Craig Hemke – Focus On The Macro Not The Micro – Groundhogs Day On PMs Options Expiration

Craig Hemke, Founder and Editor of TF Metals Report, joins us to review how technical levels, sector sentiment, and macroeconomic data continues to drive precious metals prices. Craig also calls out real-time readings on options expirations as they play out live in both silver and gold.

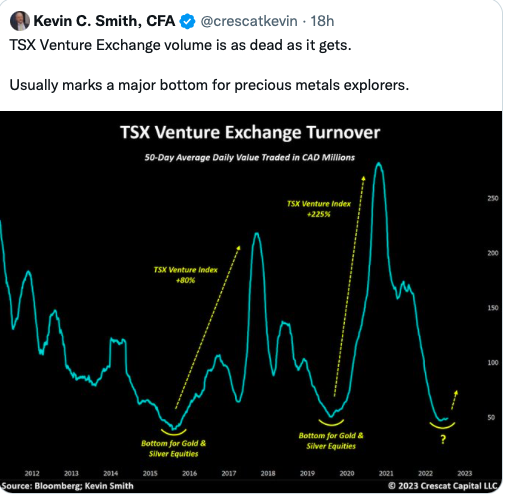

It’s a lively and candid conversation that gets into a number of key areas like Fed policy, the US dollar, interest rates, yield curve inversions, TSX volumes, pops in junior mining stocks, GDP data today, the coming PCE inflation data tomorrow, jobs numbers coming next week, recession signals, and more.

.

Click here to visit Craig’s site – TF Metals Report

.

Crescat Capital January Research Letter: Mispriced Inflation

Jan. 26, 2023

“In our view, inflation is the most mispriced macro variable in markets today. CPI growth is 5.1% higher over the last two years, but five-year forward inflation expectations are essentially unchanged. Based on our analysis, structural forces are likely to keep the annual growth rate in consumer prices elevated for much longer and substantially higher than currently priced into markets. If inflation remains stickier than policymakers are expecting, it has profound implications for the valuation of financial assets.”

“Impending recession is the consensus today, but most pundits are expecting it to be mild and few are expecting one that corresponds with high inflation. We agree that an economic downturn is likely, but we think it could be more severe in terms of market impact due to the re-acceleration of inflationary pressures. If we are right, general investor positioning is off.”

https://seekingalpha.com/article/4572864-crescat-capital-january-research-letter-mispriced-inflation

(SLVR) and (SLVTF) Silver Tiger Discovers New Wide High Grade Sulphide Zone Intersecting 6.0 Meters of 2,025.5 g/t Silver Equivalent Within 44.4 Meters of 720.5 g/t Silver Equivalent

Jan 25, 2023

https://ceo.ca/@accesswire/silver-tiger-discovers-new-wide-high-grade-sulphide

Sprott Equity Research:

“To recap, we liked the ability for Silver Tiger to mine along strike from the old El Tigre mine at developed / unmined Sooy. At the same time, we liked the ability to drift along the now well-drilled bonanza grade ‘Black Shale’ horizon. Today took us by complete surprise with second bonanza zone emerging, with double win of being essentially underneath the decline being driven in right now. In fact, unlike the typically narrower (but super high grade) Black Shale Horizon, broader hits on the new Sulphide Zone like 19.6m @ 624g/t AgEq (or 4.6m @ 1,551g/t AgEq based on narrower higher-grade intercepts) relative to shallower HW Gold Zone (21.3m @ 48.5g/t AgEq) and Sooy Vein (9.4m @ 355g/t AgEq) talk to not just grade, but big tonnage potential too. The new sulphide zone has been traced across ~150m now, with UG drilling to continue delineating mineralization north and south along strike. The new discoveries, and good progress on decline advancement are the foundations for production and are all being laid out nicely. For now, we maintain our BUY rating and C$1.10/sh PT, which is based on US$1.50/oz AgEq on the existing resource, and same again for a nominal 85Moz. Key price drivers remain (i) resource drilling at Sooy / El Tigre / Seitz Kelly for (ii) a maiden MRE in 2023 ahead of (iii) continued extensional and discovery drilling, and (iv) a potential PEA.”

FREAKY FRIDAY………………………… AGAIN……………………

What does that have to do with investing?

Not sure how to post back to you without being smart…. 🙂

I certainly do not want to cause any disagreements between us…. 🙂

Then let peace be with you!

Haven’t heard in a long time. Are you doimg well?

Today Fortuna(FSM) reported reduced reserves followed by a 5% hit to its share price. Apparently a guy from Roxgold, the previous owner of the mine, made a mistake. Freaking Fortuna Freaky Friday.

Hi Terry, I read something about Fortuna and investors about a week ago, but I wasn’t able to find a back-up for the allegations, mining is like we all know a very tough business, are you in Fortuna. I went back to re-read the same article however the content had been pulled but the headline remained. Strange! DT

Hi Again Terry, this is the article I read:

https://money.tmx.com/en/quote/FSM:US/news/6788579452363091/SHAREHOLDER_ALERT_Pomerantz_Law_Firm_Investigates_Claims_On_Behalf_of_Investors_of_Fortuna_Silver_Mines_Inc_FSM

This article you cited is related to a Mexican mine while the reserves reduction story comes from Yamamoko mine in Burkina Faso. I have LEAP calls which were in the money but now OTM with the shares falling today.

It would be in keeping with recent action if SLV was able to rally today and close the day back above $21.85–the 20 dma.

The daily BBs on silver are super tight. The expectation would be for at least one headfake–potentially dramatic–before a trend in the opposite direction takes hold. This will widen out the bands and give silver the room it needs to move.

However, I have a feeling this time for once, silver will just start moving upwards without having to create one or even two headfakes before an uptrend (or downtrend) takes hold.

The gold and silver ETFs are in established uptrends now. A stock like HL looks absolutely phenomenal, and is a buy on any weakness. I do own a decent position but unfortunately I own more EXK and AG, which don’t look nearly as good as HL at the moment–I wouldn’t say they are trending yet at all. EXK and AG have really messed up my perspective as I am still on pins and needles when I look at their charts.

There is an old saying in life that Bullsh#t Baffles Brains. If you are an investor, you must be a contrarian which means finding that diamond in the rough before everyone else sees the diamond mine. If you are an exploration company and you have great drill results you want to drive the investors to your project. Eventually the investors will come but it is much better for your company if you can get them there earlier, but you must understand the art of “The Bling”✨ called promotion. Few mine builders have this quality, but it is an important one often overlooked, a person who comes to mind in the mining business is Robert Friedland. There are others of course but even simple acts can draw investors to your project like identifying your business through the company name, newsletter writers, and investing sites like The Ker Report. Promotion is a necessity for people and companies who want to be successful. DT

It’s the art of pump and dump in the penny arcade. And then promoting the promise of future success.

Looks like BOIL may be getting ready to boil.

jon syl, pump and dump has nothing to do with what I was talking about, I wasn’t talking about venal, corrupt promoters of whom there are many, but as an investor there are a lot of traps in the mining business that we must understand. It is too bad that you missed my point, but you miss most points, not being able to discriminate between good and bad will make you a lousy investor. DT

Eric Nuttell, on oil, will be on BNN at 12:00 noon Eastern Time today.

Years ago had a short ride on the Painted Pony thanks to EN. Luckily I got bucked off early.

Catchy name..Dolly Varden is another one, among others.

I find him a little too bullish on oil before economic downturns but very informative.

Gold’s strength has been incredible. Every dip is being bid.

Dan Steffens better fire his weather man, he been pushing natural gas stocks last two months anyone following him loosing their balls.

The SOXX has killed SIL and SILJ in the last 2 weeks and it appears there will be upside follow through.

The uptrend in the ratio chart has been so prolonged and massive (the SOXX is up 25x vs SILJ since 2013!–talk about opportunity cost) it seems the trend is a tough thing to break.

Since interest rates peaked in October, the SOXX is actually up more than SILJ.

I hate to say it but AG is on the cusp of really breaking down vs silver. I imagine any real weakness in silver is going to send AG plunging.

SLV:AG is now higher than it was in September, despite silver rallying $5 since then!

Does AG actually mine silver?

Here is another thing to ponder:

My account is showing in the green +$172.

That would normally appear to be a good thing.

However I have a + 618.52 % error to the upside in Walker River.

That means I am in the hole … but algos merely try to keep

my account generally even. My conclusion is if there is an

account error, the algos will not know it and will continue to

neutralize the account.

I’ve posted versions of Kevin Smith’s chart for several months and the rubber is now finally meeting the road…

https://stockcharts.com/h-sc/ui?s=%24CDNX&p=M&yr=19&mn=0&dy=0&id=p96042722239&a=1269638499&r=1674860664824&cmd=print

I will be looking for it as my road rage is peaking!

Peter Spina | Gold Silver Maximalist @goldseek – 12:11 PM · Jan 25, 2023 – Twitter

“A few percent away from $2,000/oz. When Gold finally busts through $2,100/oz, you are going to see the start of a MASSIVE bull market in gold + silver stocks. Most miners could easily go up 3-5x+ from their recent lows (some have doubled already) while small caps can surge 10 X.”

https://twitter.com/goldseek/status/1618340690290937857