Christopher Aaron – Gold And US General Equities To Make All-Time Highs In 2024

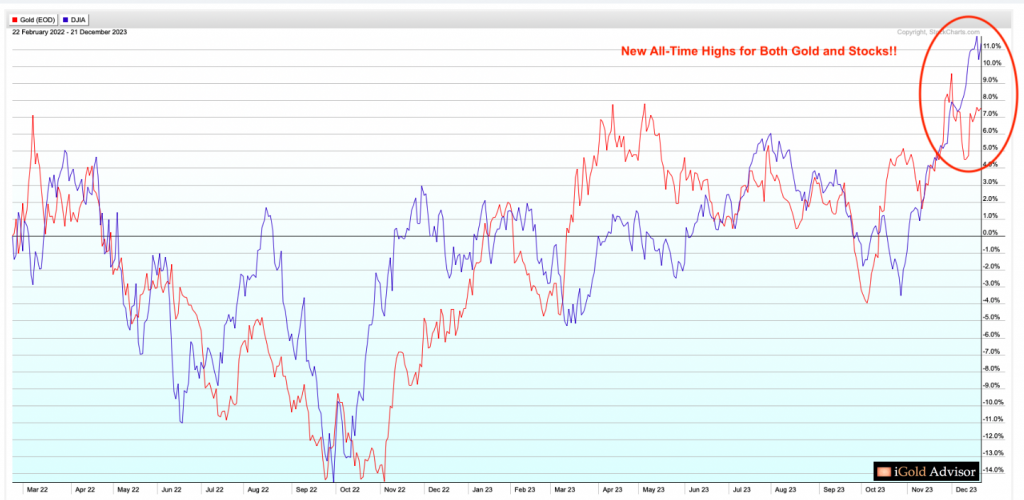

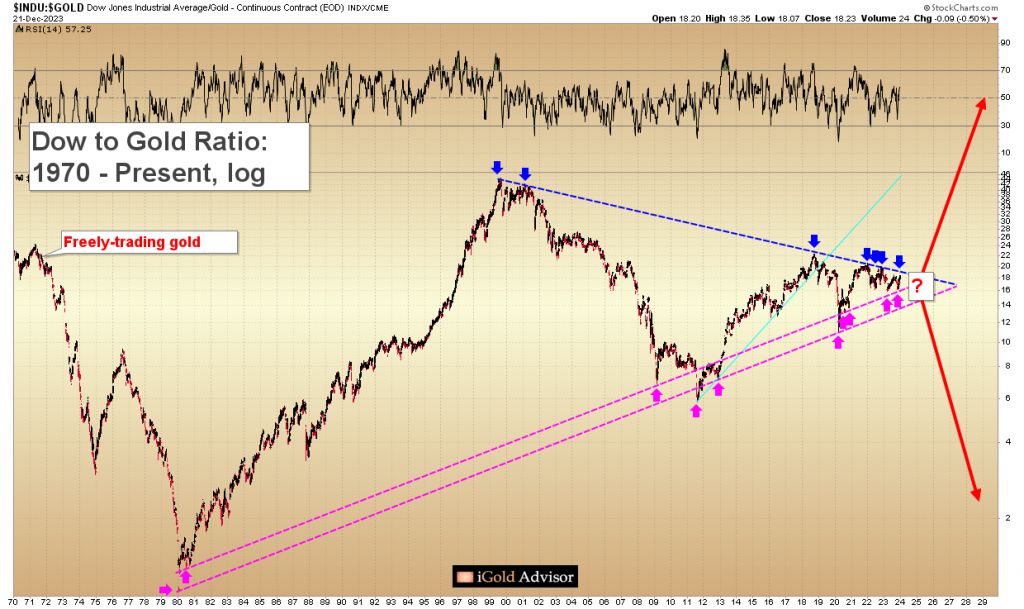

Christopher Aaron, Founder of iGold Advisor and Senior Editor at the Gold Eagle website, joins us to outline the technical set up behind why he believes both gold and US general equities will make all-time highs in 2024, but that only one of those moves will be legitimate and sustainable for the following decade. We start off looking at a chart showing the pricing correlation between both the gold price and the Dow index pricing. We further discuss the increasing correlation in pricing on a long-term 40-year Dow:Gold ratio chart; highlighting the large compression triangle it has been in for many years now. Christopher makes the point again, that this is the most important chart for all investors to keep track of, because it is getting ready to resolve in the next two years in one direction or the other.

Next we shifted over to short-term charts of the pricing action divergence we’ve seen in silver by way of the ETF (SLV) as a proxy ,versus the Global X Silver Miners ETF (SIL); as well as the divergence in gold by way of the ETF (GLD) as a proxy, versus the VanEck Gold Miners ETF (GDX). In both cases, even though these trends are only a few weeks old, Christopher expects to see more action like this of equities outperforming the underlying metals in the year to come. He wraps us up with why he feels a big move is coming in the PM stocks, especially at the tail-end of the rally to come over the next 1-2 years, where historically the equities and silver will put in their largest percentage gains.

.

Click here to visit the iGold Advisor website to keep up with Christopher’s market commentary.

.

Hi Lakedweller2 – Thanks for the update on alternating days in the portfolio.

I liked the message from Christopher in today’s interview that we are starting to see the PM mining stocks starting to diverge more recently and outperform the underlying metals price action again. Hopefully 2024 will be filled with days with more green on the screen.

Happy New Year to you and Cory and I can’t thank you enough for all the work you two do to keep us up to date on a daily basis. It is truly remarkable.

I am sure next year will be better but we are heading into no man’s land after so many years of intervention. It is very similar to “ one lie begets another” until the House Of Cards collapses. We can only hope to survive the burden they have shifted to the citizens.

Be that as it may, our agenda is not to be deterred by the crimes of others but go forward “Ever Upward”!

Thanks for those kind words Lakedweller2, and it’s nice to hear that all the hard work is appreciated.

Sometimes it can feel like we are just spinning our wheels in these low sentiment environment periods, but I also am looking forward to a much more constructive year in the resource stocks next year, especially in silver and gold stocks.

Ever upward!

Silver Price Breakout Alert

Christopher Aaron – iGold Advisor – December 15, 2023

>> For Impact Silver (IPT) shareholders:

Christopher Aaron, provides some good technical analysis on IPT later in the video linked above.

What Catalysts Will Drive the Gold Price As We Move Into 2024?

Vancouver Resource Investment – December 19, 2023

“Jeff Clark and Christopher Aaron provide their forecast for both gold and silver in 2024, including the main catalysts they believe will drive the price of gold up once again in the new year.”

00:00 Introduction

00:57 Gold Reaching All-Time Highs

06:40 Are Gold Miners Undervalued?

13:06 Precious Metals Sentiment

19:36 Central Bank Gold Buying

24:08 Forecast For Gold and Silver in 2024

31:16 Gold Stock Picks

I gave the full green light on silver many weeks ago and it was weeks before that for gold. The action since has backed me up. For example, someone here kept comparing this move to the countertrend move of last March which might have seemed reasonable based on of this SILJ chart. Compare the March or even the late 2022 rally to the current one:

https://stockcharts.com/h-sc/ui?s=SILJ&p=D&yr=1&mn=3&dy=0&id=p27803920439

Now compare those rallies when SILJ is priced in silver instead of dollars and be sure to compare the indicators as well (like RSI and MACD):

https://stockcharts.com/h-sc/ui?s=SILJ%3ASLV&p=D&yr=1&mn=3&dy=0&id=p57137691265

Momentum in silver had spoken before the current bullish divergence existed which is why the divergence happened. The tide has turned and the market knows it so the miners are understandably outperforming the metals that they mine. Silver is still over 7% away from its high of 2 weeks ago yet the silver miners, SIL and SILJ, have already eclipsed their highs of 2 weeks ago by around 5%.

As is typical of a new bull market in the gold sector, the Canadian dollar is launching its own bull market.

https://stockcharts.com/h-sc/ui?s=%24CDW&p=W&yr=3&mn=7&dy=0&id=p94704874323&a=443833933

Today might’ve been the top for SIL vs FNV, at least for awhile.

https://stockcharts.com/h-sc/ui?s=SIL%3AFNV&p=D&yr=1&mn=5&dy=0&id=p04109858518&a=1555190682

IPT’s low this month was still roughly 450% above its December 2001 low BUT priced in the best real money, gold, this month marked an all-time low. And priced in the metal it mines and number 2 money, silver, this month marked its second lowest low at just a hair above the 12/2001 low. In order to match IPT’s real all-time high of 2006 (that means priced in gold), it would have to rise about 4,000% from today’s close. However, it’s for better reasons than IPT’s real past performance that I am more bullish than C. Aaron.

I couldn’t disagree more.

1.) The herd will always be as dumb as it ever was.

2.) All miners are “specs at best” and Impact is among the best in its class. As I’ve pointed out repeatedly Impact has diluted investors far less than most and the big dilution this year was completely justified.

3.) Fred has been the exact opposite of your assessment of him. It would have been idiotic to grow their operations materially during a brutal bear market given their properties’ ore grades. Fred has in fact done a stellar job at keeping the company in great shape and investable.

As mentioned on page 8, the company has the ability to ramp up production when the price of silver rises and you really should read page 14 too.

Plomosas was brought back into production on time and on budget because management is more than competent.

I find it telling that you’d own it at all considering your opinion of Fred. If I held your opinion I would not own a single share let alone my 7 figure quantity.

Btw, any investors that are “more educated than ever” about silver know that it must rise a lot from the current level and that such a rise would be extremely good for a company like Impact.

Nope not a millennial but I thought that you might be one for a few reasons.

Btw, do you know of a Mexican silver miner that grew its operations to your liking over the last decade and also avoided falling 80 to 90 percent since its 2011/12 top?

PAAS. Perfect. That’s one of the biggest “silver” miners in the world with globally diversified assets and more revenue from gold than silver yet it still fell 86% following its 2011 top. Yes, it is currently up more than 3 times since bottoming 8 years ago but that’s mostly attributable to its serious gold production as well as its size (“economies of scale”) and political diversification including diversified currency risk. Not only does PAAS mine more gold than silver but it has more gold than silver in the ground.

When you look at companies that are much more reasonable alternatives to IPT (i.e., small producers in Mexico) you’ll find that few if any bucked the bear market in any material way. EXK for example is much larger than IPT yet it still fell 92% following its 2011 top. The fact is, the market dictates the choices that are available to management teams and I am glad that IPT chose to weather the bear market rather than risk getting itself into trouble with massive dilution and debt on unfavorable terms to expand operations at a time when silver was hardly worth mining.

Today the wind is at IPT’s back and it remains uniquely capable of delivering explorer level gains during a bull market while also limiting risk due to its cashflow from production which will improve greatly with Plomosas.

On dilution, I’ll repeat the point I made before. Coming into 2023 there was less than 150M shares out after 30 years and NO consolidations. Few if any similar miners out there can show a similar record of restraint. Whether you like Plomosas or not, the financings/dilution this year made sense. I’ll take their approach over debt any day at least until they are much bigger.

I don’t know what a major nickel producer has to do with this conversation

You’re welcome to invalidate my claim. You can look up the info just like I can. On comparing oranges to oranges that’s probably only possible to a degree since there probably aren’t any companies just like IPT. Yes it’s a producer but I’d bet that most speculators by it first for its exploration potential and view the production as a nice perk to help keep financings down, and it has done exactly that. Look at explorer Defiance Silver for example. It began around 2009 but had no volume to speak of until it picked up some property from IPT about 5 years later. So it was basically a shell until around 10 years ago yet it now has more shares out than 30 year old IPT. And I’m not knocking DEF because that’s how these juniors must operate and I’ve seen far worse dilution from others. My point remains that IPT is among the best when it comes to dilution and the timing of their financings. The bear market did necessitate some financings because it brought some lean quarters to the company’s operations so financings were needed in order to keep exploring and avoid putting all their mines on care and maintenance and laying off a lot of workers. They did have to “mothball” one mine but it will be back when the time is right and since IPT is the largest employer of the remote town’s people near its operations (and other reasons) it was a good move to keep producing. The company has never had a single problem with its workforce that I’m aware of unlike most Silver miners in Mexico. There’s been no strikes and their relationship with the federal government seems as positive that of the local government. These days more than ever that’s a good thing.

EXK sports ten times the market cap of IPT and it just opened a $120M line of credit and then announced a $60M share offering. Last year it raised about $50M. In 2020 it raised about $83M. Not long after the bottom of the gold bear market, it raised $56M and just before the bottom it raised $16M. That’s a lot of paper yet today I like the company and own it.

I’ve traded Avino but it’s been years. For the bull market that’s starting now I would rather own many others or SILJ, which is up 350% vs Avino since early 2016…

https://stockcharts.com/h-sc/ui?s=SILJ%3AASM&p=M&yr=9&mn=7&dy=0&id=t9372330201c&a=1565315074&r=1703709709163&cmd=print

Intervention Report:

I was up +4.07% today … but after subtracting out the OTC error on yesterday’s close, I ended up -$31.00.

Some up and some down for month 24.