Excelsior’s Week In Review [Episode 1] – Gold Puts In The Highest Daily, Weekly, And Monthly Closes Ever

By: Shad Marquitz

It was a very busy week in many areas of the financial markets, with new macro reads on inflation and consumer confidence data, and market moving comments from Jerome Powell, and a number of talking Fed heads. Additionally, many media outlets lost their minds covering the controversial comments from Elon Musk during the 2023 New York Times DealBook Summit regarding his response back to some high profile advertisers, such as Apple, IBM, and Walt Disney, boycotting his X social media platform (formerly known as Twitter).

This last week was also notable with the news of the passing of 2 public giants: Henry Kissinger died at 100, as one of the most infamous Secretaries of State that was both beloved and despised under both presidents Nixon and Ford, and played a part in the rapprochement between the United States and the People’s Republic of China, as well as the introduction of the petrodollar to OPEC countries trading oil, being a replacement for the gold-linked standard that existed prior to Nixon. Then Berkshire Hathaway‘s Vice Chairman and #2 under Warren Buffet, Charlie Munger, passed away at 99 years old.

Macroeconomic Movers:

We continued to interview guests on the show that highlighted various studies and metrics pointing to a mixed but weakening picture with regards to the “strength of the consumer.” In particular, our chat with John Rubino this week stuck out in my mind with concerns he raised about the housing and real estate markets, a falling savings rates for US families, record high credit card debt, and falling retail sales numbers. The November Conference Board’s consumer confidence index was 102 after a downward revision of 3.5 pts to October which took it to 99.1, the lowest since July 2022.

- Here is a link to John Rubino’s recent interview:

Financial markets overall continue to be fixated on the inflation picture, and this week we got economic news about the central banks favorite read – the PCE deflator. The numbers for October PCE headline inflation came in essentially the same and flat as the prior month in September, and the core inflation reading was only up 0.2% month-over-month. The year-over-year gains in PCE Inflation were 3% headline and 3.5% core, versus the 3.4% and 3.7% readings seen in September. While there were no real inflation fireworks with metrics coming in roughly as expected by the market, it didn’t stop market participants from speculating on when the Fed would shift towards more accommodative

Will the Fed be cutting rates in early 2024? Jerome Powell claps back in Friday’s speech.

Fed fund futures have moved forward in their odds for rate hikes to begin as soon as March of 2024, with billionaire investor Bill Ackman, founder of Pershing Square Capital Management, that is looking towards a potential Q1 rate hike. On Wednesday Ackman stated “We’re betting that the Federal Reserve is going to have to cut rates more quickly than people expect.” He added that, “What’s happening is the real rate of interest, which is what impacts the economy, keeps increasing as inflation declines.”

Federal Reserve Chair Jerome Powell got on the mic on Friday, at Spelman College in Atlanta, to address the recent speculation and upswing in the general equities, cryptocurrencies, and commodities from investors believing that the Fed is finished raising rates and will soon pivot to cutting. Powell attempted to walk back this bout of recent speculation and surging markets across the board, by remarking that the central bank needs to see more evidence that inflation is on its way back to the Fed’s 2% target.

Now whether or not the Fed is kidding themselves on getting back to stable and sustainable 2% or less rate of inflation remains to be seen. Regardless, Powell tried to pour cold water on the idea that the central bank would be hiking anytime soon and stated, “It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease.” Powell conceded that after one of the most aggressive rate hiking cycles seen in 40 years that monetary policy is “well into restrictive territory,” but he and other Fed heads continue to say that they are going to remain data dependent and are open to keeping more rate hikes on the table.

Regardless, of the Fedspeak, the markets took the recent economic readings as a signal to buy everything, pushing the general equities higher, Bitcoin over $38,000 and Gold well above the $2000 line in the sand to end the week and the month. A friend of the show, Peter Boockvar remarked in a missive this last week that, “…the S&P is looking to finish the year nearing astronomical 20% gains, something that I would have thought to have been impossible with rates raging higher over the last 2 years. But, then again, remember as I wrote in September — rate cuts are usually the signal for the market to crash — not rate hikes.”

Gold puts in a new all-time high on the daily, weekly, and monthly charts:

With regards to the very solid rise in gold to end November on Thursday at an all-time closing high on the monthly charts, and this last Friday Dec 1st at an all-time weekly closing high and daily high at $2089.70 (eclipsing the 2020 high of $2089.20 by $0.50); it has many generalists scratching their heads wondering where this strength in the yellow metal is coming from. Sure there has been some geopolitical turbulence in the Middle East the last 2 months, but much of that war premium has come out of the markets at this point as evidenced by the fall in oil prices and a containment of the situation to a regional conflict, where talks of truce have begun once again. There are also more concerns of a recession coming in 2024, but that has been steadily the case for a while now. This seems to be more of a wide market acceptance that the Fed is likely done with it’s monetary tightening cycle, and while paused now, despite what they say, it’s just a matter of time before monetary easing begins once again.

I thought Quoth The Raven (QTR Fringe Finance) nailed it on Friday’s substack post with this statement:

“Did the Chairman mean to signal the markets that it’s time for a year-end financial orgy? I don’t think so, but whatever the case, he has a problem. Honest money— gold—begins to shine light on a dollar that is rapidly heading toward the dustbin of history, as all fiat currencies eventually spend eternity”

I’d agree with QTR Fringe Finance, that the weakness in the US dollar, combined with a bid in bonds the last few weeks bringing the 10-year interest rate all the way down to 4.21% on Friday, played a huge role in the recent strength in gold and silver prices. Many high-frequency trading algorithms are keyed off the US dollar and 10-year yield, and that likely was a big tailwind, in concert with the overall market take that the Fed is done hiking, despite all the speeches they rushed out to give in the mainstream media this week.

On November 23rd, I hosted an interview on the KE Report with Michael Oliver, where he pointed out that both gold and silver and even the precious metals ETFs like GDX and GDXJ were showing constructive things on a momentum basis that may not be as obvious if just looking at pricing charts in isolation. However, he conceded that even on the pricing charts, we are seeing very bullish recent actions in the PM sector overall.

- Here is a link to that recent interview with Michael Oliver:

We also heard from Dave Erfle earlier this week, where he outlined some of the bullish candlestick patterns forming on the weekly charts; and that there are a lot of positive factors stacking up technically for the precious metals sector. Another positive trend we reviewed was that industry leaders like Newmont and Barrick have been outperforming the PM mining indexes lately, and that this may indicate more generalist investors getting positioned in the gold miners once again.

- Here is a link to that recent interview with Dave Erfle:

With regards to the gold and silver miners, this week, I brought Robert Sinn (aka Goldfinger) on the show to review a number of areas from the macro picture, to the technical for gold, silver, and GDX, but then we really spend some time discussing the state of the PM mining stocks. We highlighted the changing cost of capital for the junior miners if interest rates started to pull back down again, and debated if there were some companies that won’t be able to fund new programs or keep the lights on. This tied into a larger discussion on if current depressed conditions in the junior PM mining stock valuations may spur on more merger and acquisition transactions in the near future. We reviewed the string of recent M&A proposed transactions announced with Calibre Mining (CXB) & Marathon Gold (MOZ), Adventus Mining (ADZN) & Luminex (LR), Silvercorp Metals (SVM) & Orecorp (ORR.AX) & Perseus entering the mix as a dissenting vote, and Nighthawk Gold (NHK) & Moneta Gold (ME). It will be fascinating to see if more merger and acquisition deals are announced in the market in the near future, now that the underlying metals prices have bounced higher, and sentiment is starting to improve in the sector.

- Here is a link to that recent interview with Robert Sinn earlier this week:

Where are the best opportunities in the precious metals stocks?

We all wonder this question quietly to ourselves, and we receive questions like this all the time in emails, or see people debating this on resource chat forums all over the internet. The truth is that there isn’t a one-size-fits-all answer for where the best opportunities are, because it ultimately is different for each investor based on their own unique risk tolerance parameters around the marketcap size of companies they invest in, or acceptable share-count limitations they may impose, or which jurisdictions they will or will not invest in, or which stage of companies from discovery stories, to advanced exploration stories, to developers, or producers, or royalty companies they are comfortable with.

It also comes down to whether individual investors feel right now that the risk/reward set up is more favorable for hunting down companies building value in answering unanswered questions through “alpha”, or in picking off positions in more established but severely undervalued companies that have already derisked quality development or production projects, and that will have solid optionality upside or “beta” in a sector sentiment rerating higher. Again there is no right answer here, as it comes down to personal preferences, portfolio and diversification balance, and which style of investing a particular person has.

Throughout the course of this year, we’ve had a number of good discussions about this topic around strategies for value investing in either alpha or beta stocks with Erik Wetterling (aka The Hedgeless Horseman). On this last Thursday Nov 29th, Erik and I recorded another interesting discussion that touched upon this topic, and the main takeaway was that regardless of whether people were investing in alpha stocks or beta stocks in the sector, that if they wait until it is very obvious that we are in a new bull market in hindsight, many months later, that the biggest and easiest gains will have already been made.

- Here is the link to that recent interview with Erik Wetterling:

Strategies around positioning in optionality plays during low sentiment markets:

With optionality plays, they tend to fall into 2 groups: 1) developers with defined ounces in the ground that are severely discounted based on where current metals prices are, or 2) they are producers that also have ounces in the ground that could get rerated higher paired with the potential improvements coming to their mining costs and economic margins due to larger macro trends.

These optionality plays can languish and get disproportionately punished during bear markets and falling prices, but conversely, they can be an interesting area for investors to consider, coming out of bottoming periods of low investor sentiment and engagement in the sector. The reasons for these companies severely underperforming in bad sentiment, is because of their associated higher costs to mine or rising capex to build projects or falling metals prices hurting the project economics. However, these exact same reasons, can turn into a tailwind in rising metals price environments, because their margins can expand on a percentage basis, in a much bigger way, than with a larger producing mines, or lower cost development projects.

Thus, when the sentiment worm finally does turn in the precious metals sector, then optionality companies can be rerated up substantially. In fact, as is typically the case with valuations in a trending sector, we’ll often see market caps getting to the other extreme of overvaluation at the peak mania phase of a bull market. In the past, we’ve seen that same type of phenomenon of overvaluation, extrapolating positive conditions in the present out perpetually into the future, in other sectors like cryptocurrencies, cannabis stocks, or more recently with lithium stocks and A.I. tech growth stocks.

We ended the week on Friday with an interview with Fred Davidson, CEO of Impact Silver (TSX.V:IPT – OTC:ISVLF), a microcap silver-zinc-lead producer and explorer in Mexico. Impact Silver is a very widely followed stock on our KE Report platform, and we get regular requests to do updates with them. The interview generated a lot of discussion on multiple platforms afterwards, and received some questions about why this company garners so much interest in the first place as a small higher cost producer? It seemed like a great example to use for this week’s missive, when discussing the strategies around using optionality and volatility as tools in bear and bull markets.

For full disclosure once again: Yes, I’m also a shareholder of Impact Silver, and biased in that sense, but my goal here is to unpack the reason I personally like smaller producers like Impact Silver, for their optionality and beta in a rising metals price and improving sentiment environment. These same concepts could be applied to other optionality plays in either the more advanced PM developers or producers. So to reiterate, this is less so about this particular fish of Impact Silver, and more about teaching investors how to fish for optionality opportunities once the basic concepts are internalized.

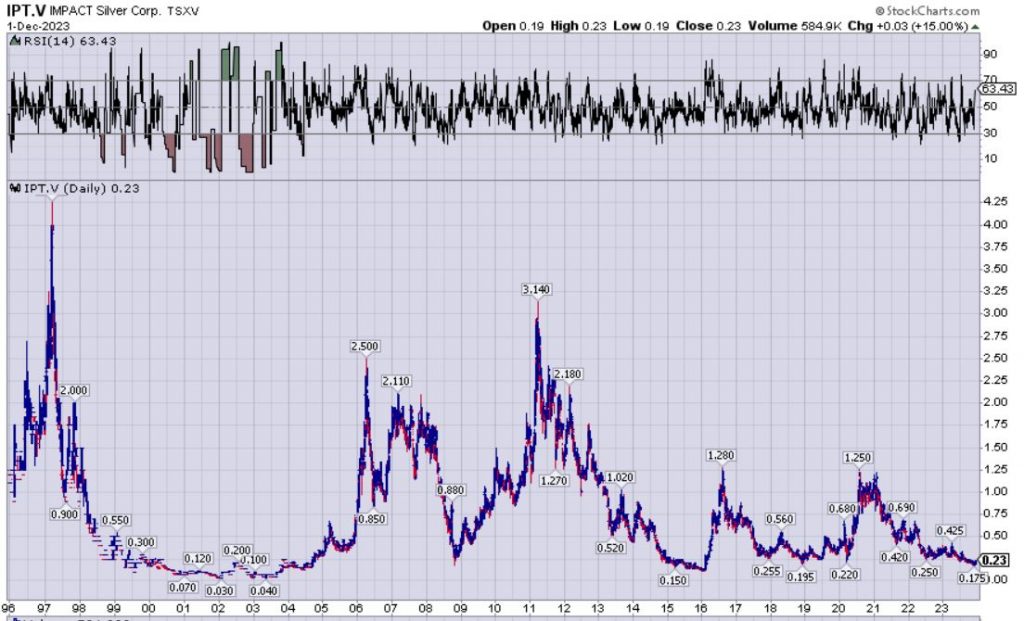

Many folks could pull up a shorter-term pricing chart of Impact Silver and cringe at the pullback the stock has had over the last few years as the bear market in PM junior stocks intensified. IPT.V hit a high of $1.25 in the big sector rush into the summer of 2020 and again hit $1.22 in the #SilverSqueeze of early 2021, however it closed on Friday at $0.23. Some investors would look at this pullback as a warning to steer clear of this stock and as the rationale that something must be wrong… but they’d be misunderstanding how optionality works on the downside, and more importantly, missing how optionality will work on the upside in a better bull market.

Like all optionality plays, Impact Silver has admittedly been trounced in valuations repeatedly during tough market conditions in silver along with the precious metals stocks overall, and thus is subject to gut-wrenching pullbacks. However, IPT.V was also a perennial outperformer during key sector bull runs from 2002-2007, from 2009-2011, or during the 8-month PM surge in 2016, or the move from mid-2019 through late 2020. Bear markets don’t last forever, and when the sentiment turns, optionality stocks and higher cost smaller producers like Impact Silver usually smoke most of the larger silver miners when a solid bull market gets underway. In many of those bull runs, IPT.V surged 10x, 15x, or higher in valuation, because their margins were expanding more on a percentage basis for each increment that silver increased, paired with more enthusiasm from investors about their exploration upside.

So regardless of the other fundamental drivers for value-creation “alpha” with a stock like Impact Silver, of which there are a few I’ll get to momentarily; the main takeaway is that an overall beta stock like IPT.V has a high probability of continuing to rip to the upside in bull markets, and then correct harshly during bear markets.

There are plenty of other junior gold or silver producers or developers we could review with similar chart patterns, of plunging down big, only to rally big, and the plunge again, following the underlying patterns and sentiment within the PM sector overall. My pal Erik Wetterling, calls them “trading sardines” because they are like a fish jumping up and diving down repetitively, and so if one can position or add during low periods and then sell or lighten up during high periods, then they can use this optionality as a tool to their advantage.

The reality is that most of the established development or production stocks that have been around for years or decades are actually “beta” stocks. There are very very few companies that really make a huge discovery or do some kind of transformative transaction as “alpha” value-creation plays. While many will remember the few companies that actually bucked the trend and did something special, the truth is that most alpha plays, especially on the purely exploration side, don’t pan out and just burn through capital.

It is often stated from geologists that there is a 1 in 3,000 chance in making a true discovery at an exploration target that legitimately ends up becoming a mine. Las Vegas has much better odds than that. However, this is the thrill of exploration and the treasure hunt, and the hope from investors that they are holding the winning lottery ticket that will make them a 10x 20x or 50x return in the perfect scenario playing out. I truly wish that for everyone reading, me included, that holds some exploration stocks in their portfolio, as it only takes a few big winners to bail out the ones that inevitably will fail to make an economic discovery.

The overall point here is that, in lieu of the few “alpha” plays that will make a big discovery or make some grand transformation and outpace the rest of the sector through amazing value creation, that there is still plenty of money that can be made positioning in optionality “beta” plays that will move up with the sector. The reality is that when the whole sector really gets going, it turns from investors needing to have a rifle approach and being very selective stockpickers, to more of a shotgun approach starting to work. Instead of trying to find the very few companies that may swim against the current, it turns more casting a wide net and almost always getting a good haul. So in a bull market, yes, the rising tide will lift most boats, and even the turkeys will fly in the beta optionality stocks.

As a result, it’s easy to get complacent in a bull market because most stocks are going up — but we still want the better outperformers in this group. This brings up a final point though, of spending the time to look for the “beta” optionality companies, that have the most torque to the upside in that rising tide. In addition to having ounces in the ground and/or improving margins that will allow an optionality stock to get rerated higher, we also want to search for other potential value drivers on the “alpha” value-creation side. Often these additional value drivers are hiding in plain site, and are just being shrugged off in a bad sentiment market. The other consideration here are companies that may have struggled for various reasons, but that also may have overcome a key hurtle or have a better focus moving forward in the quarters to come that is being ignored due to recency bias.

We’ll circle the discussion back to Impact Silver again, to illustrate this point, and look under the hood at a few other considerations that could give them extra torque in a coming bull market. First of all, as a producer IPT has no debt, no royalties, and no hedged prices, so they are not encumbered by any of those limitations on true price spikes in silver, lead, or zinc. This is so important to consider, as often times you can see a bull market in many commodities, and yet some of the underlying associated producers of those commodities won’t run because of financial overhang from debt, or margin encroachment from royalties, or muted returns due to their hedge books. We saw a great example of that in the oil patch last year, where there were clear winners and laggards, due to some of those same exact caps on revenues keeping pace with price runs in the underlying commodity.

Secondly, Impact Silver has got nearly 2 decades of mine development and production history under their belts, and a management team that has proven over and over again that they can replace their resources through exploration and continue mining in both good and bad markets. This means that for many investors there is much less fear of them going out of business during downturns, or growing irresponsibly and unsustainably during upturns. Many poorly run companies in the resource sector take outsized risks in both good and bad times that don’t pan out and compromise their future operations ending in bankruptcies or getting taken over by larger companies to stop the bleeding. So when looking at optionality companies, they are not all in the same basket, and need to be further sorted for where they are financially, operationally, with regards to permits, or development, etc… all taken in the context of when a turn is happening in the sector.

One more note specifically on Impact Silver, as a highlighted example here, is that I see the potential, in a better pricing environment for their operations to fund a more expanded exploration focus across both the Zacualpan and Plomosas districts. Being a growth-oriented silver-lead-zinc producer is what animates me about their potential in a higher metals price environment, because margin expansion leads to more exploration.

That is a key “alpha” value-creation dynamic I’m constantly looking for with any “beta” producing companies – a setup where rising prices really matter materially to the economic margins, and free up revenues to reinvest in exploration expansion. Now a company has got to have the kind of mineral prospectivity on a district scale land package to warrant that kind of enthusiasm, as almost all companies will claim they have exploration upside. So in essence, the exploration upside and potential targets need to materially matter to the overall size and scope of the company.

So for example, IPT.V is about a CAD $44 million market cap company at the time of this writing, and so the 20,000 – 25,000 meters of drilling they have planned in 2024 could actually move the needle for them, where a similar or even much larger program may not move the needle of a larger producer that has 10 to 20 times the market cap. With that in mind, if silver does eventually get back up to the $28-$32 range and/or Zinc can claw it’s way higher over the next 2 years back into the $1.20’s or $1.30’s, then I could envision their exploration team doing well north of 30,000 meters per year, and making some new discoveries. Quite frankly that kind of exploration program coming from a small producer is more compelling to me to me than most of the unproven drill plays people like to speculate on. Pre-revenue early stage explorers that don’t have operating mines and mills, can’t directly monetize higher metals prices, and thus have to mine capital markets for more money instead of the metals investors want exposure to.

While the alpha plays may be more compelling and have more sizzle to their marketing pitches, the reality is only the best in breed and most competent teams will realize big success in this niche of the precious metals equities. Again, these alpha plays are the ones that can just blow away the results of any other stage of mining stock when they really run, and they are normally the subject of “bar talk” for years afterwards… but they are like spotting a unicorn and few and far between. There are some investors and newsletter writers with a solid track record of uncovering a disproportionate amount of these stories early on and benefitting themselves and their followers. More power to them and again, nothing is as thrilling as an alpha play that is catching fire with investors and gaining traction in the marketplace.

For everyone else, and us mere mortals, the beta plays in established developers & producers & even royalty companies, with ounces in the ground that will get revalued higher in a bull market run are a good place to stalk these companies. The most torque usually come as a result of tighter share floats, the most room to expand economics, and then possibly paired with other exploration or development value drivers in the near to medium-term as accelerants. These are a rewarding part of the sector to be looking to position in during the latter stages of bear markets and the early stages of new bull market runs. Happy hunting!

In summation:

This last week was full of interesting news on inflation and consumer confidence, Fed speakers making the rounds in the media, and the markets anticipating the central bank tightening cycle has come to an end. As the Fed pauses, many market participants believe that in early to mid-2024 that the pendulum will swing back toward monetary loosening again, and inevitable rate cuts if we see the economic conditions continue to weaken. It is going to be fascinating to see how things develop as we round out this year and head into the first quarter of next year.

While almost all markets have been rallying lately, one of the big stories of last week was clearly the highest close in gold on the monthly, weekly, and daily charts, which is bullish for the longer-term technical picture anyway one slices it. We did see some strength in silver and the precious metals miners, but they’ve got a lot of catching up to do to look as strong as the yellow metal has lately. We’ve seen a string of M&A deals in the gold and silver stocks recently, so that will be a trend to keep following along with, wondering “Who will be next?” There are many positive factors stacking up in the precious metals sector, and while things could get short-term overbought, it is clearly a market where, in the medium-term, the biggest risks appear to be to the upside, and where corrective pullbacks will present buying opportunities for investors not yet fully positioned in the sector.

- Ever Upward!

P.S. – I’ll likely be writing a weekly recap like this here at the KE Report, but have also created a free substack page, where you can follow along with my additional market commentary.

Hi Ex, what is happening with Jayant Bhandari these days. DT

Good question DT. We’ll have to check in with Jayant and see if we can get an update from him soon.

Hi again Ex, could you ask Jayant if he still likes Maritime Resources, I find it a compelling story, that just keeps looking better. Cheers, DT

Appreciate your commentary and will visit your substack regularly.

Much appreciated Terry.

Charlie Munger, Who Helped Buffett Build Berkshire, Dies at 99

By Noah Buhayar – Bloomberg – November 28, 2023

“Charles Munger, the alter ego, sidekick and foil to Warren Buffett for almost 60 years as they transformed Berkshire Hathaway Inc. from a failing textile maker into an empire, has died. He was 99.”

“Berkshire Hathaway could not have been built to its present status without Charlie’s inspiration, wisdom and participation,” Buffett said in the statement.

“A lawyer by training, Munger helped Buffett, who was seven years his junior, craft a philosophy of investing in companies for the long term. Under their management, Berkshire averaged an annual gain of 20% from 1965 through 2022 — roughly twice the pace of the S&P 500 Index. Decades of compounded returns made the pair billionaires and folk heroes to adoring investors.”

“It’s terrific to have a partner who will say, ‘You’re not thinking straight,’” Buffett said of Munger, seated next to him, at Berkshire’s 2002 meeting. (“It doesn’t happen very often,” Munger interjected.) Too many CEOs surround themselves with “a bunch of sycophants” disinclined to challenge their conclusions and biases, Buffett added.

At 99, billionaire Charlie Munger shared his No. 1 tip for living a long, happy life: ‘Avoid crazy at all costs’

By Tom Huddleston Jr. – CNBC • Published December 3, 2023

A Tribute To Charlie

Jesse Felder – The Felder Report – 12/02/2023

What exactly constituted “crazy,” in Munger’s estimation? “My partner Charlie says there is only three ways a smart person can go broke: liquor, ladies and leverage,”

Hi Jerry: Stay away from wild women, my number 1 rule. Hell, hath no fury like a woman’s scorn. DT

DT……ditto on that one… 🙂

I also………. am planning a new site info section….. since OWL is GONE …..

being lost in the woods for some time .. my new site will be called

HOOT , HOOT, by OOTB…. lol ….. 🙂

Love it OOTB!

HOOT, HOOT!

The Long Claw…. 🙂

🙂

Bill Ackman Bets Fed Will Cut Interest Rates as Soon as First Quarter

Amanda Cantrell – Yahoo Finance – Wed, November 29, 2023

The Pershing Square Capital Management founder said such a move “could happen as soon as the first quarter.” Traders had been fully pricing in a rate cut in June, according to swaps market data.

“We’re betting that the Federal Reserve is going to have to cut rates more quickly than people expect,” Ackman said in an upcoming episode of The David Rubenstein Show: Peer-to-Peer Conversations. “That’s the current macro bet that we have on.”

https://finance.yahoo.com/news/bill-ackman-bets-fed-cut-231248854.html

Elon Musk Offers Vulgar Response To Fleeing Advertisers —They Won’t Be Coming Back

Peter Suciu – Forbes – December 01, 2023

Correction: Elon Musk Offers The Only Appropriate Response To The Most Vulgar Enemies Of The West

+1 good one.

+1 Yes

Wow! Gold shot up to $2148 on the February futures contract 2 hours ago, but has now pulled back down to $2106 at the time of this posting.

It may be a wild start to this next week!

Say, where’s Joe? (Sell! Sell! Sell!). Be nice to hear how he’s gotten steamrolled…

He doesn’t seem to surface much during bullish periods and he was last active 2 months back near the recent bottoming process, advising everyone to go to all cash (right before almost all markets started to rally moving forward). Rinse and repeat.

Wow. I think I will wait until it comes out in paperback. Outstanding Ex.

Haha! Thanks Lakedweller2. Well, first we need a few years of content before it comes out in a paperback… but this one was the first step into a larger world.

Go for it! Excellent.

On the reasons to despise Henry Kissinger, which you didn’t mention, refer to Christopher Hitchens book, ‘The Trial of Henry Kissinger’, for some of those reasons.

Did Hitchens point out that he was a servant of the Rockefellers?

Understood Terry. Yes, Kissinger was part of the deep state cabals, and also way into the Trilateral Commission with the Rockefellers as well, but I didn’t want to get too much into that in this first weekly review. There have been a number of articles out this week reminding of the reasons he was despised, and some dark humor meme’s pointing out much of the evil Kissinger was involved with. That’s a good part about having the blog here where we can expand more on certain aspects.

For the written piece, I felt the US/China trade opening and petrodollar connections were the biggest economic legacies worth noting from him, and didn’t want to camp out much longer on him than that quick mention. Instead, it seemed more appropriate to focus more on Fedspectations, Gold breaking out to new highs, and opportunities in the mining stocks on this maiden voyage.

Cheers and appreciate the additional comments and perspectives.

New All-Time Highs For Gold, Breakouts In The Gold Miners, & Capitulation In The Juniors

Goldfinger Capital – 12/03/2023

“Last week’s video was titled “Gold Bulls About To Enter Nirvana”, and based on the $150/oz move higher we’ve seen since last weekend gold bulls may be starting to feel a sense of Nirvana. In this week’s video, I discuss wild Sunday night futures trading and break down the key technical levels in gold. We are in uncharted territory and there isn’t much price memory within $100 of where gold is trading as I type these words ($2106).”

“I also discuss the bullish sector rotation in equities, the continuing disinflationary trend in the economy, Friday’s non-farm payrolls report, the big move in Bitcoin, and more compelling phase 2 trial data from Cybin. I conclude this week’s video by delving into last week’s gold miner chart breakouts, more signs of capitulation in the junior mining sector.”

Gold Breakout & Road to $2300 & $2500

Jordan Roy-Byrne – The Daily Gold – 12/03/2023

“Gold finally made its historic breakout last week and the price is hovering around $2100 as the week begins. Gold has measured upside targets of $2300 and $2500.”

“Silver has measured upside targets of $31. Silver is wrestling with resistance at $26 but could reach $29-$30 if Gold moves to $2300.”

“The gold stocks broke out from inverse head and shoulders patterns and have more short-term upside.”

Hi EX … IMO , we may not have to wait for gold to reach$2300 , for silver to reach $29-$30. Silver is the coiled spring ……… BONG !!!!!!?

That’s a good point IrishT. The technical setup is pretty good for the medium-term in gold and silver after basing for the last 3 years, during a pretty tough environment. There are a lot of fundamental reasons that should be tailwinds to the PM sector moving into 2024 and 2025, so looking for that coiled spring to go Boing!

Very odd .. Silver is NOT on the list … What are they hideing ?

https://www.zerohedge.com/commodities/these-are-critical-minerals-china-eu-us-national-security

Don’t know why silver is not on list but JP Morgan is probably near by the reason.

Cramer bad mouthing Gold early. He doesn’t know why gold is strong but I guess he doesn’t know why the dollar is weak either. He probably Does know who pays his salary.

CNBC pumping Bitcoin. Just as the General market went up for 12 years in a 45 degree line, Bitcoin now should do the same as it is fundamental to corruption.

Cramer…. little scum bag….X Goldman saker…….

yeah Cramer… Oy vey…

Palladium is not on the list also……

day/GC…gold hit its ABCD target overnight…GDX led by hitting its ABCD target late friday…Now what happens…No idea…..In strong trending markets pullbacks are swift and reverse quickly…A prime prime target for gold retracement is price 2021 swing high of 10/21 and .382 fibonacci retracement at 2027….glta

Gold went up over $ 50 twice at Sunday open last night and I told my wife to watch it be negative by open …. Never thinking it would happen. Then when Cramer started making comments like Gold would be good but People are so afraid of it … one would know the smash down this morning is orchestrated again.

Of course, its orchestrated when it goes down but not when it goes up! LOL! LOL! DT

Fundamentals often try to emerge for the miners and all fundamentals are pretty much metals positive. Orchestrated intervention occurs when markets are overly contrary to economic theory but consistent with market manipulation. Orchestration occurs when managed money, The Fed and the media act in concert toward a particular outcome.

Orchestrated markets occur in the upside when there is a 12 year 45 degree angle in the charts of the General Markets, particularly in the “Magnificent Seven”, while the miners are driven down while Gold increases consistent with the decline in the dollar. If an orchestrated market in the miners , it most likely will be accompanied by an inpouring of managed money following their “orchestrated” destruction of miner prices.

Now would be a good time to start orchestrated increases in the miners, although years behind when it fundamentally should have occurred. Remember that intervention started in earnest when it became apparent that the US Fiat Dollar was destined to fail …

Although manipulation has always occurred, the Federal Government became a partner to intervention after 1971 and Nixon closing the gold window. Then there was concerted effort to deregulate Banks and Corporate Interests so the Transfer of Wealth could grow exponentially.

Orchestrated take down today … sure was.

Of course, it was orchestrated on the way down! LOL! again DT

Oh… OK. You have no real point except agreement. Thanks.

Hi Larry. Thanks for sharing your technical thoughts, and yes, that was wild trading action in overnight overseas markets, only to see it get monkey hammered back down today in the general trading session.

It will be interesting to see where the gold price settles out as this week evolves.

Gold should fill its 11/28 gap but I doubt will go much lower than that. It will probably be 2 or 3 more weeks before it and especially the miners take a more significant pause. One thing’s fore sure, the big momentum breakouts of many weeks ago are not threatened.

agree Matthew…also it may possibly? hit the day volume breakout bar on 11/27 down to 2003.50…At that level, break out those 1 minute to 10 minute views for a clue…glta

https://www.youtube.com/watch?v=qupj92X0ocU

Michael Boutros : Technical Analysis

02:49 – US Dollar (DXY)

08:19 – US Treasurys (10Y&2Y)

23:20 – Gold (XAU/USD)

33:33 – Silver (XAG/USD)

1:00:07 – S&P 500 (SPX500)

1:05:26 – Crude Oil (WTI)

Hi BDC – thanks for sharing Michael’s technical take on a number of markets.

Yes, his analysis is price only oriented. Very objective.

A possible Gold correction was signaled last week.

Note Hecla and the Fibo buy zone for Newmont:

https://www.fibonomics.com

I hope this helps, BDC.

NatGas may have bottomed. More later.

Record U.S. oil production is pushing prices down

https://www.axios.com/2023/12/05/us-oil-production-record

Hello KER Crew!

This is my first “Week In Review” article here on the site, and hope folks enjoy it, as it took a fair bit of time to crank this out today. It’s an idea Cory & I had been marinating on for a while, and this seemed like a great week to launch this new feature, with gold having just broken out to a new all-time high on the monthly, weekly, and daily charts last Thursday and Friday.

Also, I’ve simultaneously launched a new free substack page, to be able to catalogue these weekly reviews, and other thoughts and musing I may send out to subscribers there, that I may do additionally beyond just my comments here at the KE Report, so please subscribe there if you want to get those emails as more content goes up there mid-week.

https://excelsiorprosperity.substack.com/

Hopefully folks appreciate some of this extra commentary and analysis, in addition to all the interviews we bring onto the show.

We also may be featuring more articles from other analysts we like, here on the site, as we’ve done from time to time in the past. Stay tuned for more…