Craig Hemke – Precious Metals Retracement After The Short Squeeze – What’s Next?

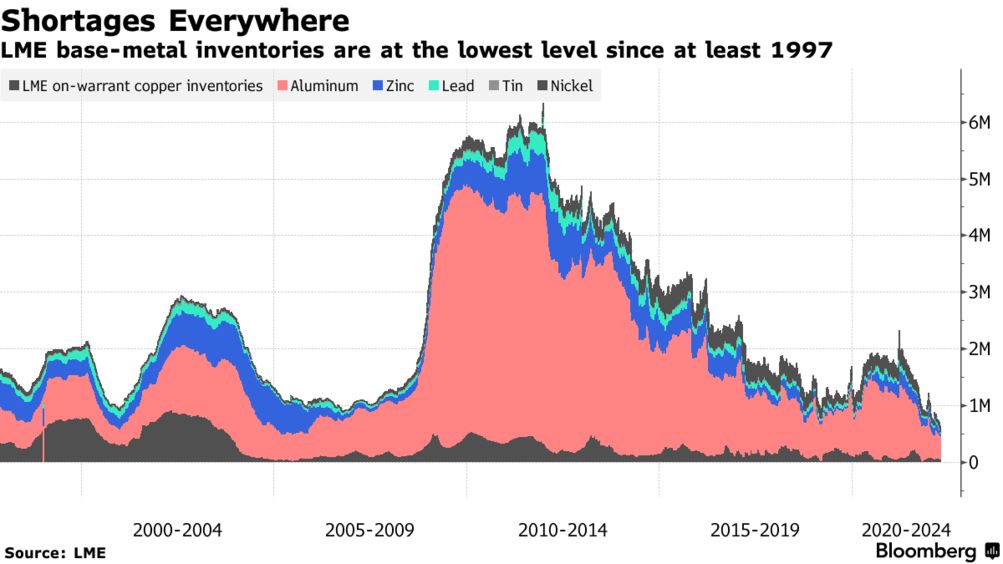

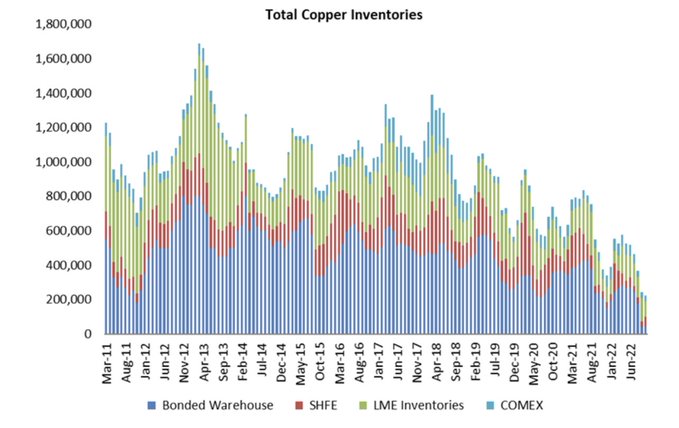

Craig Hemke, Editor of TF Metals Report, joins us to review the retracement of Short Squeeze Number 4 from last week, and the macro factors coming next moving into year end. The discussion expands into a number of areas including options expirations next week, the December Comex contract popularity, trends in real interest rates in relation to how they are calculated specially versus inflation expectations, potential changes in bond buying, the inverted yield curve, US dollar weakness, what a Fed pause would mean next year, the underperformance of the junior mining stocks relative to the metals, and the lower supply of base metals.

.

Click here to visit Craig’s site – TF Metals Report

.

Haha! Yes, Lakedweller2…. There is always next year…

You heard me give Craig a hard time about that in last week’s segment, and then he mentioned that again in today’s editorial, but called himself out on it. (he always cracks me up with his rants and side tangents).

To his point though, there really are a lot of things culminating into 2023… [Fed ending rate hikes, China Reopening, the resolution of if the dollar will keep breaking out or start breaking down, some kind of resolution with the Ukraine/Russia conflict, potential for full on recession or a deflationary rout, continued energy crisis, and so many things that nobody can even imagine yet…].

As Ed Sullivan used to say… “It’s gonna be a Really Big Show…”

Sullivan had the champ Sonny Liston on the show one night displaying his massive bicep. That was a really big muscle.

Ex: You left out a continuation of the resolution of junk crypto and the associated Ponzi schemes.

I saw where losers on FTX were starting GoFundMe pages in order to get their money back. You

going to join in?

Banking Giants And New York Fed Start 12-Week Digital Dollar Pilot

By Lananh Nguyen – Reuters – November 15, 2022

“Global banking giants are starting a 12-week digital dollar pilot with the Federal Reserve Bank of New York, the participants announced on Tuesday. Citigroup Inc , HSBC Holdings Plc (HSBA.L), Mastercard Inc (MA.N) and Wells Fargo & Co (WFC.N) are among the financial companies participating in the experiment alongside the New York Fed’s innovation center, they said in a statement. The project, which is called the regulated liability network, will be conducted in a test environment and use simulated data, the New York Fed said.”

“The pilot will test how banks using digital dollar tokens in a common database can help speed up payments. Earlier this month, Michelle Neal, head of the New York Fed’s market’s group, said it sees promise in using a central bank digital dollar to speed up settlement time in currency markets.”

This kind of digital dollar pilot program just makes one feel all warm and fuzzy doesn’t it? 😮

With inflation still near record levels and the future trend of business highly dubious, it is altogether too easy to see a time of reckoning ahead. This gives them the perfect backdrop to roll out their digital currency and social credit system. The hackers whether state or personal will be blowing hot air into their hands waiting for the CBDC’s to be introduced, (central bank digital currencies, forget about the fancy name they give them to make it all look very appealing). I think it will be a disaster much like Prohibition was and will serve the criminal elements of our society. DT

Sven Henrich @NorthmanTrader 9:15 AM · Nov 16, 2022 · Twitter Web App

“It’s only the highest interest rate on credit cards in the series since 1995.

And that’s just the data from August which doesn’t account for the last two 75bp rate hikes.”

“Record credit card debt and record interest rates on them. Best of luck.”

https://twitter.com/NorthmanTrader/status/1592929427109072897

FREAKY FRIDAY……………………. AGAIN……………

Warm and Fuzzy………unless you are in Buffalo, NY………

Not Freaky Friday for me. My account is going crazy. Currently – $107.93. Another great performance. Getting a reservation for Buffalo but flights delayed.

🙂 Hitch a ride on one of those snowflakes…… lol

There is always next year. That is what I am going to tell them when they want to pull the plug.