Emerita Resources – El Cura Resources Continue To Expand At The IBW Project, And A Legal Proceedings Summary For Aznalcóllar

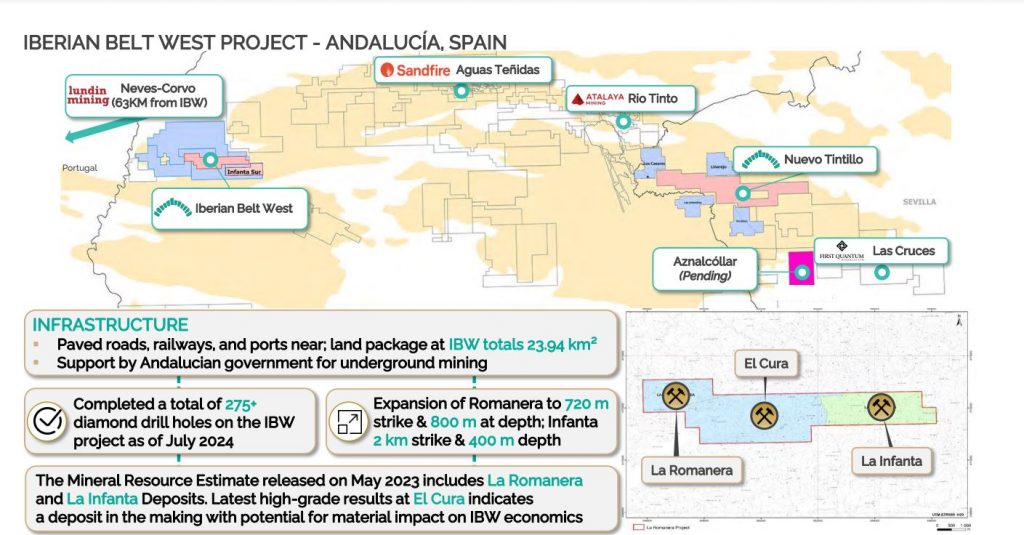

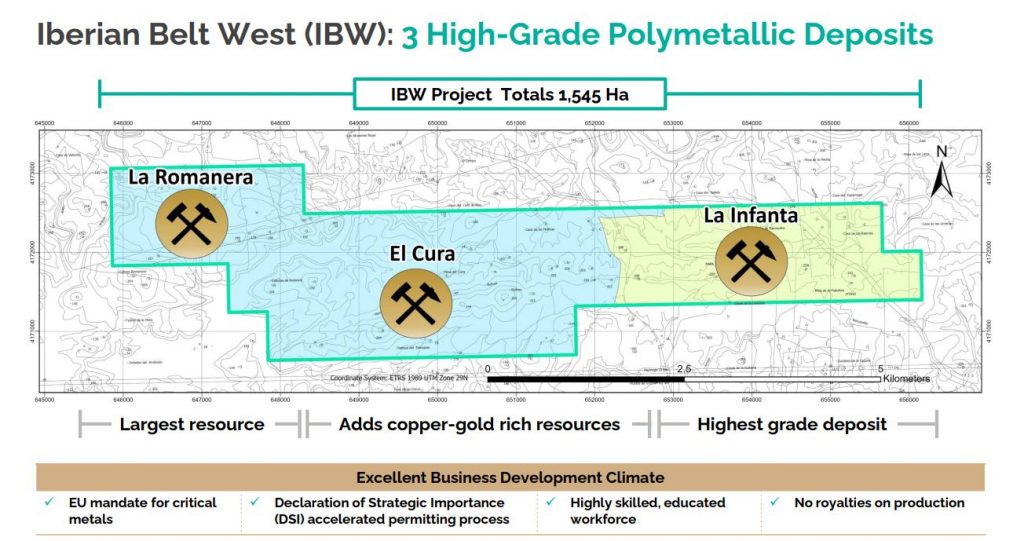

David Gower, CEO and Chairman of Emerita Resources (TSX.V: EMO) (OTCQB: EMOTF), joins me for a comprehensive exploration update at their wholly owned polymetallic Iberian West Project (IBW), located in southern Spain. The IBW Project includes three Volcanogenic Massive Sulfide (VMS) deposits: La Romanera, El Cura and La Infanta. We also get another update on the legal proceedings at the Aznalcóllar Project later in the conversation.

We start off reviewing the assay results from the latest batch of drill results at the El Cura deposit, announced on August 20th.

Recent results from the ongoing drilling campaign at El Cura include:

- Drill hole EC057: 3.1m grading 2.3% copper, 1.8% lead, 4.7% zinc, 2.21 g/t gold and 78.71 g/t silver, including a 1.9m interval grading 3.3% copper, 2.5% lead, 6.2% zinc, 3.13 g/t gold and 110.58 g/t silver.

- Drill hole EC062: 7.2m grading 1.0% copper, 1.4% lead, 1.9% zinc, 1.31 g/t gold and 60.10 g/t silver.

- Drill hole EC067: 16.9m grading 1.4% copper, 1.0% lead, 2.1% zinc, 0.93 g/t gold and 42.66 g/t silver, including a 3.1m interval grading 1.1% copper, 1.5% lead, 3.5% zinc, 1.46 g/t gold and 59.69 g/t silver.

- Drill hole EC068: 2.7m grading 1.3% copper, 1.0% lead, 3.2% zinc, 1.58 g/t gold and 46.59 g/t silver.

David outlines that the El Cura deposit has potential to significantly increase IBW resource tonnes with additional high-grade gold and copper mineralization. The Company has approved an additional 10,000 meters of diamond drilling at El Cura due to the results of the program to date which demonstrate the deposit remains open for possible expansion at modest depth. This drilling will focus on converting the previously delineated Inferred Mineral Resource Estimate to an Indicated Mineral Resource Estimate in support of economic studies, as well as extending the lower and western regions of the known resource.

El Cura is located in between La Infanta and La Romanera, but more closely resembles La Romanera metallurgically, returning higher gold values along with the base metals. David walks us through how each of these 3 deposit areas plays into the larger development strategy, where the earlier stage mining decline at La Infanta can now drift through El Cura on the way to the development of La Romanera, bringing in El Cura in as a future economic driver much earlier in the mining sequence. We discuss all the derisking work going on in the background building toward the Pre-Feasibility Study (PFS) later this year, as well as an update on the environmental permits anticipated to come in over the next couple months.

We wrap up with David summarizing that the Third Section of the Provincial Court of Seville has completed the hearings for the criminal trial on the alleged crimes committed during the process of awarding the Aznalcóllar tender. The hearings commenced on March 3, 2025 and were completed on July 15, 2025. The Trial judges, Angel Márquez Romero (President of the Court), Luis G. de Oro-Pulido Sanz and Carmen Pilar Caracuel Raya, will now prepare their rulings on the criminal allegations. The company is still awaiting further clarity on whether Emerita Resources will be awarded the high-grade polymetallic Aznalcóllar Project later this year, as the only other qualified bidder at the time.

If you have any follow up questions for David regarding Emerita Resources, then email those in to me at Shad@kereport.com.

Click here to follow the latest news from Emerita Resources

.

.

It is probably now heading for 85 cents Cdn. to complete a big ABC correction.

https://schrts.co/MKbvYPnc

Hi Matthew, have you bought any HGRAF yet. It became Jay Taylor’s biggest holding when he bought @ 16 cents. Then it soared to 2.70 and is 1.43 now. And Jay still likes it.

Hi Bonzo, no I haven’t bought any and won’t be buying any. I never buy after such moves. Remember NVO blasting to almost $9 in 2017? Hundreds of millions of shares traded after that top and now it is down 99%. That’s a tough lesson for those who “bought the pullback” or failed to sell on its way up.

Thanks for the interview. The interesting thing about Emo is not only is AZN a terrific piece of real estate for any mining company to own, but as time goes on…the criminal case has surfaced as a “statement about corruption” in Spain. During these times of questionable regulation of markets worldwide, the growth of the BRICS and the international pressures from autocratic regimes, the ruling in the Emo criminal case is “very important” just from the perspective of corruption among politicians and the wealthy.

Just on the face of things, the Administrative Court could have awarded AZN to EMO long ago as three levels of trial courts and appeal courts have determined that crimes were committed in “not” awarding AZN to EMO in the initial applications for the AZN property. AZN had been shut down for tailings issues. The government put it up for bids and the competition to EMO that got awarded the AZN property turned out to be a “shell company” that provided an application for the property “failed to meet the minimum requirements” for qualification for award.

EMO was the only “qualified” company applying and should have been awarded AZN years ago. Infact, EMO spent One Million dollars on a plan to reclaim the tailings property issue along with the application. Therefore, by the Spanish regulations, EMO was the “only qualified bidder”.

However, because of the “political and money interests” involved, a criminal process became necessary. During the trial, a lot of evidence was produced demonstrating a conspiracy of Elected Officials, Government appointed officials, Mining Executives, Media and peripheral participants who criminally participated to acquire AZN before, during and after the application for AZN.

Investors were concerned when learning that a “criminal trial” was necessary as the crimes were very visible. But as time has gone, it has become apparent that the involvement of “officials and Money interests” was so egregious that a legal record needs to be made for possible more criminal actions beyond just the award of AZN.

Patience has been required of investors, but in the meantime, growth of the EMO resource has been on-going identifying additional resources making EMO’s standalone potential very valuable by itself. So a ruling could come at any time as the trial is over and if one reviews the evidence alone, the Defense for the 16 defendants only amounted to “I didn’t do it”, which is totally contrary to the evidence. “I didn’t do it” or “some other dude did it” is only a defense in cases where the Defense has no evidence to dispute what witnesses and direct physical evidence portray.

Great comments Lakedweller2. Yes, the Aznalcóllar tender fraud case, became wrapped up in daylighting a whole lot larger corruption environment within the government of Spain, so it has been instructive in that sense. It is interesting that Emerita has attracted unexpected allies during this process that would not normally be cheering on a mining company.

Specific to Aznalcóllar all of the evidence seems to lead to the conclusion that fraud was committed by the government and the other bidder, which would disqualify them, and thus the project should be awarded to Emerita. Considering the shenanigans around trying to award a recent license to the initial bidder by more corrupt government officials, I’m still concerned about true justice being served here. There are likely a lot of higher up Spanish elites caught in the cross-fire using money, secrets, and their power to pressure people to not give the project to Emerita, but really hoping the judges make the right call here.

We’ll know the outcome in the next few months… until then, there is plenty going on at their IBW project.

It was a little concerning that one of the Judges in the criminal cases was offered a promotion before the verdict. I would assume that the offer comes from the government which is a codefendant in the AZN case as well as several others. It reminds me of how the SCOTUS had some “political appointments” in the US which proved to produce some rulings which are inconsistent with the Constitution. So yes, we still must wait on the AZN decision as the evidence is clear, the law is clear, the regulations are clear …but, none of those can prevent a decision contrary to all those if the person making the decision has another agenda in conflict with the law and lacks sufficient character, empathy and professionalism to rule with a democratic constitution.

https://www.tradingview.com/x/ho43n6We/

HydroFool : Beware Another Dump!

The CEO Is OK With Shorting!

All CEOs should be ok with shorting but it wouldn’t make a difference if he wasn’t ok with it.

She is OK with Canadian shorting!

Are you OK with naked shorting?

You said shorting the first time. That’s very different than naked shorting. No one should be ok with that criminal act.

Shorting without collateral (borrowed shares)

is an evil accepted in Canada. BDC

I don’t think it’s technically legal there either, Canada is just more lax when it comes to enforcement.

agree: No one should be ok with naked shorting.

https://www.youtube.com/watch?v=7M1Ce2epjGA

Matthew, you’re right. Lynch (and Taylor)

imply a lack of enforcement.

BDC, you should not buy into a stock like HydroGraph if you are worried about shorting. The stock went parabolic and it was shorted all the way up and all the way down. There was another short attack this morning but this stock quickly recovered. If you know why you are invested and you believe it is the real deal you shouldn’t be worried. The shorts are out there for sure but they will get their head handed to them. In the meantime I’m fully aware of what this stock has to offer and I have resumed buying taking an even larger position. If you feel nervous maybe you should consider EMO, Emerita Resources, or NICU Magna Mining. This stock is not for nervous nellies, widows, or orphans. If Kristin said she is okay with shorting what she is really telling you is that her company has the goods and she is confident of success. LOL! DT 🤣😊👌

The only thing that enervates me

is the ongoing acceptance of evil.

Furthermore BDC, I don’t know why you are buying Canadian stocks on the OTC, you get derivatives but you don’t get a stock. There is nothing more risky than buying derivatives. You don’t make sense when you worry about shorting but you must prove what you say. Where is your link? You realize that it is dangerous to make a statement about naked shorting without backing up your source. Nobody can hide behind a computer and make false accusations. They must be proved, they can find your IP number. You should be careful with your reporting. What evil, BDC you are making false accusations. DT

And again BDC, if you make false statements over the internet and you don’t have proof and the company deems that you have injured them they can take you to court. You better be careful about what you say. “LOOSE LIPS SINK SHIPS”. I am surprised at your behavior. I thought you were smarter than that. DT

BDC says, ” Their product is questionable. I can think of variations off the cuff, without much effort-all of them original at least to me.

By the way I share information, I don’t pretend to know something that I can’t share. That is such elitist BS. DT 🤣

BDC, are you a shill? DT

It is really foolish when posters do what BDC just did, listen to others on the internet and think that because you are reading something that someone else posted and taking it as fact without checking the validity of their remarks, that it must be so. The internet has a lot of truths and a lot of deceptions. I believe it is about 50-50. The trouble with most people is that they get their news from mainstream media, we here all know how reliable that is. But the internet is not 100% proof it has its flaws but it has to be treated as such.

When I asked BDC for a link to verify his belief that HG was being naked shorted he couldn’t provide one, and furthermore he hasn’t provided a link where he claims that Kristin Breure is okay with shorting. Now he has two strikes against him. Therefore because he is posting on the internet I refuse to believe what he says and therefore he has lost all credibility. LOL! DT

Naked Shorts are Killing Canadian Start-Ups! DT

DT, I don’t dance to your drummer. A few days ago you extolled that you were in-out-in-out of Hydro. No problem. It’s the way of trading, and keeps free markets flowing.

My criticism stands. Their product is very likely viable and useful, and a worthy addition for coming events; however, its uniqueness is questionable. I can think of variations off the cuff, without much effort — all of them original, at least to me.

None of this, though, is related to the question at hand: naked shorting ‘accepted’ in Canada, and a CEO OK with it. BDC

DT, please stick to the most current thread. Thanks. BDC

BDC, you created the thread with your mention of two types of shorting and now you are telling me to stick to the thread, that’s hilarious! DT 🤣🤣🤣

You quoted this thread. Enough. Tomorrow. BDC

DT: I just noticed you misquoted me. Please desist. BDC

[BDC says, ” Their product is questionable. …]

The gold sector has rid itself of a lot of doubters and is now ready to fly again.

https://schrts.co/HQJbqUjP

I love it when you talk that way…

Just over to the EMO ceo.ca board and reading “Kudos to Excelsior” for the interview of David Gower. Another great job by the Korelin guys. I should add that one of the compliments came from Doc Jones. You guys are on an “information roll”.

HydroGraph is back pulling “WHEELIES” in the mall parking lot! There always has to be a Show-Off in the crowd! LOL! DT 🤣👌😊