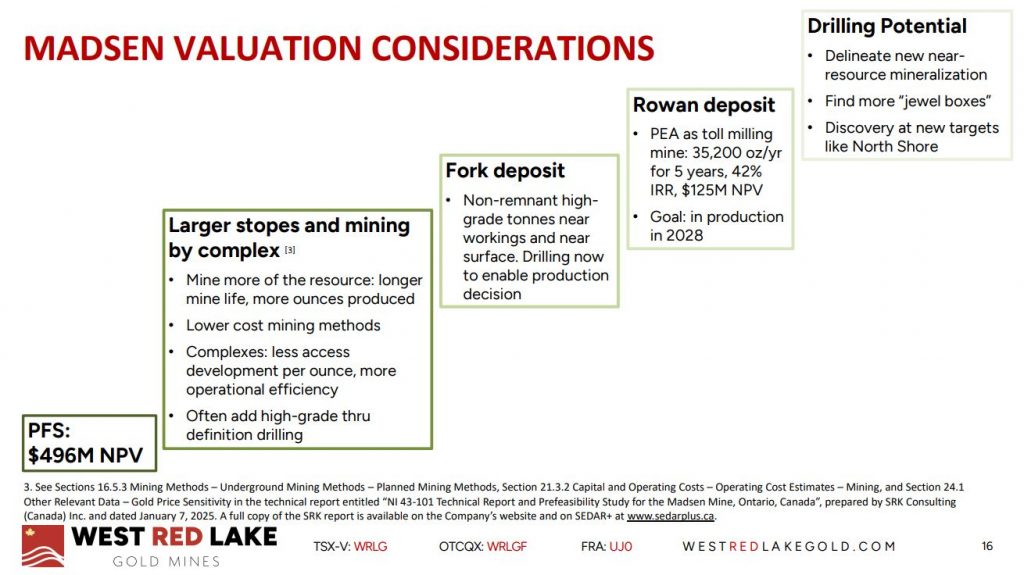

Shane outlines how diligently the operations team has worked to achieve commercial production only seven months after completion of the bulk sample. While they are not at full production capacity here in early 2026, the plan it to continue to ramp up from this strong base, and then reach sustained permitted capacity by mid-2026. For this first quarter (Q1) of 2026, the mill feed will come predominantly from the 4447 area, the high-grade zone in South Austin that the Company defined in 2025. Mill feed is expected to average in excess of 6 grams per tonne gold (“g/t Au) in Q1.

Next we review all the development work in their underground operations that led up to gaining the confidence mining at Madsen since the middle of last year, opening of stopes in multiple areas like Austin and South Austin in addition to McVeigh. Then we look ahead to other areas of growth like the new 904 high-grade zone in Lower Austin, the potential to drift over to Fork for 2027, as well as the potential to supplement mill throughput with ore from the satellite Rowan deposit in the next couple years. There has been ongoing drilling at these areas over the last few months which will continue moving forward, further defining the areas for expanded resources and future production growth.

If you have any follow up questions for Shane regarding West Red Lake Gold, then please email me at Shad@kereport.com.

- In full disclosure, Shad is shareholder of West Red Lake Gold Mines at the time of this recording, and may choose to buy or sell shares at any time.

Click here to follow the latest news from West Red Lake Gold Mines

For more market commentary & interview summaries, subscribe to our Substacks:

The KE Report: https://kereport.substack.com/

Shad’s resource market commentary: https://excelsiorprosperity.substack.com/

Investment disclaimer:

This content is for informational and educational purposes only and does not constitute investment advice, an offer, or a solicitation to buy or sell any security. Investing in equities and commodities involves risk, including the possible loss of principal. Do your own research and consult a licensed financial advisor before making any investment decisions. Guests and hosts may own shares in companies mentioned.

.

.

.

.

.

West Red Lake Gold Mines Inc (WRLG) Stock Forecast & Price Target

Advanced Equity Forecast – Investing.com

Overall Consensus: Strong Buy

4 Buy

0 Hold

0 Sell

Analysts 12-Month Price Target – Average $2.375 (+97.92% Upside)

https://www.investing.com/equities/west-red-lake-gold-mines-consensus-estimates

Shane Williams – President & CEO , WEST RED LAKE GOLD MINES

Global Business Reports – February 2026

>> How does West Red Lake’s development strategy reflect market dynamics?

“When we acquired Madsen in 2023, the gold market looked very different. Our thesis was that gold would rise, but we could not have anticipated that it would have risen this quickly. Nonetheless, our idea to reenter production quickly before slowly growing output over several years suits the current market well, because it allows us to produce while the price of gold is high. Entering production in 2025 has delivered excellent returns for our balance sheet and our shareholders. We held C$46 million in cash at the start of 2026, reducing the need for further equity raises on the markets.”

“While we have always maintained a relationship with retail investors, as we enter commercial production in 2026, institutional investors are also starting to demonstrate significant interest. Madsen, one of a handful of new gold mines entering production in Canada at this moment, is a very unique story. Capital is looking to back gold projects moving from development into production to capitalize on the favorable commodity price, and our market capitalization reflects this strong position.”

https://www.gbreports.com/contents/shane-williams-2/