Faraday Copper – Recap Of Phase 3 Drilling Building Into An Updated Resource Estimate And PEA – Upcoming Phase 4 Drill Campaign Initiatives

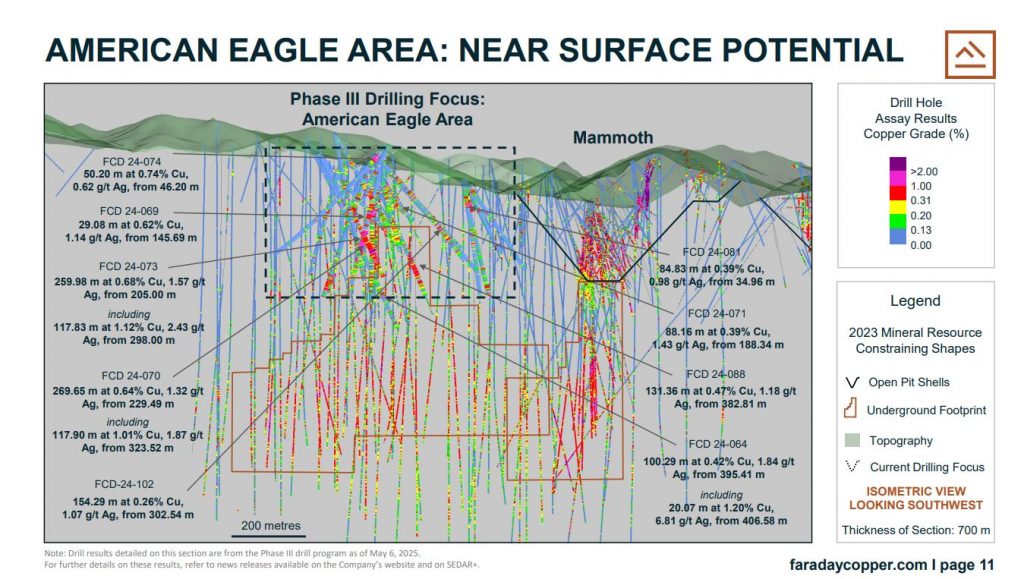

Graham Richardson, CFO of Faraday Copper (TSX:FDY – OTCQX:CPPKF), joins me to provide a comprehensive exploration update recapping the key milestones and discoveries from the 30,000 meter Phase 3 drill program, that is building into an updated Resource Estimate and more advanced update to the Preliminary Economic Assessment (PEA) due out in September. Then we dive into the strategy and objectives for the upcoming 40,000 meter Phase 4 drill program, with a continued focus on defining, expanding, and testing new target all around the American Eagle Area at their 100% owned Copper Creek Project in Arizona.

The Copper Creek Project already has a 4.2 billion pound copper resource, and will be expanding as the drill results from the prior Phase 3 program are incorporated into the updated Resource Estimate, where it is anticipated to have a healthy portion in the indicated category. With regard to the updated PEA, Graham highlights how much geotechnical and metallurgical work will be incorporated, making it a much more advanced PEA, and this is why the work programs after it is released will springboard over the PFS and go right into the Feasibility Study for 2026.

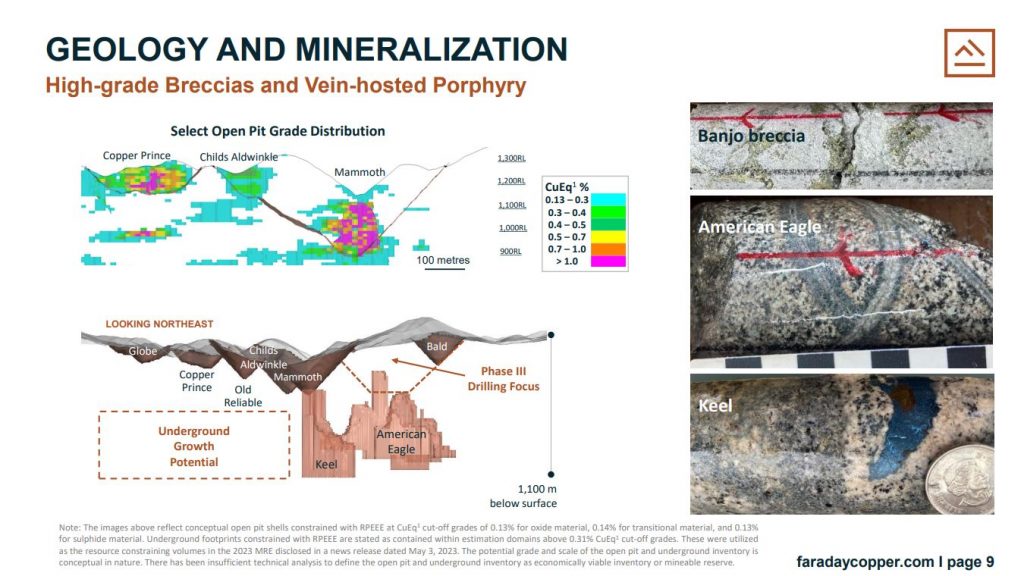

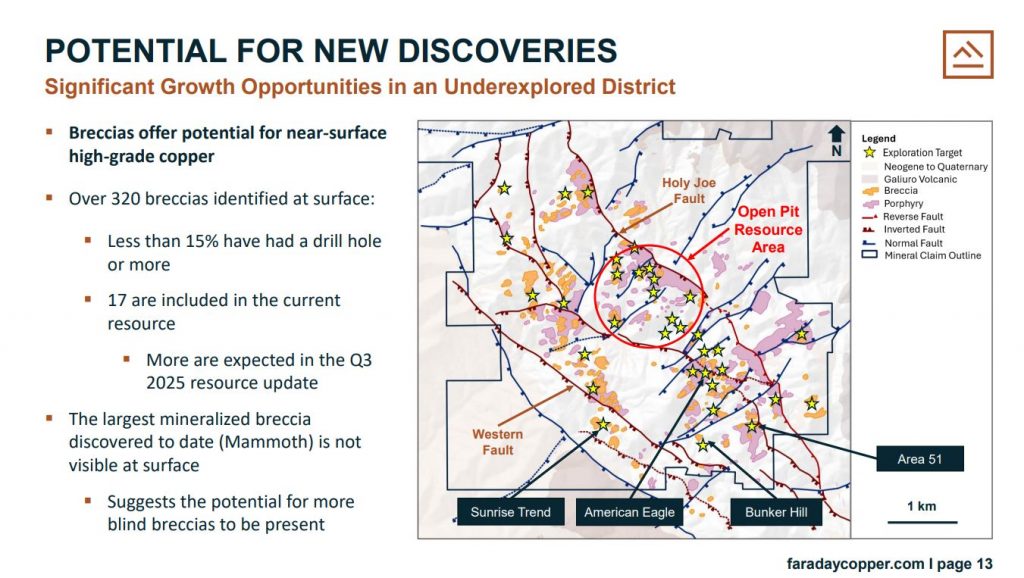

Graham and I discuss a number of the new discoveries made in Phase 3 at the new Banjo Breccia discovery, and recently discovered Winchester breccia, in addition to putting some holes into earlier-stage exploration targets at Old Reliable, the Sunrise Trend (which may indicate the presence of a new porphyry system), and at Horsecamp. There were some holes in Phase 3 that targeted near-surface supergene copper mineralization with the goal of better understanding the distribution of oxide mineralization. Five holes were drilled near the Globe breccia and two near the Copper Giant breccia. There will be more follow-up on this near-surface oxide mineralization as part of Phase 4.

In addition to expanding mineralization, testing new breccia targets, and infilling the American Eagle area in the upcoming Phase 4 drilling, there still will be some further definition holes drilled down into the deeper porphyry targets at the American Eagle and Keel deposits to better understand the geological controls and mineralization.

The company is well cashed up to complete all these work programs after announcing the closing of the CAD $49Million financing on July 29, 2025. Graham also unpacks the strong roster of shareholders including the Lundin Family and Murray Edwards, as well as a number of institutional investment firms. We wrap up discussing the infrastructure advantages and positives of operating in Arizona as a jurisdiction.

If you have any questions for Graham regarding Faraday Copper, then please email them to me at Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Faraday Copper at the time of this recording, and may choose to buy or sell shares at any time.

Click here to view the latest news from Faraday Copper

.

.

Warren Buffet? That dummy you derided for having all that cash?

Hi DT. I like Faraday as well, and it seems that they are still flying under the radar with most investors, especially those that claim that they would love to find some good domestic North American copper stocks, but can’t find any… (Huh?)

There are plenty of compelling domestic copper stocks…. Arizona Sonoran is my favorite copper developer, and Magna is my favorite up and coming copper producer, but Faraday is pretty solid and continuing to expand significant copper resources in Arizona… the best state for copper in the USA. then other domestic copper stocks are Surge Copper, Northisle Copper, Power Metallic, Metallic Minerals, Vizsla Copper, etc… etc…. plenty of choices in the US and Canada.

You’re correct that the longer-term “buy and hold” type of investing is not a good fit for the cyclical commodities sector and the even more volatile resource stocks…. the vast majority of them are trades, be it PMs, oil & nat gas, copper, uranium, lithium, whatever…. Sure there are windows of time where holding a stock a year or two or even a few years may work in special cases, but most stocks or ETFs offer multiple trade setups per year, where folks can buy the dips and sell the rips.

Wishing everyone here at the KER good trading!

The US imposes tariffs on one kilo gold bars. This is getting really interesting! DT

Yeah, I saw that on the 1 kilo gold bar tariffs. Wild times!

Gold is blasting higher maybe the tariffs are responsible. Do You Think? DT

We’ve never seen anything like this in recorded History! Jim Rogers DT

I like Faraday copper, I have it in one of my portfolios as a watch stock. I sold out my Hydrograph today because it looks like it will correct more, but I will get back in at some point. HG has been a Real Ripper! A 5 bagger gain in three weeks is nothing to sneeze at.

I also bought some Talon today but I don’t expect to see such huge gains. Stocks that show volume get my attention and now Talon is in the crosshairs. It is starting to look parabolic but I like parabolas because you know they reach an exhaustion point and then they correct. Buy and Hold has never been successful for me only a few investors like Warren Buffet, have the insight to stay the course but in this market he has opted out. This is a traders market delight in resource stocks. DT