Weekend Show – Looking Into Next Year For Markets, Fed Policy, Inflation and Interest Rates

On this Weekend’s Show we look ahead to next year when the Fed has stopped hiking rates. We are not predicting how many more hikes are coming but rather what the market and economic environment looks like with rates flat.

Please keep in touch with Shad and I through email. We have been receiving a lot of great emails from all of you relaying questions for our guests and companies. Please keep them coming! Our email addresses are Shad@kereport.com and Fleck@kereport.com.

- Segment 1 and 2 – Peter Boockvar, CIO at Bleakley Financial Group and Editor of The Boock Report joins us to look into 2023 when the Fed stops hiking rates (assuming thereafter rates are held steady for a period of time). We focus on the market environment with generally higher interest rates, where inflation will be at that time and how different sectors perform.

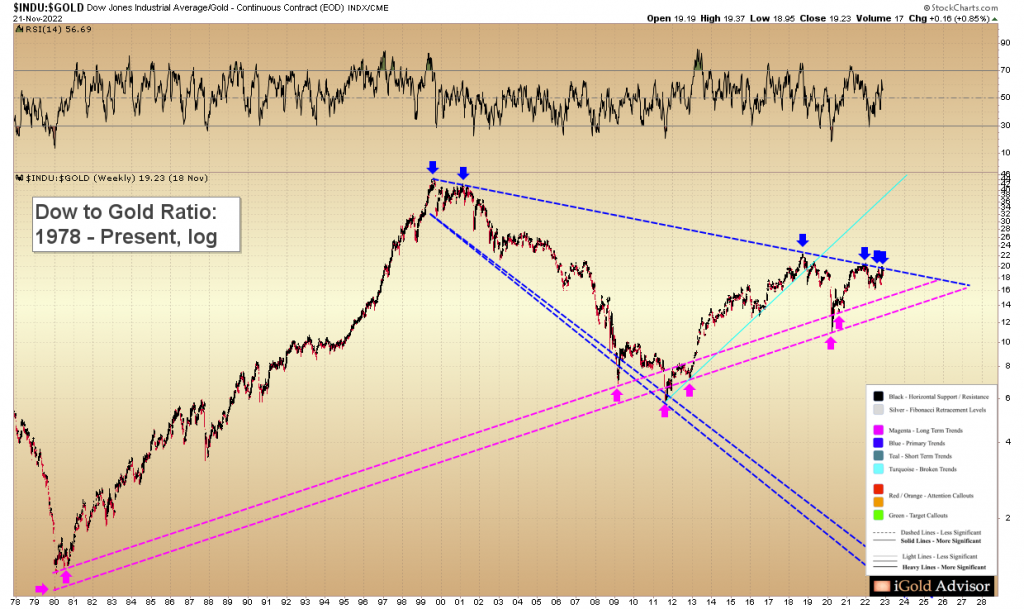

- Segment 3 and 4 – We wrap up the show by replaying an interview from Tuesday with Christopher Aaron, Founder of iGold Advisor and Senior Editor of GoldEagle.com. Christopher shares his big picture outlook for the precious metals. He sent us the Dow:Gold ratio chart, which is posted below, dating back to 1978. We also discuss a very important level broken in bond market that signifies the end of the 40+ year bond bull market.

Exclusive Company Interviews This Week

- Enduro Metals – New President Will Slack, Initial Results From The 2022 Drill Program At The Newmont Lake Project In The Golden Triangle

- I-80 Gold Corp – Bonanza-grade Drill Intercepts Returned From CRD Mineralization At The Hilltop Zone

- Goldshore Resources – Reviewing The Recent Maiden Resource Estimate And Ongoing 100,000 Meter Drill Program

- Thor Explorations – Comprehensive Exploration Update At The Douta Development Project

- Skeena Resources – Recapping Drill Results From November, Multiple Discoveries And Resource Extension Results

- Eloro Resources – Acquisition Expands The Iska Iska Property, Drill Results Grow The High Grade Feeder Zone

- Hemisphere Energy – Recapping A Solid Year Of Oil Production Growth, Increasing Free Cash Flows, Paying Off Debt, Initiating A Dividend, And Share Buybacks

- Enterprise Group – Comprehensive Company Overview, Areas For Growth, And Financial Strength

Gordon Brown selling Brit public Gold to ‘private interests’ at the then current bottom was no accident or mistake. Just another treasonous ‘elite’ deserving of the rope.

The Anatomy of Brown’s Gold Bottom

Keith Weiner – Kitco – Monday June 19, 2017

“As most in the gold community know, the UK Chancellor of the Exchequer Gordon Brown announced on 7 May, 1999 that HM Treasury planned to sell gold. The dollar began to rise, from about 110mg gold to 120mg on 6 July, the day of the first sale. This translates into dollarish as: gold went down, from $282 to $258. It makes sense, as the UK was selling a lot of gold… or does it?”

“We won’t get into the theories of his motivation. However, we note that if he wanted to—pardon the dollarish—push down gold, he was not particular effective. He squandered half of Britain’s gold to get the price to drop 8.5%. That lasted but a few months. By the end of September, the price was not only back up to $282 but rising rapidly on its way past $320. Then it came down with volatility, rose, slowly fell to just under $260 about two years later. The price bottom just about coincides with the end of his selling.”

“This is history, and it’s been discussed and analyzed many times. What has not been seen until now is a look at the gold basis and cobasis during this time. Was gold becoming abundant due to selling? Or did something else happen?”

https://www.kitco.com/commentaries/2017-06-12/The-Anatomy-of-Brown-s-Gold-Bottom.html

If The Bankers decide to crash the system instead of pivoting, investors won’t need to worry about Due Diligence everything including Musk’s kitchen sink will be on sale. It will be a distress sale like no other. I’m sure that Blackrock will be ready for the opportunity of a lifetime. DT

This all by design …It’s called, Tikkun Olam…Wealth destruction then wealth distribution…From white to black & brown…

Thanks to all the KE Report guest contributors for another great week of daily editorials, company interviews with management, and another solid weekend show with Peter & Christopher.

Also thanks to all the listeners of the podcast and radio show, and those members of the KER crew that post and participate here on the blog, sharing insights with our community. Ever Upward!

I relistened to Peter’s segments on this weekend show, and was very impressed by his straight-forward and balanced take on the macroeconomic trends in many different sectors and asset classes in the markets.

It’s a pleasure to have candid discussions with thought leaders like him that are quite well-informed and help cut through a lot of the noise and narratives bouncing around in financial media. It’s a true blessing to our community that guests like Peter come on the show and invest their time with the KER Crew.

Obviously Christopher’s segment was great as well, and that is why it got a replay on this weekend’s show.

Christopher also created a Youtube video of this interview, and overlaid a number of helpful charts and graphics, as well as doing an expanded introduction and wrap-up, before and after the KE Report talk.

It’s worth watching the video to see the charts and technical indicators paired up with his comments.

Ghana Tells Gold Miners To Sell 20% Of Refined Bullion To Government

By: Carl Surran – Seeking Alpha News Editor – Nov. 25, 2022

“Ghana’s government on Friday ordered all large mining companies to sell 20% of the entire stock of refined gold at their refineries to the country’s central bank starting January 1, part of its plan to stem dwindling foreign currency reserves.”

“The Bank of Ghana and the government’s marketing arm will buy the gold from companies including Newmont (NYSE:NEM), AngloGold Ashanti (NYSE:AU) and Gold Fields (NYSE:GFI) at the spot price with no discounts.”

Here’s an interesting table of Gold reserves held by G20 countries that someone posted over on ceo.ca.

It’s pretty revealing about which countries have solid gold reserves and which ones don’t.

https://cdn-ceo-ca.s3.amazonaws.com/1ho8hh0-Screenshot%202022-11-28%20002352.png

Hello Cory and Ed,

Can you bring Trader Vic on the weekend show? It will be interesting to hear his outlook for 2023.

I’d enjoy getting Trader Vic on the show again, but the last few times others have asked or I’ve asked Cory he’s declined about getting him on the show again.

Daily chart concerns can easily be overridden by the shape of the bigger charts especially early in a trend change (like now). A lot of money is waking up to the current opportunity in the gold space so further upside before another pause looks probable.

Interestingly, priced in dollars or gold both GDX and HUI put in their low monthly closes 83 months after their bear market low monthly closes of 2015 which in turn were 83 months after their low monthly closes of 2008.

https://stockcharts.com/h-sc/ui?s=%24HUI&p=M&yr=19&mn=0&dy=0&id=p41444149482&a=1298597629&r=1669576915747&cmd=print

Gold bullishly broke through its monthly Ichimoku Cloud in 2019 and finally backtested it over 3 years later as it also tested 2 big speed line supports (one originating at the 1999 low and the other at the 2015 low)…

https://stockcharts.com/h-sc/ui?s=%24GOLD&p=M&yr=25&mn=11&dy=0&id=t2847924950c&a=730649401&r=1669576976182&cmd=print

The chart just above already “expired” so here it is again:

https://stockcharts.com/h-sc/ui?s=%24GOLD&p=M&yr=25&mn=11&dy=0&id=t4280932021c&a=730649401&r=1669610484806&cmd=print

The Golden Cross Gold Miners Index looks better than ever before after rising 200% since one week ago.

https://stockcharts.com/h-sc/ui?s=%21GCIGDX&p=W&yr=5&mn=0&dy=0&id=p88950868469

Silver is up 20% since August’s final close while gold is up just over 1%. It’s up for 5 of the last 6 weeks and now looks ready to add further significant gains. Any scary pullback will probably have to start from a much higher level (at least $2 higher?)…

https://stockcharts.com/h-sc/ui?s=%24SILVER&p=W&yr=7&mn=3&dy=0&id=p32489448438&a=1284100415

The miners will likely light up just as Silver:Gold breaks through current resistance:

https://stockcharts.com/h-sc/ui?s=%24SILVER%3A%24GOLD&p=W&yr=5&mn=0&dy=0&id=p99328668488&a=1144482232

HUI looks great and shows no credible technical “need” for another pullback now (Friday’s wimpy performance probably isn’t credible in light of the holiday).

https://stockcharts.com/h-sc/ui?s=%24HUI&p=W&yr=7&mn=0&dy=0&id=p26503203545&a=1038741662

SILJ looks ready to accelerate to the upside.

https://stockcharts.com/h-sc/ui?s=SILJ&p=W&yr=3&mn=11&dy=0&id=p20724895669&a=1120142324

It does appear that SILJ has made it up to or just above some key resistance areas as of late.

Looking forward to seeing the silver miners stretch their legs a bit on the next upside move higher, and catch many of the shorts and also nervous bulls hiding on the sidelines in cash by surprise. The bull likes to shake the most riders off it’s back as possible, as it climbs the wall of worry.

The silver mining stocks looked quite compelling a few months back as things were grinding down and bottoming in both silver and the silver stocks in September. That coincided nicely with the contrarian signal of some folks vocally advising investors to “sell everything and go to cash,” as they missed the tradable rally once again. That’s what makes a market.

The dollar remains a strong sell especially if it goes above 109 from here. (I doubt that it will but it wouldn’t be shocking if it does.)

https://stockcharts.com/h-sc/ui?s=%24USD&p=W&yr=6&mn=5&dy=0&id=p49393787306&a=1272180256

At least $62-ish looks easy…

https://stockcharts.com/h-sc/ui?s=%24WTIC&p=M&yr=15&mn=3&dy=0&id=p83097117651&a=833193131&r=1669578663108&cmd=print

Oil is daily oversold versus gold but going much lower.

https://stockcharts.com/h-sc/ui?s=%24WTIC%3A%24GOLD&p=D&yr=1&mn=3&dy=0&id=p93611929249&a=1108848486

I’d say there are many times that there are few comments made on a Friday interview and with it being Black Friday when markets are slow and close early in the States it should come as no surprise that even a great interview with the hedgeless about Brixton wouldn’t garner huge comments. I never got around to listening to it on Friday and I’m sure it was the same for others. I look forward to the eventual news flow from Brixton.

Found the selloff in Emitrea on Friday on one hand comical and opportunistic on the other. Took advantage of what I consider a fire sale.

Looking for Magna to set a new high this week as the story looks great and the pieces are falling in place for a nice double in the short term.

Thanks as always to all the contributors. Keep those charts coming Matthew. Much appreciated…Glenfidish keep the comments/updates coming. Joe please come out with a SELL SELL SELL. Hoping to see $1800+ gold again. Cheers.

Hi wolf thank you for your post the feeling is mutual. Also thank you for bringing that up regarding charts with matthew and more of comments/update type for me 🙂 its not for lack of having charts although i did post some important ones two months back for hui/xau that are playing precisely to what was called.

Good charts matthew on the shorter term perspective with wti. I remain with my longer term call which is sideways here or stairstep down for few months then fall off a cliff into summer.. Mark this down, 45/50 ish handle a buy of a lifetime down there. This move down is going to fuel miners higher very fast imo.

Im still sticking with my 1.02/1.04 usd call end of month or first week of december

Yep… Oil has really taken a good drubbing since earlier in the year when it peaked during the Ukraine conflict starting up and escalating. Now the media is running with it being further impacted by the China Covid protests, and lack of demand from the world’s second biggest economy.

___________________________________________________________

Oil At 11-Month Low Amid China Clashes Over Covid

By Barani Krishnan – Investing.com (Nov 28, 2022)

“Fierce protests against COVID lockdowns in top oil importer China are putting greater pressure on crude prices amid what’s already a week of strained nerves for traders awaiting monthly US jobs numbers that could decide the next Federal Reserve rate hike. Chinese implied oil demand seen down 1 million bpd, with less buying from Russia too.”

Wow. I hadn’t noticed that 30%+ selloff in Emerita (EMO) on Friday, until you just mentioned it here.

The selling appears to have been triggered from the news released on the court date for Aznalcóllar. Looks like it is still several years off (2025), and many expected it to be pending more imminently.

_______________________________________________________________________________________________________

Court Date Has Been Scheduled for Aznalcóllar Criminal Trial

25 Nov 2022

“Emerita Resources Corp. (TSX-V: EMO; OTCQB: EMOTF) announces that the Third Section of the Provincial Court of Seville has set March 3, 2025 as the date for the criminal trial on the alleged crimes committed during the process of awarding the Aznalcóllar tender. The trial is an oral hearing that is expected to be completed on July 15, 2025.”

https://ceo.ca/@globenewswire/court-date-has-been-scheduled-for-aznalcllar-criminal

What is a Nuclear Microreactor?

“Nuclear is getting smaller … and it’s opening up some big opportunities for the industry. A handful of microreactor designs are under development in the United States, and they could be ready to roll out within the next decade.”

“These compact reactors will be small enough to transport by truck and could help solve energy challenges in a number of areas, ranging from remote commercial or residential locations to military bases.”

https://www.energy.gov/ne/articles/what-nuclear-microreactor

Ep 228- An Update on the Uranium Market ft. John Ciampaglia with Srivatsan Prakash

Nov 17, 2022

“John Ciampaglia serves as Chief Executive Officer of Sprott Asset Management and as Senior Managing Director of Sprott Inc. Here we discuss the various dynamics in nuclear energy, uranium markets, where he sees the market heading, as well as a discussion on gold, oil, and more.”

Uranium Market Minute – Episode 197: IEA Proposes A Doubling Of Nuclear

Uranium Insider w/ Justin Huhn

Uranium Market Minute – Episode 198: COP-27 – Finally, Nuclear Has a Seat at the Table

Uranium Insider w/ Justin Huhn

It has been nice to have been diversified into the Uranium mining stocks during the last few years, as they’ve had some pretty nice gains overall, while it has been a tougher grind in the Precious Metals sector since things peaked in mid August 2020 and have corrected down for over 2 years. There were also fantastic moves in Lithium stocks and Oil & Nat Gas stocks during this same period that was a rough slog for the PMs.

Having said that, it would seem based on how things have played out the last 2 years and comparing things where they are currently, that the setup is going to be more skewed to the Gold and Silver stocks outperformance moving forward.

Still this illustrates the concept of why it’s not generally a good idea to put all one chips into just one commodity basket when investing in resource stocks, but rather to take a more diversified approach in one’s portfolio, playing into the sector rotation. Different commodities and related stocks pop at different times, and each have their own season in the sun, and then the baton gets passed to the next hot resource sector, and so on…

>> Here’s a performance chart of the Uranium miners over the time period from mid-August 2020 to present:

Here’s another intriguing chart to consider from our buddy Steve Penny on the Uranium to Gold ratio:

In the short to medium term, again, it will likely favor Gold outperformance over Uranium, but on the longer-term time horizon, he makes a good point that there is the very real potential that yellowcake could outperform the yellow metal.

https://cdn-ceo-ca.s3.amazonaws.com/1ho92up-Uranium%20To%20Gold%20Ratio%20Chart%20Steve%20Penny.JPG

Yeah Ex. That court date news sent the stock down big. That’s what do comical. The value without getting that awarded to them was already below value. Retail investors are just so stupid. Easily back up over a $1 as news from the 14 drills continues proving up the asset

Yep, agreed Wolfster. Emerita should have been valued and should currently be valued on IBW which they do have in hand, and people should not have been factoring in Aznalcóllar yet until/if it is awarded to EMO. The crazy high valuation last year into this year didn’t really make sense yet, but neither does the crazy low current valuation. That’s what happens when retail investors push a stock around with emotional trading though, and that’s what makes a market.

Normal smash Monday continuing into the second week down to the bottom of my rangebound range. Same thing end month 10.

Dollar Index : Fall 2022 : Now or Never

https://tinyurl.com/2rrhew58

Tumble or Turn