Americas Gold and Silver – Optimization Of The Galena Operations, Acquisition Of The Crescent Silver Mine, The EC120 Mine Ramp Up At Cosalá

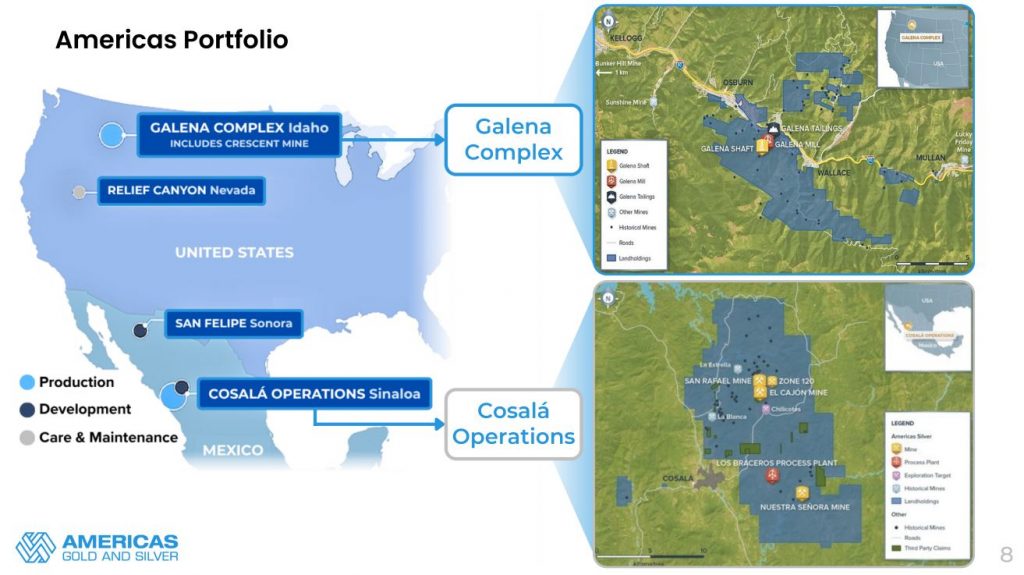

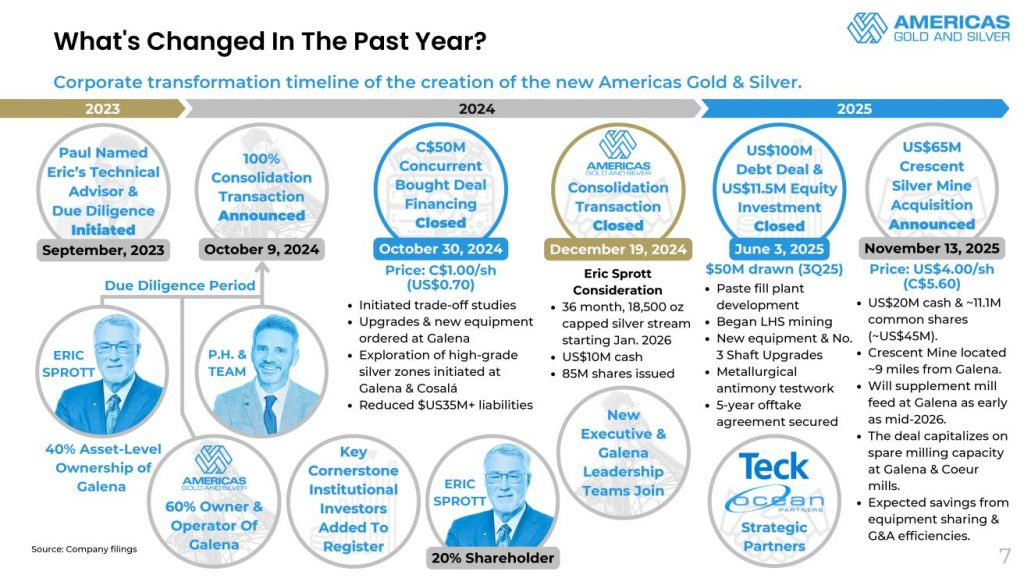

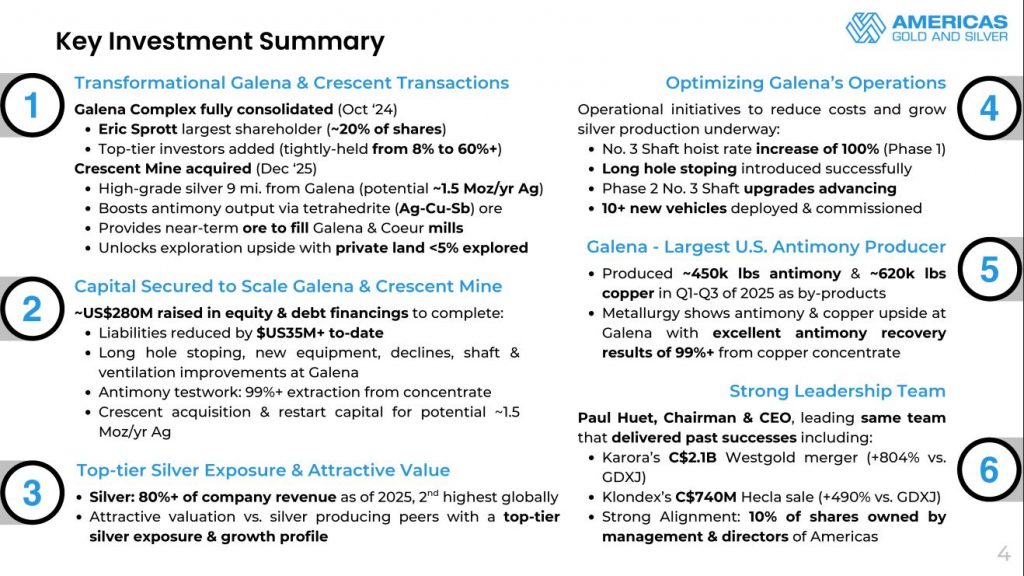

Oliver Turner, Executive VP of Corporate Development for Americas Gold and Silver Corporation (TSX: USA) (NYSE American: USAS), joined me for a comprehensive review of the several key optimization initiatives ongoing at their producing 100% owned Galena Complex, located in Idaho, USA; as well as at the EC120 mine at their Cosalá Operations, located in Sinaloa, Mexico. Additionally, we reviewed the news out today regarding the closing of the acquisition of the Crescent Silver Mine located just 9 miles away from their Galena Complex in Idaho.

We started off unpacking the multifaceted approach to optimizing their Galena mining complex this year, comprised of 4 shafts and 2 mills currently being underutilized, but setting up for a marked incremental increase in production growth over the next few years.

- The company has invested big in 2025 in a new fleet of mobile equipment to improve efficiencies and uptime.

- There is a 2-phase upgrade initiative for the hoist at the No. 3 Shaft, where the motor was upgraded to a larger more powerful one, increasing the amount of tonnes that can be raised each day. Additionally, there is a more advanced breaking system and communication platform that will be implemented in 2026 that will further increase the amount of ore that can be raised and run through the mill for processing.

- A key shift to from the ‘Cut and Fill’ mining method using hand held jacklegs, to a mechanized Long Hole Stoping mining method, which is far more efficient and still quite precise.

- Grade-driven growth, building upon future mine sequencing following up on the successful exploration at the 034 vein at the 5200 level and the 149 vein at the 4300 level.

- There is capacity at their 2 mills to accept larger amounts of throughput as mining capacity expands

- The incorporation of new management and operational personnel, building for the future.

Next we discussed the big news out today on December 12, that the Company has closed the acquisition of Crescent Silver, LLC, which owns the Crescent Mine in Idaho. The consideration under the Acquisition is made up of US$20 million in cash and approximately 11.1 million common shares of Americas Gold and Silver. The Crescent Mine is a synergistic addition located just 9 miles from the Galena Complex, and is a fully permitted past producing mine which will be advanced for a restart in 2026. The Crescent Mine will provide a supplementary high-grade source of feed to their 2 mills at Galena, further utilizing processing capacity. The mineralized material at Crescent is very similar to the tetrahedrite material at Galena which contains high grade Silver and significant by-product potential from antimony and copper, which meshes perfectly with their strategy to maximize the production value across all metals.

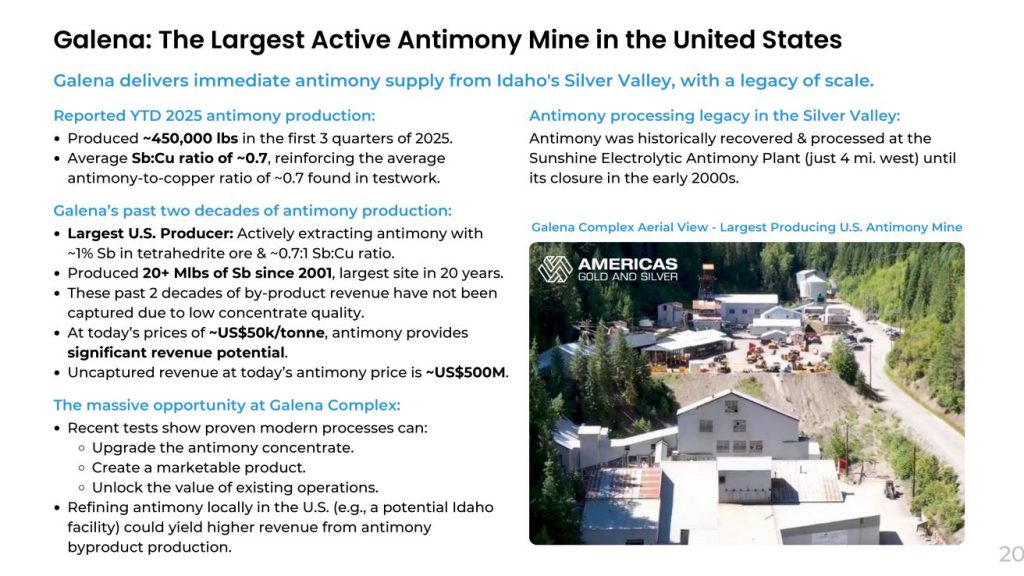

Throughout 2025, there has been very promising metallurgical testing, confirming high recoveries of antimony alongside strong silver and copper recoveries from ore currently being processed. Until recently the company was not getting paid for antimony or copper, but that will be changing in 2026 based on a new off-take agreement signed with Ocean Partners USA Inc. for treatment of up to 100% of the concentrates from the Company’s Galena Complex at Teck Resources Limited’s Trail Operations in Trail British Columbia; one of the world’s largest fully-integrated zinc, lead and critical metals complexes.

Next we shifted down to the Cosalá Operations in Mexico, with the operating San Rafael and El Cajon mines, which has been critical to getting the company through tougher markets over the years. The Company is investing in exploration to extend the San Rafael mine, and importantly tunneling over into a new area of the El Cajon mine called the EC120 mine, which will now see increased silver production in the years to come. This brought up the point that this company is one of the few North American silver-focused producers with the objective of over 80% of its revenue generated from silver in the year to come.

If you have any questions for Oliver regarding Americas Gold and Silver, then please email those to me at Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Americas Gold and Silver at the time of this recording, and may choose to buy or sell shares at any time.

For more market commentary & interview summaries, subscribe to our Substacks:

The KE Report: https://kereport.substack.com/

Shad’s resource market commentary: https://excelsiorprosperity.substack.com/

Investment disclaimer:

This content is for informational and educational purposes only and does not constitute investment advice, an offer, or a solicitation to buy or sell any security. Investing in equities and commodities involves risk, including the possible loss of principal. Do your own research and consult a licensed financial advisor before making any investment decisions. Guests and hosts may own shares in companies mentioned.

Click here to follow the latest news from Americas Gold and Silver

.

.