Encore Energy – Introduction To A Growth-Oriented Uranium Producer Operating In The USA

William Sheriff, Executive Chairman for enCore Energy (TSX.V: EU) (Nasdaq: EU), joins us to introduce this growth-oriented uranium producer with operations in South Texas, and further development projects in Wyoming, and New Mexico.

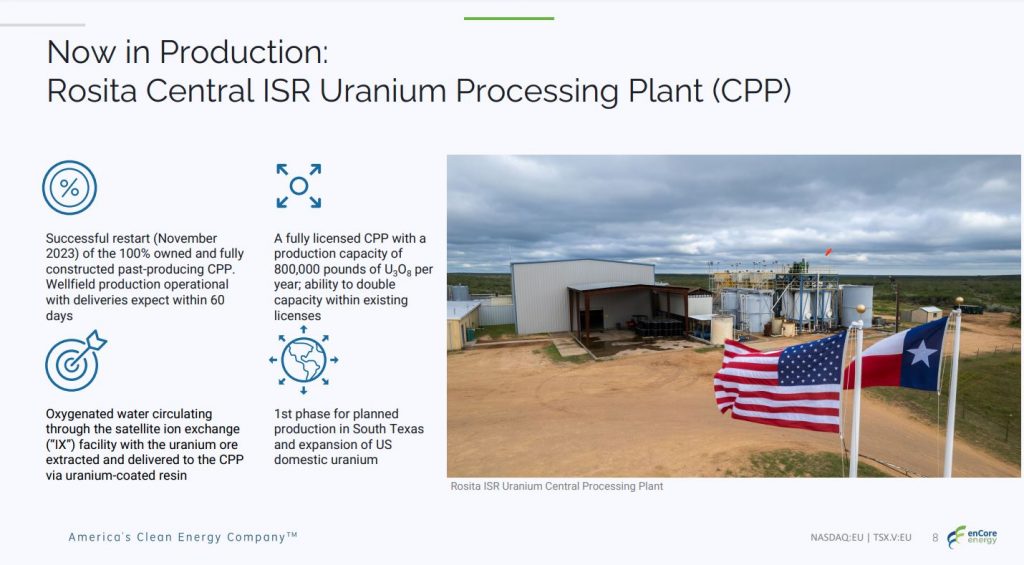

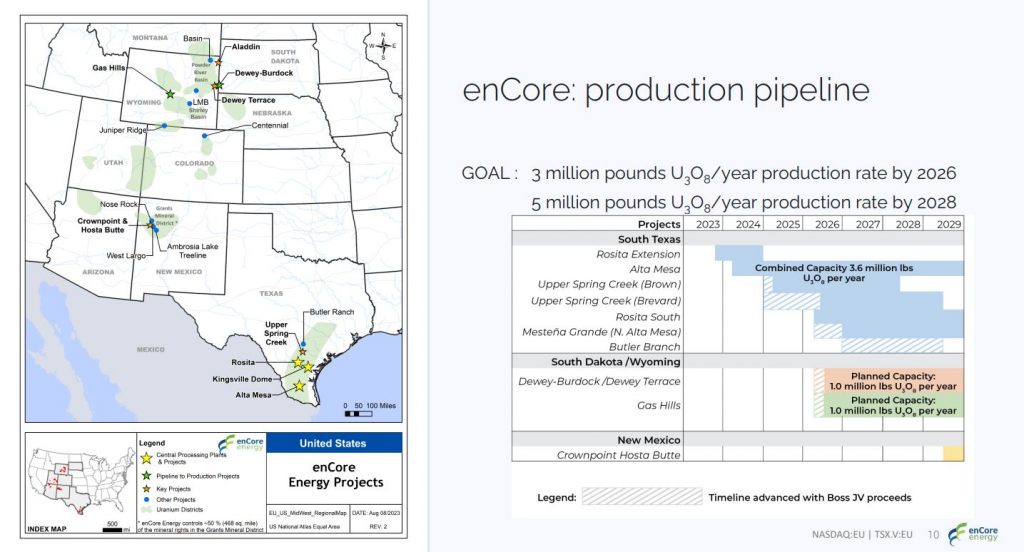

We start off getting a breakdown of how the production will be ramping up at the producing Rosita processing center, and the plans for Alta Mesa to move into production later in 2024; and then how they’ll continue to grow in 2025 and 2026. There are also a handful of satellite deposits in South Texas like Upper Spring Creek (Brown and Brevard), Rosita South, N. Alta Mesa, and Butler Branch, that will feed into the production profile over the next few years.

Next we had Bill outline the development opportunities in Wyoming at the Dewey-Burdock and Gas Hills projects, as the next prospective area for production growth a few years out, with a very favorable permitting environment in place. Additionally the Company has substantial uranium mineral reserves at multiple projects in New Mexico, further out in the development pipeline.

We wrap up having Bill review the pedigree of the management team and board of directors, the debt-free financial strength of the company, share structure, break down of key shareholders, and the investment the company is making into new technologies.

If you have any questions for William about enCore Energy, the please email us at either Fleck@kereport.com or Shad@kereport.com.

*In full disclosure, Shad is a shareholder of enCore Energy at the time of this recording.

.

Click here to follow along with the company news at enCore Energy

.

William Sheriff of enCore Energy Corp. (EU) presents at Metals Investor Forum

MIF – January 19-20, 2024

Justin Huhn – Cameco Drama, Uranium M&A, Egregiously Valued Stocks | Uranium Insider Interview

“In this conversation, we talked about Cameco focusing on expanding their tier one assets like Cigar Lake and MacArthur River. Justin also expressed confidence in higher uranium prices in future contracts, but he also highlights the constrained supply and the need for uranium production ramp-ups to balance the market.”

“Justin also mentioned that if the uranium bull market lasts longer than 24 months, there will be a lot of M&A. He also talks about the importance of looking at pounds in the ground for valuation metrics in a bull market.”

“Justin told me that there are a few companies that are egregiously valued. More specifically, he thinks some of them are unlikely to ever produce. And even if they do produce, it’ll be minimal.”

https://youtu.be/kJbqCGD9ILQ