American Tungsten – Unpacking The Financing, Offtake LOI Signed With GTP, Ongoing Rehabilitation And Development Work At The IMA Tungsten-Moly-Silver Mine In Idaho

Ali Haji, CEO of American Tungsten Corp. (CSE:TUNG) (OTCQB:DEMRF) (FSE:RK9), joins me to for a financial and operations update on all the exploration, development, and rehabilitation initiatives underway; focused on bringing onshore tungsten mining and production capabilities to the United States through its derisked past-producing IMA Mine in Idaho.

Today on October 22, American Tungsten announced that, further to its press releases dated October 14, 2025, October 15, 2025, and October 20, 2025, it completed the first tranche of its non-brokered private placement for gross proceeds of C$16,770,510 from the sale of 6,500,198 common shares of the Company at a price of C$2.58 per Share (the “LIFE Offering”) under the Listed Issuer Financing Exemption.

We start off discussing this financing, the rationale for both the timing of it, and the subsequent repricing of it lower to gain better traction and confidence with incoming institutional investors. Most importantly, we get into what these funds will enable in terms of future value creation through the ongoing rehabilitation and development work at the IMA Mine.

Next, we discussed the Letter of Intent (“LOI”) signed back on September 20th with a prominent U.S-based offtake partner, Global Tungsten & Powders (“GTP”). Ali highlights that their agreement with GTP marks a pivotal milestone in their emergence as a leading domestic supplier of high-grade tungsten, now vetted by one of the largest tungsten processors in the world. This LOI not only affirms the robust market demand for more domestic supplies of tungsten, but also reflects the deep confidence their partners have in their technical capabilities and long-term vision to move from development into near-term production.

Then Ali expanded the ongoing IMA Mine Rehabilitation Progress:

- A total of 115 feet of the Zero Level access tunnel has now been successfully rehabilitated, measured from the portal entrance; with anticipated work on the zero level tunnel approximately 80% complete.

- Rehabilitation efforts are now within the heart of the main collapsed zone, currently estimated to span approximately 50 feet.

- At a September site visit the management team reviewed the Zero Level rehab work, the D Level underground workings, the historic tailings area across the road from the canyon, and the broader site area.

- The MSHA inspector expressed confidence in the site’s progress and praised the quality of work completed. A Radon measurement taken within the tunnel yielded a zero reading, affirming a safe working environment.

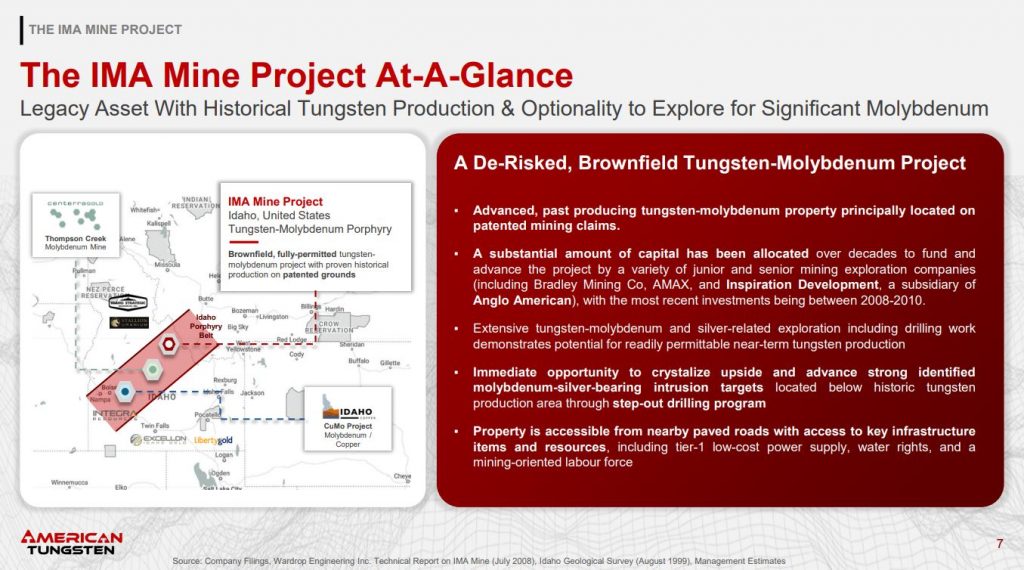

Zooming back to the project level, we shifted over to the tungsten, molybdenum, and silver resources in place and the infrastructure advantages of the IMA Mine as an advanced, past producing brownfields site, located on patented mining claims in Idaho. There has been a substantial amount of capital spent over many years to advance and build the project by various mining companies, including the Bradley Mining Company, Inspiration Development Co. (subsidiary of Anglo American PLC), and American Metal Climax. There is solid infrastructure including roads, tier-1 low-cost power supply, water rights, and a mining-oriented labor force nearby, which can help fast-track this project back into production, with a low capex anticipated to be ~$20 Million.

Ali reiterated that they are continuing to work closely with government agencies to build partnerships seeking to secure funding. He believes there is the opportunity to secure key strategic partnerships and non-dilutive financing with the U.S. Department of Defense, Department of Energy, and Defense Advanced Research Projects Agency, and mentioned that those discussions are underway and applications were previously filed.

This brought up the critical and strategic nature of tungsten as a defense metal, where the majority of tungsten supply is controlled by China, and why the US government is keen to develop supply chains outside of China which has placed export controls on this metal, and many other critical minerals. Tungsten is a necessary component in a wide array of defense applications, including but not limited to the production of ammunition, armored equipment, artillery, and space exploration.

There is planned drill program to expand the known tungsten, molybdenum, and silver mineral resources, and this will be utilized for an updated Resource Estimate, and the upcoming Preliminary Economic Assessment (PEA). The company will also be conducting a trial mining and bulk sample exercise, more metallurgical tests, and the company is now working towards the construction decision on a processing plant on-site, which is a change and upgrade to the previously envisioned direct ship ore (DSO) business model.

If you have any questions for Ali regarding American Tungsten, then please email those into me at Shad@kereport.com.

- In full disclosure, Shad is a shareholder of American Tungsten at the time of this recording, and may choose to buy or sell shares at any time.

For more market commentary & interview summaries, subscribe to our Substacks:

https://kereport.substack.com/

https://excelsiorprosperity.substack.com/

Investment disclaimer:

This content is for informational and educational purposes only and does not constitute investment advice, an offer, or a solicitation to buy or sell any security. Investing in equities and commodities involves risk, including the possible loss of principal. Do your own research and consult a licensed financial advisor before making any investment decisions. Guests and hosts may own shares in companies mentioned.

Click here to follow the latest news from American Tungsten

.

.

LOL…………. better have some gold…….. 🙂

MIC……. still in place… Trumpster big mouth has not done anything… IMO

HydroGraph Announces Up to C$20 Million LIFE Offering of Units

This capital raise by HydroGraph is coming at a well timed moment, this stock is running and there is a Depression/Recession on the horizon, it may soon be much harder to acquire capital for expansion. They now have $11.5 million CDN in the bank add in another $20 million and it gives the company a comfortable cushion. DT 👌👍🤣

Speaking of Almonty (from the interview above with American Tungsten)…. It looks like they are clearing the decks to do a capital raise; possibly in tandem with some kind of M&A deal or strategic position. Something to keep an eye on for the handful of US tungsten companies on the board.

__________________________________________________________________________________________

Almonty Announces Filing of Preliminary Base Shelf Prospectus Available for 25-Month Period

10/22/2025

“Almonty has filed the Preliminary Shelf Prospectus and Registration Statement to provide the Company with greater flexibility to access new capital going forward, but the Company has not entered into any agreements or arrangements to authorize or offer any Qualified Securities at this time.”

The US debt Clock is now over $38 Trillion. GO BABY GO! LOL! DT

Don beats Drums of War for Direct Action in Venezuela! This should help support the National debt.

https://www.msn.com/en-us/news/us/ar-AA1OXk3C